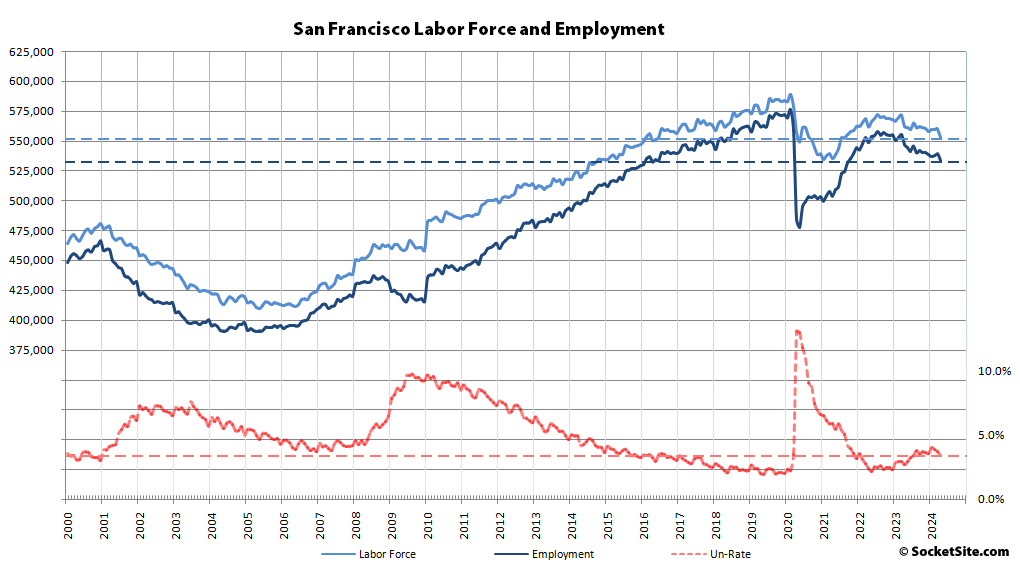

Having increased by an upwardly revised 1,500 in March, the net number of San Francisco residents with a job dropped by 5,400 in April to 533,700. As such, there are now 13,700 fewer employed residents in the city than there were at the same time last year, over 40,000 fewer employed residents in San Francisco than there were in February of 2020, prior to the pandemic really having hit, and over 36,000 fewer people in the local labor force (552,700), all despite “an unemployment rate of just 3.4 percent!” and the “AI Boom!”

