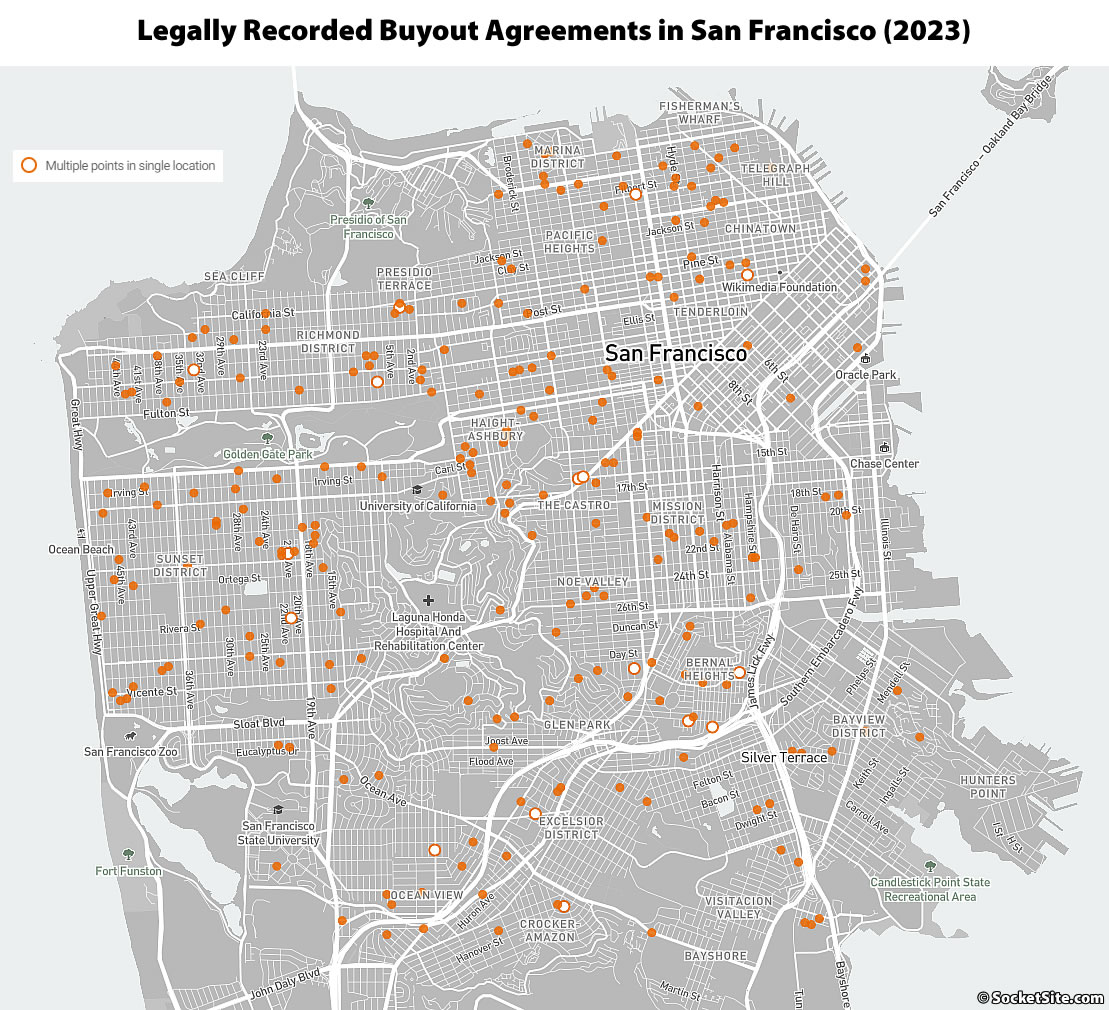

Landlords in San Francisco inked 260 legally recorded tenant buyout agreements last year, as mapped above, a 33 percent drop from the 389 inked in 2022 and 391 inked in 2021, with a 20 percent year-over-year drop in the number of “pre-buyout negotiation” forms having been newly disclosed as well and the highest reported buyout agreement totaling a little over $204,000, paid to a single tenant of a multi-unit building in the Inner Richmond, all according to our queries of the City’s databases.

Having averaged $53,828 in 2022, the average reported buyout agreement in San Francisco dropped to $43,124 last year, with an average payout of $28,720 per tenant, which was down from an average of $35,720 per tenant in 2022 and the lowest average payout per tenant in six years.

And for the first time in six years, the Mission wasn’t the San Francisco neighborhood with the most inked buyout agreements, having dropped by 49 percent from 2022, with the Sunset having led the way with 29 inked buyout agreements in 2023, followed by the Mission (25), Ingleside (20), Haight-Ashbury (18), the Inner Richmond (18), and Parkside (17).

