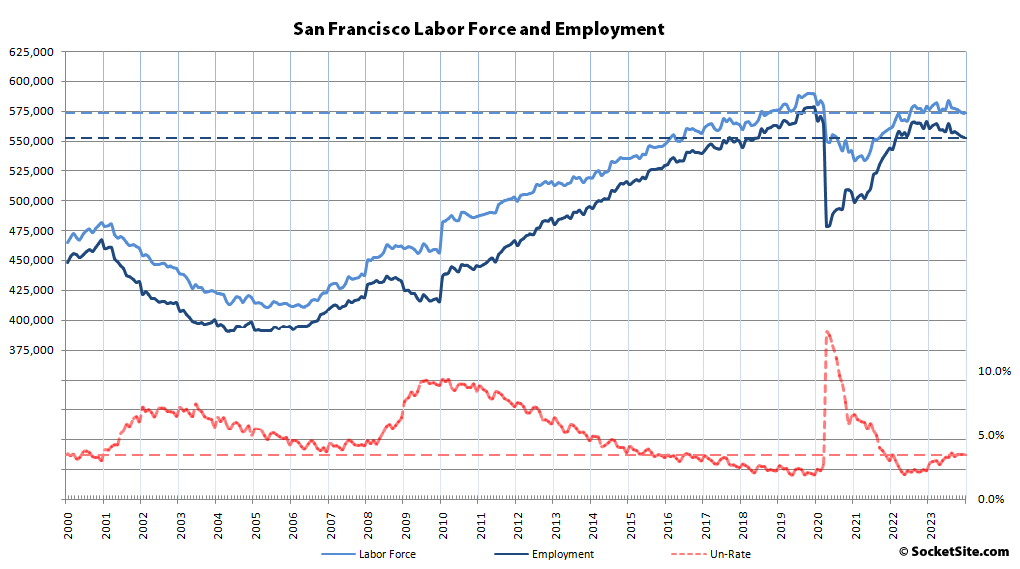

Having dropped by a downwardly revised 1,900 in November, the net number of San Francisco residents with a job dropped by another 1,300 in December to 552,800.

As such, there are now over 13,000 fewer employed residents in San Francisco than there were at the same time last year, representing the largest year-over-year decline in employment in nearly 3 years, with over 25,000 fewer employed residents than there were at the end of 2019, prior to the pandemic, and over 16,000 fewer people in the local labor force (572,800), all despite “an unemployment rate of just 3.5 percent” and the “AI Boom!”

