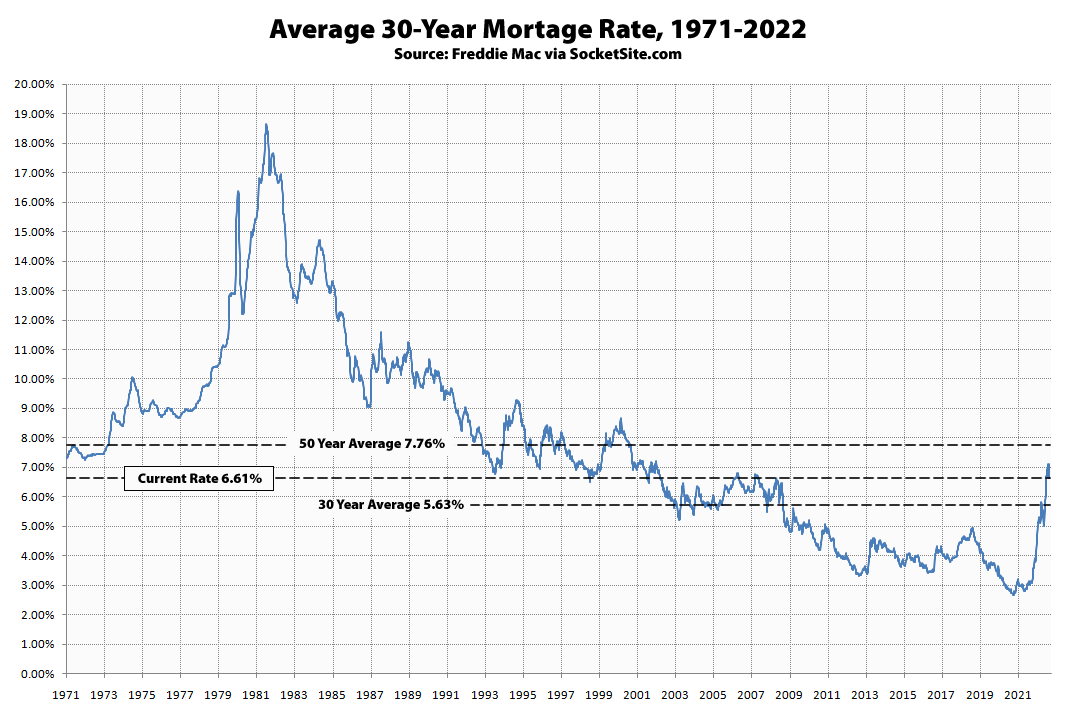

Buoyed by a slowdown in the pace of inflation, the average rate for a benchmark 30-year mortgage dropped 47 basis points over the past week to 6.61 percent but is facing headwinds as the Fed is expected to continue raising rates over the next couple of quarters, likely by another full percentage point or more.

And despite the drop over the past week, the benchmark 30-year rate is still 113 percent higher than at the same time last year, 149 percent higher than last year’s all-time low, and well under its long-term average of 7.76 percent, with the average rate for a 5-year adjustable rate mortgage (ARM), which Freddie Mac will no longer publish, double the average 30-year rate on offer early last year.

UPDATE: The average rate for a benchmark 30-year mortgage inched down 3 basis points over the past week to 6.58 percent, which is still 112 percent higher than at the same time last year, 148 percent higher than last year’s all-time low, and well under its long-term average of 7.76 percent.

At the same time, the probability of the Fed raising rates by another full percentage point, if not more, within the first quarter of next year (2023) is currently running at over 90 percent, up from under 80 percent a week ago.