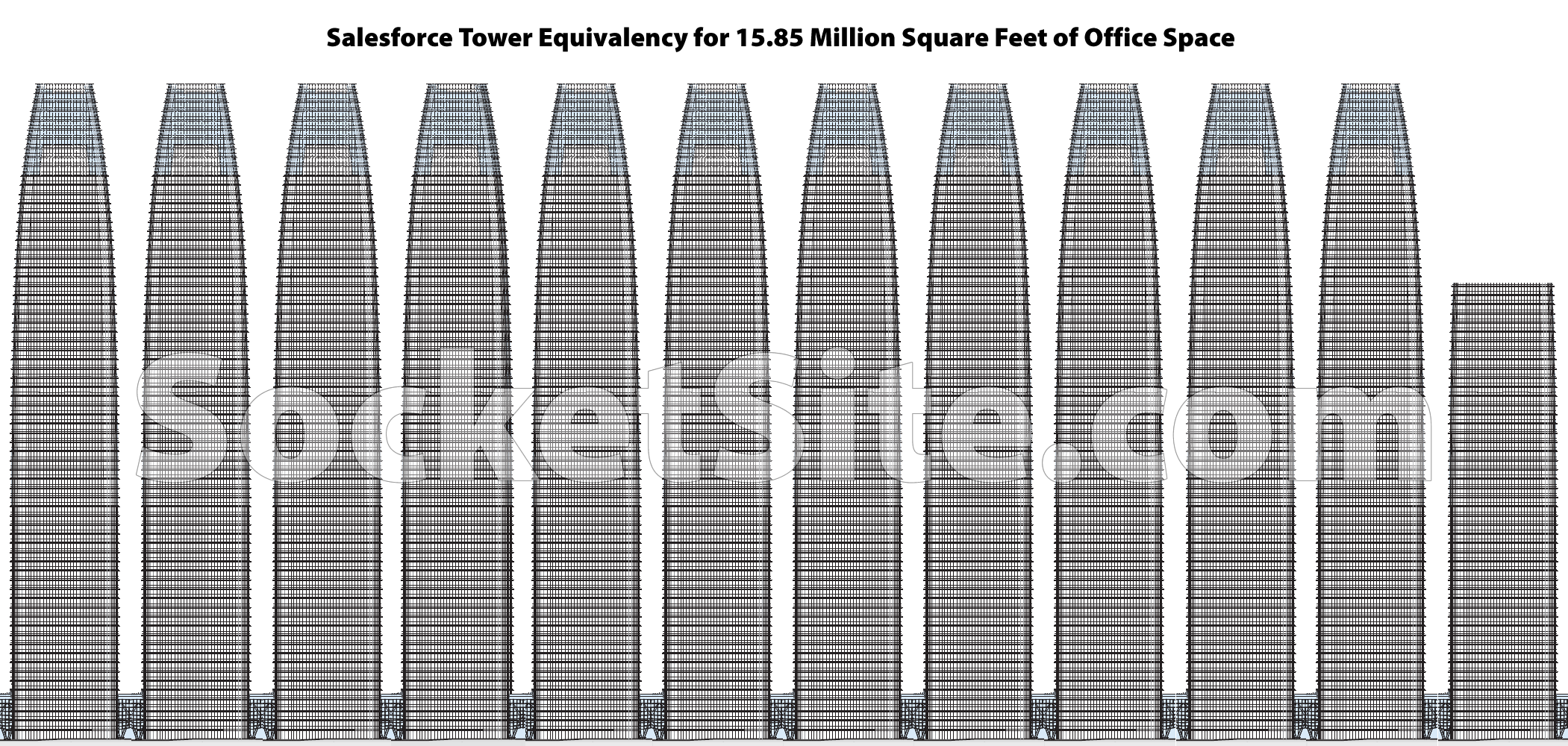

As we outlined last week, there is nearly 16 million square feet of vacant office space now spread across San Francisco, which is up from around 14 million square feet of vacant space three months ago and as compared to under 5 million square feet of vacant space at the start of last year.

For context, the 1,070-foot-tall Salesforce/Transbay tower at First and Mission, which is the tallest building in San Francisco, contains 1.35 million square feet of office space spread across 59 floors.

And once again, employing the framework we introduced last year, there is now 11.7 Salesforce Towers, or 693 Salesforce Tower floors, worth of empty office space in San Francisco, which is roughly enough space to accommodate between 91,000 (based on an average, pre-Covid, density) and 122,000 (a la twitter) worker bees.

This is going to double, not go down, as we come out of the pandemic.

CEOs, families, team members, and investors have all given up on San Francisco as an HQ. Too dangerous and too expensive. I think this slides down for another five years.

