Purchased for $2.331 million or roughly $1,430 per square foot in the fourth quarter of 2015, the Lumina Plaza C’s penthouse unit #8E, which features 12-foot ceilings and measures 1,630 square feet, with two bedrooms and two baths, returned to the market listed for $2.586 million in the fourth quarter of last year.

And having been reduced to $2.486 million in February, and to $2.349 million in March, the sale of 333 Beale Street #C8E has now closed escrow with a contract price of $2.286 million, a slip of 1.9 percent from its 2015 sale (not accounting for a couple of custom upgrades).

The HOA dues for the unit, which includes a parking space in the garage, have been running around $1,200 a month.

Why is this news worthy? The market has plateaued since 2015 and it never crashed 3 years later. The article may come off as “bad’ news”, but the fact that the market is easily holding steady and will only go up in a year or two considering construction has gone down and several tech companies are IPO’ing and doing very well at it – again.

I think you’re jumping the gun a bit. It wasn’t too long ago that people were proclaiming that the price rise wouldn’t stop unless we all stopped using our cell phones or there was war between the Korea’s or some such apocalyptic event. “How could prices even drop here?” was a theoretical question.

Even though prices have dropped here before, for those with short memories these apples show how mundane a price drop is. Simply, no buyers step up to pay what you once paid.

The wider Case-Shiller numbers haven’t appreciably flatted yet. And in the last cycle they flatted for over a year before the serious drop began. And even the “flat” top wasn’t tabletop flat, there were ups and downs. And that’s of the wider average. There’s always a spread of individual data points within the average.

This is a niche RE focused blog and even here some people are struggling to get a grip on the change in tone of the RE market. You are just barely starting to see some mentions of these examples of RE distress on sites of broader interest. My anecdotal dinner party experience tells me that for those not professionally involved in either economics or real estate the idea that the market is anything by straight up is quite foreign. The fact that people incur losses with even a multi year hold is often met with incredulous disbelief.

But market knowledge eventually percolates and the anecdotes of incredible RE gains that fed into ever more demand at the beginning of the market cycle eventually turn into tales of woe and losses.

RE markets have momentum and the cycle dynamic is strong. Look at the last market cycle and how it followed that of many other cities and how the up of this cycle followed other markets. And how in both cases the price/income ratio shot up. Note that the iPhone was introduces in 2007, a hugely successful tech product right as the market collapsed. Where is correlation between IPO’s and the market as a whole?

The reality is that while they make great stories, exceptional people are the exception. The teenage google millionaire and the Chinese villagers who pool their resources to get into SF RE might be great narratives, but a rising market puts money in everyone pocket, the HTML hack and the brilliant Google software architect alike. And there are many many more hacks than brilliant geniuses. A market flattening out at a very high valuation is costly to all. And even a few percent downtrend at a high valuation becomes an economic millstone around the necks of any who venture into a declining market.

“a rising market puts money in everyone’s pocket” … except those who would like to buy property but it gets further out of reach

I should have said ‘puts money in the pocket of all buyers’

(And why the ‘[anon]’??)

Actually the present market is really simple to explain. It’s a plateau.

But again, in the last cycle the market went: up, flat, down… So flattening out after the upswing doesn’t add weight to the “this time it’s different” argument.

And if prices can change slope from double digit up to flat without any significant change in fundamentals, what’s stopping them from changing from flat to down? i.e. If one thought that the upswing was purely fundamentals and it would take a huge event (Korean war, tech collapse,…) to stop the upswing and yet we’ve had a large deceleration without a correspondingly huge hit to fundamentals, doesn’t that add weight to cyclical factors driving the market vs fundamental factors?

In 2008 the economy was in its worst shape since the Great Depression. SF’s unemployment rate peaked almost 10%. Today, the Bay Area unemployment rates are under 3%. In 2008 the stock market dropped. Today, it’s still around record highs.

The underlying economy today is not like the underlying economy in 2008.

And again, the 2007 era decline of housing prices caused the economic problems of 2008 and later, not the other way around. In that cycle, as in this one, housing prices rose beyond their fundamentals and at some point that momentum ran out.

The difference is that the 2007 cycle encompassed the entire US housing market and much of the rest of the world. The scope of that cycle meant that it’s down slope posed a serious threat to the global economy.

A decline in SF (or even wider bay area) housing prices, even a significant decline, will not even give the global economy the sniffles.

