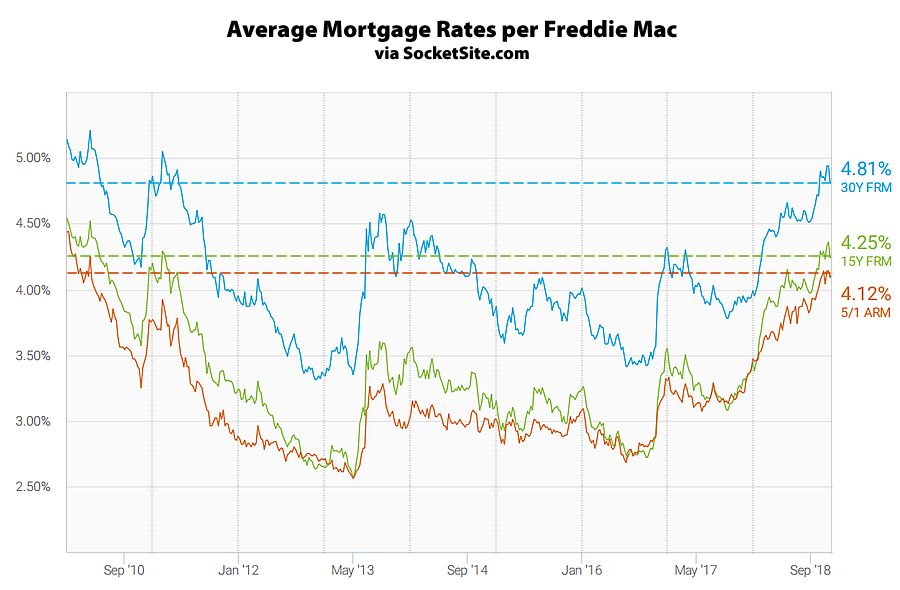

Having dropped 13 basis points over the past two weeks, the average rate for a benchmark 30-year mortgage is now holding around 4.81 percent, which remains 91 basis points higher than at the same time last year and within 24 basis points of an eight-year high, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has dropped 11 basis points from an eight-year high to 4.25 percent but remains 95 basis points above its mark at the same time last year and the average rate for a 5-year adjustable has inched down 2 basis points from its eight-year high to 4.12 percent but remains 80 basis points above its mark at the same time last year.

And while speculation that the Fed will slow its pace of future rate hikes was fingered for yesterday’s jump in the DJIA, according to an analysis of the futures market, the probability of the Fed instituting another rate hike by the end of this year has actually ticked up 3 percentage points over the past 24 hours to 86 percent.