Let’s see what happens when we are a year out of the pandemic. San Francisco has a massive inherent advantages in terms of weather and recreational activities, and a concentration of tech workers / megatech companies who aren’t going anywhere. The crime issue is partially pandemic-related desperation (crime is up all over the country).

From a financial point of view, no, you don’t want your accounting team based in downtown SF. I’d bet the HQ continues to be in SF with the executive team being onsite there, with distributed offices for other teams. A scale-down, not a complete departure.

These same advantages can be had at a lower price not more than 15 miles south and east of SF. In addition, California the state itself is becoming an undesirable place for business because of the existing (and under proposal) tax and regulatory regimes.

These mega-corps can and will (have) shift to other places as guided by keepers of company beans. But the liabilities taken on by local governments will remain on the books.

Uncertain Incomes but certain (and growing) expenditures!

The biggest handicap SF currently has, is its political and institutional tilt — in the head not screwed in the right place way. This pandemic has laid bare all the entrenched ineptness, inadequacies and tomfoolery. Isn’t it ironic that it is the uni-party institutional-ism that is most vocal about ‘diversity’? How about some of that political and institutional diversity?

I don’t get the logic of leaving SF and moving to San Mateo other than to alienate your SF, Marin or East Bay employees. If you’re gonna leave, leave to Denver or Austin. I just don’t think many companies will fully up and exit 100% of their presence to another city. when everyone lives in the Bay. Or, go 100% remote, which I also doubt many will do.

California has been an undesirable place for business for decades. This is not new.

I agree that SF is mismanaged and more voices are needed.

A He** of a lot o damage can be done – to city finances and revenue to services businesses/restaurants – if just 80% (of either of those things) happens….maybe even 90%.

But I agree it’s pointless to try and predict things – either positive or negative – based on…well, nothing really other than hypotheticals. Giving things 6 mos to a year makes sense. The big challenge will be finding thigs to talk about in that time 🙂

Notcom, everyone, who was here in 2001? There was a massive economic bubble and exodus. What happened to city finances, service businesses?

I hear stories about SOMA being shuttered up, but other than that, life pretty much went on normally for the rest of the city. Curious to hear from others around in 2001-2004.

San Mateo has connectivity from SF, East Bay & South Bay. It is a much better location in terms of centrality with all the desirability and little of the headache.

Hybrid workplace is the evolving employment model.

Employee gets to commute less but farther when needed. Employer gets the benefit of lowered RE/Office overhead costs. For those companies that can survive with 100% remote, they are already on the move towards better tax/regulatory/cost havens.

California has not always been an undesirable place. In the 60s, 70s, 80s, 90s and early 2000s it was a rather inviting place which manifested in the incubation and success of several mega-corps. It was the capitalistic endeavor that conferred untold riches (really unimaginable success) to State of California.

What has changed between then and now is (IMO) is really the overtly business-unfriendly tilt.

It is just objectively wrong to say California was hugely “business friendly” in the 90s and 2000s but not now. That represents a completely selective reading of really basic facts.

State of California, Historical Data

I don’t have time to dig through that. But I would encourage those with more at stake to do so — to really get a view of how grossly mis-managed and the level of business unfriendliness by way of increased corporate and personal taxes while not addressing increasing housing affordability and availability problems.

Uncertain Incomes is right! The stock market’s record lows (esp in tech) will be the final nail in the coffin for SF. These taxes are ruining these companies

Sent From My Samsung Galaxy

S&P averaging +12% YTD .. for what? Margin borrowing is at its historical high — highest ever. I have to wonder how many people with over inflated RE borrowed to invest in this market.

What are these “stock market record lows” you speak of? All this speculation about the impending *collapse* is amusing.

Plugger is joking.

I assume that Pluggers comment was intended sarcastically. But he has inadvertently made a good point. The conventional wisdom used to be that the cost of paying high salaries and burdened costs that came with clustering employees in high cost cities was necessary to get the growth and lofty stock valuations that tech companies sought.

But now companies have been operating 80-90% remote for a while now and their stock prices have done just fine. Operations have continued just fine. Apple had yet another product launch event just today.

The pandemic will eventually end, but the lesson that things can work well financially and technologically without in person concentration in high cost cities is not one that can be unlearned. And there will be far reaching consequences from this lesson in where we live and how we work in the future,

A specific feature of the current market is the amount of margin involved.

The Archegos saga from this past March is quite the read. Can happen to anyone.

@Panhandle Pro – Weren’t you pitching the theory that at soon as there was a vaccine people would be trying to front run each other in a race to get back to SF? Now that’s being pushed to a year after the end of the pandemic?