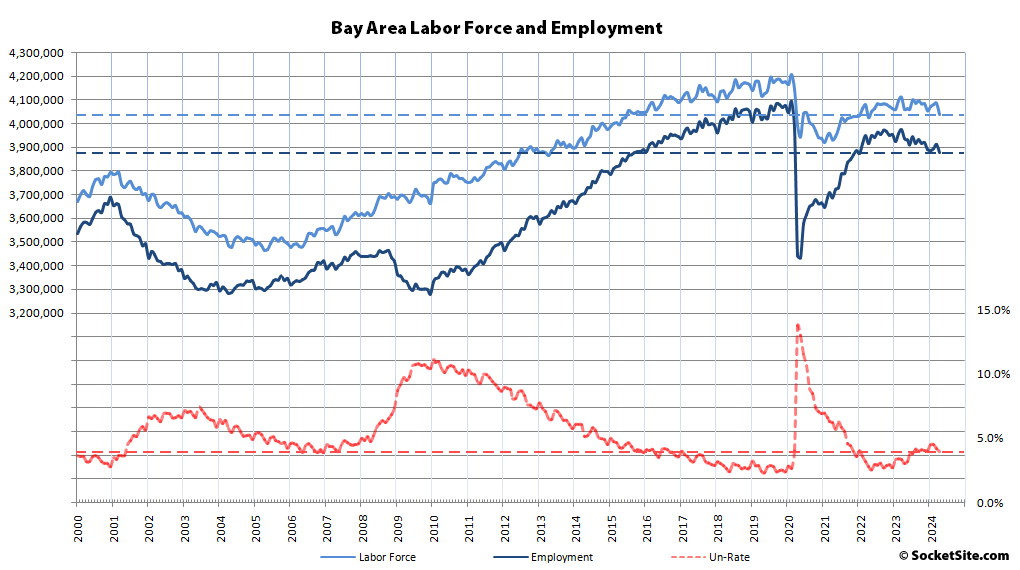

At the same time, the number of employed East Bay residents dropped by 12,200 in April, slipping back under 1,500,000 for the first time in two years, with 16,000 fewer employed East Bay residents than there were at the same time last year, over 70,000 fewer employed residents than there were prior to the pandemic and over 50,000 fewer people in the East Bay labor force (1,569,400), all despite “an unemployment rate of just 4.4 percent.”

The number of employed residents spread across San Mateo and Santa Clara Counties dropped by 12,700 in April to 1,409,800, representing over 28,000 fewer employed residents than there were at the same time last year, over 80,000 fewer employed people in Silicon Valley than prior to the pandemic and nearly 65,000 fewer people in the local labor force (1,463,300) for “an unemployment rate of just 3.7 percent.”

Net employment spread across Marin, Napa and Sonoma counties dropped by 4,000 in April to 435,200, which is roughly even with the same time last year but down by nearly 22,000 versus prior to the pandemic with nearly 18,000 fewer people in the combined labor force (452,000) for “an unemployment rate of only 3.7 percent.”

And as such, the net number of Bay Area residents with a job dropped by 34,500 in April to a two-year-low of 3,878,400, which is effectively back to mid-2015 levels, with over 57,000 fewer employed residents than there were at the same time last year and over 210,000 fewer employed residents than there were prior to the pandemic and trending down.

We’ll keep you posted and plugged-in.

Well, according to a story bylined by Adam Beam and published by the Associated Press back on Apr. 30, 2024, San Francisco’s population grew by 0.1% in 2023—a gain of about 850 people, according to the data released that same day by Gov. Gavin Newsom’s administration. If both that and the data summarized in the post above are correct, does it imply that either we have a growing cohort of unemployed people or that…well…let’s say what economists call “the informal economy” is expanding at the expense of what is accounted for by county-by-county labor force statistics?

Tech layoffs deep and wide showing a mark.

This is also consistent with an AI boom, which inevitably will decrease the need for human labor and salaries. Regardless, clearly the Bay Area is 1) not that desirable anymore and 2) not a source of new jobs. This places a new spotlight on government deficits, empty downtowns etc.

I agree that it will “inevitably decrease the need for human labor and salaries”, but that will be in the medium-to-long term.

In the short term, AI-focused companies are a source of new jobs, but on net, it doesn’t look like jobs are increasing because jobs in older lines of work are being eliminated. Even at companies like Google, jobs are being eliminated wholesale via layoffs so that they can fee up revenue to hire in AI-related jobs.

Many if not most of the people being hired into the new AI-centric jobs are not local to S.F. at the time of hiring. ICYMI (in the SF Gate story entitled San Francisco is seeing an uptick in complaints about ‘bed pods), looks like the real estate impresario and owner of that 2-story San Francisco Fire Credit Union building at 12 Mint Plaza wound up using it to “provide” substandard housing for new arrivals in San Francisco from Asia, and charging said tech workers $700 a month for tiny “bed pods” in it. So apparently a lot of people didn’t get Cave Dweller’s memo that there is no real reason to set up shop in SF or Silicon Valley.

Look at the bright side: fewer well-compensated “information” workers means fewer patrons to bum Sam Altman’s fry when he goes out for a bespoke $2000 vegan tasting menu.popup in “his” city, and when Sam wins, we all win.

Those jobs are never coming back – at least not with the current level of housing costs and business disadvantaged environment.

