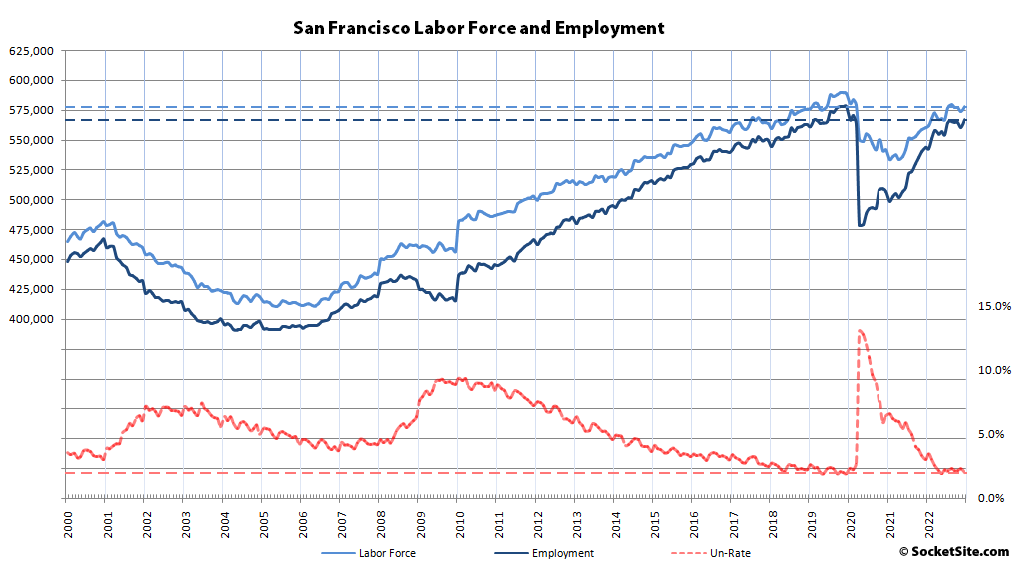

Having atypically dropped in October and November, the net number of people living in San Francisco with a paycheck increased by 5,900 in December to 566,700, ending 2022 with 23,000 more employed residents in the city there were at the end of 2021 and 88,000 more employed people than there were in April of 2020, when the pandemic-driven unemployment rate peaked at 13.0 percent versus 2.0 percent at the end of 2022.

That being said, there were still over 11,000 fewer employed residents in the San Francisco at the end of last year than there were prior to the pandemic, over 11,000 fewer people in the labor force (578,400), and local unemployment claims are poised to climb over the next quarter or two.

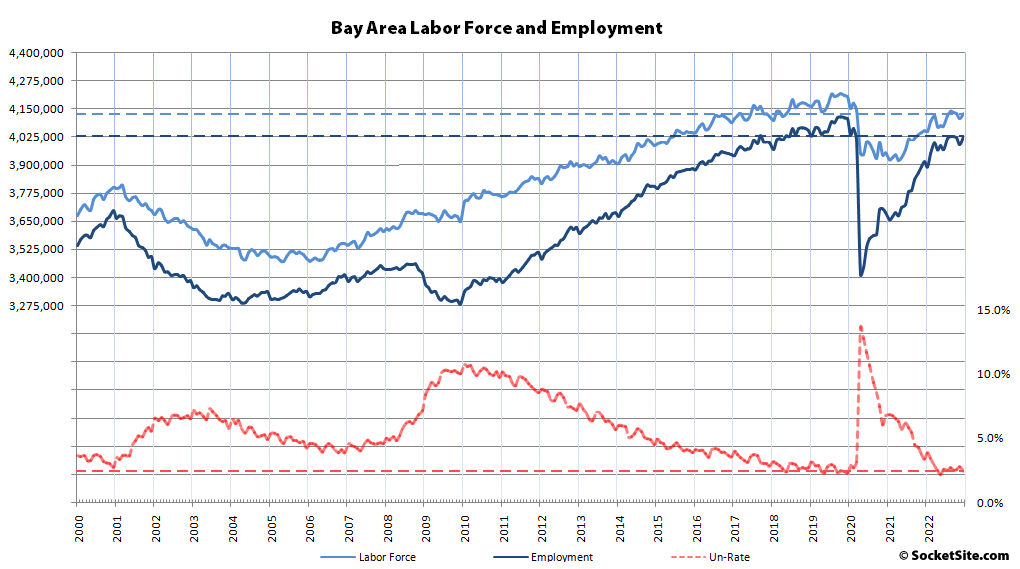

The number of East Bay residents with a paycheck increased by 14,200 in December to 1,539,900, representing 32,700 more employed residents than at the end of 2021 and 236,000 more employed than in April of 2020 but nearly 37,000 fewer employed residents than prior to the pandemic having hit and over 38,000 fewer people in the labor force.

Employment increased by 4,500 in San Mateo County last month and by 8,400 in Santa Clara County. And as such, there were over 50,000 more employed people down in Silicon Valley than there were at the same time last year and nearly 10,000 more employed residents (1,487,800) than there were prior to the pandemic, with an unemployment rate of 2.0 percent.