“concentration of tech workers / megatech companies who aren’t going anywhere”

This statement that tech workers and companies “aren’t going anywhere” seems hard to square with what’s actually been happening.

It was just announced that Bank of Marin is purchasing River Bank in Sacramento as so many millennials are relocating there from SF/the Bay Area. Their expansion is following the Bay Area exodus. Sacramento is poised to grow far faster than the Bay Are or California as a whole over the next 5 years.

We’ll see how many people stay in Sacramento after they’ve spent all summer there.

@SFRealist .. people like nice weather. The following things, they like more:

0) Access to employment / economic opportunities

1) Retain more money in the pocket

2) Better schools for kids

3) Safer neighborhoods with no risk of being a crime victim

4) Better quality of life

5) A functioning city government

If $1M invested in SF inflates at the same rate as similar amount in a region elsewhere — the elsewhere region will win.

Maybe you’re right.

Based on the last, oh, 170 years, though, people have paid a premium to be in San Francisco over Sacramento. We’ll have to see.

If we can set aside the intra-regional rivalries and “yesterday’s new’s” reading for a second – my condolences to anyone whose grandfather sank the family fortune into Buffalo real estate back in 1928 – lets’ review Dave’s tidbit for a moment: A Bay Area bank just bought a Sacramento (area) one…if there’s going to be any HQ movement it’s INTO the BA, not out of it.

I stand behind my statement about residential housing and I believe the data loosely supports it. Rent is flat or slightly up depending which source you ask.

I don’t believe I ever made any claims about office space.

Google is expanding in the Bay. So is Facebook, etc Those companies hire so many people every month it offsets a lot of outward migration.

Massive advantage? The climate is increasingly hotter and drier, and the recreation is overrated, esp when compared to other norcal cities… Or even Reno, which can boast quick access to Tahoe/mountains

well its not more dangerous or expensive compared to like 2015..

@Panhandle Pro

As for recessions in SF. This is my fourth since the mid 1980’s. The early 90’s. 2000. 2008. Now 2020.

As for ranking the first three in order of severity. Early 90’s easily the worst. Then 2008. Then 2000. I expect the 2020 crash to be as bad as the early 90’s recession. In fact I expect it to be as bad as the early 90’s recession was in LA. Which LA never really recovered from. Much worse than what happened in the Bay Area.

From talking to locals the early 90’s in SF was much worse than the recession of the mid 1970s’ and the early 1980’s. By the early 90’s the hollowing out of SF’s previously very deep and wide economic base over the previous two decades first became obvious. Apart from tech and finance and tourism SF no longer has a serious economy. And as most of tech are just VC Potemkin companies they can evaporate very quickly. Like they did after 2000. But unlike 2000, when I’d say maybe 40% of the companies were dot com operations, about 90% of current tech jobs in SF are for dot com operations. Whose only purpose is to spend money not make it. I’ve seen companies like this go from $10M in the bank to acquired by a liquidation shell company in nine months.

Those familiar with the economic decline of the economic base of LA and the Southlands since the late 1980’s will see a very familiar pattern in SF in the recent past. From very broad manufacturing and services powerhouse to a just a few very cyclic narrow base sectors. SF probably has not been this vulnerable economically since the Silver Boom in the 1860’s. And that ended very badly for San Francisco.

Saying “Apart from tech and finance and tourism SF no longer has a serious economy,” is like arguing apart from his ability to shoot and pass well Steph Curry isn’t a good basketball player. Would you prefer the City’s economy relied on fossil fuels like Houston or consumer packaged goods like Chicago?

Yeah, echoing this. Anyone who implies that SF or the Bay Area has a monoculture of industries is just woefully misinformed.

Just wondering how long you have lived in SF. And have you have you actually gone though the Census Bureau, Dept of Labor, Commerce and equivalent state agency reports going back to the 1950s and earlier? I have. A very interesting read.

I did a deep dive through the relevant statistics because of a claim I read about a decade ago that the anti-growth / no-growth politics that started in the 1960’s in SF had no impact on the city economy. The statistics tell a very different story. Like tens of thousand of jobs in small professional services companies leaving the city between 1965 and 1985. How about the removal of a very large number of manufacturing jobs from SF. Pretty much all gone by the mid-90’s. Way before your time i suspect.

In the last two decades SF has added just very low paid services jobs and much fewer very high paid tech and fiance jobs. The middle is almost gone. As shown in the official statistics. The situation in LA has been much worse in the last twenty plus years but although SF and the BA in comparison looks very good when you dig through the numbers the very broad based economy SF had from its founding till it started dissolving in the 1970’s. Gone by the late 1990’s.

As for the greater Bay Area. I remember when the Santa Clara Valley had a very healthy and very large manufacturing base and all the allied support industries. Still going strong in the 1980’s. Almost gone by the late 190’s too. That was many tens of thousand of well paying middle class jobs.