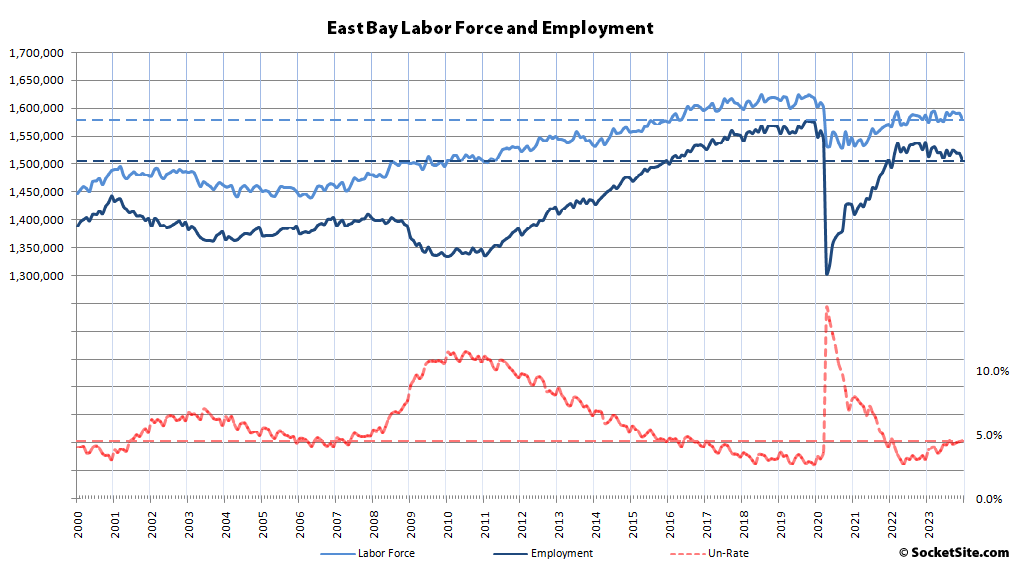

At the same time, the number of employed East Bay residents dropped by 12,700 in December to 1,506,500, representing nearly 32,000 fewer employed residents than there were at the same time last year and 67,000 fewer employed residents than there were prior to the pandemic, with 38,000 fewer people in the East Bay labor force (1,578,800) and an unemployment rate of only 4.6 percent.

The number of employed residents spread across San Mateo and Santa Clara Counties dropped by nearly 9,000 in December to 1,444,300, representing 39,000 fewer employed residents than at the same time last year, with over 48,000 fewer employed people in Silicon Valley than there were prior to the pandemic and 24,000 fewer people in the local labor force (1,499,700), with an unemployment rate of only 3.7 percent.

Net employment across Marin, Napa and Sonoma counties dropped by 4,700 in December to 431,500, representing 7,000 fewer employed residents than there were at the same time last year and nearly 30,000 fewer employed residents than there were prior to the pandemic, with over 23,000 fewer people in the combined labor force (448,800) for an unemployment rate of only 3.9 percent.

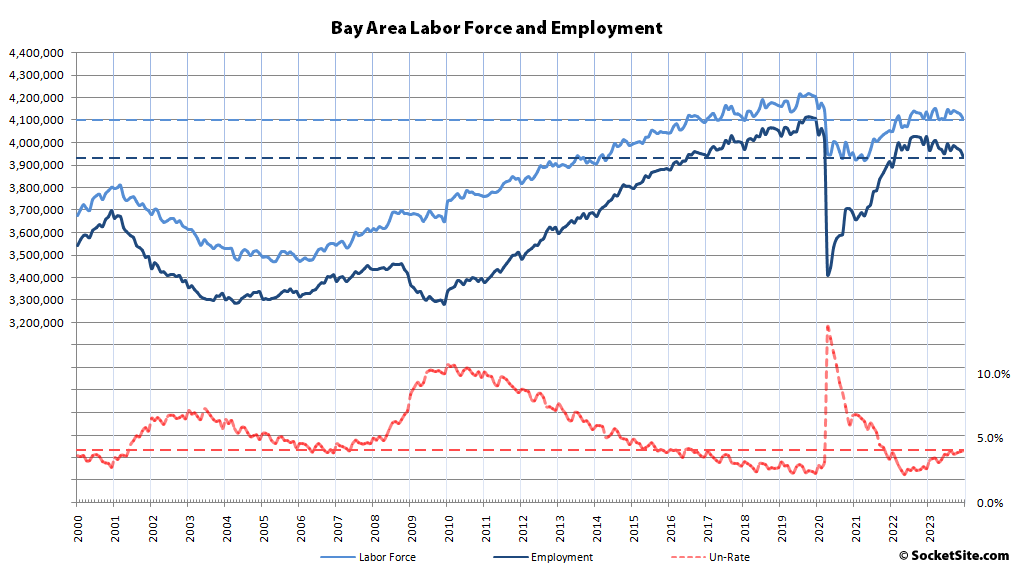

And as such, the net number of Bay Area residents with a job (3,935,100) dropped by over 27,000 last month and was down by over 90,000 on a year-over-year basis, representing the eight straight month with a year-over-year decline in Bay Area employment, with over 170,000 fewer employed residents than there were prior to the pandemic, over 100,000 fewer people in the labor force and local employment now back to 2016 levels and trending down, none of which should catch any plugged-in readers by surprise.

AI doing the AI thing! I hate to say this, but more layoffs are coming. Everyone is going to get caught in the crossfire.

The other factor is Man Francisco is no longer a viable place for mate finding. People underestimate the drive of young people to find mates and the impact it has at every level of social and economic structure. Once mate finding well dries up/has too much competition – the herd breaks off.

