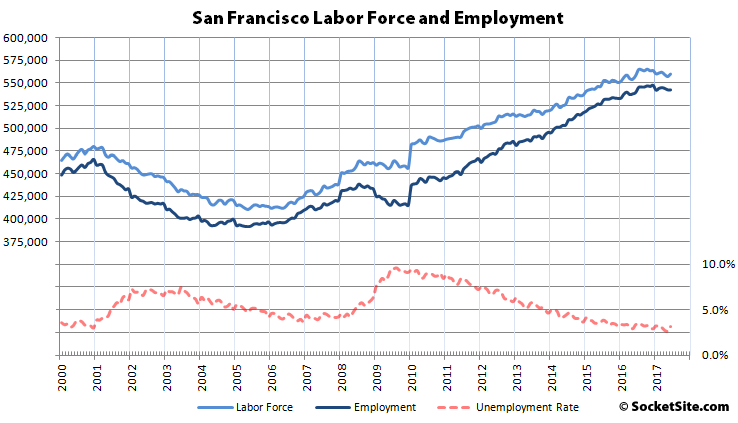

With no growth in the number of people living in San Francisco with a job last month (542,100), despite an increase in the labor force by 2,800 to 559,800, the unemployment rate in San Francisco ticked up from 2.7 to 3.2 percent in June.

And for the first time since 2009, employment in San Francisco dropped in the first half of the year, decreasing by 5,100 since the end of 2016.

At the same time, there are still 76,600 more people living in San Francisco with paychecks than there were at the end of 2000, an increase of 105,400 since January of 2010 and 2,900 more than at the same time last year. But the year-over-year gain has been trending down since mid-2015 and is at its lowest level in nearly eight years.

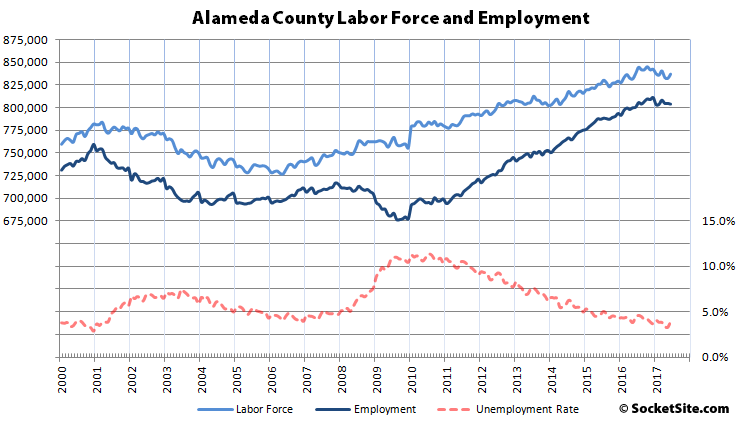

In Alameda County, which includes Oakland, employment slipped by 800 in June to 803,600 and is now running 7,300 lower than at the end of last year but still 3,400 higher on a year-over-year basis, which is the smallest year-over-year increase since early 2011, with an unemployment rate of 4.0 percent and 111,600 more employed residents since the beginning of 2010.

Employment across the greater East Bay slipped by 1,500 to 1,335,900 and the unemployment rate ticked up to 4.1 percent as the labor force increased by 8,200.

Up north, the unemployment rate in Marin County ticked up to 3.1 percent as employment slipped by 100 to 135,800.

And down in the valley, the unemployment rate in San Mateo County inched up to 2.9 percent as employment slipped by 100 to 435,800 while the unemployment rate in Santa Clara County inched up to 3.5 percent as employment slipped by 100 to 986,800 as well.

Another indicator supporting the macro trends some have been seeing for a few years now.

Everything is a cycle and, extrapolating from the previous labor force cycle – to the extent one can, there is potential for an 18% drop in the labor force over the next 5 years. Meaning SF’s labor force would fall to around 460K. That number is interesting as its about where the city was in 2010 and it’s from 2010 on SF has seen a significant deterioration in quality of life – from growing gridlock, failing infrastructure maintenance, noticeable degradation in SF’s “burbs” and rapidly rising rents and home prices. Dropping back to 2010 labor force levels could be very salutory for the city.

