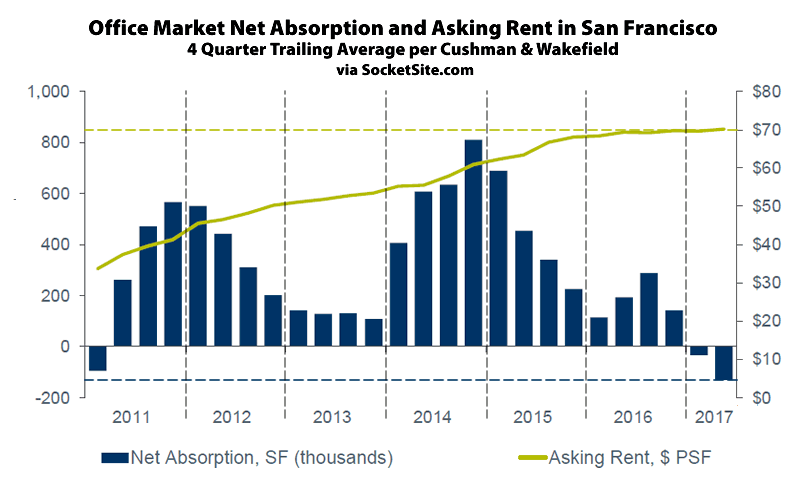

Having slipped a nominal $0.11 per square foot (0.1 percent) in the first quarter of 2017, the average asking rent for office space in San Francisco inched up $0.50 per square foot (0.6 percent) in the second quarter of the year to an all-time high of $70.16 per square foot per year.

That being said, the year-over-year gain in asking rents has dropped to 1.2 percent, down from a 2.4 percent gain in 2016, a 15 percent gain in 2015 and an average annual increase of nearly 20 percent over the previous six years.

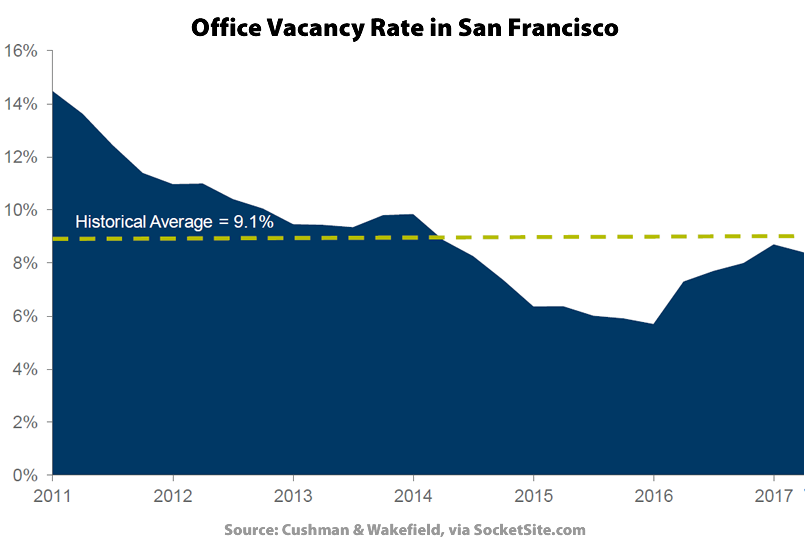

And while the overall office vacancy rate in San Francisco decreased by 30 basis points in the second quarter of the year to 8.4 percent, and remains 0.7 percentage points below the historical average of 9.1 percent, it’s the second highest vacancy rate in San Francisco since the third quarter of 2014 and 1.1 percentage points higher than at the same time last year, according to data from Cushman & Wakefield.

In addition to 5.2 million square feet of truly vacant office space in the city, the amount of rented space available for sublease remains at 1.4 million square feet.

And while leasing activity has totaled 3.3 million square feet in the first half of the year, versus 6.2 million square feet in all of 2016, net absorption was a negative 115,000 square feet in the second quarter of 2017 versus a positive 271,000 square feet in the second quarter of 2016.

And in addition to 2.3 million square feet of new office space slated to be ready for occupancy in San Francisco by the end of the year, 55 percent of which is currently pre-leased, another 2.9 million square feet of space is also under construction.

These numbers indicate a weakening office market in SF and don’t bode well for the 2.3 million square feet set to come online in the next six months (only half of which is leased) and the 2.9 million feet under construction.

It looks like musical chairs is happening – despite leasing activity of 3.3 million square feet in the first half of this year, the net absorption dropped for the second quarter in a row. That indicates many of the new leases are companies moving from one SF location to another and freeing up space in the process. Salesforce is doing this. No indication of major relocations of workforce to SF which is telling. In terms of non-government and non-health care related jobs, the office number suggest a stagnant and perhaps beginning to falter SF jobs market. Tech may be wavering as a good chunk of the sublease market is space being dumped by tech companies.

