The number of single-family homes and condos that traded hands across the greater Bay Area totaled 4,504 in January. And while the 33.7 percent drop in volume from December to January was only a little higher than average (31.2 percent), sales were down 7.8 percent on a year-over-year basis, according to recorded sales data from CoreLogic.

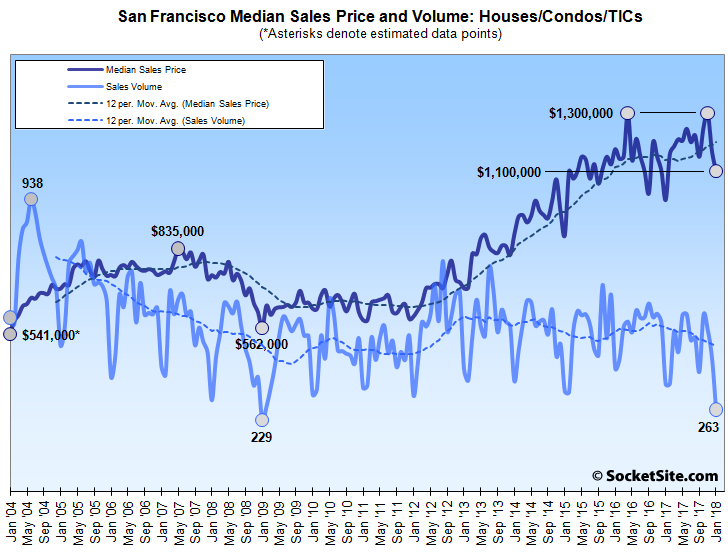

And in San Francisco, the recorded sales volume dropped to 263 last month, which was down 39.0 percent from December, 23.5 percent lower on a year-over-year basis and the slowest January in terms of transaction volume since 2009, as charted above.

In Alameda County, recorded homes sales dropped 36.2 percent from December (1,475) to January (941) and were 3.2 percent lower versus the same time last year, sales in Contra Costa County (941) dropped 30.8 percent and were 10.0 percent lower on a year-over-year basis, and sales in Solano County (418) dropped 18.4 percent from December to January and were 9.3 percent lower versus the same time last year.

January home sales in Santa Clara County (989) dropped 34.9 percent from December and were 4.3 percent lower versus the same time last year while sales in San Mateo County (312) dropped 44.6 percent last month and were down 18.1 percent versus the same time last year.

And still recovering from a fire related hit in October, while home sales in Napa (97) dropped 24.8 percent from December to January, they were 1.0 percent higher versus the same time last year and January sales in Sonoma County (394) were down 18.4 percent from December but 7.7 percent higher versus the same time last year.

Sales in Marin dropped a seasonal 32.3 percent from December (220) to January (149) and were down 19.5 percent versus the same time last year.

And the median price paid for those aforementioned 263 homes in San Francisco was $1,100,000, which was 9.8 percent higher versus the same time last year but down 6.0 percent from the month before and 15.4 percent below the upwardly revised, record-tying mark of $1,300,000 reached in November.

At the same time, the median sale price in Alameda County was $750,000 last month, down 1.4 percent from December but still 15.4 percent higher versus the same time last year; the median sale price in Contra Costa County was $525,000, down 4.5 percent from December but 6.5 percent higher, year-over-year; and the median sale price in Solano County slipped 1.6 percent in January to $403,500 but remains 11.9 percent higher versus the same time last year.

The median sale price in Santa Clara County dropped 4.0 percent to $960,000 in January but remains 22.3 percent higher versus the same time last year while the median sale price in San Mateo County inched up 1.2 percent to $1,215,000 last month and is now 31.4 percent higher, year-over-year.

The median sale price in Marin was $915,000 in January, down 3.7 percent from December but 13.0 percent higher versus the same time last year while the median in Napa dropped to $605,000, which was 2.6 percent higher on a year-over-year basis, and the median in Sonoma dropped to $566,000 in January, down 7.2 percent from December but 8.6 percent higher versus January 2017.

And across the greater Bay Area, the median home sale price dropped 5.3 percent in January to $710,000 but remains 13.1 percent higher versus the same time last year.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

– And the median price paid for those aforementioned 263 homes in San Francisco was $1,100,000, which was 9.8 percent higher versus the same time last year

– The median sale price in Santa Clara County … remains 22.3 percent higher versus the same time last year

– the median sale price in San Mateo County … is now 31.4 percent higher, year-over-year.

31% increase in San Mateo sounds out of this world on a YoY basis. Still looking to see how rates affect us — hopefully we’ll see a consistent lowering in price rather than only a comparison with a single spike

The key line that you forgot the clip: “Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix,” especially as sales volumes decline, including to a 9-year low in San Francisco.

As long as our economy is strong (and we continue to underbuild), prices won’t drop.

…said everyone in December of 2007.

Maybe you can’t see any difference between now and 2007. I can (hint: iPhones).

Every market has to correct. I think Trump is doing his best in triggering the next recession. If it happens I think it will be the economy tanking real estate (through high interest rates and recession) rather than the other way around like last time. By how much? We could go back to the 2008 top which would be a 20% drop.

Is this supply and demand in action? I am casually looking at houses in Hillsborough and I am not excited about spending $4.5M on a fixer-upper. Waiting for a drop until I make my move.

Speaking of Case-Shiller…has the February data been released?

I’m in San Mateo proper, and it is insane at the low end. 1300-1600 sq foot 3/2’s for under 2m are getting bid up to an extraordinary degree because supply is so, so low in desirable neighborhoods.

This is the first I’ve heard of this.