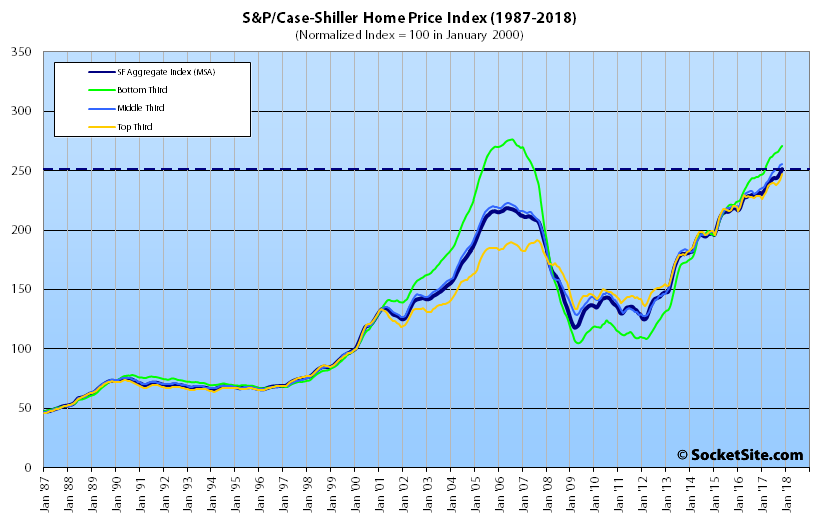

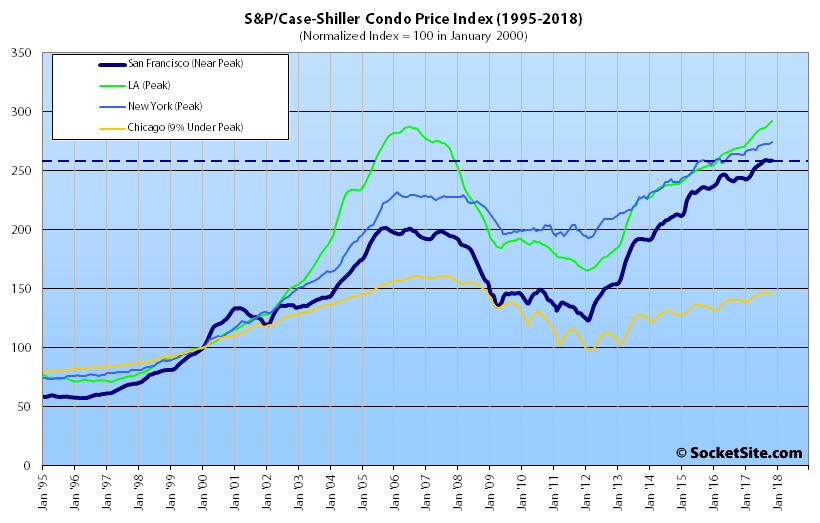

Having ticked up 1.2 percent in October, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked up 1.4 percent in November to another all-time high while the index for Bay Area condos regained 0.2 percent of the 0.3 percent it shed the month prior.

With November’s gain, the index for single-family home values is now running 9.1 percent higher on a year-over-year basis with outsized gains at the lower end of the market continuing to drive the index overall.

Having inched up 0.8 percent in November, the index for the bottom third of the market is now running 10.6 percent higher versus the same time last year while the index for the middle third of the market is 9.9 percent higher having inched up 0.5 percent from October and the index for the top third of the market is running 8.4 percent higher versus the same time last year having ticked up 2.2 percent.

That being said, while the index for the top third of the market is now 29.4 percent above its previous peak ten years ago, and the middle third is 14.8 percent above its previous peak, the index for the bottom third of the market has another 1.9 percent to gain before it’s back to the level at which it peaked out in 2006.

And having slipped 0.3 percent in October, the index for Bay Area condo values inched up 0.2 percent in November and is now running 6.1 percent higher versus the same time last year and is 28.4 percent above its previous cycle peak in October 2005.