Recently it’s been layoffs for layoffs sake. What with these experienced (read: high income) software engineers and front line managers. The types of jobs that AI is going to replace are elsewhere, so AI’s impact on shrinking Bay Area employment has been and will be mundane for the foreseeable future. I suspect it’s a net plus actually.

Layoffs aren’t done for “layoffs’ sake.” Layoffs are done to cut expenses in order to improve the bottom line when the free money spigots for billionaires dry up. When money is cheap, speculative businesses expand as fast as they can, without regard to productivity, profitability, or long-term sustainability. These types of businesses horde workers the same way they horde office space. They use increasing numbers of employees as an ersatz measure of their viabliity, in order to secure even more loans at even better rates, as well as publicity in the business press and bragging rights on the golf course. For these and many other reasons, large employers are loathe to lay off workers, and only do so when they have to. Layoffs are a sign of a reckoning in progress.

For most companies, I think most of what you wrote makes sense and is reasonable, but in the case of the one which all would have to admit is a large Bay Area employer…well, lemme just tell you what the relevant section of their 2023 Q3 earnings statement said (I happen to be a holder of holder of Class A stock in this company):

They didn’t break out the geographical impact of their reductions in workers, but I think it’s obvious that S.F.’s expensive workers and office space will bear the brunt of this, as will their new space in San Jose.

That same company reported $77 billion in revenue, up 11% year over year, with a 3 percent increase in operating margin, during the same period in which they planned the described continuation of layoffs. Net income underwent a 41.5 percent increase! Early in 2024, the stock is at an all-time high (and they are continuing layoffs this year).

They clearly didn’t have to lay off anyone. They didn’t have to pay out premature lease termination fees.

You guessed who this was by now, right? Alphabet Inc. I knew a double-digit number of people who worked there prior to 2022, many of whom I went to college with, and as of this month, every single one of them has been let go.

True, but this is all happening since the advent of normalized interest rates and quantitative tapering. The end of the unchecked growth mania that was fueled by years of free money for billionaires means even they now have to pay more attention to the bottom line. Profits and stock prices can certainly continue to increase, but absent cheap loans, the rampant unproductive growth has ended, and downsizing is now in progress, at even the biggest companies, as you note. The relevant point here, I’m sure we’ll agree, is what the end of this bubble portends for local commercial and residential real estate.

Layoffs aren’t done for “layoffs’ sake.”. That used to be. See Alphabet as referenced by Brahma (incensed renter) for the latest industry trend. I recently caught myself telling somebody who’s (still) at Google that I’m “sorry to hear that”, which is quite a new angle, but seemingly appropriate in light of their new-found toxic work environment. And Alphabet are not alone in this kind of par-for-the course year-round layoff scheme. I can’t imagine entering a corporate environment out of school these days.

In any case, SFGATE reports today that San Francisco has seen some 10,000 layoffs last year (“A San Francisco agency tracking layoffs reported a stunning total for 2023”), so there’s a number to mull.

Or as we first reported last week, “there are now over 13,000 fewer employed residents in San Francisco than there were at the same time last year, representing the largest year-over-year decline in employment in nearly 3 years, with over 25,000 fewer employed residents than there were at the end of 2019, prior to the pandemic, and over 16,000 fewer people in the local labor force (572,800),” all of which is net of layoffs and re-hiring, which is what really matters and shouldn’t catch any plugged-in readers by surprise, despite misanalysis by others last year.

To oversimplify somewhat… When the risk free rate is near zero, a business activity projected to yield 5% makes sense. If the risk free rate goes to 6%, that activity no longer makes business sense. Higher rates also hit the real estate market hard. And the problem is that the hits to the RE market and the employment market are correlated. So RE investment doesn’t provide quite the diversification that people might expect. Doubly so for local RE because hits to local employment feed back into hits to RE.

It’s always easy to look at asset class correlations in hindsight, but the world is not a static place. Local employment and RE are taking a hit but the stock market is near an all time high, with local tech a big driver of that!

..but the stock market is near an all time high, with local tech a big driver of that! . Generally speaking, the volumes are not very strong. Nasdaq 2023/2022 Monthly Volumes. If anyone has the patience and time, would be interested in trading volume information for the marquee tech stocks.

