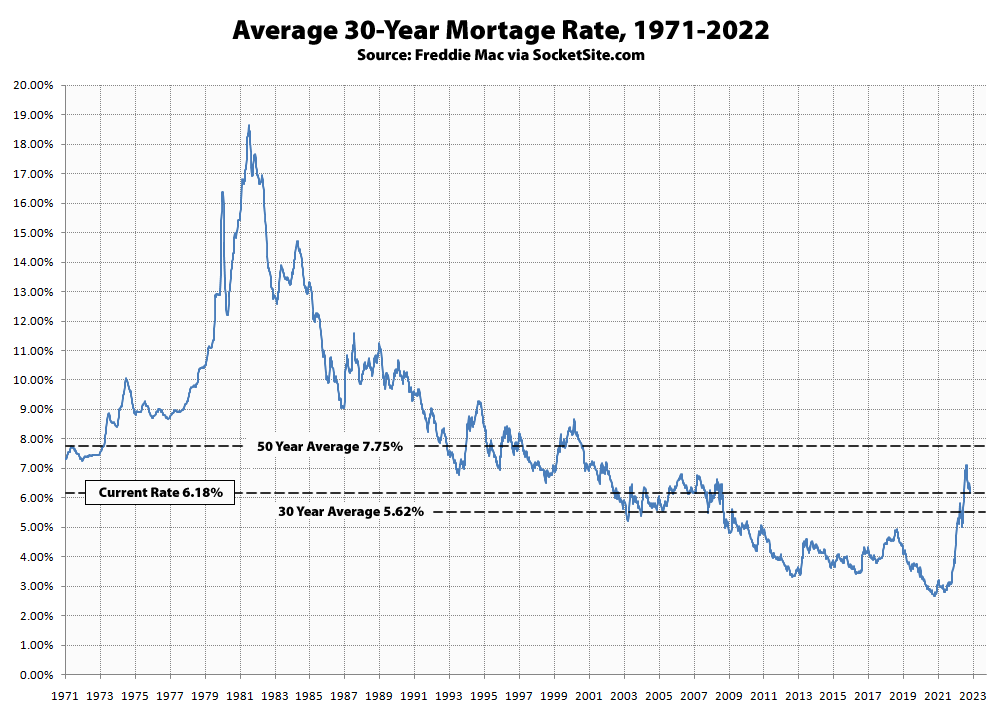

The average rate for a benchmark 30-year mortgage dropped 18 basis points (0.18 percentage points) over the past week to 6.15 percent, which is the lowest average rate in fourth months but still 250 basis points, or 73 percent, higher than at the same time last year; over 350 basis points, or 130 percent, higher than its all-time low of 2.65 percent in early 2021; and over 50 basis points above average for the past 30 years.

At the same time, the probability of the Fed hiking rates by at least another 50 basis points over the next two months is now hovering around 80 percent, around half of which is likely priced in. And while purchase mortgage loan application volume in the U.S. jumped last week with the drop in rates, it remains 35 percent lower than at the same time last year with pending sales in San Francisco down over 40 percent on a year-over-year basis to their lowest level in over six years.

Except that you can’t live in it, it’s probably a better time to buy RDFN than a house.

Who in their right mind would want to buy RDFN, yes it’s 94% from it’s all time highs but there is still 100% downside. It’s a zero, stick to soccer.

As of this writing, that stock is up 47 percent year to date, versus the S&P 500’s rise of 4.7 percent and/or ZG’s rise of 36 percent during the same time period.

I personally wouldn’t buy it right now, but given that two years ago Zillow shut down its AI-driven home flipping business and laid off 25% of their staff and that stock didn’t go to zero, I wouldn’t say there is 100 percent downside. If the stock goes too low, it’ll be bought out by another player in the space.

Funny story about Zillow’s home flipping business. A friend’s father died and she printed the obituary in the paper. Home prices were going up so there was no need to sell quickly. She goes to sell and lo and behold the house is already cleaned out and Zillow has recorded title from the “owner” signed two weeks after the real owner died.

Someone saw the obituary, made up a fake drivers license with her dad’s name and sold Zillow her dad’s house. Zillow tried to fight it as an innocent victim until the lawyer pointed out that the fake drivers license had the fraudster’s approximate age, which was less than the amount of time he supposedly owned the house. Like the last sale was in 1972 and the guy’s license showed the supposed “owner” was 28 years old. Can’t claim victimhood status when you didn’t take even the most basic steps to check. Zillow caved and ate the ~$400K loss.

No big surprise when they exited the business.

Short covering, it will be sold wholesale.

“Who would want to buy Redfin?”

I guess only the people who wanted to make 50% in two weeks.

As of yesterday, bond markets are now pricing in Fed tightening less than 50 bps over the next two meetings. I’d probably take the other side of that bet (i.e. I think we’ll see 50 bps over that stretch barring some negative shock). But markets are also signalling that is the end of it, with the Fed lowering rates later in the year. I wouldn’t bet against that.

The Fed’s chairman has said multiple times over the past several months that the FOMC intends to keep rates higher for longer in order to address inflation, so anyone betting that rates will go lower later this year is going to be in for a rude awakening when the projected Fed cuts don’t materialize.

UPDATE: The average rate for a benchmark 30-year mortgage inched down another 2 basis points (0.02 percentage points) over the past week to 6.13 percent, which is the lowest average rate in fourth months but 258 basis points and still 73 percent higher than at the same time last year.

At the same time, the probability of the Fed hiking rates by at least another 50 basis points over the next two months has ticked up to 85 percent.

That framing is not quite right. The bond markets are predicting about an 85% chance of fed hiking by as much as 50 bps by the March meeting (not “at least”). Markets are showing almost 0% chance of a hike beyond 50 bps. If you have access to a Bloomberg terminal you can see the exact predictions – 47 bps. Markets then show no further hiking and likely lower fed funds rates starting in late fall. This is why mortgage rates (which don’t really track fed funds) are trending lower.

No, the bond markets are predicting an ~84 percent chance that the fed will have hiked rates by 50 bps by March, with a ~2 percent chance of a 75 bps hike. In other words, “the probability of the Fed hiking rates by at least another 50 basis points over the next two months has ticked up to 85 percent.”

But you also need to factor in the trades betting that the Fed will raise only 25 bps by March – about 14%. Far more traders are betting on 25 bps than 75 bps. Look at a Bloomberg terminal if you want precision (47 bps). Hence the present bet is 50 bps or less, not “at least” 50 bps.

So, about 86 percent of the traders are betting that the fed will hike rates by more than 25bps, or at least 50bps. Good to know.

By the same token, 99% of the trades predict a hike of only 25 to 50 bps. Better to describe things with precision so as not to mislead.

By the way, for the wonks without a Bloomberg terminal, here is what the markets have priced in for future fed cuts:

End of 2023: – 47bps (after the 2 expected hikes in Feb and Mar)

1H 2024: – 93bps more

2H 2024: – 46bps more

1H 2025: – 14bps more

If you think they are wrong, there is money to be made. This also explains why mortgage rates (which are long term loans) are trending down even though we likely still have a couple of near term fed hikes coming.

UPDATE: Following today’s quarter point hike, the probability of the Fed having hiked rates “by at least another 50 basis points” has jumped to 99.5 percent, with an 80 percent chance that it will now total even more.