For context, across the 20 major cities tracked by the home price index, Seattle, Las Vegas and San Francisco recorded the highest year-over-year gains in November, up 12.7 percent, 10.6 percent and 9.1 percent respectively versus a national average of 6.2 percent.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Houses up 9.1% year-to-year and condos up 6.1%. That’s what very low supply and continuing strong demand will get you. Simple economics.

The full 2017 SF-only numbers tell the same picture, with medians for houses up 9.1% and condos up 8.7%. With a full year of data, “mix” issues wash out. As oft-noted, you really only need to look at Case Shiller to get a very accurate picture of SF housing trends.

These price hikes will change at some point, but not (obviously) until we see supply increases or demand waning, and neither has happened yet, despite the premature calls for the last couple of years that we’ve already reversed course.

You don’t seem to understand how mix works (hint: it’s not the same as seasonality and a full year of data doesn’t “wash it out”).

Regardless, take note of the little green line above and its divergence from the pack, which is a trend mimicked in San Francisco proper as well.

Yes, I understand the very simple concept of “mix.” I did take several semesters of advanced statistics – and anyone who took middle school school math can get it. You are arguing that the “mix” of high, mid, and low end sales has changed, and that there are more high end sales now than there were a year ago (and thus, you argue, prices really haven’t gone up but have gone down; it’s just that the “mix” includes more high-end sales which skews the median). But you need some evidence of that, and there is none. While the “mix” might change materially from month to month, a full year of sales isn’t going to have a “mix” that’s materially different from one year to the next barring some extremely unusual event, like the subprime crash in 2006-07. Nothing like that is changing the “mix” today. Thus, issues of “mix” certainly do wash out with a full year of data. Simple Stats 101 (just google “sample size” if you still don’t understand and want a more detailed explanation). In fact, the average SF home price rose a little less than the median in 2017, indicating that – if anything – lower end sales made up a greater proportion of the “mix” in 2017 than in 2016. So, if anything, the “mix” went the other way from what you are arguing.

As to the “little green line” – so, lower end places have been appreciating slightly faster than higher end places, although not in the most recent month. But all tiers are appreciating. What’s your point, that SF only appreciated 8.4% in the last year rather than 9.1%? Okay.

Try as you might, your argument that up is really down is exceedingly weak.

And once again, despite protestations to the contrary, you really don’t understand the underlying data and drivers of the trends at hand.

But at least you’re consistent and getting closer to an understanding as you back into the impact of “lower-end” sales. Or as we actually wrote above, “with outsized gains at the lower end of the market continuing to drive the index overall.”

“Outsized gains at the lower end”

Lower 1/3 gained 10.6% in the last year. Highest 1/3 gained 8.4%. If you want to argue that “proves” declining prices in SF, have at it . . .

And if you really care to continue arguing with yourself in a strawman manner about “proving declining prices in SF,” rather than understanding what’s driving the market, have at it – at least you’re now headed in the right direction with respect to mix…

Well, please explain exactly what is “the right direction with respect to mix” and the evidence you’re relying on. Because you’re making no sense at all.

OHHHH the green line is disconnecting again, and at a faster rate. We know how this plays out…

Sure who knows how long this might go on for, but I am thinking not much longer. IE a year or two more max, but I think less. rates rising as well. Marginal buyers start getting knocked out. Job market is already maxed out and trend is softenting / platueaing.

I dont think it matters if you are buying for the next 20 years, but anyone buying, especially on the green line, is playing a dangerous game.

In my local area of experience again I am seeing Concord move way hi, with prices getting a bit eyebrow raising in that area again.

Bubble is getting real big now.

Now is the time to be building mass cash and waiting patiently. Be it for buying RE in 2 – 3 years, or stocks. Either will be a much better buy in a few years vs now. IMHO

People said exactly the same thing when I last bought in SF. It was 2014. I’m doing ok.

What’s the evidence for the job market softening? SF’s unemployment rate is at 2.3%.

I meant it cant get much better than this. that seems obvious at this point.

I don’t think there is any evidence of a softening labor market. As long as Tesla, Twitter, Uber can keep on raising money, things will look rosy – once the investors spook due to the lack on any profitability in near or intermediate term the outlook could change really fast.

It’s not that hard to buy at (or near) the bottom, all it takes is guts and a bit of luck to buy Citi Bank and not Washington Mutual or a SFH in SF and not Stockton. Selling at the top of the market is a lot harder.

