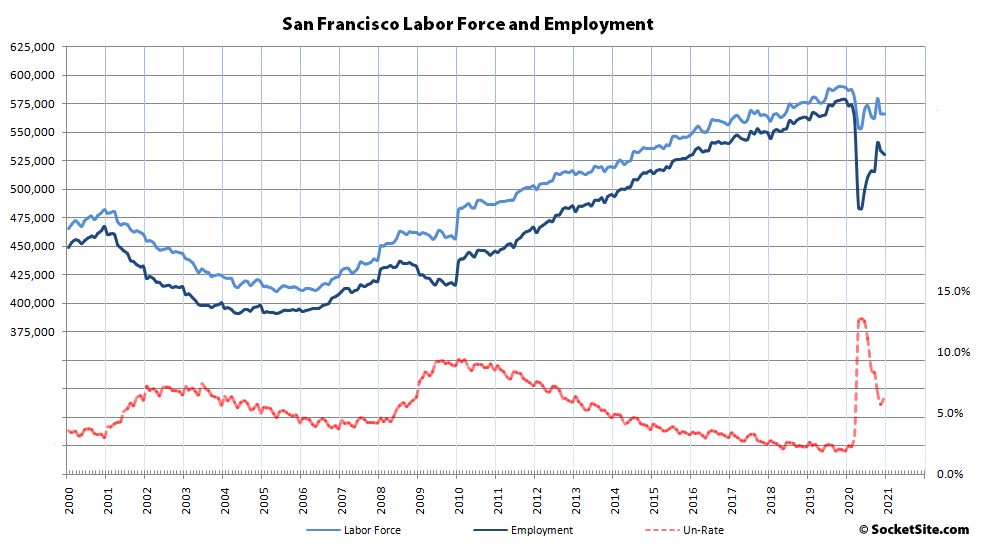

As we outlined last month, while the unemployment rate in San Francisco dropped in November, the number of people living in San Francisco with a paycheck (i.e., employment) was actually on the decline, as was the case across the Bay Area as well.

And in fact, the number of employed people living in San Francisco dropped by 10,800 over the past two months to 529,900, ending 2020 with 48,200 fewer employed residents than at the beginning of the year and 23,100 fewer people in the labor force (566,200) for an unemployment rate of 6.4 percent (versus 1.9 percent in December of 2019).

At the same time, the unemployment rate across the East Bay ticked up to 7.9 percent at the end of last year, with 125,700 fewer employed residents (1,447,700) than at the start of 2020 and 45,100 fewer people in the labor force overall (1,571,700).

The unemployment rates inched up in both San Mateo and Santa Clara counties in December to 5.8 and 5.9 percent respectively, with 94,900 fewer people employed across the two counties (1,397,600) than at the start of last year and 38,500 fewer people in the labor force (1,485,200).

The unemployment rates were up across the northern counties at the end of last year as well, with an unemployment rate of 5.4 percent in Marin, 6.5 percent in Sonoma and 7.3 percent in Napa and 34,300 fewer people employed across the three counties (427,100) than there were at the start of the year and 16,400 fewer people in the labor force (455,800).

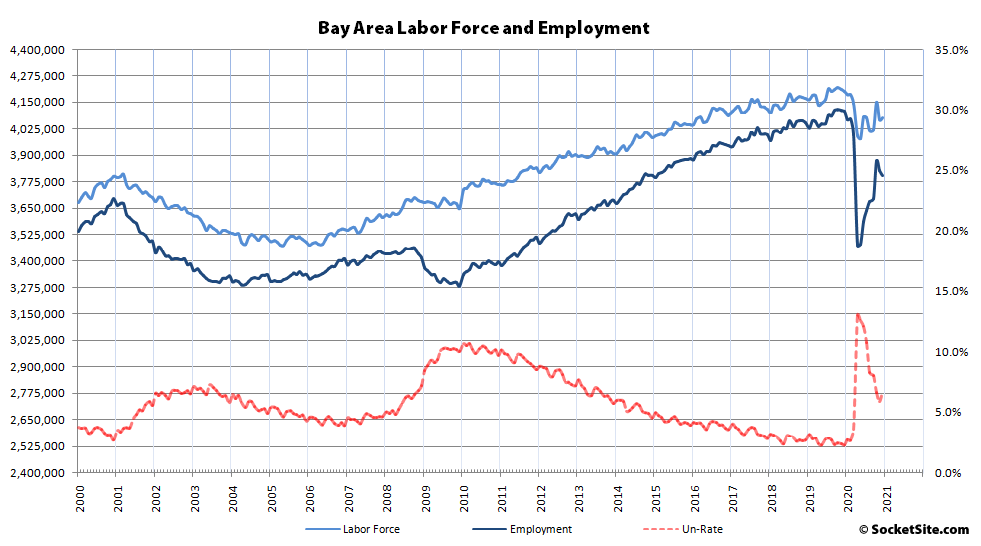

And as such, the unemployment rate across the Bay Area was 6.8 percent at the end of last year, versus a record-low 2.3 percent at the end of 2019, with 123,100 fewer people in the labor force (4,078,900) and 303,100 fewer employed (3,802,400).

And in related news today, Uber, After Buying Postmates, Lays Off More Than 180 Employees:

Will the highly-compensated executives that were brought into Uber from Postmates stick around, or will they take their (equity) “winnings”, now that they don’t have jobs and nothing is keeping them in The City, sell their homes and decamp to Texas or Florida?

I have this idea that these are circular deals.

Execs from Company X buy Company Y with shareholder equity.

Execs in Y clean house on behalf of X to bring “value” to the purchase price.

Execs in Y get paid and re-invest (lets say hypothetically in the neighborhood where it matters for Execs in Company X inflating the value.).

Execs in Company X cash out followed by Execs in Company Y cashing out.

Value on paper is inflated. And the speculator from wherever else is left holding the bag.

Maybe not exactly in this specific manner — but in the eco-system of grifting shareholders and so on ..

you are correct, sir