Of note, this is the first time in at least 7 years that net absorption has been negative for two quarters in a row.

Aside from the 50% of the SF Tower taken by Salesfocre, do we know how leasing is going on the rest of the building? Beyond that, about 7.8 million square feet of space is or will be available in the next 6 months. That’s a huge number and the amount of space being sought is much smaller. Will the 3rd and 4th quarters also see negative net absorption – these numbers suggest that indeed they might.

On the flip side, financing for these new buildings is still cheap by historical standards and the asking rents are at an all-time high, so landlords should have room to lower the asking rents and still make a healthy profit…

True, but at a macro level these numbers may have implications for SF planning decisions going forward. It is unlikely there will be a jobs boom again in terms of percentage gain, as there was these past two decades. It calls into question the need for the Central SOMA plans projected 45K jobs. Leaving aside the ridiculous housing/jobs imbalance in that plan, maybe its time to scale it back. Or Lennar’s CP/HP – is 5 million square feet of office space really needed there – they were having trouble finding takers and a fair chunk of that space may go to a very large private school and other education related purposes? Why not scale back office use by half and significantly increase the new housing component.

If SF is near its natural peak in jobs and population, which some think it is, it may be time for scaling back future big office projects in favor of more housing and mixed use projects. But, as you say, economics would suggest the developers of the buildings coming online now will do OK. Lennar’s CP/HP – they may have to reconfigure that project if job and office trends continue as they have been recently.

Note – I think the 1st and 2nd quarter 2017 net absorption bars are reversed on the graph.

[Editor’s Note: That’s incorrect.]

Must be reading the blog posts incorrectly. The linked post says net absorption was a minus 553K in first quarter while this post says net absorption was a negative 115K in the second quarter. That’s why I thought the first quarter bar should be larger than the current 2nd quarter bar.

The chart shows the 4-quarter trailing average.

It’s telling that the Fed themselves have said numerous times that the most frothy area right now is CRE. SF is a bit of a different animal, but beyond the mega cap tech companies, I don’t see the startups really expanding too much in the near future.

If you look at Snapchat and Blue Apron stock today, you’d see why. And outside of tech companies, I don’t see much reason for companies to grow or relocate here; the cost of living is a huge burden on all but their highest paid employees, getting around can be tough, and there’s a lot of snobby people running around. Nice weather and pretty views only go so far.

Neither Snapchat or Blue Apron is based in San Francisco, so they are particularly bad examples.

On the other hand, Salesforce is based here and is booming.

Not really. Even Bloomberg wrote today that this could be a problem for local companies Uber, Dropbox, and Airbnb (all mentioned specifically). Not only in terms of their own IPO, but in getting more private money in the meantime.

Airbnb apparently raised another billion in March.

Are you aware that there is an important difference between “raising money” and “earning a profit”?

Do you think casting about every six months for additional loans from Persian Gulf speculators is a sustainable business model?

Are you aware that apparently Airbnb became profitable last year?

I don’t know about new loans from Persian Gulf countries, but it looks like Airbnb’s last round was Google Capital and TCV. Both from the Bay Area, no?

Uber is a Ponzi Scheme to the max. Ponzi Schemes eventually collapse.

Salesforce isn’t booming? Its market value has grown about 20% since Jan. 1. It employed 6000 people in San Francisco on Jan. 1. Surely more now.

Correct, salesforce is not ‘booming.’ A real business, especially one that was founded in 1999, should not have negative retained earnings. A child that sold lemonade for 5 minutes would be more profitable than Salesforce has been in 18 cumulative years of operations.

So they’re like Amazon.

Spot on re: the lack of growth or relocation here by non-tech companies. Indeed there is a new wave of major relocations out of San Francisco by companies with large job bases – Union Bank, Blue Shield, Schwab and others are rumored.

As to tech companies, they’re a small segment of the office market and yet account for about half the office space being put up for sublease – not a healthy sign and it calls into question assumptions by some that major tech expansion will happen in SF. SF’s tech situation could turn dicey if Twitter/Uber fail or significantly re-trench or if LinkedIn relocates to the NW. For all the talk of tech, Google and other major SV players only have small SF footprints.

Lennar CP/HP and the Giant’s MR are in good positions as those projects are measured in decades and they can be changed to meet a likely new reality in which demand for new office space in SF significantly falls.

“As to tech companies, they’re a small segment of the office market” but are they the only growing segment?