I guess I am just saying, at 2.3%, it really cant get much lower, but it most definielty can get higher, and historically it does, and historically this rally in stocks and RE and employement is epic already.

Its just a matter or reversion to the mean and the end of the cycle.

Rising interest rates will be what we will need to watch. And if the hi flyer tech companies start stumbling, and they will, and rates are moving up quickly, which may happen, I dont see how things wont start to pull back meaningfully. Not like 2008 – 2012 of course (in terms of RE). The RE market locally might remain pretty strong or ok, because we are so underbuilt, even more so now than ever I think in the core bay area.

But the stock market is going to take a good hit, now that all the sideline money is getting in at the top. This always happens, why would it be different this time?

I was lucky and bought RE in 2009, sold in 2015, but plowed the money right into a home much closer to SF in a nicer area, and where I want my kids to grow up vs my original place in Concord, which was always meant to be a starter home till my kids hit school age. Luckily it coincided with the RE crash. But i planned for it for quite some time, so some luck, but msotly good planning.

This time Im going all in stocks as I think the opportunity will be greater there, vs picking up a rental or a condo in DTO or SF to rent out, because I think the RE market will stay ok here, but the stock market will take a hit. Or like Dave always says, pick up a rental in another city. But Im not going to do that personally.

Im curious how others are positioning themselves?

I agree; if it walks like a duck and quacks like a duck it probably is a duck.

I can’t sell my home, so the only way I am divesting myself is a gradual conversion of stock to cash. So far I have only sold stocks that have not performed to my expectations over time. I don’t see a great place to put the money once out of the stock market – RE is fairly high priced across the US and stock prices are high across the world. So it is a painful wait because the cash makes no (meaningful) return, but after today’s tumble of the DOW it feels a little less painful, and it makes me consider to sell more.

But will the downturn happen in 2018 or 2022?

It’s easy to predict that the tide will come in, but the value comes in predicting when. Right now, there’s no sign of it.

When is a guessing game, and very valuable if you can guess it right – buy low and sell high.

Personally, my guess is 50% chance before the end of 2018, 85% before the end of 2019 and 99% before 2020. When you know for sure that it is a downturn, it is usually too late to get out.

@Anon123 One can’t call the top or bottom in RE or the stock market. One can only look at trends, cycles and other metrics and from that get out during the up-cycle and, if lucky, near the top.

Dave, I agree; if you want to get out near the top, you can’t wait for it to be obvious as it will already have passed you by and in RE it is even harder to get out on the down slope – stocks can usually be dumped in 2 minutes the less you are some billionaire from Omaha.

Oakland Lover was wondering how others were positioning themselves and I added the why.

@Anon123 If one owns a home here there is no problem. There will not be a crash as some have argued here. Appreciation will moderate to the national average, IMO, over the next 10 – 20 years. Nothing wrong with that for owner occupied folks. It’s the investors who have to be careful, IMO, about accepting negative or flat cash flow in the BA in hopes of massive appreciation.

I sold my condo in SF in October 2017 and closed on a house in Reno in December 2017. While it may or may not be a “top” of the RE market in SF, it was a very nice gain on my purchase from 2007. I believe the Reno RE market has a ways to go on the upside still. In my tax-deferred investment accounts, I’m still long equities (probably 85/15 equities to cash). We probably have too much cash in my husband’s 401k, but he is more conservative (he is 60/40 equities to cash while I’m 100% equities). I do think we are in for a recession in the next couple of years, but I’m increasingly doubtful it will be this year. Also, I’m all in on Nevada over California at this point, as I stand to personally benefit from people moving out of (or at least moving their assets out of) California for a lower tax environment, even though I am politically opposed to the tax cuts that got passed (which while being bigly in my own personal interest I feel are not in the best long term interests of the country).

Sold a SF mixed use building in 2016 and then gradually put the proceeds into the stock market in stages, with the bulk of it around November 2016, again in April 2017. Focus was on International equities in 2017 which returned about 30%. Some in diversified ETFs which returned about 20%, and my own legacy domestic large cap equities returned 60% to 200%.

