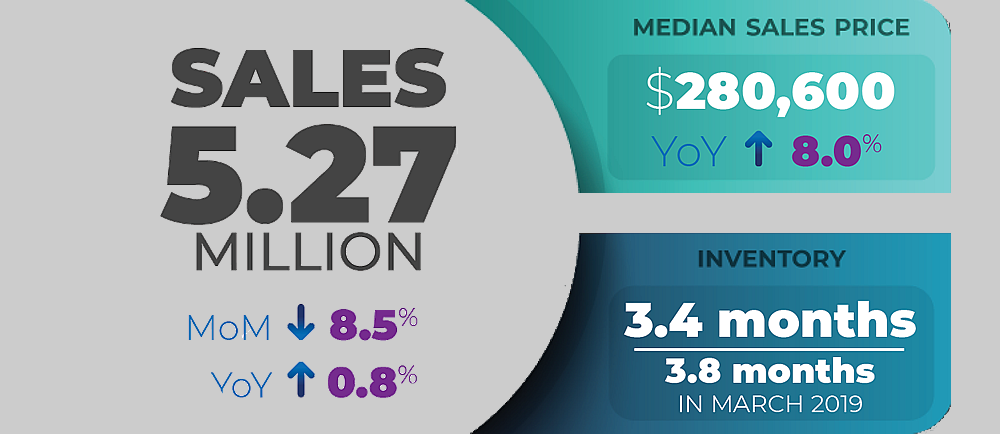

Having jumped 6.5 percent in February, prior to the stock market having dropped and the impact of COVID-19 having taken hold, the seasonally adjusted pace of existing-home sales across the U.S. subsequently fell 8.5 percent in March to an annual rate of 5.27 million sales but still managed to eke out a 0.8 percent year-over-year gain, according to the National Association of Realtors.

But keep in mind that March sales are driven by contract activity in February. And as such, the COVID-19 hit won’t really be reflected in the pace of sales until April and May.

And as we outlined last month, for example, while the pace of home sales in San Francisco was already “down 20 percent on a year-over-year basis and dropping fast,” new contract activity is now down over 40 percent versus the same time last year.

It seems obvious that unless you really have to sell right now, you just won’t. This is different from the subprime mortgage bubble, where homeowners literally shouldn’t have been owning homes. Given that rates are low, if you need money, just borrow against your equity. Only a moron would sell.

But wait to sell for what exactly? Prices were pretty bubbly before this even started. And this will lead to profound shifts away from urbanization with many businesses never to recover. And if people are needing to tap into equity for day to day money, then they literally shouldn’t be owning the homes they are in this time around either.

If you can go back in time 3 years and sell then you should. But in the real world, 3 years in the future will be even worse a time to sell.

A lot of people thought they were smart by holding out to sell when the market started to turn last time, only to be crushed as the market kept crashing.

another reason you might sell is if you get offered two hundred thousand over your list price and 600 over what you bought for…

…in mid 2015 and remodeled a bit, including a newly legalized lower level, last year.

DBI just shows a bathroom remodel, not a lower lever legalization?

I was replying to a comment about how everyone should have sold 3 years ago, so the 2015 note means what? They bought in ’15, the market peaked in ’17 and it has gone steadily down for the last 3 years?

Simply more context, in terms of the actual dates involved. And prior to the permitted remodel, the lower level bathroom was unwarranted.

Lol if you need to borrow money to pay your mortgage, that’s the definition of someone who shouldn’t own a home. If you haven’t closed a cash out refi on a jumbo, you’re not getting one now; it’s too late. Only way is if you have $100k or more liquid with a bank and the cash outs are capped at $200k. If you have that, why would you bother a cash out refi? Classic lender case of those who need it can’t have it; those that can have it, don’t want it.

2 comments

First one said: “It seems obvious that unless you really have to sell right now, you just won’t.”

Second one said: “in the real world, 3 years in the future will be even worse a time to sell.”

First comment is current world common sense.

Second comment is a classic “I have an opinion – likely wrong – but I will present it as fact” – can we all borrow your 3 year crystal ball so we can figure out some stock picks while we are at it?

3 years from now home prices will be even higher. Many of the large tech companies have stocks at or near all time highs, as of today. They are not firing people. They will only grow in power and importance. In fact, the fourth quarter GDP is expected to be higher in 2020 versus 2019, and if not, 2021 is supposed to be higher than 2019 as a whole. Also predictions that may turn out wrong, but to say in 3 years for sure it will be a worse housing market – well that sounds like someone that has missed on capturing massive gains in the last 5 years and has some sour grapes.

No one thinks big tech is going away, but this is going to be a huge economic hit. And in a downturn the ad budget is the first thing to go. FB & google are all about ads. People aren’t going to ditch their smartphones, but they might not drop $1000+ on them so readily anymore. Big tech isn’t going anywhere, but its hard to see why or how they would take up the slack of all the companies that don’t survive this economic hit.

Not every ad market has been hit equally. Hospitality and travel? Yes, for sure. Home supplies, online education, weed delivery not so much. People sitting at home spending time on their computer has not stopped one bit, if not increased.

Wrong on the ad front. Streamers report traffic has doubled but their revenue is 50% what it was at lower levels. Ad revenue has been obliterated.

That’s streaming. Like I said, not every ad market is affected equally.

You’re saying streaming is getting hit harder than other markets? OK news to me. Streaming is the only thing going on right now. No sports, just e-sports.

I’m sure you can cherrypick 1 sector that’s up, but overall the remaining 99% are down — way down. You cannot deny that. FB and GOOG are hurting. Costs up, revenue down.

“VerizonMedia, which owns Yahoo! and TechCrunch, took a big hit from the pandemic’s effects as advertising spending came to a complete halt.”

“Verizon Communications Inc withdrew its full-year revenue outlook on Friday as it lost 68,000 phone subscribers who pay a monthly bill in the first quarter amid lockdowns due to coronavirus outbreak that closed 70% of its stores.” Analysts had expected a loss of 100.

Name link for the full story.