And I don’t really expect people to hang out in SF unemployed during this downslope. My expectation is that any economic stress we do see will have people transitioning into gig economy jobs for a brief period and then quickly become part of the domestic out-migration that we’ve been seeing. Just like there is no point in hanging out in a cold & foggy back yard, when better conditions beckon close by.

With a localized bust in a high end area, people can just move away. But if you are in a cold backyard in a Chicago winter, you may as well stay put since the weather across town is no better. When the entire US crashes, where is there to go to? So people ‘Shelter in Place’ against the economic storm.

Except that in 2008 the unemployment rate in SF went from 4.6% to 6.4%. In the last year, SF’s unemployment rate has gone from 3.0% to 2.4%. The trend line is going the opposite direction of your theory.

People have been predicting on this site a SF real estate market and/or tech economy collapse since probably 2014. They’ve been wrong all along. Why is it different this time?

Someone only contributes to SF unemployment if they are both living here and not working. Someone who leaves or works a gig job does not contribute to unemployment here. Gig jobs were not nearly as prevalent last time around and many people were shell shocked by the effect of the housing decline and the economic pain was so widespread, where was there to go?

So, it would not at all be surprising for the unemployment rate to be lower this time than the last. And again, take a look at this snippet from the brookings paper:

Of particular interest here are respondents’ answers to a pair of open-ended questions in the survey (questions 16 and 17):

—Was there any event or events in the last two years that you think changed the trend in home prices?

—What do you think explains recent changes in housing prices in [location]? What, ultimately is behind what is going on?

“Most respondents wrote in answers to these questions; only a few left them blank. The questionnaires left space for writing 20 words or so, and many lled the available space. Only a few wrote one-word answers.

Comparing the responses to these two questions between the 2004 and 2006 surveys seems likely to be fruitful for understanding the turning point, because long-term expectations dropped a full 4 percentage points over that relatively short interval, roughly half of the total drop from the peak. Moreover, the answers will not be clouded by any references to the financial crisis, which was still entirely in the future.

Between these two years, a striking change in the tenor of the answers can be observed.”

The turn in the housing market caused the economic crisis, not the other way around.

Basically, you and others have created a straw-man that something fundamental needs to “happen” in order for there to be a change in the housing market. But that was not true last cycle and it hasn’t been true this cycle for the change from up to flat. Changing expectations are sufficient to create changes in pricing.

And one of your straw men would seem to be that prices are stagnant or flat right now. You also do not account for job growth, strength, expansion, population growth, the list goes on.

@Ohlone Californio – “A straw man is a common form of argument and is an informal fallacy based on giving the impression of refuting an opponent’s argument, while actually refuting an argument that was not presented by that opponent”

“Posted by SFRealist – 3 hours ago – Actually the present market is really simple to explain. It’s a plateau.”

I presume that you can look up the definition of ‘plateau’ on your own time.

And yet, prices have been at a rough plateau, factually speaking. Maybe some segments down, maybe some segments up.

If you are convinced we are on the edge of an economic precipice, have you sold all of your stock holdings?

So he presented it. You ran with it. Thanks for the pedantry though.

More, you used a term that was inserted, plateau, and you ascribed an eventuality to it. And you went on to talk about other eventualities based upon that. You used the past downturn and tried to correlate as well. I don’t think you’ve made coherent arguments …

Not much in the way of views.

It’s a kaleidoscope of windows.

My thought too. At that price point you’d expect to have at least some sort of view other than of your neighbors.

