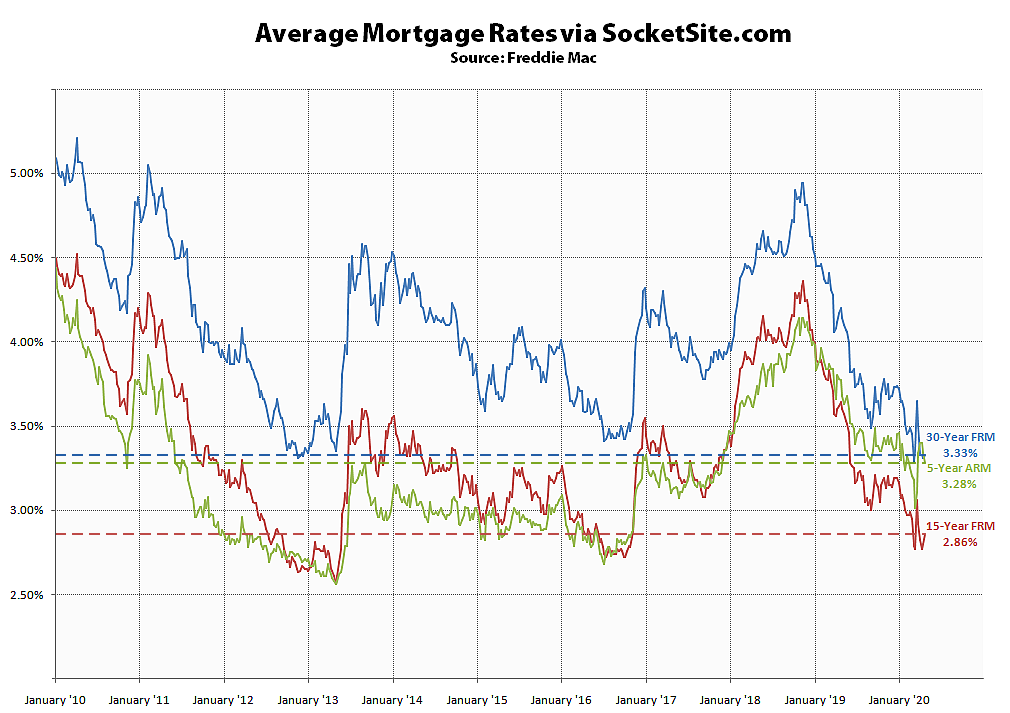

Having inched down to within 2 basis points (0.02 percentage points) of an all-time low last week, the average rate for a benchmark 30-year mortgage has since inched back up 2 basis points to 3.33 percent, which is still 87 basis points (0.87 percentage points) below its mark at the same time last year, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has inched up 6 basis points to 2.86 percent, which is 78 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable shed 6 basis points and now measures 3.28 percent, which is 49 basis points below its mark at the same time last year and back below the average 30-year rate for the first time in four weeks.

While the benchmark rate effectively remains at an all-time low, purchase contract activity in San Francisco is currently down nearly 50 percent on a year-over-year basis and existing-home sales activity across the U.S. is poised to plummet.

To quote Freddie Mac: “While financial markets initially rallied on the news of Federal Reserve support and are improving due to the Senate’s passage of a new small business stimulus, we continue to see a deep economic contraction amidst uncertainty about the recovery formation.”