A prolonged drop in the labor force will be followed by a drop in SF’s populations as well. This could be what the doctor has ordered and especially as regards attaining some degree of home/apartment affordability.

There is the potential for that. There is a potential for anything.

There is also the potential the San Francisco will continue to grow.

Cycles are the/a driving force and it’s increasingly obvious the current cycle in SF (labor force, population, rapid RE appreciation) has peaked. The question is how low will the down cycle go and when will it bottom out. If anyone can time that they will make a bundle. BTW, it’s better to track overall trends if you are a RE investor rather than to time “the market”. FYI, I used 18% for the labor force potential drop as that was the previous cycle’s drop. I’m not explicitly predicting that will happen. A drop is coming for sure but it’s magnitude is still TBD.

It is possible we will all switch from iPhones and Android devices to some other operating system. Unlikely, but possible.

SF has been through booms and busts many times. There *will* be a downturn–the only question is what it will look like. Then there will be another boom and we’ll grow again. All of this has happened before and will happen again, regardless of our communication device choices.

“there is potential for an 18% drop in the labor force over the next 5 years”

In the meantime, Amazon just signed a massive 180k sqf lease on Market Street to double their footprint in SF. This is the 5th or 6th +100k sqf lease in the city this year, but keep talking…

[Editor’s Note: And yet, the Net Absorption of Office Space in San Francisco Has Dropped.]

There are 8 million square feet available by EOY. Truly vacant, sublease and new construction. The Amazon lease is hardly massive in that context. Google’s commitment to 8 million feet in SJ – that is massive.

The net absorption has been negative for two quarters now and I’d wager it’ll be negative this quarter which would set a 2 decade or so record. BTW, for all these 5 or 6 100K leases this year the absorption is falling. Think about what that says.

Plus 3 million additional square feet come online by 2020 EOY. Labor force is dropping, population is leveling, rents and prices are dropping. One modest lease does not counter what the down cycle trend. Blue Shield will vacate much more space next year as it moves to Oakland. The trends are clear now, but were evident a few years back too.

Ok, so here is how I read this:

1) Net absorption rates have turned negative in the last two quarters, which does suggest a turn of the cycle from boom to bust. BUT, net absorption rates have barely turned negative in a time when a massive amount of new office space has been coming to the market. IMO, NET absorption doesn’t capture the whole picture.

3) I agree that big, long time employers like Blue Shield and Union Bank are moving some office space to the East Bay, BUT look at the companies taking up the new space: Amazon, Salesforce, Slack, Cruise, Affirm etc. These are fast-growing, well-paying companies. Not all will be a success, but it is more likely than not that one or two of them will occupy 10x their current space in SF in 5 years.

4) Unfortunately, housing in SF has become a luxury good where less than 20% of the population can afford to buy in the city. If home ownership is a luxury good, demand is driven by the amount of people making +$120k per year. Here is an example on how this might impact the market for SFH: If 200 Blue Shield jobs that pay $70k per year leave the city and 100 new Amazon jobs that pay $150k per year come to the city, do prices for SFH go up or down? While the total number of people in the city has gone down, I believe that the demand for SFH would go up. Why? People making $70k per year were already priced out, whereas the new employees making $150k add to the demand for SFHs.

As always, I might be wrong with my assumption and I welcome well articulated, dissenting views.

@socketsite: Do you have an article on how much new office space has been built over each of the last 5 years?

I think you’re overshooting w/ the claim that the Amazon jobs will be $150K: this isn’t the HQ, so why should we assume they’ll mostly be six-figure salaries? Similarly, I think you’re UNDERshooting w/ BlueShield, that IS the HQ, and insurance can pay very well (underwriters, actuaries, etc.)

Of course neither of these may be “typical” examples, but w/o more comprehensive examples, we’ll all be guilty of cherry-picking data to support our preconceptions.

These are all fair points.

The numbers are more illustrative. I agree some of the Blue Shield salaries should be higher, but there are a lot of sales people and claims handlers at insurance companies that don’t make 6 figures.

