While the average rate for a benchmark 30-year mortgage had slipped back under 7 percent last week, said average had been compiled prior to last week’s rate hike by the Fed. And while the majority of the latest rate hike appeared to have been priced-in to last week’s rates, the 10-year treasury rate, which forms the foundation for the benchmark 30-year mortgage rate, had subsequently ticked up 15 basis points, “which should push the average 30-year mortgage rate back over 7 percent,” as we outlined at the time.

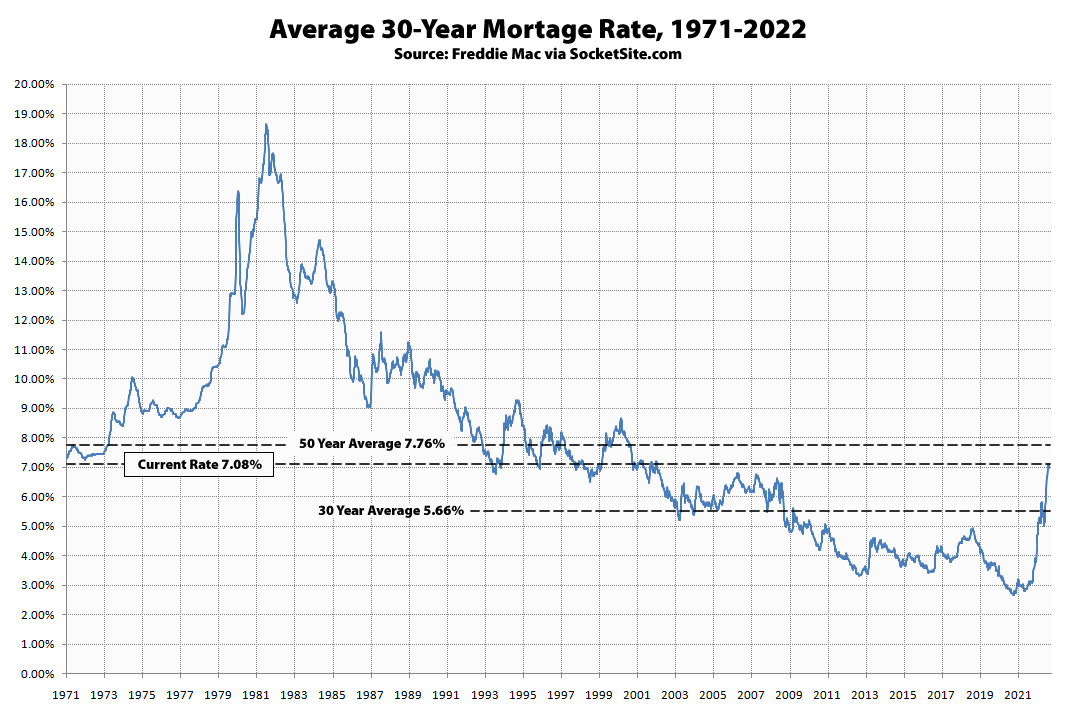

As projected, the average rate for a benchmark 30-year mortgage has since ticked up 13 basis points to 7.08 percent, which is 138 percent higher than at the same time last year and over 180 percent higher than last year’s all-time low but still below its long-term average of 7.76 percent.

At the same time, the average rate for a 5-year adjustable rate mortgage (ARM) has ticked back over 6 percent and is 140 percent higher than at the same time last year and over double the average 30-year rate on offer early last year and climbing.

Mortgage rates are sharply down, only today. Did you not look at the 10 year yield yesterday? This post is already badly dated.

In fact, we did. And yes, the yield on the 10-year treasury has dropped 30 bips since Freddie Mac’s last survey, which has dropped the average 30-year rate back under 7 percent.

But the average 30-year rate remains over twice as high as at the same time last year and over 150 percent higher than last year’s all-time low, which is the macro issue for the market that hasn’t changed, nor is dated, despite the drop. In related news, Pending Home Sales in San Francisco Down Nearly 50 Percent.

I don’t claim to have a crystal ball any clearer than anyone else, but that drop in the 10 year yield will probably be looked at as a freak occurrence in the space of a few months. I think It was the 2nd largest drop in two year and ten year yields in ten years (the one in Mar 2020 was bigger). And of course, if we get a higher CPI reading in the coming months, it’ll reverse so quick it’ll make your head spin (which is what I think will happen).

All the real estate agents and mortgage brokers should start running ads that say “buy now or be priced out forever!”