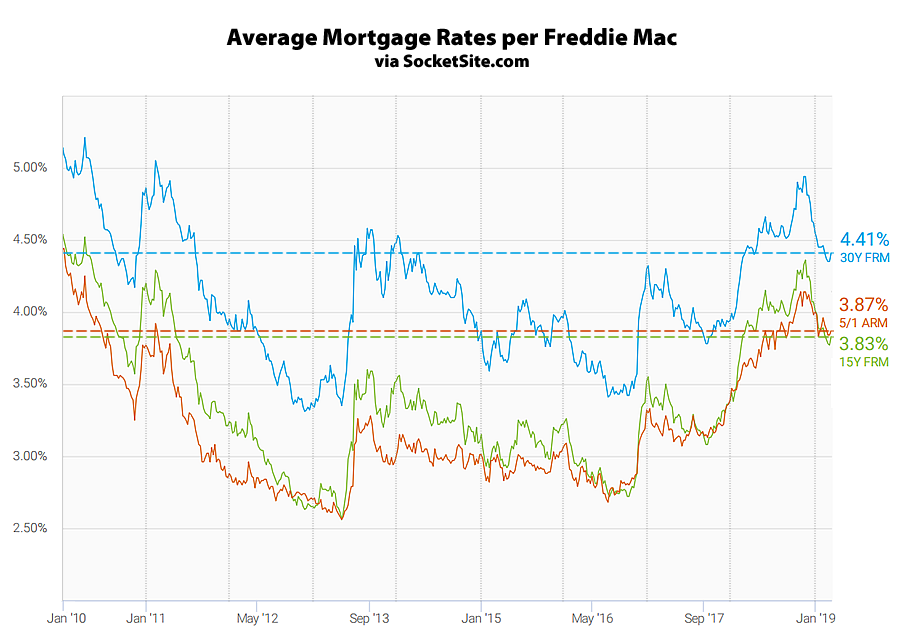

Having dropped 59 basis points since hitting a 7-year high of 4.94 percent this past November, the average rate for a benchmark 30-year mortgage ticked up 6 basis points over the past week to 4.41 percent but remains 5 basis points below its mark at the same time last year, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage, which had dropped 52 basis points since mid-November, ticked up 6 basis points as well to 3.83 percent but remains 11 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable inched up 3 basis points to 3.87 percent, which is now 24 basis points above its mark at the same time last year and still 4 basis points above the 15-year rate.

And with the Fed having formally signaled a more “patient” approach with respect to any future rate hikes, as signs of a global economic slowdown continue grow, the probability of another hike by the end of this year has dropped to under 2 percent with the possibility of an easing having now ticked up to 11 percent, according to an analysis of the futures market.

Now you’re deleting direct quotes from today’s NYT about the SF real estate market and pending IPOs?

An off-topic quote from a fluff piece in the NYT’s Style section, on a post about mortgage rates? At least you’re consistent. But yes, we are. And now back to the actual topic and trends at hand…

The ARM on my wife’s rental property (originally primary residence) adjusted up 0.5% via Wells. Was 3.75, now 4.25%.