Having ticked down 2.8 percent in January, the National Association of Realtors Pending Home Sales Index, a seasonally adjusted index for which 100 denotes “an average level” of activity, dropped 10.6 percent in February to 110.3, representing the sixth consecutive month-over-month decline for the index which peaked at 132.8 in August of last year.

In addition, contract signings were down 0.5 percent on a year-over-year basis last month, representing the first year-over-year drop in eight months.

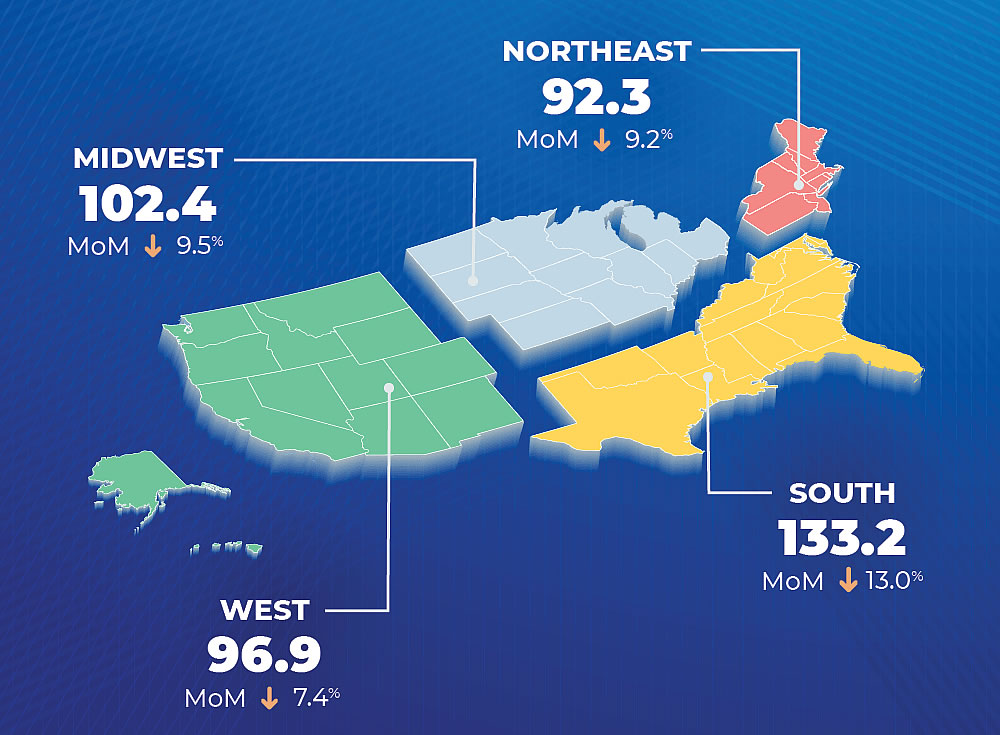

And out west, pending home sales dropped 7.4 percent in February to a below average mark of 96.9, which was still up 1.9 percent on a year-over-year basis.

Covid Arrived

Debt Repayment Delayed

Risk Climbed

High Rates Ticked

Affordability Killed

Economy Crashed

The interpretation that national sales volume has slowed due to negative economic circumstances is at odds with the widely-reported trends of aggressive bidding and extremely low inventory in the broader market.

Rates are still near historic lows. Covid’s arrival has improved the balance sheet of many Americans with fewer opportunities to spend money, people are paying down debt. San Francisco’s mixed real estate price signals (rents down, prices flat/up) are anomalous. If you speak to people outside our city, you’ll find people are experiencing a ripping strong market with overbids and very tight inventory. If anything, it is the muted effects in our city of this national trend which are keeping San Francisco home prices up as rents fall locally.

The WSJ reports the available inventory of homes for sale is lower (in terms of months of inventory) than it has been in the last 20 years. From a March 30th article titled, ‘U.S. Home Prices at Fastest Pace in 15 Years’:

“U.S. home prices are rising at the fastest pace in 15 years, reflecting how fiercely buyers are competing for a limited supply of homes in nearly every corner of the country.

From small cities like Bridgeport, Conn., to large ones like Seattle, prices have been steadily moving higher. Two closely-watched house-price indicators released Tuesday posted double-digit national price growth, demonstrating the widespread strength of the market.

A number of forces have merged to fuel the red hot housing market, including mortgage rates dropping below 3% in July for the first time ever. Millions of millennials are aging into their prime-homebuying years in their 30s. New-home construction has lagged behind demand and homeowners are holding on to their houses longer.