It is interesting to muse about the “depth” of this bull market in stocks. i.e. how much selling can it withstand?

But still, if someone became unemployed now it is far better to be a forced seller of stocks now than a forced seller of RE. I think there’s a lot of fat in big tech that can be cut without any loss of profit. So it seems possible that tech stocks could keep soaring even with ongoing cuts to employment. But still, with so much of the market gains driven by tech there’s a clear linkage between the stock market the RE market and the employment market. With these three components being the main pillars of many peoples wealth it seems worthwhile to watch how they are correlated to each other.

“Diversity reduces adversity” as they say, but correlation reduces diversity. Its a tough market out there!

What’s been helping stocks up is the speculative element that the trillions in cash that are sitting on the sidelines are starting to melt into the stock market (and elsewhere) once the interest rates slide downwards. Out of all brokerages, even Vanguard in their annual look-ahead webcast last week alluded to the idea how it might be a good idea to move out of over-weighted cash positions and get ahead of the crowds (I am paraphrasing).

wilson said: I think there’s a lot of fat in big tech that can be cut without any loss of profit. So it seems possible that tech stocks could keep soaring even with ongoing cuts to employment.

You’re basing this on what, exactly? Have you ever been in a position of management responsibility at a “big tech” firm, or even been employed by one for a meaningful length of time?

Or are you just sitting around listening to pundits on Fox business or CNBC (who overwhelmingly have never run a real economy business) talk about what they read in quarterly earnings releases and Wall St. Journal editorials?

Yes, but I don’t think the internal politics of companies moves the market much short to medium term. Maybe not what the pundits say, but earnings are tremendously important. Hype and “hot” technologies are important to the market as well (AI these days). Investors are basically looking at growth and/or value. Earnings drives the value crowd and working on something which investors expect to produce future profits drives the growth crowd.

Look at all the products that Google has killed over the years. Their stock didn’t tank because they killed Google Reader. In the past they tried to re-cycle people working on products that got killed. But had they let those people go I doubt the market would have cared.

Now talking longer term, I have seen firsthand the negative morale effect of layoff waves. But IMO the productivity hit in this case is not really the loss of the people laid off, but the de-motivation of those who remain. Particularly with waves of layoffs it created the perception that management doesn’t know what they are doing. This could be true or it could be simply that economic conditions keep changing, but either way it creates a bad type of uncertainty that can paralyze an organization.

@wilson. “the perception”. Oh well, this is Sundar Pichai you are talking about here.

wilson, having been in this situation I can assure you that while there definitely is a negative impact on employee morale when there are multiple waves of layoffs, the larger one is the productivity hit due to the loss of staffing and increased workload on the staff that survive the layoffs.

At the last company I was at that had more than one layoff round, project and ongoing support tasks didn’t decline with the loss of staff, and I assume that was because top management, like you, thought that there was “a lot of fat…that can be cut without any loss of profit”. Well, they were wrong.

Because most of the competent technical professionals wake up on the second or third day afterwards and said to themselves “my group went from four people to just me. Why the hell am I working myself to death doing the job of three other people for the same money?” And then they start looking around for another job and soon quit. So there’s a “multiplier effect” with layoffs, because more significantly more positions wind up vacant than are actually affected by the layoffs.

And it does affect profit, because all of a sudden the company’s customers aren’t getting the support and responsiveness they are used to, and when it comes time to renew, they switch to a product from a different vendor (or run their advertising campaign with another website/social media platform). But there’s a delay in the reduction in top-line revenue. The Karen Firestones of the world won’t tell you that when they are spouting off on CNBC about topics they know nothing about.

At the last company I was at that had more than one layoff round, project and ongoing support tasks didn’t decline with the loss of staff, and I assume that was because top management, like you, thought that there was “a lot of fat…that can be cut without any loss of profit”. Well, they were wrong. Because most of the competent technical professionals wake up on the second or third day afterwards and said to themselves “my group went from four people to just me. Why the hell am I working myself to death doing the job of three other people for the same money?” And then they start looking around for another job and soon quit. So there’s a “multiplier effect” with layoffs, because more significantly more positions wind up vacant than are actually affected by the layoffs.