But housing costs are coming down, at least for existing homes. ICYMI, “the average asking price per square foot of the homes which are in contract is…around $900 per square foot in San Francisco, which is…over 10 percent lower than its peak in 2022 and inching down”. Ten percent is nothing to sneeze at, and that is due to demand destruction at the hands of The Fed. Now it’s just a matter of whether or not The Fed will let things play out until they hit their natural equilibrium. Since inflation hasn’t hit the target yet, it’s not clear that they will step in to support mid-pandemic market price levels.

Yep, condo prices, especially sweat-box loft buildings in SOMA are 15-20% off their peaks.

And then there’s the sad, sad story of Opera Plaza where even after you have paid your $1100 monthly assessment fee, you’re charged an additional $250/month “access fee” to park your car in your own spot.

I notice a 1 bed recent closed in there for $425,000 which is less than a studio in a newer building,

I’ll have to go looking for some sweat-box loft units in SOMA.

As a building in a neighborhood with “Easy access to Public Transportation” (according to the listing), Opera Plaza does not have deeded parking. If the HOA is calling the parking spot lease amount an “access fee”, to me that seems like a smart way to thwart gig economy hackers from renting out the below-market-rate parking space to others via a sublease. The HOAs are justified by the 24-hr security, heated pool, gym, saunas, club room & racquet ball courts.

Looks like the final sentence is referring to Apt 512 at 601 Van Ness Ave, a 707 ft.² unit that evidently went on market for $510k starting in the fourth quarter of 2023. The closing price you mentioned works out to just over $601 per ft.², which seems like a great result for the buyer when compared to the $794 per ft.² that realtor dot com says is the median price in Cathedral Hill.

After a cursory search, I didn’t see any sales of 1 bed, 1 bath units there near the 2022 peak, but consider that the CPI Inflation Calculator on the BLS website indicates that the amount Apt 512 sold for earlier this year is equivalent to only about 1.7 percent above what it sold for over twenty-five years ago in today’s money. Prices are coming down, but it isn’t a real estate market crash, so no one should be sad.

You need to go back further, to the mid-teens when condo prices peaked in the current market. 601 Van Ness Ave #644 closed for $715,000 on August 19, 2016. That unit is two floor higher and is slightly larger at 751 SqFt

Is the parking access fee in addition to the rental of the parking spot? Charging rent for parking is reasonable, but both rental and access seems like gouging or at least obfuscation of the true cost.

Yes, it is in addition to the HOA Payment.

Most buildings in San Francisco of that age (Potrero Court, Diamond Hts Village and Dolores Plaza, etc) offer deeded parking at no extra charge.

@Charlie – I don’t think you can assume that HOA fees include rental of a parking spot. Building management are free to unbundle parking from living space. Residents who don’t need a parking spot can then lower their expenses. It sounds like that $250/mo. access fee is actually the parking spot rent.

Milkshake, looking at the current listings at Opera Plaza, I think you are right. It seems condo owners are guaranteed a parking space if they want one but must pay the $250/month parking fee. I think the owner of the commercial spaces at OP also owns the parking garage as it is available for public parking too. Probably makes more $$ from the Opera goers.

I am under the impression that housing has accelerated moving out of reach, regardless of interest rates. In other words, the current interest rate environment might simply obscure this scenario, and big picture, things move in the wrong direction, fast. Chances are, by the time we might see interest rates in half, a twenty percent drop or even more could still not be enough. Just look at CPUC/PG&E, insurers, state/local governments etc. all turning the screws. There’s a reason these costs are now called “the second mortgage”. And that’s just looking at housing – there’s ppl in Sacto mulling an increase of the price of a gallon of gas by 50c every year, on top of the regular excise tax increases (CARB, look it up).

Housing is much cheaper in other places around the US and the world, that can provide the same or better quality of labor as the Bay Area – and in even more quantities. Even a cursory research/comparison of real estate prices with other knowledge centers of the world will reveal massive housing costs and by extension labor pricing differences. And then was never really the need for so much labor in the knowledge economy. Add to this massive (yet silent) replacement of jobs due to affordable robotics and AI.