If you did not directly experience the SF and Bay Area economy back in the 1970’s and 1980’s you will have no idea what just a broad based economy it was back then. And just how thin and brittle it now is. The same goes for the state. The state economy back then was a truly awe inspiring sight. It could go toe to toe with countries like France for the sheer width and depth of the economy in all sectors. Now basically all that is left legacies industries, construction and property bubbles, and hi tech companies who are either dot com scams that will never make a cent profit, just burn capital. Or rapacious de-facto monopolies who funnel almost all their very high net profit through foreign tax havens.

Some of us have been around a very long time. And can do the math. And have watched the local and state economy hollowed out over the last few decades.

The economy of SF has not been this fragile or thinly spread since the tail end of the Silver Boom in the 1860’s. The Depression after that crash was a doozy. Way before both our times. But some of us know the history. Bubbles always end badly.

tfourier: Sounds like you have done a lot of research. How is the diversity of the SF economy different than Phoenix, Seattle, Las Vegas, Miami, Austin, etc?

Unlike the 2000s where dot-com was a parallel commercial ecosystem, nowadays it is fully ingrained into the econonomic system and inseparable. Your take, “the only purpose is to spend money not make it” is not a real thing either. Of course many of these companies will fail. But they’re not designed to waste money. Pretty rididulous take there.

I’ve been working for VC financed tech start ups since the 1980’s. I know my history. I not only know my way around a term sheet but I can tell you lots of Sand Hill stories. All the way back to the beginning. I not only know where the bodies are buried but who wielded the shovel that whacked the victim on the back of the head. Before burial.

I also know my way around some of the more arcane areas of financial engineering. So I know how that game works. Not just simple stuff like reverse-repos but even such fun areas as CDO^2 default cascades and the really creative types of synthetic derivatives.

So what I stated is completely factually correct. They are little more than a sophistic variation on a Ponzi. Thats who currently fill so much of SF office space. They can go from a full office with dozens of employees to liquidation in under a year. Once warned a CFO that was going to happen to them. Would not believe me. Nine months later he was the last employee out the door.

That’s one of the more mundane war stories from the trenches. Plenty more where that came from…

That’s great. I wish more people would share VC and SV stories on here. No need to say where the skeletons are buried either. Names and situations can be slightly altered to spare the innocent. I’d be all ears.

That said, they’re not designed to fail of course. And, given what you’ve said, you’ll also know I’m sure a million and one success stories. Many such stories of course being acquistions and mergers and the like which never garnered much press. I mean, how sexy is the whole payment capture ecosystem? Not very, not to the media at any rate. And to continue with just that sector, there’s the sheer fact that people worldwide won’t be stopping buying things on their phones any time soon. And both the hardware and the software are local.

@Ohlone Californio — majority of the startups are simply ‘momentum plays’ that take advantage of cheap interest rates/ high liquidity. And since almost of these momentum plays are likely to go wrong they are hedged against real estate. The RE valuation is protected using artificial shortages by way of government regulations, subjective and emotional marketing (arts/culture, fine dining, extra cultural activities etc). And local/state governments like this because it helps them harvest massive revenues by way of taxes. At some point the momentum game attracts external foreign capital — but only so because this external foreign capital is trying to escape tax harvest in the origin home country and is also seeking yield and protection against inflation.

But of course startups can also make profitable exits mid-momentum — by acquisition by a larger company or through a block buster IPO. The losses (lack of value) are transferred to the shareholders of the acquiring company.

Every once in a while the momentum breaks due to debt build up. It has to. That is how it absorbs losses and re-starts. Business Cycle.

Some startups do emerge successful. But they are few and far between.

Yes well your take is largely talking past me with willfull intent and personality seemingly, Cave Dweller. And I’m not really interested in its lack of congruency with my charge capture industry example, for one.

VCs uses probabilistic approach to investment simply because nobody knows the future. Therefore the notion an investment will fail is built into the initial assumptions. Hence risk management / hedging. Even then any smart VC will rarely invest his own money. Top tier VCs invest leverage as it will allow them to build a wider (and/or deeper) portfolio. And this kind of leverage can really grow wings in a low interest environment or also can go spectacularly bust.

SF Bay Area (and California) is exposed to concentration risk. This happened because the perceived yield was greatest in tech correlated with RE. Tech needs unhindered/un-tethered capitalistic environment to thrive.

If tech goes bust so will RE/SF/California because of concentration / correlation. That is all it is.

