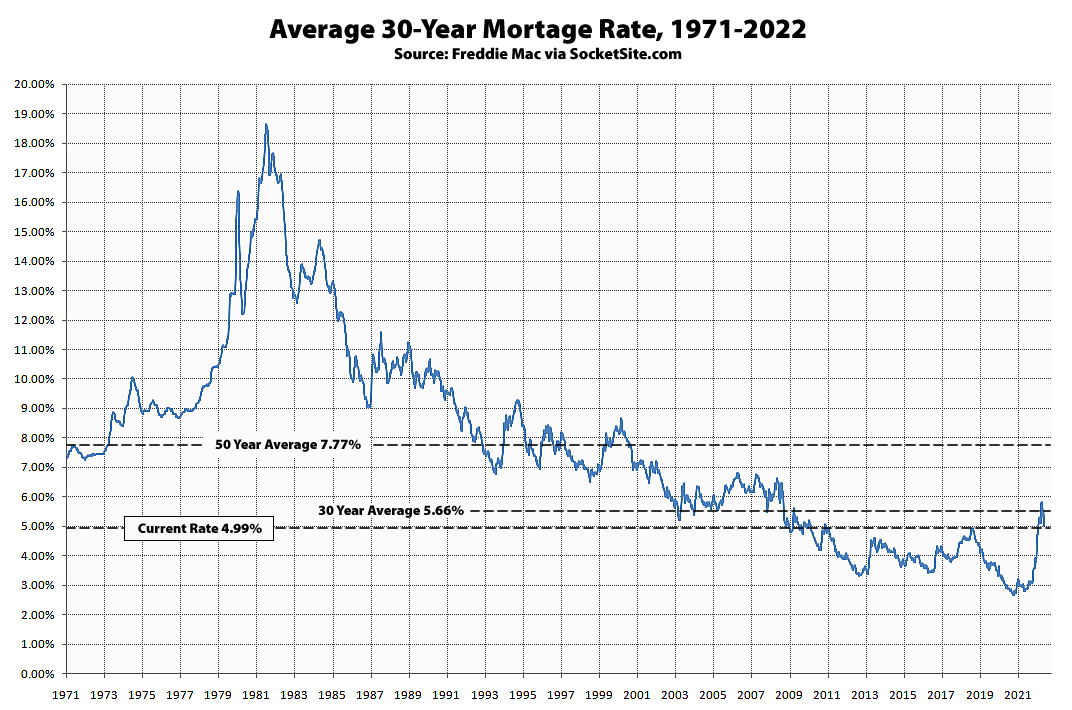

Despite the Fed’s recent rate hikes, the average rate for a benchmark 30-year mortgage had plunged from 5.81 to 4.99 percent over the past six weeks, including a 31 basis point (0.31 percentage point) drop over the past week alone, driven by an “increased risk of a formal recession and declining consumer confidence overall,” as we outlined last week and isn’t a positive sign despite some industry spin.

At the same time, the prevailing 30-year mortgage rate is still 222 basis points and roughly 80 percent higher than at the same time last year, with the average rate for a 5-year adjustable rate mortgage (ARM) having inched down to 4.25 percent, which is 185 basis points and 77 percent higher than at the same time last year, and pending home sales, which are now down nearly 40 percent in San Francisco, have continued to drop.

These rate changes are more of a roller coaster ride. With 30yr fixed rates fluctuating 50bb+- a day. One day 5.09% and next day 5.65%.

Also, the builder sediment has turned negative across the nation. Many buyers have been bailing on new homes and walking away from their purchase contracts. Lumber prices are softening. Skilled labor is becoming more abundant. At least in my part of the country. I think I’ll check in with the union hiring halls around the country to see how their job books are holding up. If a sure way to gauge the employment situation at lease in construction.

As a side note, it’s also hard to refinance an existing high rate loan with rates bouncing daily. And if you believe the BLS jobs report today I’ve got a bridge to sell you. Kinda smells like books cooking in the kitchen if you ask me.