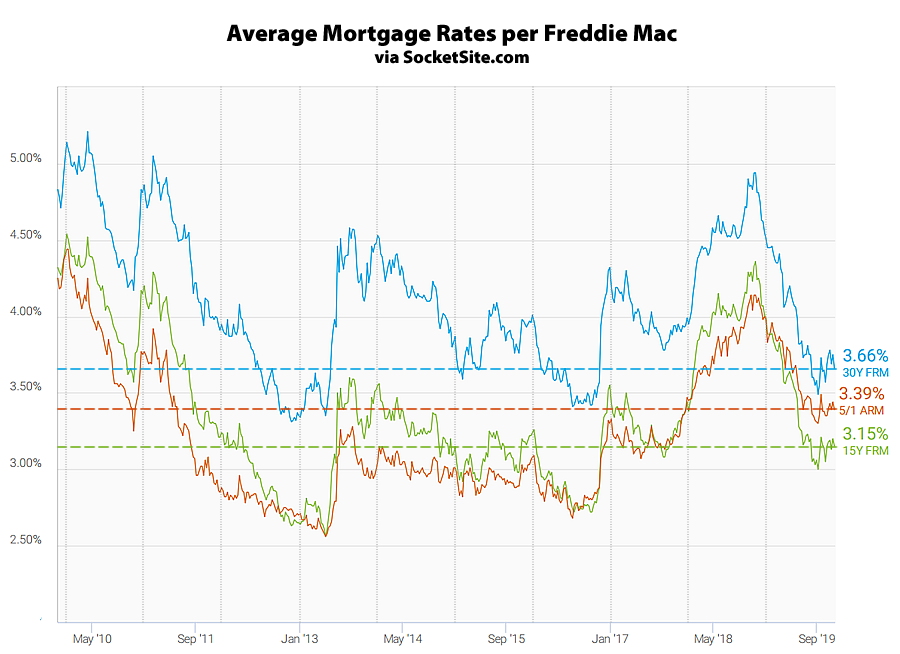

The average rate for a 30-year mortgage dropped 9 basis points over the past week and now measures 3.66 percent, which is 3 basis points lower than two weeks ago, according to Freddie Mac’s latest Mortgage Market Survey.

As such, the 30-year rate is now 115 basis points (1.15 percentage points) below its mark at the same time last year and back to within 25 basis points of a three/six-year low. Keep in mind that the long-term average for a 30-year mortgage is well over 6 percent but has only averaged around 4.2 percent over the past decade.

At the same time, the average rate for a 15-year fixed mortgage is currently running around 3.15 percent, which is 109 basis points (1.09 percentage points) below its mark at the same time last year, while the average rate for a 5-year adjustable has been holding at around 3.39 percent, which is 70 basis points below its mark at the same time last year.

And according to an analysis of the futures market, the probability of the Fed instituting another rate cut over the next year has been bouncing around 50 percent (i.e., who knows) while the probability of a rate hike over the next year has just inched up from zero to 2 percent as well.

A rate hike. Ha ha ha ha ha.

I wish that we were disclosing what actual jumbo rates were going for SF property instead of national averages. First Republic and SVB jumbo rates are much lower than these national, conforming loan figures. But little in the Bay Area is conforming loan 30 year cookie cutter packaged up and securitized stuff.

Harder to track over time with any kind of accuracy, but much more interesting than what the Fed does.

I am having a hard time coming up with an explanation to myself as to why jumbo mortgage loan rates in the Bay Area would be lower than “national, conforming” loans. Since non-conforming loans are not, as you say, “cookie cutter packaged up and securitized”, liquidity should be lower (creating liquidity is most of the point of mortgage securitization), and hence rates should be higher to compensate investors for the relative loss in liquidity, no?

Bay Area jumbo rates are marketing expenses for higher value asset management services. Get them into your system with 2.5% rates (current First Republic rate) , then try to sell them on 1-2% wealth management fees.

The default rate on Bay Area jumbos is lower than conforming loans. Rich people tend to pay their bills.