We’ll keep you posted and plugged-in.

The shift to remote work is giving a big lift to the Richmond and Sunset. I’m very bullish on the Richmond in particular, considering the investments to Geary Rapid Transit and building height limit increases along California, Geary, Clement etc, along with its existing assets including Lands End, Baker Beach, and the Presidio, all of which listed above the Sunset doesn’t have.

Correction: The Sunset is getting height increases as well, however Geary and California are getting higher limits.

To someone not among the flippers, developers, and other hangers-on in the S.F. real estate “game”, what does “a big lift” mean? Does that mean that two and three storey buildings in the neighborhoods you mentioned will get redeveloped with more units at a liveable size to take advantage of higher allowed building heights? Or does it mean those neighborhoods will attract more attention from investors and penny ante landlords looking to make bank by turning out tenants protected by rent control and putting those buildings on the market for other uses? Enquiring minds want to know.

No no!

The Richmond District is terrible! Don’t look there, don’t go there! Nothing to see, please move along!

No nice restaurants with walkable neighborhood strips, an abundance of trails and easy walks to beaches. No good access to the Presidio and GGP for running and relaxing. No fun coffee shops and aspirational restaurants, no relatively-easy parking. No fun bars. No good food.

So many coyotes!

It’s always foggy! No surfing!

No nice families around who want their kids to grow up in a safe neighborhood with good schools. So difficult to pop across the GGB to get to Marin trails and fun.

Forget it!

“fun bars…So many coyotes”

So coyotes and cougars, oh my!!

To put my previous question in more concrete terms, take a look at 246 20th Ave via your favorite real estate listings site. Last I checked was zoned RH-2 prior to any upzoning. Go ahead, I’ll wait.

At current asking, one could get that house, a 3 bedroom, 1.5 bath Edwardian SFH on a lot of 2,996 ft.² at about $664 per ft.², which is significantly lower than the city-wide median. Occupied at the moment, but it’s a business tenant, I don’t know if a buyout would still be involved to change it’s use.

Now, tell me what do you think is more likely: will that be demolished and replaced with a taller building with more units to take advantage of all of the recent upzoning? Or will the buyer build an ADU in the back of the yard, taking advantage of the “extra deep lot”, to provide additional housing since we’re in the midst of a housing crisis?

Or will the height be kept exactly where it is, and have its internal structure tweaked to turned it into a hive of pods that are being rented out at $700 a month like that building in Mint Plaza? Or Those 5 homes which were cut up and reconfigured by Starcity to be “co-living spaces”?

If you want genuine answers, you could try being less condescending to other people.

The intent was to be sarcastic, not condescending.

I think the genuine answer is that most of our local real estate hacker community is only out to take the path of least resistance, and so it’s highly unlikely that someone is going to buy that property in The Richmond and take advantage of either the upzoning or the recently-created ADU allowances. Cutting up an SFH, stacking bunk beds in each room and calling the result “co-living” is a much easier lift, and I definitely look down upon that alternative, because it doesn’t produce any more housing.

But perhaps even that hack won’t work. As of this writing, at least one of those homes featured in the post I provided a link to (didn’t know this at the time, I just looked), 6 Nottingham Pl in Jackson Square, apparently didn’t sell as an “investment opportunity” in 2020 in spite of commanding $1,527 rent per room on average and is currently up for a short sale / receivership sale (dual-tracking foreclosure) asking $1.575 million (Starcity, which The Chronicle called “the San Francisco startup that helped pioneer a model of tech-centric, urban co-living” at the time, failed and was acquired by a rival New York-based firm in the Summer of 2021).

I’ve lived in a small, maybe illegal, basement studio in San Francisco Civic Center home for a decade. My rent is next to nothing as landlord gave good price for assisting them in their home. Now he wants me out.

My rent is under $800/mo for studio. Landlord has illegally asked me to move, sent somewhat threatening emails about how bad it would be if he took me to small claims for $4k back rent while jobless 2022 to 2023. even though I have paid regularly for a year now and tried to pay down back rent.

I was approved for rental subsidy but he refused to sign W2 needed to receive funds, He entered my unit without notice which I caught and documented. I finally sought help from Tenderloin Housing Group and they said instead of taking him to court for his harrassing and inappropriate coercion to move out, I should try a cash for keys agreement and see if he will buy me out. landlord said he doesn’t want to go to court and is open to buyout then said he will waive $3k and 3 months rent. Shouldn’t I ask for money to move? not just $3 waived? How much should I ask for?

I would find a lawyer. They will help you get the most money possible. If the unit is illegal then the landlord may owe you all of the rent you ever paid.