The coronavirus pandemic has turbocharged this demand. Many Americans sought homes with more space to work remotely during Covid-19, or felt freed to move farther from their offices.

At the same time, the pandemic worsened the already severe shortage of homes for sale. Low interest rates prompted more homeowners to refinance and stay put instead of moving. Others delayed their moves due to concern about virus exposure, according to real-estate agents. Even as home builders have ramped up the pace of new construction in an effort to keep up with demand, they are limited by rising material costs and shortages of land and labor.

“It really can only be characterized as a super sellers’ market, not even just a sellers’ market,” said Odeta Kushi, deputy chief economist at First American Financial Corp. “The supply-demand imbalance isn’t going away anytime soon.”

-and-

“Separately on Tuesday, a house-price index compiled by the Federal Housing Finance Agency found a 12% increase in home prices in January from a year earlier, a record annual gain in data going back to 1991, the agency said. The Mountain region, which includes states like Idaho and Arizona, posted the strongest annual gain, at 14.8%, while the West South Central division, which includes Texas and Louisiana, was the slowest, at 10.2%.

“The houses are flying off the shelves,” said Monika Prasai, a real-estate agent in San Diego. “You have buyers who are ready and willing to move, but it’s difficult to find them something because there is no inventory.”

So… no homes are being built.

More precisely, demand exceeds the current supply, with not enough homes being built.

That’s incorrect. While the turnover of existing homes has dropped, the pace of new home sales is currently lagging production, driving inventory levels up.

Your other linked post refers without attribution to US Census Bureau data on New Home Sales.

It’s true in the dataset that new home inventory increased from 304k homes for sale nationally at the end of January to 312k homes for sale at the end of February.

In the West, however, the number of new homes for sale dropped from 232k at the end of January to 194k at the end of February.

Regardless of whether the the inventory goes up or down, I would suggest that the fact that prices are rising broadly is sufficient to support my claim that ‘not enough homes are being built.’

To pull out a quote from the article I copied above:

“It really can only be characterized as a super sellers’ market, not even just a sellers’ market,” said Odeta Kushi, deputy chief economist at First American Financial Corp. “The supply-demand imbalance isn’t going away anytime soon.”

Most working economists don’t define ‘demand’ as the number of actual homes sold, as you do here. If twenty people bid for one house and 19 go empty handed, that doesn’t mean the market has demand for only one home.

Perhaps we’re mistaken, but the context above was nationally. And in fact, new home inventory is up 9.5 percent over the past six months as sales have lagged production.

In addition, you appear to be quoting incorrect data, as inventory levels actually inched up out west in February to 77,000 homes while sales slowed as well.

I have found that posting links to other sites here is a useless exercise because you only link to your own stories, so I won’t try.

I’m pretty sure, in a national context(!) if US home prices are rising at the fastest pace in 15 years, (per the WSJ), there aren’t enough homes being built, (or marketed and or sold) to meet demand.

April 3, WSJ headline: “The Housing Market Is Crazier Than It’s Been Since 2006”

April 4, WSJ (If You Sell a House These Days, the Buyer Might Be a Pension Fund): Yield-chasing investors are snapping up single-family homes, competing with ordinary Americans and driving up prices

How does this movie end?

Homes in SF are too dissimilar to make good candidates for most institutional buyers, I presume. Since the Great Financial Crisis, there have been several companies focused on accumulating nice single family homes in mostly suburban areas.

How it ends is with more people renting who would have traditionally owned. This was definitely a trend after the Great Financial Crisis, but my sense is that the pendulum has swung and after 10 years of RE gains, more and more people want to buy homes, especially with low mortgage rates.

As for institutions entering the single family home market and crowding out individuals, that is a price we pay for our monetary policy that answers every problem with a rate cut. Eventually rates are so low in ‘traditional’ investing that insurance companies and pension funds with liabilities projected in the future start seeking yield in different asset classes – finally coming round to single family homes.

As long as the institutional buyer is not over-levered, it shouldn’t pose any great risk to neighborhoods or the financial system.

“.. more and more people want to buy homes, especially with low mortgage rates.”

Not sure about this. If prices are rising and lending terms are stricter wouldn’t this imply higher down payments?

“As long as the institutional buyer is not over-levered, it shouldn’t pose any great risk to neighborhoods or the financial system.”

If the cost of rent climbs higher, I would assume renters/buyers would optimize for that expense. Less space, smaller home etc. If that does happen, wouldn’t risk manifest in terms of non-performing / ill-liquid assets on the books?

It seems to me we are headed in the way of another GFC ..