Having inched up 0.5 percent in September, the National Association of Realtors Pending Home Sales Index, for which 100 denotes “an average level” of activity, declined 2.6 percent in October to 102.1 and is now running 6.7 percent lower on a year-over-year basis and 9.1 percent below last year’s high of 112.3.

At the same time, while the inventory of homes on the market across the country shed another 1.6 percent in October to 1.85 million, as is typical for this time of the year, inventory levels are now running 2.8 percent higher on a year-over-year basis (versus 44 percent higher in San Francisco).

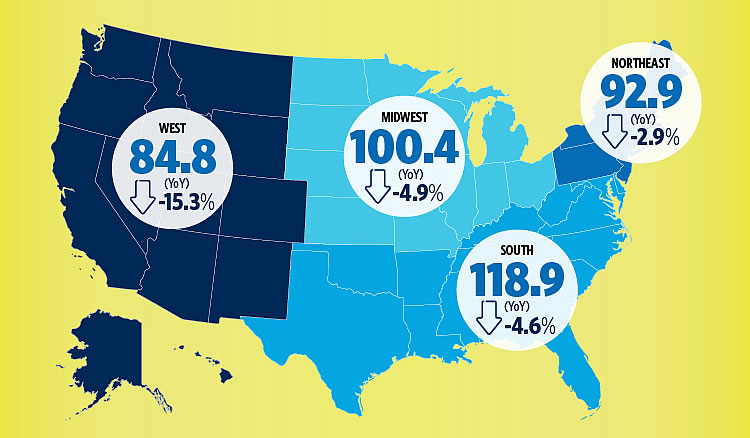

And out West, the Pending Home Sale Index dropped 8.9 percent to a well below average 84.8 and is now running 15.3 percent lower versus the same time last year.

But the experts have been saying for years that low inventory was holding back sales volume.

Meanwhile WaPo recently ran an article called “The New Boomtowns” about how people are moving to secondary cities in droves. And finding out that it is actually an upgrade and not a downgrade.

And in related news, I just closed on the sale of my rental property, it has treated me well but no more Bay Area real estate for me. Don’t get married to your investments, ride the trends.

Congratulations! Now go explore the world, and see how other countries and their populace enjoy life, are happy, and their governments are supportive, rather than antagonistic. You’ll cone to realize here in the U.S,, you are overpaying more for less quality, amenities, etc.

Is the buyer of your rental property an owner-occupant, or investor?

First time buyer, but lots of investors were looking.

Yes we’re certainly overpaying compared to other countries, but we are not other countries; it seems like in America, the more supportive the government becomes, the more we overpay. I mean how much does SF spend per homeless person, with few results to show, and then comes back to the taxpayer asking for more? I used to support all of those social programs when I was younger, but now I see how the game works.

You probably exhibited a lot of patience with a first time buyer. I sold to a guy who was under time constraints to buy (part of 1031 exchange) after selling his $8M property.

I meant a government supportive of the business community, not just on social issues: homeless, mentally ill, and drug addicts. In SF, politicians wonder why they can’t keep families here. Who wants to raise a family when there are so much crime, filth, homeless, mentally ill, drug addicts, and pot shops around? The anti-business sentiment here dictates many of the bad policies, leading to a diminished quality of life.

As one example, Singapore is very pro-business but the government also has strict controls over drug use and trafficking (quick trial, death penalty, death by hanging,) no graffiti, no littering, and strict green spaces. The government also promotes property ownership especially for married young couples and a generous child care package with excellent educational systems in place. It does a good job integrating the three primary ethnic races (Chinese, Malaysians, and Tamil Indians) by cross-promoting culture and religion so everyone is knowledgeable and respectful of the differences and traditions i.e. eating halal vs. non-halal. So, I see it more as what values a particular city prioritizes which will determine its fate.

If Trump succeeds in driving the economy off a cliff, this is a good time to sell real estate everywhere.

Interesting. I think I’m going to ride this one out. Rents are still high, no sign of a decrease just yet. Employment is strong. Vacancies are low. On a cash flow basis the rentals are still paying off. And where do you go with the money? It’s either a 1031 exchange or a multi-million dollar tax bill. There’s no deals out there right now.

There were many considerations, but overall I took a gamble and paid the tax, went to cash equivalents, and have dry powder for the next downturn. Sure I was cash flow positive, but my thesis is that Bay Area appreciation is maxed out due to affordability and quality of life, while there is upside to be found elsewhere, and I could parlay into multiple properties. The next downturn could be shallow or bad, no way of knowing. But I don’t need median prices to go down 25%, just an increase in good deals to be found.

I did the same as you did in 2016, just bit the bullet and paid the taxes on the sale of one of my rentals (mixed use commercial and residential.) Spoke with my estate planning attorney and he asked if I wanted to 1031 out of state on triple net properties. I figured if I wanted to stay in the landlord business, I would keep what I have in SF. Buying out of state did not address my intent to reduce and eliminate my real estate holdings.

Given the changes in the tax laws, that reduced the large subsidies given to the more expensive properties, the inventory has gotten significant less ‘affordable’ to buyers.

I expect we are going to see a lot more SB35 redevelopment like Vallco shopping mall. Where the developer realizes they can make more money supplying 50% of the units as ‘affordable’ since they will not both: 1. Not sit in the market, and 2. The developer can skip playing the expensive ‘community benefits’ game.