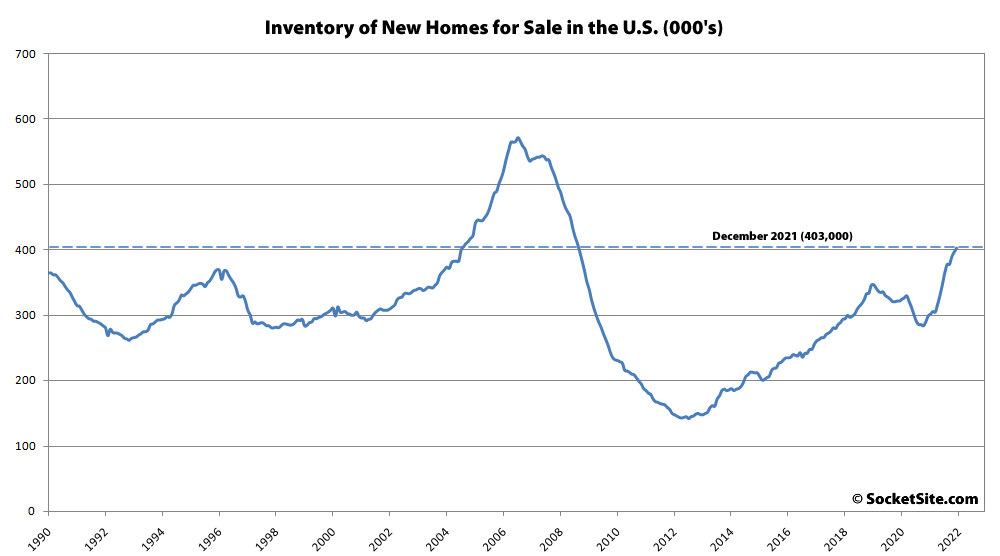

While mortgage application volumes to purchase a new home in the U.S. increased 10 percent from December to January with typical seasonality in play, application volumes were down 12.5 percent on a year over year basis, according to the Mortgage Bankers Association and despite the fact that the number of new homes on the market across the country hit a 13-year high in December and inventory levels were up 35 percent, year-over-year.

At the same time, while the average loan size for new home purchases inched up a (1) percent to a record high of $427,000, the rise in the average loan amount is still being driven by a change in the mix, with purchase activity “continu[ing] to be concentrated in the higher end of the market,” per the MBA, a key trend which shouldn’t catch (too many) plugged-in readers by surprise.

is the greater bay area (outside of SF) following this same trend?

While we don’t break it down between new and existing sales, nor for the greater Bay Area, pending sales activity in San Francisco was down an average of over 20 percent on a year-over-year basis in January but listed inventory levels, which are poised to climb, were down as well.