In my perception throughout the country only substantial growth comes from tech companies or what we consider tech that eats into other industries. Tesla; auto/energy, uber/lyft: transportation, netlix: TV/film, amazon: retail, any fintech; finance/banking/mortage/real estate, airbnb: travel, couple players around insurance. Plus massive growth in other zero sum game plays like cloud computing, security and even online ads. Lots of other smaller industries’ lunch is eaten by tech companies. I am not sure if its fair to consider healthcare as tech but the line between them is definitely blurry.

Maybe I am biased or our media only likes to write about silicon valley but I rarely hear about an American success story in an urban area that doesn’t involve tech. I can also confirm this by looking at the stock market but sure financial markets can act irrationally sometimes. Its safe to attribute Seattle, Portland, Denver and Austin’s growth to the growing tech presence in those cities. I believe there are some growing American cities due to the fracking boom, but other than random geological luck, healthcare and tech what other factors are contributing to our economic growth in urban centers?

I was referring to tech companies in SF and not tech overall. Seattle is seeing huge growth in tech firms but SF not so much. The curiosity being tech firms are generally shedding space here -they account for 50% of the sublease space (give or take) but no more than 10% of office space overall.

I don’t disagree that tech is a significant driving force in many booming metros. But SF is unlikely to see huge swaths of office space dedicated to tech as there is in the SV or Seattle or Austin. Given that, its hard to see who is going to fill the planned space. The next two quarters will tell a tale. Almost 8 million square feet of available space with no Salesforce or Uber waiting in the wings set to take big chunks of that space. If leasing during the second matches that of the first there will be a huge shortfall of demand vis a vis supply.

Wait, are you saying that the tech economy is bigger in Seattle than here? By what measure?

Dave may want to do a reality check, although I admit the edge – of only 3/2 – isn’t as large as I would have thought. (and of course just b/c you work for a tech firm, doesn’t mean you, personally, are “in” tech)

Crane count: Seattle leads the nation with 58 active. SF is only number six with 22. Getting beat by even Chicago.

@Notcom – I was a few years ahead of myself. Seattle is poised to overtake SF in tech jobs in 5 years or so. For now one stat from FlexJobs is 393K STEM & Tech jobs for SF and 335K for Seattle.

And how many in San Jose, Oakland, Mountain View, Palo Alto, etc.?

I believe the figures are for metro areas – I know mine were – so SF and Oakland would be together, as would MV, PA and SJ (SF itself has only ~600K jobs, so obviously half of them aren’t in tech)

@SFRealist – as I noted, my reference was to SF specifically as compared to Seattle and not to the SV. The Seattle numbers are for the Seattle/Redmond engine which is charging so much of the growth in the Puget Sound area.

Right. But if you don’t count any cities in SV, you’re not counting lots of SF residents, who will buy lots of SF real estate.

@SFRealist – I’m referring specifically to the SF office market and not RE in general. There appears to be a large excess of office space forming in SF. Non-tech large employee firms are leaving SF, not relocating here. Who will fill this space? Not tech firms as they are freeing up space. Salesforce has signed already for its needed space as have UBER and Twitter. That leaves boutique PR, marketing and legal companies as the target market. They’re willing to pay high rents but, how much space do they need? There is a big gap between the 8 million feet available with 3 million or so being sought. Legal firms aren’t going to be able to fill that gap.

Some companies have left SF because it was so expensive. If SF ends up with too much space, prices will drop and those companies will return. If prices don’t drop, that’s because additional new companies continue to grow. What’s the problem?

I would think it depends largely on how much they have to drop: you’ll note from the chart that rents doubled in the past 5 years; if they fall a similar amount, and the (newly constructed) properties were financed w/ the expectations of $60 rents, then I would think that might become an issue with the lenders.

The problem is that, at these rents, the Blue Shields and Union Banks can’t afford to “park” large mid-level workforces in SF. Tech companies are willing to pay over the top rents but, as VC funding slows, investors will start looking at bottom line numbers including outrageous rents.

Prop M is really a blessing in disguise for developers as, had it not been in place, another several million feet would be coming online in the next few years. It’s dicey as it is with 8 Million feet available and almost 3 million feet under construction and set to come online by EOY 2020.

The rent numbers look unsustainable. How much rents fall will impact planned developments like HP/CP and the Flower Mart which are years from breaking ground. Some may no longer pencil out.

So in the worst case scenario, which is hypothetical because none of us are privy to the details, a couple of new buildings may not get built.

So what? Cities all over America would kill for this worst case scenario.

I meant non-zero-sum game*

There will undoubtedly come times when there are greater than historical vacancy rates in SF’s CRE market, And then times in which those vacancies get filled. If more buildings are built and the vacancies increase, rent will go down a bit in older buildings, making SF more competitive with other parts of Bay Area, with Seattle and elsewhere, and thereby filling up empty space. There is no way to perfectly time the opening of new office buildings to the employment market (aside from perhaps having them leased to companies bringing in workers from out of the area).