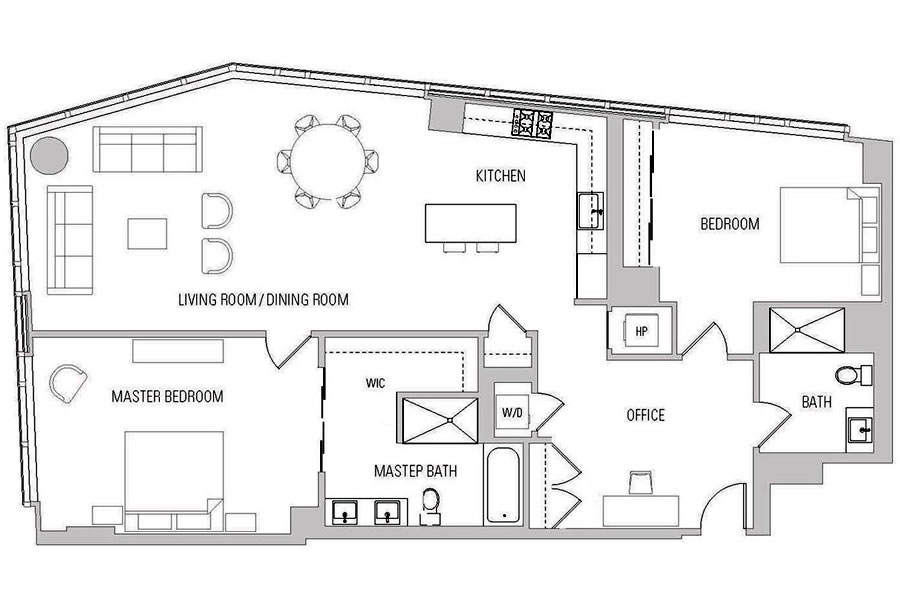

The foyer … I mean ‘office’ also seems to be a poor use of space.

Other than that, the place looks fine … as long as you like grey cabinets.

And importantly too:

(1) were the buildings there three years ago (when it sold last), and

(2) how far away are they

I’m guessing:

(1) yes, and

(2) further than it seems in the pics. I tried to locate it on the satellite view, but didn’t have much luck…and I’m puzzled by that large whitish building in the first and last shots – looks like some old rehabbed warehouse – since I don’t see anything that high (tho if it’s not in googleview ‘cuz it’s new that would answer question #1)

That’s the former post office/DEA building at 375 Beale/390 Main which was built as a tank factory in the 1940s, recently remodeled, and is now home to the Metropolitan Transportation Commission.

Yes, thank you; and the same building that was the subject of heated criticism (So I guess to correct my statement [below] this unit DOES offer the advantage of allowing you to keep an eye on how the MTC is wasti…er, spending your tax dollars)

I’ve now located it, and it’s

(1) yes

(2) pretty darn close! (30-40′)

Why someone would want to pay that for this escapes me, but that would have been true 3 years ago just as much. And although both SS and the listing are correct as describing it as a “penthouse” in the current usage of such as (merely) a top floor, I much prefer the traditional def of a separate setback “house” atop the building…particularly in a case like this where the only conceivable advantage is not having someone upstairs.

I hate that the closet is actually just a corner of the bathroom.

If you’re a long time reader of this site, you will know that any news that points ‘down’ is news here (and gets inflated in the title)! Everything else gets mopped under the rug

Yep, this site is fixated on luxury condos. While luxury condos might have peaked (or remained flatish) since 2015, everything else has appreciated solidly since then. The main problem is that the sheer quantity of “luxury condo sells for below 2015 price” articles can make a not so “plugged-in” reader believe that the market is weakening. Obviously, there is tons of evidence to the contrary of that.

[Editor’s Note: Ignoring the actual body of evidence of what we track, and why one might actually have reason to believe that “luxury condos might have peaked,” this comment is right on cue.]

They deleted two of my posts, but condos are still doing quite well.

If not in the same building, at least try picking something in the same neighborhood, or even a comparable high-rise development, and not a unit in a different area and building type which is half the size (did you know that smaller units tend to fetch a higher price per square foot?) of the topic unit at hand.

It was a listing in SOMA – so I think it was quite comparable. Secondly, I’m aware that units with less square footage go for more money. Absolutely fair.

But you’re missing the point: As Jos says, you guys tend to focus on the doomsayer stuff – but the real story is that the housing market is doing quite well – and there are louder and even more successful stories (like the one I mentioned) than the old “unit sells for 2017 price tag”. Zzzz…

Not just smaller, but 40 percent smaller on the top floor of a 6-story development in Western SoMa. An appraiser would, or at least should, be laughed out of the room for offering it as a “comp.”

We focus on the market and data-driven trends at hand, sans spin or cheerleading, be they up or down. And if you simply can’t process evidence of any weakness in the new construction market, either in specific or on the whole, without defaulting to the trite “doomsayer” barbs, this probably isn’t the best site for you.

As we so quietly “mopped” atop the site last week: A near Record-Setting Sunnyside Sale. And headlined a few weeks before: Contemporary Glen Park Home Catches the Neighborhood Wave.

Of course, if you’re a long-time reader of this site, you’ll know there are plenty of people who will simply whine and whinge, regardless of the topic at hand.

