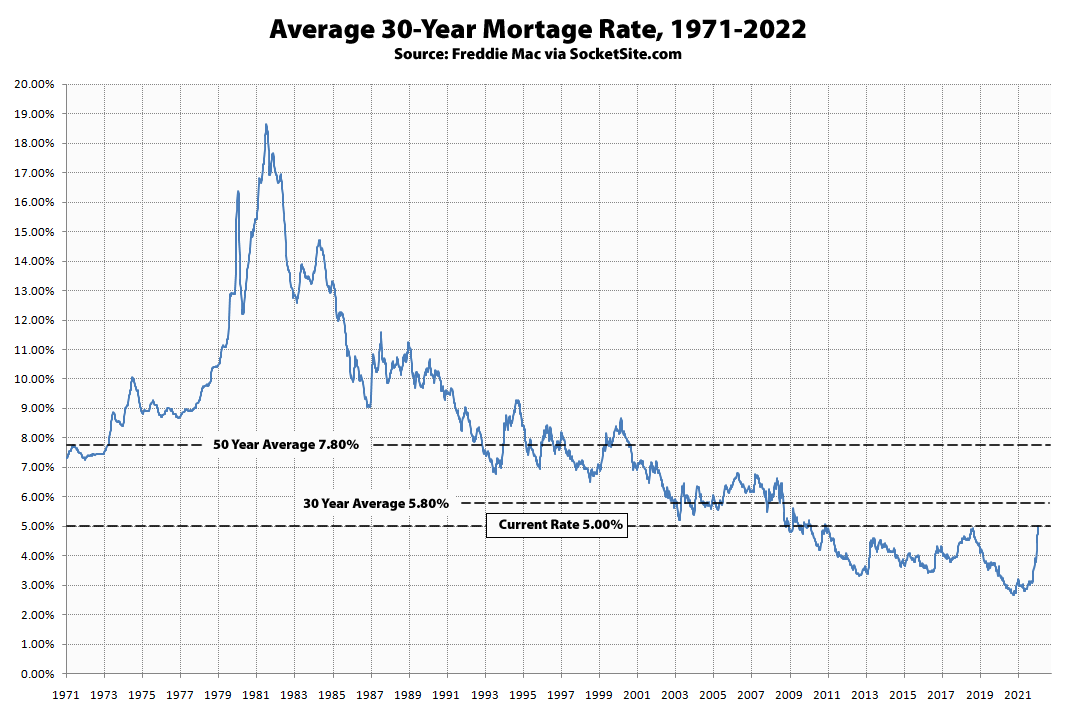

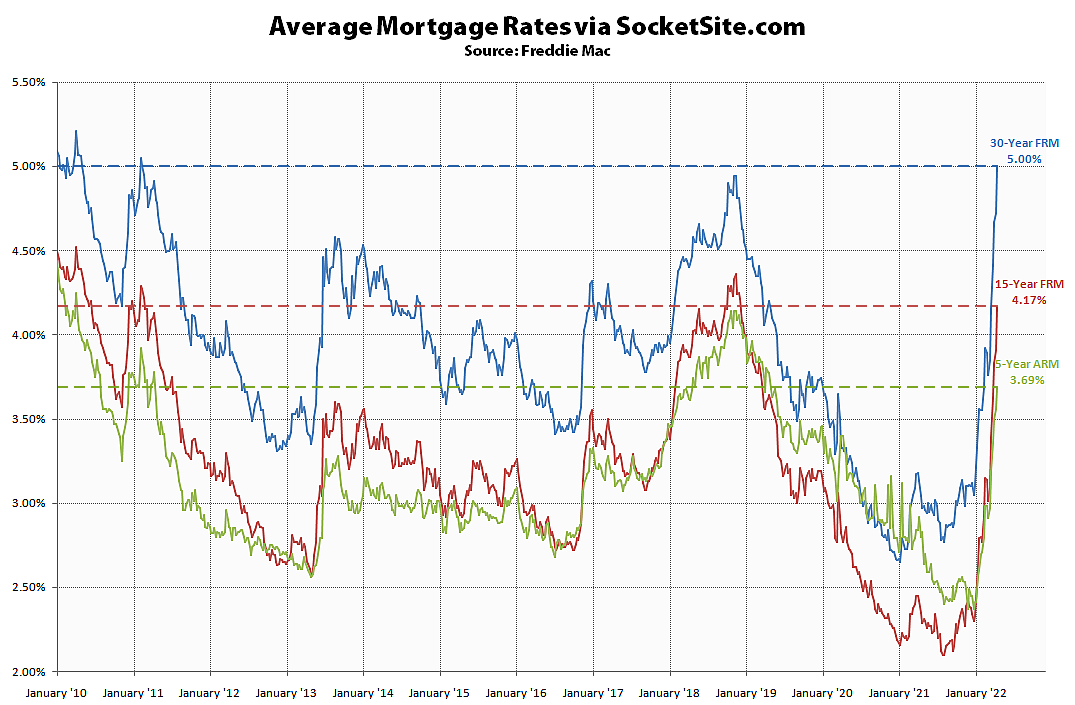

The average rate for a benchmark 30-year mortgage jumped another 28 basis points (0.28 percentage points) over the past week to 5.00 percent, which is 196 basis points and over 60 percent higher than at the same time last year, over two (2) full percentage points higher than in January of last year, and the first time the average rate has started with a five (5) since the first quarter of 2011, a trend that shouldn’t catch any plugged-in readers by surprise.

At the same time, the probability of the Federal Reserve raising interest rates by another two (2) full percentage points by the end of the year has jumped as well, which should translate into even higher mortgage rates, less purchasing power for buyers and downward pressure on home values.

And with the jump in rates, the share of mortgage applications for shorter-term, adjustable-rate mortgage (ARM) products has more than doubled, from 3.1 percent to 7.4 percent of total applications since the start of the year, and is approaching a 3-year high with the average rate for a 5-year ARM having jumped from 2.41 to 3.69 percent since the start of the year (at which point the average rate for a 30-year fixed was 3.11 percent).

Also -3% real interest rate with CPI at 8.5%.

Rates will have to come way way up to slow the economy down.

Crazy how 5% interest rates is still beyond low. I agree with the soccer coach. With CPI at 8.5% and only 5% 30 year fixed. Your at a negative number. Not to be Captain obvious, this inflation can be a blip or a new trend . Like the weather , further out it’s harder to predict . Needs to be in the 11-12% range to maybe cool the market. I am putting offers for around 3m. 50% down and getting killed. POS houses in the 2000-2500 sqft and needs a lot of work in Burlingame . Feels like 2005 but instead of all the fake money, same amount of people paying all cash.

Looking at stats I have no clue how the real estate market is so hot. I just think a certain amount of people are doing really well and so few houses for sale. All other metrics seem to be useless. I wish everyone was leveraged , at least that would explain it .