When it comes to Amazon, I would be quite sure they will be predominantly software engineers which make 6 figures quite easily. Most companies that open an SF office do it to get engineering talent that they can only get around here.

Keep in mind that ‘net absorption’ represents the net change in occupied space. In other words, if a million square feet of space was occupied at the beginning of a quarter, and a million square feet of space was occupied at the end of the quarter (perhaps with some of the space being vacated but then leased to a new tenant), the net absorption would be even, even if ten million square feet of new office space became available but remained vacant.

1) Net absorption is an overall measure exclusive of new office space coming on the market. Despite the Amazon lease – which is quite modest, occupied office space is falling in SF. Or has been for the past 6 months. Now being mirrored in the declining labor force. It does not mean a bust but a softening which, given macro trends, could be prolonged. A factor in this will be the Bay Area’s decreasing share of tech jobs compared to other metros in the coming decades. The signs of this are the more robust growth of tech jobs not just in Seattle but places like Raleigh Durham and Austin. Also, the rapidly growing pool of skilled workers in Seattle, Boston, Raleigh, Atlanta. Tech companies don’t need to set up shop in the BA to find workers as they once did.

3) Amazon will add significantly fewer jobs than Blue Shield will relocate out of SF to Oakland next year. Other companies like Slick and Cruise are taking just small amounts of space and, if one or two hit it and add 10X additional space it won’t be near enough to make up for the space being given up by large non-tech employers. Keep in mind that about half the sub-lease space is being put up by tech companies. They are either shrinking their SF workforces or not expanding them as once planned. Twitter being a prime example – a while back they announced they’d not being expanding into several floors of their building as once planned. The SV biggies are not taking large SF footprints. Google a case in point. It’s putting its flag down in SJ and building 8 million feet of space. More than 5 times the space of the Salesforce tower.

4) The housing situation will be somewhat helped with a fall in jobs and population in SF. I was careful not to say solved. The high paying jobs, even if tech were to totally leave SF, would still exist in SV and the bio-tech SSF hub. Buoying prices. The whole BA is at a disadvantage because of this – a tech worker can transfer to Seattle, agree to be red-lined salary-wise for a year, and still get a nice raise because of the lack of an income tax in Washington State. This gets back to the talent pool issue which impacts the BA as a whole too – it is no longer the only game in town in terms of finding a large, educated and technically oriented workforce.

Things are not going to crash – I don’t believe that. They will level out. The trends will prevail as they always do. Housing appreciation is going to be larger in a host of other metros for the coming decade. but prices aren’t going to tumble much here. Appreciation will be much less however and mirror the national average.

The office space question is – with 8 million feet available and 3 million more on the way by 2020, who will fill that space? Keep in mind that total absorption for 2016 was less than a million square feet. 8 million feet amounts to almost 50K workers. With no significant transfer of jobs into the city in sight, the office market could get dicey in the coming years. It’s likely that some large office projects in the planning stages, like the Flower Mart, will get canceled.

The Bay Area will – at least in our lifetimes – always be the center of the tech universe because (1) Stanford and Cal are here, especially Stanford, and (2) non-competes are unenforceable here, so new companies are always going to form here by those with great expertise gleaned from their work in the industry. Those two factors are the reason the tech industry flourished here in the first place, and they will keep things centered here. Doesn’t mean other places won’t have tech jobs, but this will always be the mothership.

Just wrong (that no noncompetes means always the mothership). Decentralization is rapidly accelerating, you must not be paying attention. Also, recruitment is now suffering due to BA cost of living. And young non-owning residents largely want to leave, check recent polls. They don’t want to commute 90 mins to their jobs just to buy a house someday.

also, BA may indeed remain the “mothership” for US VC (though to a decreasing degree) but VC will not necessarily be the future of tech. Nor will, 20 years hence, necessarily be, Apple. Has similarities to saying, “look how dominant IBM is….they will rule forever”

I agree that it may not be Apple. Fortunately for our housing prices, though, the first contender if Apple crumbles is Android. Just like the slow fall of Uber will redound to the benefit of Lyft.