And now back to 338 Beale #C8E, its performance and design, or even Lumina in general…

Fair. it’s not all doom/gloom. But compare apples to apples – as you said. Not a glen park home to a SOMA home. Isn’t that what you’re saying?

Beautiful place! Great location (with parking!) and 12 foot ceilings make everything seem bigger. You really can’t do much better than this in terms of location and finishes. The only thing you can complain about are views, but from the 8th floor of a low rise building, that was always part of the deal.

The buyer lost $150,000.00+ but that’s how it goes. The realtors made $100,000.00+

Id hardly call this area a great location (to live in that is). I work nearby and it is GREAT to be at and has improved 100x over the last 10 years…. but at night its boring and deserted….with the ATT park area or closer to the 2nd st / howard area being the closest to neighborhood type area around. Not too far a walk, but not exactly convenience and shops outside your door.

In 5-10 years there may be enough people actually living in the neighborhood (vs just working there) to support enough shops and restaurants (folsom st I believe is planned to be the main commercial shop st) and so on to create and actual neighborhood, but its just not there yet. Maybe once the temp bus terminal becomes the new park, so long term ya this area is a good bet. but long term being like 5-10 years out stil.

Really the lumina and infinity towers are still just glorified IKEA boxes for wanna be status people, corporate worker bees IMO. I was on Polk St this weekend and would way rather live around there, much more dynamic, interesting, diverse and still close to the CBD/job center. But if you like boringness, mostly white, “well off” types, then ya this is amazing! with parking to boot, haha. Ditch the car.

One of the listing agents was also the seller and the buyer came in unrepresented, so I think the seller is doing just fine.

I would never buy a penthouse without a balcony in a building in which every other unit appears to have a balcony. What would the neighbors think of me!?!

I’m not sure exactly what they’d say, but as they all sat out on their balconies having morning coffee, I’m sure you would come up as a topic of conversation.

It all depends on what you are doing on that balcony.

This confirms the trend of new or newer condos in the SOMA area and beyond appreciating at a sluggish rate or actually losing a bit of value. It stands in contrast to the bottom two tiers of the SFH market which have seen strong gains in the past year plus. The SF market is segmented by type of unit and the tier of the unit with significantly different appreciation between segments.

This begs the question as to top tier condos. 181 Freemont and in 2 years the Claw tower. Does SS have any news on 181 Fremont and how it is doing as regards the residential units? Despite the stagnation in condo prices in the 181 Fremont area, 181 caters to a different market than the Lumina or Infinity towers.

The bottom line is that middle tier condos units are under price pressure as shown by 524 Howard, One Oak and 1270 Mission not going forward. While the Claw should do well as it will have the highest residential units in SF, other projects such as Parcel F and the proposed condo tower at Fremont and Hawthorne could prove dicey for investors. Beyond that, many medium sized projects are on the market in SF as developers choose not to build. Rising interest rates and construction costs along with the fall election could be problematic for many of these projects.

I think that people make too much of the physical difference between condo’s and SFHs. Condo’s generally lead SFH’s at market turning points, but don’t necessarily decouple from the condo market.

More than the physical difference, look at the types of buyers. Professional investors favor condos for a number of reasons and they tend to follow the RE market more closely, be more economically focused and less emotional in their decisions and have more experience making buy/sell decisions. Owner Occupiers enter the RE market rarely, are more emotional and have less experience.

Condo’s are the canary’s in the coal mine, not because of their physical difference to SFH’s, but because that’s where investors play and they are quicker to react to market changes than OO folks.

And even within condos, we first saw weakness in the new condo sales numbers. People in charge of selling large numbers of units have more frequent market contact than even the avid RE investor.

And even within OO, notice that the low end tends to overshoot on the up (and then undershoot later on the down) and generally buyers of lower end properties tend to be less wealth (and thus less financially sophisticated) and younger (and thus having lived through fewer market cycles).

If you lined people up, from RE salesman for a massive condo tower, to RE investor, to high end OO, to mid end OO to first time buyer in order of how quickly you thought they would detect and react to a change in market conditions, I think that you’d get the same order that we are seeing in actual changes in the market this time around (and back in 2007)

I think you’re expressing a lot of your personal bias here in defining investor knowledge and preferences (of course, we all do that).

