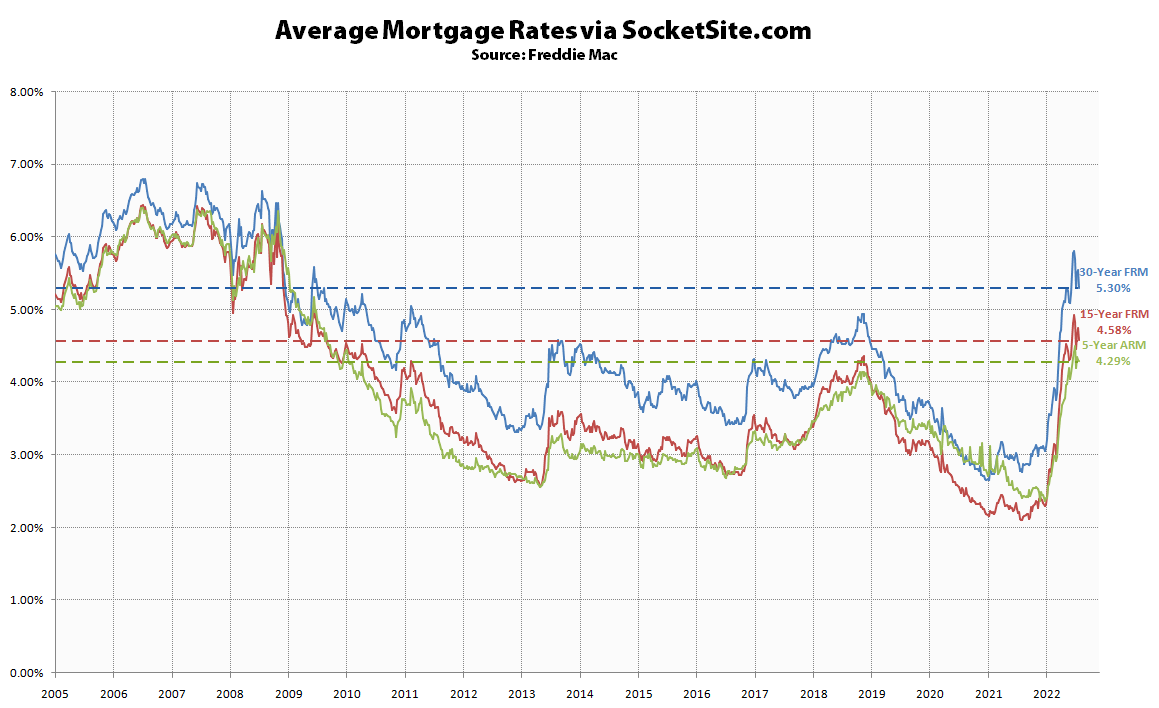

Measured prior to yesterday’s announcement of another 75 basis point hike to the federal funds rate, the average rate for a benchmark 30-year mortgage had dropped 24 basis points (0.24 percentage points) over the past week to 5.30 percent, which was still 250 basis points and roughly 90 percent higher than at the same time last year with the average rate for a 5-year adjustable rate mortgage (ARM) having inched down to 4.29 percent which was 184 basis points or 75 percent higher than at the same time last year. And to quote FreddieMac, which has suddenly seen the light, “purchase demand continues to tumble,” which shouldn’t catch any plugged-in readers by surprise.

As we noted yesterday, the 75 basis point hike to the federal funds rate appeared to have already been priced in to the market and the 10-year treasury rate, which forms the foundation of the 30-year mortgage rate, barely moved after the announcement and ended the day effectively unchanged.

All that being said, the rate for the 10-year treasury dropped 10 basis points this morning with a second straight quarter of negative GDP growth based on preliminary readings, the increased risk of a formal recession and declining consumer confidence overall.