The cuts are deep and hiring is practically frozen. And for those positions that must be filled preference for place of hire is elsewhere. In my view, AI adoption is intentionally slow paced to avoid potential crises due to employee revolts or worse. I don’t see previous level of employment happening if ever. It doesn’t make business sense.

I don’t doubt that other cities in the USA provide larger pools of labor. You might notice that the biggest tech companies already have a distributed presence all across the country and worldwide though the HQs remain right here. Add the unique quality of living here which isn’t just confined to the kind weather that keeps us cool while the rest of the country is sizzling and warm while it is freezing elsewhere. There are social freedoms here that many workers see as valuable, the rights to have a say on what happens in your own body for example.

The biggest tech companies are moving their HQs elsewhere – Oracle is the latest, moving its HQ to Nashville, TN . Even those that maintain HQs in the Bay Area have ceased expansion locally.

As for the high quality of living due to geographical location is a fair point – but without commensurate salary and so on – its not going to possible to enjoy these privileges . Same with “social freedoms” and “rights”. Why do I need to “pay” to accommodate when I can get the same or better talent without the headache elsewhere?

There was a time 40-50 years ago when the competency gap between what UC Berkeley/Stanford/Federal Labs could train vs rest of the world. In the decades past, that gap has been closed and in fact, it is not uncommon to find better talent elsewhere.

Tesla would have been a better example, Oracle isn’t even in the top 10 when ranking tech companies worldwide by marketcap. Please do post again when one of the ones that are, Apple, Nvidia, Alphabet, Meta, or Broadcom, announce an HQ move to free themselves of potential employees enjoying “social freedoms” and “rights”. Amazon and Microsoft, which are two of the others in the top 10, still have a major presence around Seattle.

And yes, just within my adult lifetime, Oracle moved from Santa Clara to Redwood Shores then to Austin, TX and as you said, now to Nashville, TN. All that says to me is that Larry Ellison — like Elon Musk — forces his investors and employees to spend more time dealing with his personal idiosyncrasies than they would at other firms. If you read their filings, you’d know that despite the move of the HQ to Austin, as of earlier this year Oracle still has more employees located in California than they do in Texas.

You understand that companies need not move their HQ elsewhere while no employing at the HQ and creating centers of excellence elsewhere, right? Also, they don’t have to grow their employee numbers to grow their operations / sales / revenues or profits. The larger point is companies will move operations, jobs, HQs (or retain them in name) to wherever they think is better return on investment – i am repeating myself. Even if tech-corporates have large numbers of employee retention inertia in California – that doesn’t mean they are hiring more or won’t see decreases in the future. At this point in time there is really no reason to hire in California for new-talent – in software, or AI, or semi-conductors or bio-tech at the same rate as what it was before the inflation tsunami hit the region. Did you buy property in California/Bay Area or SF in the last few years – hoping to take advantage of the high priced real estate during low interest regime? Well, good luck to you!

Apple getting its backside handed to it in China Apple slashes prices of iPhone 15 models to new low in China amid heated competition in world’s largest smartphone market . Think about that, one of the richest tech-corporate on the planet with vast sums of money and talent at its disposal getting out competed in Asia.

See, scale is required condition for innovation to amortize R&D costs and also funnel profits – for AI, semi-conductors, software, bio-tech, heavy industry etc. As scale erodes so will innovation. Silicon Valley/US /were/ successful because they were able to capture/address this scale. I made the point in different threads about global markets fracturing due to rise of competition from Asia. This competition will only get worse. Why you may ask? Put a pin in Bangkok and draw a 2000 mile radius circle – you get ~4.5B in population that is pivoting towards China. Great big changes are afoot. China’s Xi tells Putin of ‘changes not seen for 100 years’

Oracle’s riding their product stack into the beach. The joke’s been how they are a law firm (jerking their users around) with a tech department. Nobody in their right mind are using anything they own to start a new project or product if they can help it. Broadcomm is garbage as well, they’ve turned into a private equity investment firm. A great example though showcasing the disinvestment in the Bay Area is Intel. Their presence in Santa Clara is a shadow of the past, while remaining one the largest single property and land owners in SV – not that it matters to them it seems.