As to whether the site takes a bearish tack generally, I am reminded of when my mama told me: “If one person tell you somethin’ about yo’sef, it might be dey problem. If ten people tell you somethin’ about yo sef, it might be yo problem.”

Regarding the condo preference, I’m not saying it’s black and white, but the simplicity of paying a single HOA vs dealing with maintenance issues via individual providers and the reduced security issues are big pluses for a certain type of investor. And when you have huge momentum runs, that attracts investors that like to trade condo’s as if they were stocks.

As for the investor knowledge, I don’t think it’s a stretch to say that people who do something professionally and frequently get better at it on average. From people who sell condos day in day out at one or more large complexes to first time buyers, there’s a huge range there. And you would expect to see changes in buyer behavior along that spectrum. Plus there’s way more emotions involved in owner occupied situations.

Regarding the potential bias of the site, consider also the relentless ‘There’s never been a better time to buy’ bias of the RE industry. If your revenue stream is via commissions then you have a very strong incentive to encourage people to get into the market.

As a condo owner, I’m happy to never again have to wake up to lawnmowers and leaf blowers on Saturday or Sunday morning that would start before 10am nearly every weekend when I lived in suburbs. There might be more ambient noise with a condo, but insulation seems better, so overall, I sleep much better.

Maybe not “telling you somethin’ about yo’sef”, but rather people studying the bias’s of others. Multiple studies have looked at the long and short term price expectations of home buyers during different parts of the cycle:

“First, the data suggest that homebuyers were very much aware of trends in home prices at the time they made their purchase. There is a strong correlation between the respondents’ stated perceptions of price trends and actual movements in prices. The data also show that the opinions of homebuyers have varied over time. When price trends are strong, there is little disagreement among respondents. When there is ambiguity, respondents seem, not surprisingly, to have a much less clear picture.

The data also show that homebuyers were, if anything, out in front of the short-term changes that were occurring and that their short-run expecta- tions underreacted to the year-to-year changes in actual home prices. Their long-term expectations have been consistently more optimistic across both time and locations, but the absolute difference between long-term and short-term expectations fell from a high of 8.3 percentage points in 2008 to just 0.8 percentage point in 2012.”

And even run experiments where people were fed data about housing price trends (randomly either real or fake) and polled to see how their expectations changed:

“We find that, on average, year-ahead home price expectations are revised in a way consistent with short-term momentum in home price growth, though respondents tend to underpredict the strength of momentum. Revisions of longer-term expectations show that respondents do not expect the empirically occurring mean reversion in home price growth. These results are consistent with recent behavioral models of housing cycles. Finally, we present robust evidence of home price expectations impacting (actual and intended) housing-related behaviors, both in the cross section and within-individual..”

There are many more studies of average homebuyer thoughts, expectations and biases. There are also some studies that correlate financial knowledge with wealth/income. The combination of momentum and mean reversion drive much of the housing market cycle and for many people it does seem that they underestimate these two factors.

Condo prices in this area are going to be pushed up by Facebook’s lease of the entire 43-story tower at 250 Howard. 743,000 square feet. Then add their 436,000 feet leased at 181 Fremont.

Median pay for a FB employee is 240k.

I must know only the bottom quartile of FB employees then because none of them make close to $240K.

The $240K includes about $20K of health + food + 401k match and other benefits. Then, you might get a grant of $50K of stock that vests 1/4 each year for 4 years. Since fb is an old company, many of the old timers are vesting 1/4 from each grant, so throw in another $50K (before taxes each year)… That gets you to $170 for salary before bonuses. I can see $240K being accurate.

Well here’s one WAG. Of course they’re using “Average” which I take to be “mean” – and which would be skewed upward by ginormous comps at the top (translation: median << mean). So I’ll be happy believing $240K +/- $200K.

Regardless, their medical and food and fooseball lessons – and all the other non-cash comp – won’t help them in buying a condo.

Is it just me? I don’t see any charm in this condo. The design and decor are so lousy. Poor usage of space, not much storage space to speak of. Everything, including the view, looks so boring and plain. Why waste your money living in this condo while the hood won’t be livable for, at least, another 5-7 years. I’d be depressed myself thinking why I didn’t spend the money to get a place with a better view & garden in another neighborhood instead?

But if you a Giants fan, or drive to Tahoe every weekend, or work downtown and hate Muni, or sail out of the boat club, this would be great.

Boring, bland, no views.