@ Sean

Looks like we have run out of “thread” so positing here

The only local economy I know very well in that list of cities is Seattle (I’m purely West Coast) and despite Microsoft and more recently Amazon the Seattle area was always Boeing town. With a secondary level of manufacturing and lumber. Like Paccar over in Bellevue. And a healthy regional hub services sector. The state of Alaska is a suburb of Seattle, economical speaking.

In the last few decades companies like Starbucks and Cosco were added to the mix and it all hummed along quite nicely until the city of Seattle was serious unbalanced and destabilized by the massive South Lake Union development which directly or indirectly added over 150K people in the last decade to a city that had been around 550K for decades. Which is why Seattle went from a very well run exceptionally nice city 20 years ago to even more politically dysfunctional than San Francisco that Seattle is now.

Those few hundred K incomers working at places like Amazon voted in incompetent virtue signally politicians (or straight criminal con artists like Sawant) and the streets soon filled up with petty criminals, street junkies etc and the quality of city services collapses. And property taxes exploded.

So short term the city Seattle is a basket case, the surrounding areas benefiting from all the old timers (and businesses) moving out. They are doing very well. The huge cloud on the economic horizon for the region is the defacto bankruptcy of Boeing due to the 737 Max scandal. The direct result of the McDonald Douglas management who drove out all the old line Boeing guys after the merger. The people who destroyed McDonald Douglas due to multiple scandals have now done the same to Boeing.

The long term economy of the Greater Seattle area depends on what happens to Boeings civil airliner business. Defense is elsewhere. It not looking good at the moment. Looks like it could be as bad as the early 1970’s.

The problem is Microsoft, Amazon and tech pay very high wages but dont employ that many compared to other industries in the region. Or support as many downstream jobs. But these highly paid people drive up living costs for everyone. Starbucks and Costo etc pay well but considering how the cost of living (rent/property) has gone up at least 3x in the last two decades but pay maybe 50% max the standard of living and quality of life for the majority has declined very noticeably. Nothing destroys the quality of life for the majority of local residents faster than a large influx of tech jobs.

So Seattle is now where the Bay Area and especially San Francisco was in the 1970’s. And as the state government in Olympia is in the hands of the same type of politicians who destroyed Seattle as a nice place to live the future does not look that great at the moment.

all i know is that post 2000 you could pretty much park anywhere, get any reservation you wanted, and drive from pac heights to noe in about 10 min. heaven.

This is pointlessly hyperbolic, not backed up by historical patterns or trends, and not particularly backed by much current evidence either. SF is still by far the number one metro area in terms of investment dollars and still by far the most preferred single location for startups receiving those investment dollars — the leader for new startups actually being remote/distributed and not any city in particular. Violent crime is down over several years ago, while property crime is up. The large increase in commercial office vacancies put downward pressure on prices.

Agreed.

Anecdotally, COVID restrictions have been a real barrier to exit for people trying to leave SF. Talking to people trying to leave (especially with a family) and trying to do all the legwork of relocating virtually (scope out neighborhoods, parks, schools, community feel, virtual open homes,…) it seems quite a PIA. Same with trying to move a business.

I think one reason that apartments emptied out so quickly was that it was just so much easier for single people with somewhere ‘back home’ to move to. They just packed up and went back to mom & dad (or at least the town where mom & dad live).

Crime and the debacle of prioritizing school renaming vs reopening are both big incentives for families to bail. I think we just haven’t seem this play out yet with families because it’s been so much harder for them to plan and execute an exit.

“Anecdotally, COVID restrictions have been a real barrier to exit for people trying to leave SF.” “Anecdotally” is the key word there. The same restrictions exist across the state.

Yeah, anecdotally, I’m seeing similar with the large, public, multinational tech company I work for.

Younger employees (20s) dipped on their apartment and went home, some of them planning to return later once offices re-open.

Older folks stayed in place or, honestly, were already in a remote work situation.

I did see a lot of folks in the “in-between” (just recently had kids or plan to have kids) consider/start seriously making offers on homes in Bay Area suburbs like Marin or East Bay. Most of these folks are hedging their bets on needing to be commute local to the Bay Area in the future.

“CEOs, families, team members, and investors have all given up on San Francisco as an HQ”

The feeling is mutual of course. The wave of capital seems to have raised the cost of living far more than the quality of living. The dream of Conway and Lee would have been very lucrative but it was never what the city wanted.

I am part of the problem but I have to say that for tech to flee SF now is not great optics. It’s true that the city is a terrible place to start a business but that was already true when tech moved in, and it’s considerably less dangerous now than it was then. We’re left with “too expensive” but whose fault is that? Too late for SF, but hopefully the new hubs are not going to be in constrained topographies like mountain towns that can be overwhelmed even faster than SF.

“The wave of capital seems to have raised the cost of living far more than the quality of living.” Well said.

