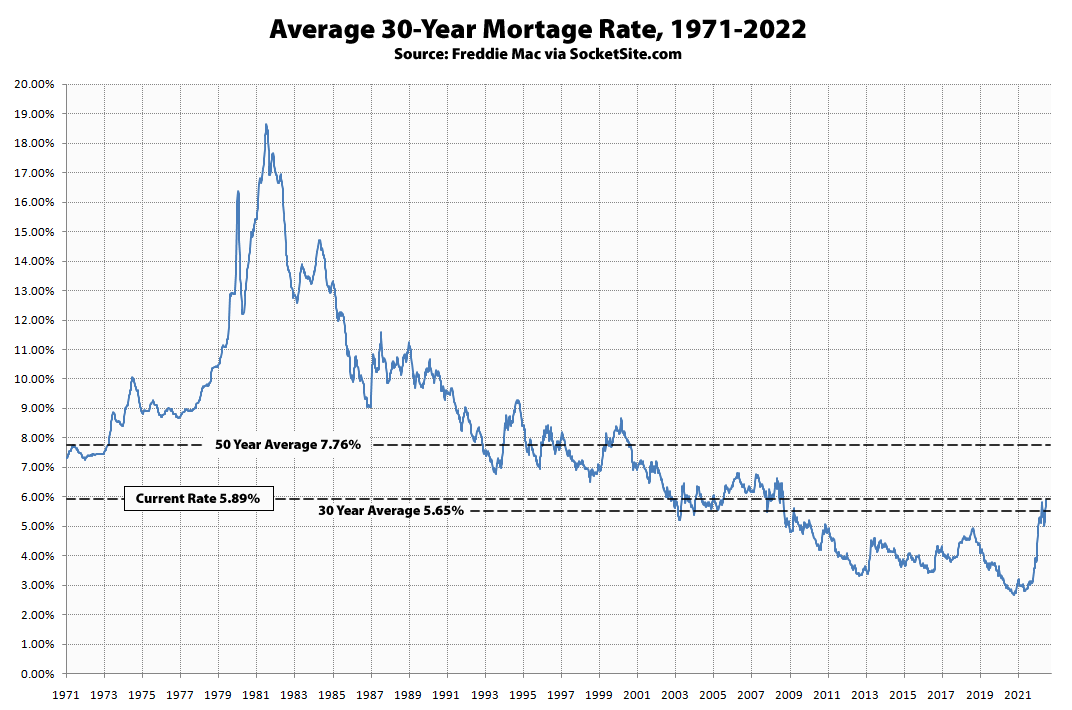

With purchase demand for existing homes across the nation having already dropped over 20 percent and the pace of new home sales down nearly 30 percent, year-over-year, driven by a jump in mortgage rates that shouldn’t have caught any plugged-in readers by surprise, the average rate for a benchmark 30-year mortgage climbed another 23 basis points (0.23 percentage points) over the past week to 5.89 percent, an average rate which is now 105 percent higher than at the same time last year and the highest average rate since the fourth quarter of 2008.

At the same time, the average rate for a 5-year adjustable rate mortgage (ARM) has climbed to 4.64 percent, which is 92 percent higher than at the same time last year and 75 percent higher than the average 30-year rate at the beginning of last year, with the probability of the Federal Reserve raising the federal funds (“interest”) rate by at least another full percentage point by the end of this year holding at “100 percent” based on an analysis of the futures market. We’ll keep you posted and plugged-in.

It would be interesting to know what percentage of new mortgages are the five year adjustable rate mortgages. Because the people taking them out are essentially taking on a pretty substantial interest rate risk, and they probably don’t have a way to hedge their exposure to the actions by The Fed.

At Jackson Hole, Powell basically promised that, barring some surprise decline in inflation, interest rates would increase and stay at an elevated level for a while. Any middle class person taking out an ARM right now is either not paying attention to the news or pretty financially irresponsible.

UPDATE: Average 30-Year Mortgage Rate Just Hit 6 Percent, Headed Up