All in all, happy with my decision to sell the mixed use property – it unlocked value and the returns were much better than the rental receipts and time and energy spent on servicing tenants. Still own a couple of other SF investment properties and due to their small size, they can be easily offloaded at any time.

There is a shelf-life to everything so it is a matter of picking and choosing opportunities.

“And having slipped 0.3 percent in October, the index for Bay Area condo values inched up 0.2 percent in November and is now running 6.1 percent higher versus the same time last year and is 28.4 percent above its previous cycle peak in October 2005.”

Hey, but let’s not forget that a swanky penthouse at the bottom of Potrero Hill just sold for only 4.4% over 2014 prices. So I guess it’s a mixed picture and nobody can tell.

Home prices gains have outpaced income gains by 200-300% in many cities. Plenty of folks (outside of SF) are getting 3% down loans with closing costs back since doing that is cheaper than renting. Others are stretching their income to the max, with the idea that their equity will continue to grow. The bottom 80% have between 50-75% of their net worth in home equity, which has created quite a “wealth effect” in the economy. However, there is a black rider on the horizon: rising interest rates.

So we moved from ‘the tech bubble will bust’ and pull the SF real estate market down to ‘interest rates will rise’ and pull the SF real estate market down.

It’s almost as if you decide on an outcome first and then solve the analysis backwards to fit the intended result.

When I was talking about deflation back a couple of years back it was actually happening, and now I’m talking about inflation because is actually happening too. In between we had a Goldilocks period, which is why I didn’t say much.

Inflation expectations can be verified with many different common indicators, but keep on dreaming of unicorns and lollipops.

I am happily holding onto my portfolio and counting my paper wealth which according to this article went up over $600k in real estate value y-o-y and (according to my E-trade statement) I bagged just a hair over a mil in stock valuation. All without lifting a finger. So glad I voted for Trump because this is all his fault. Time to guy buy a yacht and some bitcoin and double down at the peak!

Sarcasm noted – I am sure it looks like money for nothing when you don’t risk your own hard-earned money.

Those who tend to brag, tend to exaggerate their position, mostly due to insecurity. Sad.

SFr: That would be sad… if it were true! I seem to recall a certain someone (*ahem*) waxing on at length about the great life of an SF landlord, just kick back and watch the rent roll in! Which I have to admit I also enjoy, speaking of which, the best time of the month is just around the corner (yes, that’s right folks, RENT is DUE).

I used government funding to get started and then sold the company a decade later for millions (tax-free)! I think that deal was a stroke of genius, up there with maxxing out on distressed SF real estate from 2010-2013, robbing Peter to pay Paul, shuck and jive, sleight of hand and now I am king of the world! That’s how the game is played, folks! I am truly sad I missed out on Bitcoin but you can’t win them all. The wave has passed – let it go and chase the next one. That’s what I always tell the young kids (under-40) who are trying to make it big these days.

Sounds really sad – you should let it go! The ups and downs of the business cycle hasn’t changed much though, there is always an honest buck to be made for those that learn.

Most people make their living contributing to society in some way. It must feel great to make a lot of money without contributing anything of value to society in return.

I disagree – would be a pretty empty life if you ask me, but nothing’s wrong with investing for your retirement or a rainy day. And then you have people that don’t contribute anything of value to society and gets nothing in return.

Congrats on selling the widget factory Jimmie. I know you’ve been around here a while (as the artist formerly known as Jimmy the Flipper). Are you thinking about buying more after this bubble bursts?

Thank you. I haven’t been on here much in the past two years. Selling a company is more work than it would appear from the outside. My widget factory has moved to Germany and is now part of a global brand. I had the first paying job of my life — for 9 months — in 2017. I wasn’t well adapted to it and stopped showing up when my cannabis enterprise started to gain traction. Now it’s off to the races — deal-making — and IPO in sight (late 2019-2020). Have you seen the multiples on marijuana-related companies? 40X-60X gross revenues in some cases. This is the craziest market I’ve ever been in. It’s going to be a wild ride and it’s all fun and games from here on out — I don’t need the money but I love the thrill of it.

I will be buying quality properties with upside potential on the dips (when they happen, and they will), and letting my tenants pay down the loans and the market grow my money for me. The time will come and I will be waiting.