Most people are laid off not because they are incompetent but because as a consequence of financial engineering/restructuring, which in turn is a consequence of availability of liquidity in the market. Cash flow is king. It is no longer an environment where one can “jump” between jobs. In a low interest/high liquidity environment, most people also hired as a means for liquidity distribution throughout the system.

Put another way:

Those who have access to liquidity before everyone else (the rich) can buy labor for cheap from those behind. And having gained the advantage of buying cheap labor, then turn around and buy whatever overpriced goods the hardworking labor bought, again for cheap. So goes the business cycle. American caste system is invisible but indubitable.

In the Pre AI world: Any technology that was developed to solve a specific problem would first have multiple different implementations. And all these different implementations spawned various industries/employment/support/economic activity. Over time, implementations succeed or fail on their merits and eventually converge to one for couple of implementations that are capital, labor and time efficient.

In the Post AI world: This time to convergence is massively shortened, if not eliminated – since you can test implementations in a virtual environment without the overhead of physical testing and proving. This isn’t a new idea and has been around for a few decades. However, the big change is cost/energy efficiency of computation required for economically feasible AI – which was a major barrier to widespread adoption. This barrier to cost/energy efficiency was breached around 2018. And since has been progressing at a rapid rate.

In the past, “Smart People” were paid massive wages, who were deployed for problem solving and helping along with the maturation; are no longer needed in the same quantity as before. Algorithmically speaking, AI has matured a long time ago (40+ years ago) – what was lacking was access to cheap/vast data/compute. Be prepared for massive changes ahead.

The implication being: the need for “supporting” industry/labor and “technology maturation” time isn’t as it once was.

Previously, I had made several posts about high speed packet networks. This has been 35+ years in the making (since 1989). We are at a point where the entire globe regardless of its remoteness is accessible over network.

The barriers that once existed to free exchange of information are practically no more. It was this “differential” in access to information that created “information access” arbitrage opportunities – especially in places like the Bay Area which translated to nice valuations in Tech sector and accompanying RE. The availability of cheap capital was like steroids for these speculative arbitrageurs.

The new idea development/incubation and startups in many regions around the world has picked up. Also, with the high cost of living as well as poor governance, the Bay Area, particularly is not a very appealing location when compared to other parts of the US or globe.

It’s not clear, to me at least, if this was a parody of George Gilder’s prose or if you are sincere.

If the latter, you sound like the the Internet triumphalists that used to keynote academic conferences when I was in grad school. You know, the guys who used to spout off with “The Internet interprets censorship as damage and routes around it.”

It’s kinda funny now, because some of those researchers who presented at those conferences went to work for Cisco, the company that in the early days (circa 1990’s) built and sold the same devices that the CCP and other like-minded governments use to create and enforce “barriers to free exchange of information”. And they very much are part of “the entire globe”.

Is Google operating in mainland China? Is Meta operating in the DPRK? No on both counts. And of course, some countries have their own network champion companies, such as Huawei Technologies Co., and don’t need to buy Cisco’s hardware any more, so being complicit with that authoritarian government’s policies didn’t even win them ongoing business in the long term.

I agree with the point about Bay Area real estate valuations being too high and have to come down, but that is going to take quite a while to play out. When it finally happens, there will be more than one cause.

“The Internet interprets censorship as damage and routes around it.” This is pretty much how the US patent regime was overcome in China and now in Russia. And not just that – having mastered the technology differential in various fields, they are now proposing bifurcating and in some have parts already bifurcated global markets. The ascendancy of SF is fully correlated with America’s uni-polar moment – between 1991 and 2021. What happens when uni-polarity goes away?

“free exchange of information” isn’t all about sharing lol cats, access to questionable/titillating materials or sensational drivel. What was the quintessential differentiator that separated the “haves” from “have nots”? Technology: Know-How and Know-Why. And the network did really help route around these barriers.

UPDATE: Bay Area Employment Drops Year-Over-Year, Nearing 2015 Levels