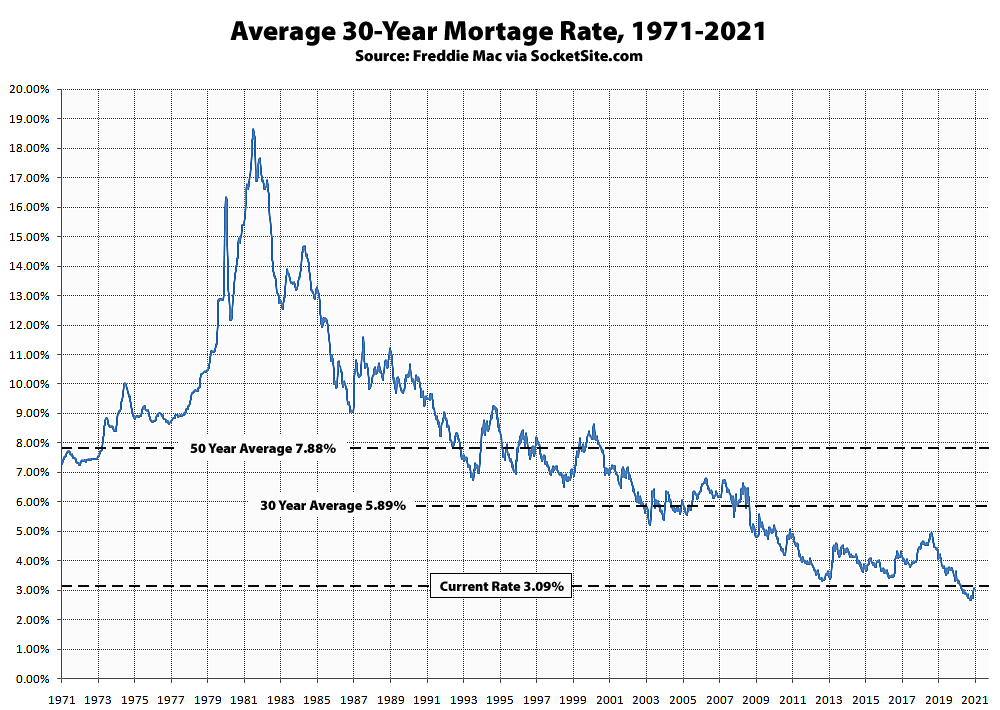

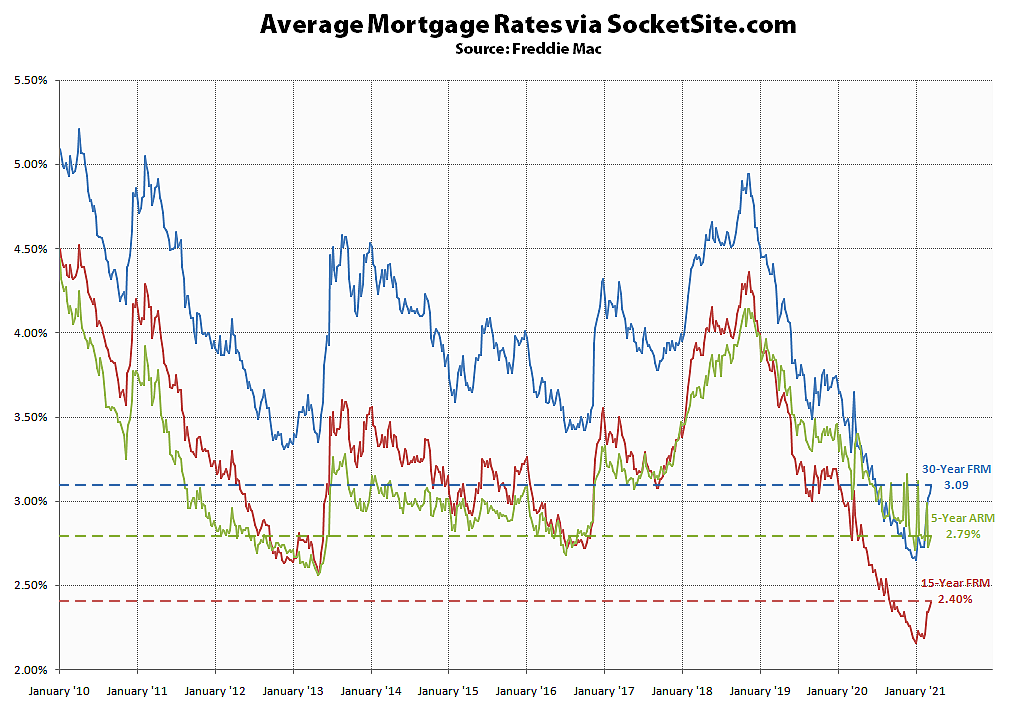

While the Fed has just affirmed its intentions to maintain a low rate environment through 2023, the average rate for a benchmark 30-year mortgage, which inched over 3 percent for the first time in seven months two weeks ago, inched up another 4 basis points (0.04 percentage points) over the past week to 3.09 percent, which is the highest average rate in 9 months.

That being said, the average 30-year rate is now 56 basis points below its mark at the same time last year, only 44 basis points above its all-time low of 2.65 percent two months ago, and around half the average 30-year rate on offer over the past 30 years.

At the same time, the average rate for a 15-year fixed mortgage has inched up another 2 basis points to 2.40 percent, which is 66 basis points below its mark at the same time last year, and the average rate for a 5-year adjustable has inched up 2 basis points to 2.79 percent, which is 32 basis points below its mark at the same time last year.

And once again, while the nominal increase in rates has slowed the pace of sales nationally, the refinancing market has taken a much bigger hit.

Real rates are extremely negative. Honestly, if Socket wants to track a mortgage rate chart it should be the real one. A 5% mortgage but with 6% inflation is still a negative -1% rate for fixed borrowers….

And that is if we can all agree on what inflation truly is, versus the aggregate stats….

You are a funny person, I realize that was just a made-up example to illustrate a point, but we are not going to have 6% CPI inflation at any time in my or your lifetime.

According to the U.S. Bureau of Labor Statistics, the CPI was, what, 1.7 percent as of earlier this month? So a 3.09 percent mortgage is still not “extremely negative” in real terms.