All of which brings us back to the data and trend at hand, which indicates that employment in San Francisco dropped in the first half of the year (despite the performance of Apple, Google, Facebook, Airbnb, Salesforce, Uber/Lyft, Oracle, Tesla, etc. etc.).

Though if I’m understanding the description correctly, employment didn’t drop. It stayed the same. The number of people in SF increased, causing an increase in the unemployment rate. Right?

My point is not that the unemployment rate can never rise. My point is that there is no sign of a crash and that it’s futile to plan for or expect a crash in the near future.

(Disclaimer about the randomness of our administration in DC. If we go to war with, say, Mexico, it would be terrible for the economy. But that will hit the entire country.)

That’s incorrect: “And for the first time since 2009, employment in San Francisco dropped in the first half of the year, decreasing by 5,100 since the end of 2016.”

And keep in mind there’s no need for a crash for the real estate market to be trending down (but it does make for an excellent straw man argument).

The crash is not my straw man. It is an argument made on this very site. It is that argument I am opposing.

Terrific! It’s amazing how many people counter any indicators of real estate market weakness with straw man retorts of “but Apple, Facebook, Google, Tesla and the S&P 500 are at all time highs!”

I’m delighted we are all in agreement that there is no impending crash!

“Demand is driven by the amount of people making +$120k per year” Hmmm. Foreign purchases of US residential real estate surged to the highest level ever in terms of number of homes sold and dollar volume last year, a 49 percent jump from the period a year earlier, according to the NAR. That surpasses the previous high, set in 2015.

SF is losing VC dominance fast. I believe someone already linked to the Bloomberg article, but SF’s 12 month trailing share of total US VC funds went from 34% to 26% in just one quarter.

There are less people with jobs here now, despite there being thousands of high paying job listings for skilled employees, for one simple reason: SF is just not that desirable anymore! Sorry folks, it has become a victim of its own success.

The trend is clear, that San Francisco is a booming center of the tech economy, probably the best positioned in the world.

“Rah rah sis boom bah!”

You’ll have to speak more loudly – I can’t hear you over all that pom-pom flapping.

Apple, Google, Facebook, Airbnb, Salesforce, Uber/Lyft, Oracle, Tesla, etc. etc.

You’re right. Those companies probably don’t have a future, so they won’t affect our economy and our housing prices.

Uber has a future as a penny stock, assuming it isn’t shut down for outright criminal behavior.

Elon Musk recently stated his company is wildly overvalued.

Even the successful monopolies (Apple, Goog, FB) that are here to stay are historically highly overvalued. They sit on wads of cash that will never make it to the Bay Area. Critically, tech companies have far fewer employees with respect to revenue and valuation than traditional businesses do. You’ve put your faith in an industry that pays its workers very well, but which is subject to wild swings, and even in the best of times, hires nowhere near as many workers as traditional industries of equivalent size.

So in spite of being based here, and having tons of money, you’re claiming that their money will “never” make it to the Bay Area. Where will it go?

I’m not the one putting faith in them, by the way. Lots of people are.

“So in spite of being based here, and having tons of money, you’re claiming that their money will “never” make it to the Bay Area. Where will it go?”

Most of their huge piles of cash go where they can put them without getting taxed on it.

Like share buybacks? I wonder where one could find large numbers of people who own Apple and Google stock?

Share buybacks! Hilarious! So, at least you’re acknowledging that much of the stock valuation of the superestars is based on goosing their own bird, and not on sales. You do know that it used to be illegal for corps to buy their own shares? Can you figure out the ethical and business logic behind those laws (it should be obvious), and can you come up with a conequence when those laws are removed (should also be obvious)?

How long can an economy run on share buybacks?

Of course, our economy is not running on share buybacks. They are an example of how money gets from Apple’s corporate coffers to pockbooks in SF.

The economy does survive based on things like Apple’s quarterly revenue of $50B.

Lots of Pesimistic people on this forum. Besides Amazon, Facebook is looking for 400k office and talking to 181 and the Chronicle site. Carmen Chu (SF Tax) stated today the city took in an extra 250 million , primarily in tax transfer due to property changing hands.