Oh hush! I’m doing something. I’m starting a marijuana company and investing in 18% interest second mortgages to people with assets but no credit. I think I’m contributing plenty!

“I’m starting a marijuana company and investing in 18% interest second mortgages to people with assets but no credit.”

The word “parasite” comes to mind, but some parasites are beneficial to the host, so maybe that’s not an apt description…

I think the sarcasm in Jimmy’s posts is obvious, and I am pretty sure that he doesn’t have a penny to his name. He just wish that he could have money for nothing, being some kind of drug lord or loan shark.

Now I know he’s faking it. No one with any credit, reputation or real assets will pay 18%. Hard money is now 9-12% tops. Parasite lite ?

True. Very safe short term (1 year or less) private lending secured by a mortgage can return 8% or so. Don’t know anyone willing to pay 18% unless it’s a spec and risky loan – a la high yield (oops junk) bonds.

One loan is a construction/reno project (short-term, 9 months) and the other is a person exiting bankruptcy with 2 prior felonies for embezzlement but about $600k in home equity. Hardly risk-free propositions.Both loans are current. I’ve capped my 2nd-mortgage activities at about $500k in total lending just to test the waters. While I genuinely believe in redemption, people have to want it. If they act up — I have no problem foreclosing and bagging a 2X gain in the process.

I’m curious if you know how the felon was able to exit bankruptcy with $600k in home equity? The California homestead exemption for bankruptcy (i.e. the amount of equity you can keep w/o turning it over to creditors) is only $75,000, up to $175,000 if you are elderly or disabled. Any idea how he swung that? Maybe bankruptcy fraud? And the required restitution from an embezzlement conviction would generally not be dischargeable in bankruptcy in any event. And California usury laws limit interest to 10%. Curious transaction, but 18% is indeed a good return, albeit the risks here seem pretty high (where the S&P gained 23% in the last year).

It’s easy. I loaned him a quarter-million dollars, everyone was paid back out of escrow and he kept his house. For now. Out of the frying pan and into the fire? Time will tell. See California Civil Code §1916.1 regarding interest rates on real-estate loans originated by a Broker.

That answers part of it – what was the broker’s cut?

3-5 points (and the title company does OK too). Nice work if you can get it… shuffle paper around, make a few grand and walk.

Yeah – had a client (big car dealer in Texas) that got filthy rich making auto loans at ridiculous rates to people with terrible income and credit histories. I still don’t see how this guy kept $600k in his house in the bankruptcy, unless he paid off his creditors in full?

Everyone was paid in full out of the escrow proceeds from the second mortgage loan.

Makes sense now – nice deal for the creditors!

The creditors had secured liens on the property. They were going to get paid one way or another.

Yes, I know of the Reno construction project although, if it is the same one, the term is 1 – 2 years. The interest 12%. It’s very safe and not a flip.

My robo-adviser ETFs are generating returns of 20% and the only risk is the stock market volatility. Assuming 18% returns on second loans, they are significant risk loans with high dollar amounts. So worst case scenario, you’ll end up either buying out the first loan and get the piece of real property.

Jimmy…weren’t you “Jimmy the house flipper” in a former life? Upgraded to a LL now, eh?

Yes but now that I have capital, I don’t need to do short-term deals to raise funds. Although I am not above a quick score when the opportunity presents itself.

Yeah it’s short term deals or having partners for most SF investors, due to the capital involved for deals here. Fortunately I didn’t have to do either; all self funded from value add projects and the phenomenal appreciation this city has. Not sure why Dave thinks appreciation will slow here and Seattle will beat it. Many in the past have bet against SF and prime Bay Area, for many years, and they have been wrong. I’d say this area has 10-20 years of juice before I’d even consider 1031ing into something else. And by then I’ll just get some medical building in a tier 2 city, or keep it all and turn over day to day operations to a personal assistant. I’d prefer that over a PM firm…don’t trust them.

Prices up what 70% since 2012? So Millennials live with their parents until they are what? 35? Or live 6 to a one-time bedroom apartment…. Feel sorry for the kids our City government had screwed over. They will never be able to buy.