While it’s true that Apple’s newer iPhone models aren’t selling as well as they were previously in China, I disagree with the assertion that Apple is “getting out competed in Asia”. Someone wanting to make that claim would have to provide some supporting sales data from other Asian countries where Apple’s products are sold.

I think Apple’s sales declines in that one country in Asia are partially due to the fact that they are more expensive, but mostly because the CCP has banned employees at Chinese agencies and state-backed companies across the country from bringing iPhones to work. CCP is largely retaliating against Apple for perceived slights against them by the U.S. government’s pandemic-era rules that prohibited the sale of some communications equipment made by Huawei or ZTE in the United States, citing “unacceptable” national security risk. The playing field isn’t level, and China doesn’t subscribe to your “free trade” capitalist dogma, the people in charge of the CCP don’t believe in “global markets”, they are engaging in Mercantilism, full stop.

Yes, China fracturing global markets is retaliation against US disallowing China to buy property in the US. Thank you for finally acknowledging this basic fact of reality in todays’ world – albeit in a rather round-about manner. And this retaliation will increase to an extent where US corporations are rendered significantly disadvantaged. Why is this relevant to San Francisco/Bay Area? Because the region is the last/major center of excellence of productivity gains in the US – which is the major reason for employment, various VC shenanigans and attendant speculation in local RE. That is slowly but surely being hollowed out. Now, let’s move on to more interesting questions – how will US out-innovate and out-compete China and what role can SF Bay Area play in ensuring that?

Keep in mind, at the moment, China & Russia are under no obligation whatsoever to respect US patent/copyright regime.

Don’t these selfish politicians realize how their global schemes are impacting the Bay Area…the

cityCity specifically ??If U.S. politicians were able to disrupt the steady supplying of fentanyl to S.F.’s illicit open-air drug markets, that would be hugely positive for The City specifically. Last month, a House of Representatives’ select committee found that China is directly subsidizing production of illicit fentanyl precursors for sale abroad and fueling the U.S. opioid crisis.

I didn’t write anything about “China to buy[-ing] property in the US”, please don’t put words in my mouth. What I mentioned was the retaliation of the CCP in response to The administration banning approvals of new telecommunications equipment from Huawei Technologies because they pose “an unacceptable risk” to U.S. national security.

Anyway, to be clear, I am happy that The Fed is destroying housing demand, would be happy if we had less demand for housing in The Bay Area (since building more housing to solve the deficit is impossible in the real world) and pricing levels returned to be more in line with what locals can afford on non-“tech company” salaries. If, in addition, we have more flippers, developers and other hangers-on in the S.F. real estate “game” moving away from here in the next few years because they found out they can’t make enough money exploiting people here who will overpay for housing to fulfill their dreams of avarice, then that will be even more positive, in my book.

I believe you got this backwards. The CCP got bigger fish to fry than worry about their new-money billionaire class’ ability to pick up trophy properties overseas. In fact, it’s been the CCP that’s been preventing the outflow of capital from China under ever tighter restrictions.

Upon further reflection, perhaps cave_dweller was referring to something I wrote not in this current thread, but one from the past. Last year, we had a discussion going about a column written by The Chron’s Laura Waxmann, S.F.’s luxury condo market is cooling which blamed the decline in sales of San Francisco luxury, ultra luxury and über luxe condos on a decrease in foreign investment in the U.S. generally, and quoted agents from real estate firm Compass as saying that “until recently, new condos had been very appealing to foreign investors” but “U.S.-China relations have been going down the tube for four years”.