So the Pesimistic people can still chime in but it is not all doom and gloom and certainly will not return to 2010 levels.

SF is frothy, no doubt from my observations. There is no long term solution for relying on TWTR, and other post-collapse easy-money companies from forming to drive up prices artificially

Hardly anyone is arguing a crash is coming. What some are saying is that a prolonged slowdown is coming to the Bay Area. A modest fall off in RE prices, much lower appreciation which will track the national average appreciation rate and slower population and job growth than Seattle or LA for the coming decade – to name the other two West Coast centers. Of note, percentage-wise LA was growing slower than the BA in the early part of the decade but now it is growing faster again which has been the historic norm. Seattle just passed 700K residents on its way to 800K – some weeks up to 1000 new residents arrive in Seattle.

The trends have been visible for several years now though maybe paid more attention to by real estate investors looking for the most lucrative RE markets in the upcoming years. Those trends have now become more pronounced and are plainly visible.

The Bay Area is struggling with quality of life issues such as inadequate public transportation and unaffordable housing. Meanwhile LA is building a potentially great public transportation system that will span the region – an area much larger than the BA. Seattle has been aggressively tackling the affordability issue before it gets out of control and indeed the wave of transplants from the BA who could not afford a home here are finding they can in Seattle/Redmond.

The BA is not coherently addressing these issues and, as such, over the coming decade plus it’s star will fade somewhat compared to LA and Seattle. And a number of other booming metro areas too.

Maybe there aren’t many people in real life who anticipate a crash, but there sure are plenty of commentators on SS.

I agree fully with Dave, and have never anticipated a crash, merely a significant slowdown in rate of appreciation – or, in fact, a significant decline in Real terms, over an extended period of time. I.e., Bay Area housing becomes a not stellar investment, per se. So you indeed are using a strawman, at least for people in this thread. For people who want to buy here, adequate, but no longer a cash machine. Recent appreciation will be seen as an anomaly.

Uhhhh, earlier in this very thread Dave predicted an 18% drop in our labor force over the next 5 years. That would definitely cause a crash in our real estate prices.

Reread what I said. I referenced the last cycle’s drop of 18% and added I specifically am not predicting an 18% drop during this down cycle.

“there is potential for an 18% drop in the labor force over the next 5 years”

As I said: “FYI, I used 18% for the labor force potential drop as that was the previous cycle’s drop. I’m not explicitly predicting that will happen. A drop is coming for sure but it’s magnitude is still TBD.”

So you’re not predicting an 18% drop in employment…. you’re just throwing out there an 18% drop in employment.

Got it!

But that’s the point. We could easily have a 18% or more drop in the labor force and the world would still get it’s smartphones. There are many many non-core jobs in the region and many jobs at unprofitable companies. Even at Google, isn’t nearly all of its profits and most of it’s revenue from just it’s advertising group? Google alone could certainly cut at least 18% headcount and not suffer a profit hit.

SF and the bay area have had boom-bust cycles for a long time and will continue to have boom-bust cycles. The amplitude of the 2007 era boom-bust cycle was very high because loose lending allowed people to lever up RE purchases to unprecedented levels.

In this last cycle low interest rates allowed people to level up to high levels as well. A 100k range engineer levering into a $1M range house is 10x price to income which is historically very high. When prices are rising, appreciation justifies the use of large leverage and any bumps in peoples personal financial situations can be fixed by simply cashing out at a large profit. When prices are flat or falling, large leverage becomes a large liability which feeds back into lowering demand at very high price levels.

There were large successful tech companies in 2007 and during previous boom-bust cycles. You can have a large boom-bust cycle without having every single BA company collapse. If we all stopped using our smartphones and Apple and Google shrunk radically, it wouldn’t be a crash, it would be an apocalypse. And I don’t see any commenters here predicting an apocalypse.

But if a bunch of $1.6M homes or condos turned into $1M properties, that might be a personal disaster for some, but at $1M that’s 3x the US median home price and nearly 18x the US median household income. There could be a very large correction here while still maintaining a premium over the rest of the country reflecting the desirability and non-bubbly tech job base in the BA.