2010-2020 was an interesting run. Looking forward to seeing what comes next.

From 2014 through 2018 San Francisco absorbed a net, on average, of about 1.5 million feet/year. From a low of negative 500k in 2017 to a high of about 3.5 million in 2018. In 2019 a significant drop in absorption started – the first 3 quarters of 2019 compared to the same of 2018. Those were boom times so net absorption is likely to be much less in the coming years. It’s hard to predict but under one million feet/year is not an outrageous guess. At that absorption rate it will take 16 years to fill the space. That doesn’t account for additional space being put on the sublease market. Several weeks ago 400K space was dumped onto the market – Juul and Trulia offered up more than 100K feet each. Trulia actually put its whole SF footprint on the market.

In that context as 5M is delivered empty in SF Burlingame Pointe delivered a more than 800k foot office building in November and Oculus took all the space. Not long before Oculus inked it’s deal Pinterest canceled its lease for all of 88 Bluxome. Likely killing that project a spokesperson for which said that without a major pre-lease the project won’t move foreword. SF is in for rough times even as the rest of the Bay Area recovers. That was the message from one analyst recently. That SF will lag the rest of the region but that maybe that is good as it will give SF time to address all its issues. Hopefully this person is right but I suspect SF will not address those issues in any significant way that would cause companies and workers to want to be in SF again.

What you’re leaving out here is that companies increasing don’t want to be anywhere. I.e. they have less desire to have a large center of gravity in any one city. This is not at all unique to San Francisco or the Bay Area more broadly.The idea that SF’s loss will be other specific cities’ gain is just not bearing out at this point, and doesn’t look to be the case in the near future. It is not a zero-sum system.

Disagree. PG&E’s moving to Oakland as well as Credit Karma: 4K – 5K jobs and the associated revenue lost to SF. Especially as their now empty office buildings in SF are likely to remain so for years. Stripe moving its 2K SF workers is a huge loss especially as they hope to double their SSF workforce in a few years. SF boosters are in denial. The emperor has no clothes as some have said for a few years now at SS.

You’ve been prognosticating for years about the imminent and irreversible collapse of the SF and Bay Area economy, mass population exodus out of the region, etc. — all without any serious objective evidence or a long enough arc of documented events to support it. So you’ll understand (or not) when nobody blindly accepts this cry wolf act. The evidence over the years you’ve been making this prediction would, if anything, indicate that you are in fact the one in denial. But hey, keep doing what you’re doing, reality doesn’t seem to tether you too much.

Before he was Seattle Dave, he was Oakland Dave, insisting that Oakland was the real center of the Bay Area. Adjust the size of your grain of salt accordingly.

More SF companies are moving to Oakland than have moved to Austin. Funny how so many posters pretend that Oakland is not an option but bring up relocating south to the Peninsula makes more sense. The East Bay is by far the most populous region in the Bay Area with 2.8 million residents. Oakland is the real option for SF companies. Oakland is a bigger threat for SF business relocations than is Austin, Denver or Seattle.

Arts and Culture – that’s what the kids want and they’re the beating heart of every next generation of technology. Period.

If it could be bought, they would’ve brought it to Silicon Valley and never moved to SF.

Two specific advantages that SF had were:

1) Better Gender Ratio (San Jose was/is also known as Man Jose)

2) Extra-Cultural Hedonistic Activities — in the open LGBTQIA+ acceptance (coupled with Hunter S. Thompson’s finest choices)

SF before it attracted GOOG/AAPL and others, for a long time was the playground for newly minted playboys from the South Bay.

This was all fine as long as the US held technological and economic monopoly. As that was the justification used to tolerate hedonistic excesses.

But now we know that technological superiority can be achieved and even exceeded by simply deploying highly motivated and highly capable people with none of the ‘arts & culture’ trappings.

In other words, San Francisco has lost its cool.

As a native San Franciscan I’d say SF lost its cool long before now. It is only in light of the pandemic that it is is becoming increasingly clear.

My guess is it’ll become a resort town, increasingly: great place to vacation, lots of long term rentals, lots of weekend homes, summer homes, just enough housing for all the people that work in food, hospitality, and essential services. Not sure what might happen to the more empty commercial towers. 1/5 vacancy rate isn’t absurdly high? I could see a few being homeless towers but I don’t think the city can really afford to babysit the less fortunate forever? Especially in the end result for most of the addicts, etc, is death or life at Laguna Honda: 5 million a year and that’s the end result.

A city is a thing. A town is a thing. Cities do not become resort towns. They change and ebb and flow over time.