In terms of the “hotness” of the market and relevant stats, keep in mind that the pace of sales has actually dropped in San Francisco, inventory, which hit an 11-year seasonal high earlier this month, has continued to climb and price reductions are on the rise.

It feels SO GOOD to have done a refi that closed in early Dec for 2.625% on the 30 year fixed. It’s not often in my life when I’ve gotten lucky financially, but this is that time. We’ve been in the house 6.5 years and the original mortgage was 3.625% (also 30yr frm) and we will continue the same payments and save $170k and pay the new loan off 6 years faster than the old loan. Amazing luck. 🙂

Does not make sense to pay extra to pay it off early. 2.625% tax deductible debt is about 1.8% in real terms. You’ll definitely do better than that in any non-crazy investment. I refi-ed at 2.35% in mid-2021. if they’d given me a 100-year loan, I’d have taken it. Take the full 30 years.

This comment would have made sense, and I would have agreed with it, in The Before Times. But in the here and now of 2022, there just aren’t any non-crazy investments that are returning > 1.8% in real terms!

In case you haven’t been keeping up on current events, you’d have to go back to the early 1980’s or even earlier before you’d find an investing environment where stocks were down double digits in percentage terms and bonds were down even more.

There is no place to hide, and if you’re in cash you are losing purchasing power due to the annual inflation rate for the United States being 8.5% for the 12 months ended March 2022 as measured by the Consumer Price Index (CPI) before seasonal adjustment.

Sure, this isn’t likely to last for a large portion of your 30 year period, but in the short term, Bayview_Rising paying off their mortgage early is basically a guaranteed return. Anything else you’d put that money into over the course of the next two years, well, like Will Rogers famously said, you should be more concerned with the return of your money than the return on your money.