With respect to the certain dominance of the Bay Area as the tech hub of the future, from Indeed’s Hiring Lab today:

“In the first half of 2017, among the 51 largest metros in the US—those with at least 1 million people—technology job postings accounted for a higher share of all postings in San Jose than in any other metro. The Washington, DC, and Baltimore metros come next. The rest of the top eight are places with strong reputations as technology centers: Seattle, Raleigh, San Francisco, Austin, and Boston. Together, 27% of technology job postings nationally were in these eight tech centers.

The share of US tech-job openings in these eight hubs has been consistent for years, rising slightly from 26.5% in 2013 to 27.6% in 2016 and 27.4% in 2017. In other words, there hasn’t been a broad shift of technology jobs away from these hubs toward the rest of the country. Furthermore, the metros in the top eight have been almost unchanged over the past five years.

But, among this set of eight, some are on the rise, while others are losing share. Both Bay Area metros—San Jose and San Francisco—had smaller shares of US tech-job openings in the first half of 2017 than in the first half of 2016 [down 5.9% and 7.8% respectively, while] Seattle is gaining share in tech-job openings the most [up 10.7%], followed by Washington [up 4.5%] and Baltimore [up 3.4%].”

An 8 city concentration of (only) 27% doesn’t sound like these are “hubs” in any meaningful sense (indeed even if it were 27% for only ONE of them it would be a small share compared to something like NYC’s share of finance).

Of course I imagine it’s also true that if one counted every bank-telling job in the country , NY’s share of “finance” would drop to practically nothing, so perhaps this suffers from a measurement problem…counting dial-readers at some pumping station somewhere along with those programmers that are redesigning the world (the ones working on web-enabled toothbrushes, and such).

Interesting article. Some more excerpts:

“56% of Silicon Valley’s tech postings are in higher-salary occupations. Seattle is slightly ahead, at 57%, and San Francisco close, at 52%. No other tech hub is above 40%. Thus, Silicon Valley, San Francisco and Seattle skew most toward the tech-jobs mix that sets tech hubs apart in the first place.”

“Are there Silicon Valley-like tech clusters beyond the eight tech hubs? Looking at every metro’s mix of job postings across all 158 technology job titles shows which ones are most similar to Silicon Valley. The top four metros with tech-job posting mixes most like Silicon Valley’s are big eight stalwarts. San Francisco tops the list with a similarity score of 83 out of 100. Silicon Valley and San Francisco aren’t just geographic neighbors—in terms of tech jobs, San Francisco is as close as it comes to a Silicon Valley sibling.”

“So which metro is the next Silicon Valley? The answer is none, at least for the foreseeable future. Silicon Valley still stands apart. The San Jose area remains the metro with the highest share of local job postings in tech, and its tech mix ranks first for fast-growing jobs and second for higher-salary jobs. San Francisco is close, with the most similar mix of tech jobs to Silicon Valley’s.”

Don’t forget the next sentence you seem to have accidentally truncated from that last paragraph: “Yet, despite their continued dominance, both Bay Area metros are seeing their share of tech jobs fall.”

Which brings us back to the actual employment numbers and trends at hand for San Francisco and down in the valley.

This shift to Seattle from the Bay Area is ongoing and one factor that should allow it to continue for the next decade or two is the quality of life in Seattle which is better than that of the Bay Area. If Seattle can crack the nut of keeping its housing significantly more affordable than the Bay Area despite the major population and job growth it’s experiencing it could indeed prove to be the Gold Rush city of the West Coast for this early part of the century.

I have friends in Seattle who are already hating the building boom, think the quality of life is already down and feel priced into their too small house. I have another friend who already moved out of Seattle. I think Seattle is going to have it’s bay area issues soon rather than later.

I have a dozen or so friends who have moved there and been able to buy a home. Something they could never have done here – despite many of them being techies. But yes, the growth there is so great now that some locals are worried.

