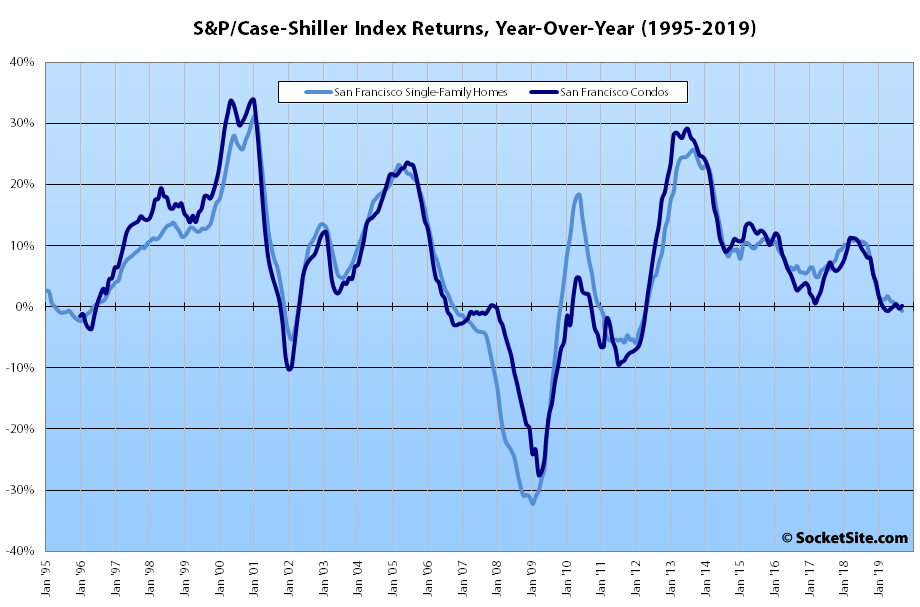

Having turned negative last month, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – has shed another 0.6 percent, an outcome which shouldn’t catch any plugged-in readers by surprise.

As such, the index is now down 0.7 percent on a year-over-year basis despite a dramatic drop in mortgage rates over the same period of time, plenty of IPO related hype from industry folks since the start of the year and a stock market which is still hovering near an all-time high. And that’s versus an indexed year-over-year gain of 9.9 percent at the same time last year.

At a more granular level, the index for the bottom, least expensive, third of the market managed to inch up 0.1 percent in September for a total year-over-year gain of 0.9 percent (versus a year-over-year gain of 10.6 percent at the same time last year); the index for the middle third of the market, which peaked last year, dropped another 1.1 percent and is down 1.6 percent on a year-over-year basis; and the index for the top third of the market shed 0.8 percent in September and is now down 1.0 percent on a year-over-year basis (versus a year-over-year gain of 9.1 percent gain at the same time last year).

The index for Bay Area condo values, which peaked in July, slipped another 0.1 percent in September but managed to eke out a year-over-year gain of 0.2 percent.

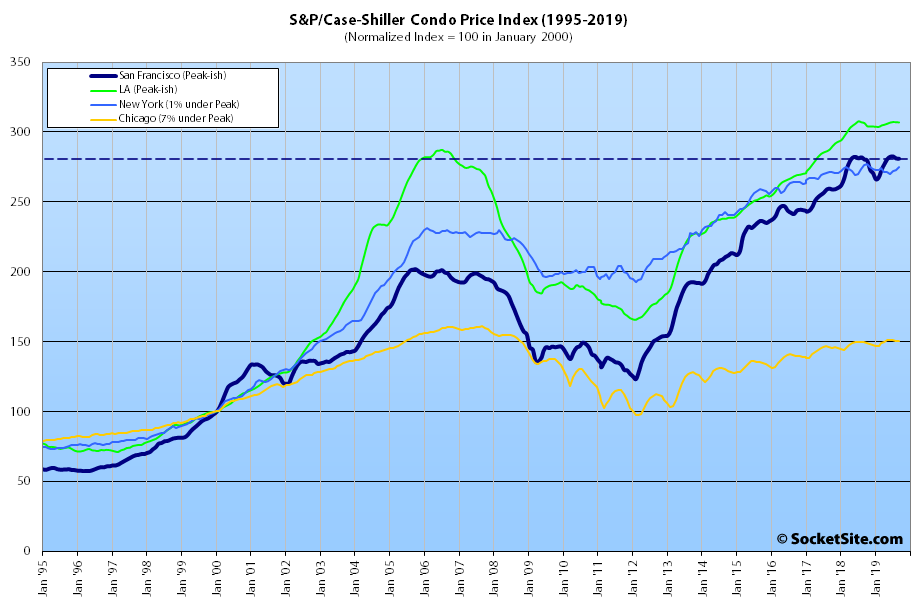

Nationally, Phoenix is still leading the way in terms of home price gains, up 6.0 percent on a year-over-year basis, followed by Charlotte (up 4.6 percent) and Tampa (up 4.5 percent).

And of the top 20 metropolitan areas in the nation, which were up an average of 2.1 percent on a year-over-year basis, San Francisco was the only metro area to record a year-over-year loss (for the second month in a row), with Chicago, which ranked second to last in terms of performance in September, managing to eke out a 0.6 percent gain.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

1.6%? So a million dollar condo got a whopping 16k cheaper. I will buy them hand over fist now

What a disingenuous remark. Everyone knows “prices are sticky” on the way down. The reason? It’s because real estate violates many of the conditions that define an open market that would be subject to conventional supply & demand theory.

Just a few of the conditions that conventional, neo-classical supply & demand theory requires that real estate violates:

it’s an asset, not a commodity (many purchases are for speculation, not use);

it’s the most illiquid market ever created;

information is asymmetrically distributed;

sellers are generally under no obligation to sell at a lower price than they seek (so “market clearing” and “equilibrium” either don’t exist or are impossible to determine in real estate);

real estate consists of many non-fungible sub-markets;

every property is unique, so precise price changes can only be determined when and if a property changes hands;

perverse tax incentives artificially inflate prices;

an extended period of historically-low interest rates artificially inflate prices.

and on and on and on…

Prices will continue to drop — but slowly, and not necessarily in a straight line…

This was inevitable due to many factors. BA affordably still is at or near the bottom nationally despite the slight decrease in prices. It will take years of flat/negative appreciation to make a significant dent in affordability in the BA.

Big employers are moving big chunks of workforce out of SF – Charles Schwab most recently, Stripe, McKesson. Perhaps UA. It could become a snowball and to the extent it does the fault is with SF and the Bay Area generally. The golden goose was taken for granted for too long and those halcyon days of boom as far as the eyes could see are over.

The BA’s population is flat/starting to drop. The job market is not as robust here as in more affordable metros. The fault lies with local political and business leaders and, to a degree, voters who kept/keep re-electing ineffective politicians. SF is the poster child for that.

Dave has been saying for years that the Bay Area’s population is dropping. Which is not true.

Slowing growth is not the same as population dropping

The Seattle Dude never responds when you actually present real data that completely debunks his claims.

That’s not entirely true (or at least not “never” based on a quick search). But as another reader noted earlier this month, domestic migration turned negative in 2016 and the pace of the domestic exodus has been ticking up, at least locally.

Slowing growth is indeed the same as population dropping for SF real estate purposes, because the population growth rate is around 1% and the birth rate is around 4%. So working people are being replaced with babies, and babies don’t buy houses.

The people who extrapolate a slight downtown to be a sign of end times are perhaps as insufferable as the boosters who compound YoY gains to infinity.