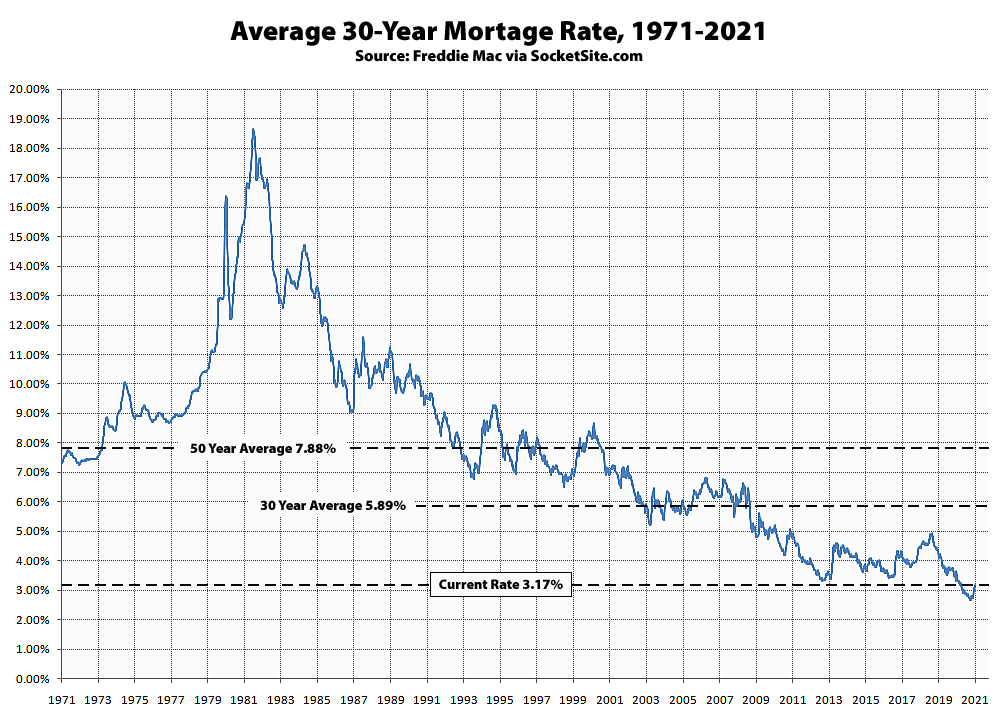

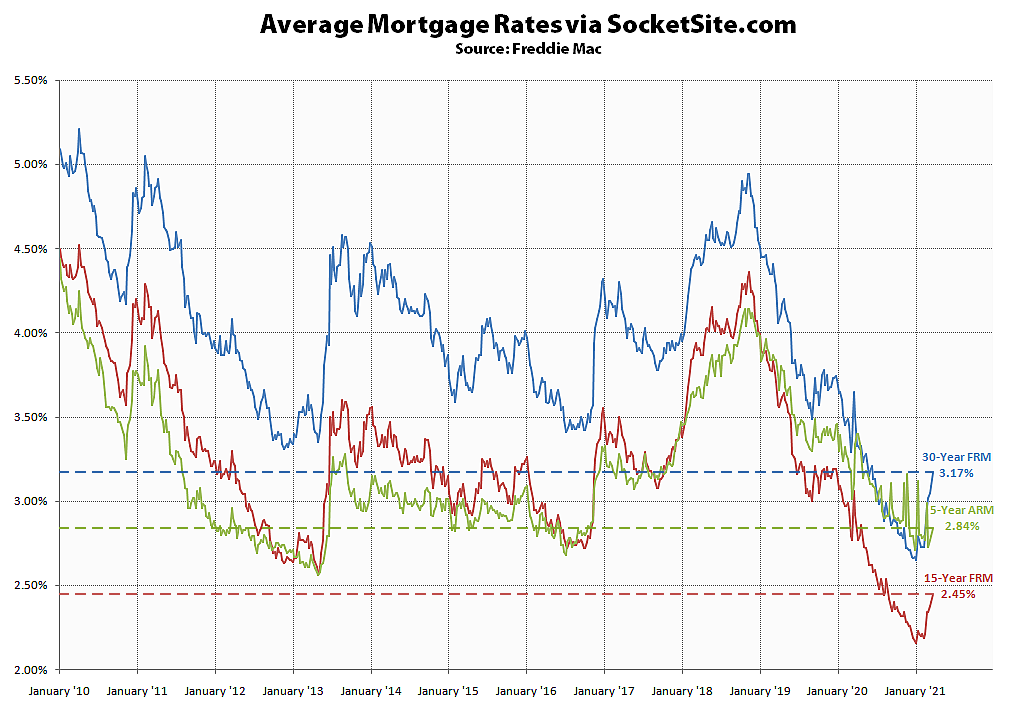

The average rate for a benchmark 30-year mortgage, which inched over 3 percent for the first time since last July earlier this month, inched up another 8 basis points (0.08 percentage points) over the past week to 3.17 percent and is nearing a 10-month high.

That being said, the average 30-year rate is still 33 basis points below its mark at the same time last year, only 52 basis points above its all-time low of 2.65 percent two months ago, and around half the average 30-year rate on offer over the past 30 years.

At the same time, the average rate for a 15-year fixed mortgage has inched up another 5 basis points to 2.45 percent, which is still 47 basis points below its mark at the same time last year, and the average rate for a 5-year adjustable has inched up 5 basis points to 2.84 percent, which is 50 basis points below its mark at the same time last year.

And once again, while the nominal increase in rates has slowed the pace of sales nationally, the refinancing market has taken a much bigger hit.

How does this all end?

There has been this obvious multi decade downtrend in rates and while its cliché to say ‘But this can’t go on forever’ In this case it really does seem like this can’t go on forever. I see how you can go from 12% to 9 % to 6% to 3% rates. But can you really go from 3% to 0% to -3% to -6%?

Sure enough I just saw this in the WSJ: many people in parts of europe do indeed have negative mortgage rates where the bank is paying them (and conversely in some places the bank gives (takes?) negative rates for savings accounts.

But can this really go on to become more than just a oddity in some parts of Europe? How would an economy work if people could just quit their jobs and just be paid to take out giant mortgages?

On the bond holder side, they have made due with low interest payments by getting capital gains with bonds increasing in price when rates drop. But when does it look like you are getting terrible rates with no prospect of further gains.

For stocks (and houses) I sometimes think the bulls are being overly optimistic, but I at least see the theoretical bull case. I don’t think there is a limit on human ingenuity, so I think we will eventually create more and more valuable companies, which can then pay higher wages and then push housing prices higher. This just might take longer with many more ups and downs then some people realize.

But for bonds, while there might not be a hard zero bound, I just don’t even see how you repeat the past 40 years. Going from 12% to 0% and going from 0% to -12% are not at all the same thing. Whereas I have no problem believing that the next 40 years for stocks will match the last 40.

Did you watch the FOMC meeting last week? The pump is on till at least 2023.