Seattle just passed 700K residents on its way to 800K. One worry of some locals is that the city might reach a million residents down the road. Still, Seattle’s median home price is around 700K despite all the appreciation and it’s median income is not too much less than that of the BA.

Refin’s home search stats consistently show Seattle as near the bottom of the list for locals looking for homes in other areas while the Bay Area is at the top of that list. Quality of life worries are real there and the common theme is they don’t want to make the mistakes made here in the Bay Area.

Yep. lower-paying commoditized tech jobs (tech support, etc.) are being moved to cheaper places. The higher-paying, high end jobs remain concentrated in the Bay Area. “Although the overall share of tech jobs in hub metros has been essentially flat from 2013 to 2017, higher-salary tech jobs have become more concentrated in top-tier tech centers over the past year, while lower-salary tech jobs have dispersed a bit. In other words, tech hubs are keeping their grip where it really counts—on higher-salary tech jobs.” SF/SV may lose three $80k/yr desktop support technicians but gain three $150k/yr cloud engineers.

@Dave,

I see where moving from the Bay to Seattle makes it seem less expensive, but if you’ve been there for a long time and people with more money keep coming in and paying more you don’t like. Rings a bell, yes.

I have heard you use that Redfin home search stat before and I wonder if it is worth anything. I look at Redfin homes out of the area all the time for a second home not to sell mine. I wonder how distorted that is by Bay Area people having enough money to look at second homes in other areas compared to other regions.

The magic of the bay area is not that its fortunes go up in a straight line untethered from economics or reality. The magic of the bay area is that it can rise up and rebuild from the crashes and downturns. The BA is desirable and while its fortunes may fall more than some people would like and stay down longer than they expect they will not fall so low as to create a permanent downward spiral.

When Detroit closed factories and trimmed jobs many were left with unwanted skills and few options. This creates a drain on government which results in higher taxes and reduced services which suppresses job creation and feeds back to increase social problems.

When the dot com bust happened to the BA in 2000, many simply left and went back home. Doing warmed over web design to create a doughnut delivery app might not really be worth billions, but it probably will keep you off welfare and give you a reasonable life in your home state or country.

Investors will lose interest in condos with stagnant or falling prices, but the condo’s will still be here.

Towards the end of the tech cycle excessive optimism leads to financial excess and hucksterism. But at the bottom of the cycle with nothing to lose and everything to gain, that same optimism is what creates new industries.

The magic of the Bay Area is more difficult to experience if one has a 2 plus hour commute to a condo in Pittsburg as that is all one can afford. Especially so if one is starting a family. The magic has apparently been lost on the 40% of residents who say they are thinking of leaving the area.

The tax situation in California is similar to what you describe. Higher taxes (most recently the gas tax increase) and reduced services – in terms of road maintenance/cleanup and major infrastructure stuff – like the Oroville Dam. All of those are not helping the BA retain it’s share of tech. Speaking of taxes, tech salaries are the same in Seattle but the lack of an income tax means those salaries come with a premium of about 6%.

The Bay Area is not Detroit and no one is arguing that, but it has rested on its laurels too long and failed to address mounting problems. Problems that impact not just residents but employers. Hence the fattening in employment is most pronounced in SF, but is seen throughout the Bay Area in these most recent numbers.

“The magic of the Bay Area is more difficult to experience if one has a 2 plus hour commute to a condo […] 40% of residents who say they are thinking of leaving the area.”

But that’s now at the top of a very large boom cycle. People left after the dot com bust and people will leave on the down-slope of this cycle. And my point is that’s a good thing. The Bay Area is not a bottom of the barrel location and people who didn’t make a bubble top fortune don’t necessarily have bottom of the barrel skills. People swarmed in for the Gold Rush and hobbled home when it was over.

And high taxes are a problem if you’re just treading water financially as a company or as an individual. Yet another reason why “flat” isn’t a stable state around here.

But 10-15 years from now when the current bubble is a distant memory and a bunch of Stanford grad students are shooting for “the next big thing”, what’s their payoff matrix look like? 99%+ chance of failure and thus taxes aren’t an issue. 1% chance of making at so big that taxes aren’t an issue.