@Zugamenzio Farnsworth — just an opinion. Extra-cultural was interesting as long as it was not the norm — something different. A reason to be cool or a kind of a rebel or whatever floats the boat in a controlled environment — for the working bloke. When there is no personal security and lax crime enforcement these activities will start veering and drop off into unsafe and uncontrolled zones to the detriment of all. For most people (I’d guess 98.5%) ‘safe’ is a foregone choice over being ‘cool’.

Growing violent robberies, physical assaults etc in SF are I believe a by-product of an inability to maintain public safe spaces for everyone. If these aren’t curtailed, then I do not see a situation where SF can be a desirable city to visit or spend time in.

IMO, Woke-ist re-interpretation of law does not bode well for future of SF.

Correction

inabilityincompetency, inadequacy and ineptness combined with unwillingnessA City with as much revenue and as large a budget and with as small a geographical region and with a relatively small population to manage should not have these issues. Or should be easily manageable.

So why is this happening?

Pensions

@Ohlone Californio — IMO, legitimized political bribes. Which help re-inforce the political/institutional tilt. I am not against pensions per se. But when those are leveraged to mis-manage, push woke-ist propaganda, under-perform and overlord over the citizenry (tax extraction & over-regulation), they invite scrutiny.

The recent SFUSD episode was an eye-opener on how deep this tilt is entrenched.

Its very simple: the 1st time your colleague or competitor gets the contract/sale/promotion/assignment, etc. because they showed up to the office or trade show and you didn’t? Et voila: welcome back

In case you weren’t paying attention, SF was losing conferences and trade shows BEFORE Covid

16 million square feet of shelter sitting idle while tens of thousands sleep and live on sidewalks. Capitalism is crazy…

Capitalism gave the City of SF untold riches. Just look up the city tax revenues. And then look at the payroll and the allocations. It is really 4+ decades of mis-allocations/mis-spending/mis-management that brought us to where we are today.

Don’t blame Capitalism for faults and utter incompetency elsewhere. How many people on this very site suffered through the city to apply and procure a simple construction permit?

the city govt failed, despite capitalism, not because of it. so much money coming into coffers and the city kept expanding employees, pensions, and did nothing to improve conditions. we need a complete change in leadership. the ultraprogressive agenda has uttely failed. we need a moderate left govt who can get stuff done and is not full of virtue signalling. the failure has been across every aspect of city governance

Everyone knows that Oakland is the true geographic center of the Bay Area and that the East Bay is the most populous region. Blue Shield, PG&E, Credit Karma, Square have all realized this fact and have moved to Oakland. San Francisco is a manufactured business center. We now see the cracks in the armor of forcing an illogical inconvenient location as the business center of the Bay Area. I don’t see SF growing as a business center. Makes zero sense for the quality of life in our region to keep forcing the greater East Bay population over a 5 mile wide body of water just to work in SF when Oakland is so much more convenient for everyone. The commute into Oakland from the East Bay and even from SF would save so much time and so much population from idling vehicles stuck at the approach of the Bay Bridge.

Except no one from the peninsula will commute to Oakland. The negatives of SF downtown are even worse in Oakland (crime, homelessness, traffic) and the upsides aren’t as good (dining, entertainment, etc.)

Downtown Oakland is much cleaner and calmer than downtown SF. There’s no Tenderloin in downtown Oakland while there’s a bucolic Lake Merritt. Also better climate and many great dinning and drinking options.

The city had, and to a large extent still has, access to thousands of empty hotel rooms to house unhoused individuals. Commercial space is not designed, zoned for, or appropriate for housing anyone, let alone individuals who need focused medical, psychiatric, and social services support. There is also that pesky thing called the Constitution that protects private property rights, and the city cannot just seize private property without paying fair market compensation. So, thank you but next idea.

The City has had decades and many billions of dollars of resources over these years to address homelessness. While it is a complicated issue that does need a state and national focus, the reality is that SF, has, as it has with so many other major issues, failed miserably in adequately addressing the problem.

SF doesn’t like to solve problems. It decorates them. All icing, no cake, etc etc.

you could easily argue that the have used that money as a magnet to increase the problems. all carrot, no stick

In the many decades I have lived in SF I’d say on average I have seen maybe a couple of dozen actual homeless people per year. Long term residents of SF, well greater than 5 / 10 years, and natives, who for various reasons lost their apartment / room and have no where to live at the moment. They are very easy to spot and I usually stop for a kind word or a gentle inquiry if the opportunity presents itself. They usually work out OK. Lots of programmes, lots of options.

Now what I have seen over the years is tens of thousand of drifters, transients, street junkies, street crims, mostly from out of towner, recent arrivals. And the one group that it really is heart breaking to watch. The mentally ill. But due to the ACLU and patients “rights” activists many hundreds of mentally ill died in squalor on the streets and there not a single thing any one can do to stop this as long as current laws in California remain in place.