Net employment across Marin, Napa and Sonoma counties increased by 2,500 last month to 433,400, representing 8,000 more employed residents spread across the northern counties than there were at the same time last year and 66,500 more employed residents than in April of 2020, but nearly 37,000 fewer employed residents than there were prior to the pandemic and 37,000 fewer people in the combined labor force (444,600) with an unemployment rate of 2.5 percent.

And across the greater Bay Area, the net number of residents with a job increased by 35,500 in December to 4,027,900, ending 2022 with 114,400 more employed people than there were at the end of 2021 and nearly 617,000 more employed residents since the second quarter of 2020, with an unemployment rate of 2.4 percent, but 86,000 fewer employed residents than there were prior to the pandemic having hit, 90,000 fewer people in the labor force and a wave of recently announced plans for mass layoffs from a growing number of large Bay Area employers.

If you don’t catch the “living in san francisco” part – then this is very misleading. Roughly 700k people (non-covid times) would commute to SF. So the SF Employment rate and SF Resident Employment rate are two drastically different metrix.

We must admit, it is important to read and understand what we actually write in order to understand the implications for local real estate.

That is key. Downtown nearly doubled its population on weekdays from non-residents commuting in. Pre-pandemic. That is greatly reduced now. BART has seen a big drop in usage and some stations (Montgomery, Powell and Embarcadero) are down 80% in traffic.

How much of this is service industry employment? That should really push SF housing prices up again.

Ahh yes, those minimum wage service industry jobs are really going to drive prices higher. I’ll have what Fred is smoking…

Much of the residential price escalation in recent years has come from high paid tech workers. With tech abandoning (to a large extent) SF that price pressure is gone. Prices are dropping and especially for condos and especially in the SOMA. So yeah – prices have nowhere to go, as they say.

It would certainly be a shame if tech companies were also laying off workers in Seattle, but this is probably just an SF problem.

From Amazon, Microsoft Job Cuts Deal Another Blow to Ailing Seattle, posted yesterday, 1st ‘graph:

I don’t think that Seattle’s local economy is as dependent on the small slice of tech sector workers as S.F.’s is, because of the work that local developers have done on S.F.’s housing market to make it dependent on high paid workers who are largely from outside the area, but “the problem” doesn’t seem to be limited to San Francisco and I would think Dave is aware of this.

Seattle’s economy is more diverse than that of SF. As you say SF has been overly dependent on tech in recent years. When tech leaves there is no real alternate job sector. Seatle has Boeing – the largest single employer there and the port which is second on the West Coast. Large military presence as well. The housing situation is different insofar as Seattle has produced far more new housing over the past decade than SF.

But yes, the new work model with a diversification of jobs out of downtown cores to secondary markets affects many cities. One long term impact will be public transportation – if takes on a secondary importance as jobs are distributed away from city centers to suburbs and exurbs. It brings into question transportation projects such as CalTrans to downtown SF. There is no reason to spend billions on that now given the changes. Rather use those resources to build housing.

@Dave: Pushing public transportation to the back burner and skipping out on the Caltrans to Transbay Terminal connector and more so the second Transbay tube means ppl will continue to stay away. I am not fervently advocating, but barring the realization of a decent commute experience, those hundreds of thousand of commuters are not coming back. Corners were cut pre pandemic to instead focus on pet projects like the Contral Subway. Now we get the bill for it.

Bad news for the crowd here that’s been cheering for SF residents to lose their jobs.

Other than a mischaracterization of people that have been projecting local job losses, we haven’t seen much of a “crowd” actually cheering for that to occur. Regardless, the rather chilling news is that the pronounced downturn in the Bay Area market, and San Francisco proper, has occurred despite the rebound in employment, at least through the end of last year.

Definitely a sizable crowd that would love to see SF fail as it’s typically seen as the progressive capital.

Some of them also want it to fail because they don’t like rich tech folk who drive prices up beyond what everyone else can survive on.

The closest thing I’ve heard to what L&E is talking about was in the national media, from CNBC’s Closing Bell: Overtime show on the 18th (fast forward to the 2:06 mark):

I think it’s a shame The Fed doesn’t have the tools to cool off the labor market other than by causing layoffs. It would be wonderful to know the distribution of salary levels in those jobs that are going unfilled which causes The Fed to think the labor market is overheated.

There was a noticeable increase in people downtown over the last 2 weeks. Not normal but less abnormally empty.

last week was the JPM HC conference with 20K people downtown. nothing to do with local work.

Yep. There are policies around the corner calling everyone back to the office 5 days a week. Apple is almost there. (already 3 days a week)

Google is about to announce permanent back to work – as is Zynga. It’s just not public quite yet.. but around the corner. However, Some people have already moved out. (Zynga)

That remains to be seen. Even with recent down-sizing, unemployment rates are still relatively low for SF and Silicon Valley. Mgmt is reluctant to force it, as it can be difficult to replace talent. I don’t have crystal ball, but it looks like new era for the way office space is utilized. Absoprtion of office sublease space will happen, but slowly over time with rents adjusting down.

Not just that, but many employees have been complaining about SF and SV office centralization for a long time and I guess the companies are taking advantage of the downturn to rebalance geographically. Then again, some of them are focusing layoffs in non-SV locations so it’s hard to make generalizations.

Also, some activist-types think of WFH as a pro-minority equity move which complicates office politics.