What solves the problem of street people is mandatory drug treatments programmes and enforcement of public qualify of life laws to encourage the anti-socials to move back to where they came from. The streets junkies are almost never locals, its the streets drunks who tend to be locals and they are almost never a problem.

In the last 30 plus years SF has spent upward of $7B on the “homeless problem” and there is just as many on the streets as there were 30 / 35 years ago. Because there is no “homeless problem” there are just a whole bunch of social problems which the “homeless” industry goes out of its way to ignore.

Lets just deal with the locals on the streets, maybe 10% or less, maybe. Mostly the drunks and the mentally ill. And send the rest of them back to their home town, Where there is a better chance of them straightening out anyway,

And if you think spending more money on “homeless” programmes will solve anything, there are huge numbers in the rest of the country just ready to move to SF if its worth their while. Last time I looked up the number its about 700K / 800K minimum across the whole US. Hand out enough free stuff and just watch them stream into SF. It wont be 10K street people it would soon be 30K or 40k street people. With more on the way.

Mandatory treatment programmes and active law enforcement would soon solve the problem. Just watch the out of towners street people disappear. It happened before. Back in the 1990’s. Then only the genuine cases were left. And they could be quickly dealt with.

So the problem has zero to do with capitalism and everything to do with virtue signally politics mostly indulged in by short term residents of SF who arrive here in their 20’s, leave in their 30’s, never having to deal with the long term consequences of the politics they voted for while here. SF politics only makes sense once you realize that the swing vote in city elections for the last 50 years is people who are just passing though. And wont be living in the city in 5 or 10 years time. When the bill for results of their political “principals” starts coming due.

The social dynamics of the work place and society in general, have changed ..the need to be in central location is not as it once was, the occasional meet and greet is going to be fine, for most businesses. A developmental center where actual hardware etc. is constructed or research labs are going to still need that in person contact but not always. When you factor in cost of office space and operational costs, you are better off doing remote management. The pandemic just highlighted the workability of remote management. SF has a whole set of problems that add to the costs and reasons not rent space: crime, traffic/ transportation issues , housing expense, city government that is truly incompetent, a school system that is a joke. My prediction SF will be in limbo for a decade with some real financial difficulties.

Use of the Salesforce Tower in the graphic only dramatizes how pointless it was to defile the city’s skyline with that monstrosity.

If you don’t like it, build your own tower etc, etc

People militantly hated the Transamerica Pyramid and Bank of America Center (555 California) too, because time is a flat circle.

555 California is a pretty uninspiring building to be your second-tallest at the time it went up, to be fair. (Agree with your point though, of course.)

It was the tallest when it went up….uninspiring or not.

(It predecessors were the Clavs Spreckels [Call] Building (1897), PT&T (1925), Hartford (1964), Wells Fargo (1966)…you might start to notice a pattern there).

Interesting — I had always assumed it was later than Transamerica, but you’re right — it was three years earlier. (I had always assumed late 70s/80s just based on how blah it is.)

The original design for the Transamerica Pyramid was much less elegant and quite a bit larger. It reached its current design after participation by local citizens helped convince developers to build something that is an asset to the city, not an eyesore. No such process was undertaken for the Salesforce Tower, with predictable results.

I like how the SF tower fits into the skyline.

It really is a very unimaginative building. Buildings in NYC, Shanghai, London, Dubai, Singapore, Hong Kong, are so much more interesting.

Yes and so are buildings in Davenport Iowa. And Manchester, England. And oh, hey, look, this city has a bunch of cool buildings. (in fairness Manchester, England, has tons of awesome architecture.) Um. What, like the cities you listed don’t have boring buildings? Of course they do. Not sure why you’re on this SF Down Oakland up” tip you’re on man. There’s room for everyone in architecture criticism, seems like, for one.

The owners, the lenders, the service industry and small businesses that live off these towers will be wrecked. As commercial property values plummet the city’s tax revenue will collapse. See you in Florida. Bye bye!

the average office space is still $75 a square foot. It may not sound like a lot. Let’s say a one bed room apartment is about 600 sqft. So $75 x 600 sqft = $45,000 / 12month, is about of $3750 a month. Way above rent can be demanded by a typical one bedroom apartment in the city.

Despite the nice graphic of Salesforce tower, the vacancy rate is only at 19.7% (source, SF Gate), not that far from national average of 19.4% (source, virtual link: seeking alpha, vacancy rates in 2021).

The office rent market is simply over priced (having been hot for years). Adjustment is a good thing.

Or more accurately, 18.7 percent, based on Cushman & Wakefield’s accounting for the first quarter, as we outlined last week.