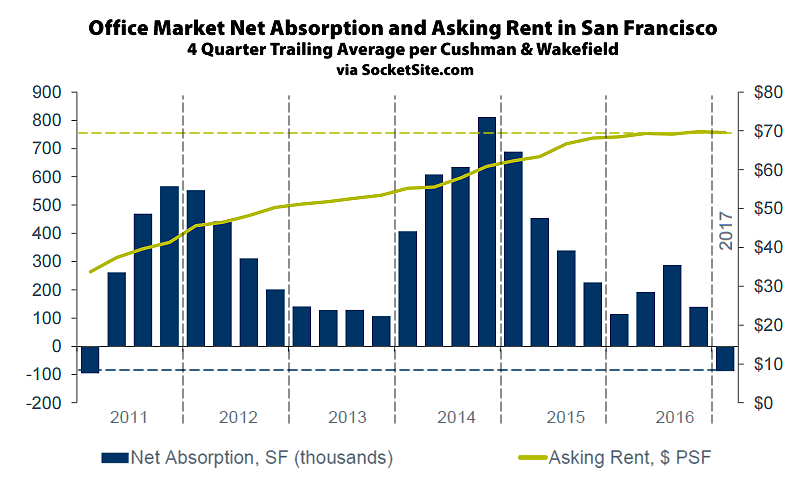

Having inched up 0.8 percent at the end of 2016 to an all-time high of $69.77 per square foot per year, the asking rent for office space in San Francisco slipped a nominal $0.11 per square foot (0.1 percent) in the first quarter of 2017. And while rents remain 1.8 percent higher on a year-over-year basis, that’s versus a 2.4 percent increase at the end of last year, a 15 percent year-over-year gain in 2015, and an average annual increase of nearly 20 percent over the previous six years.

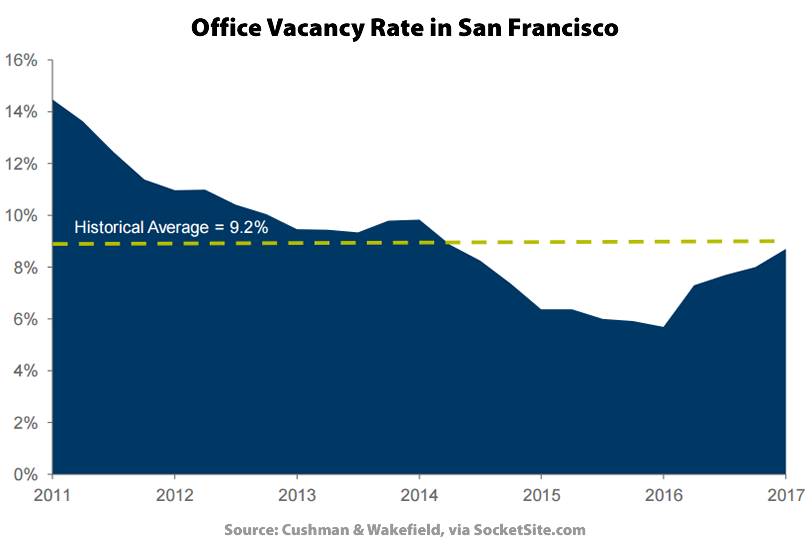

At the same time, the office vacancy rate in San Francisco ticked another 70 basis points to 8.7 percent, which is the fourth consecutive quarter of increasing vacancy and the highest vacancy rate since the third quarter of 2014 but still 0.5 points below the historical average of 9.2 percent, according to data from Cushman & Wakefield.

On the supply side, in addition to 5.2 million square feet of truly vacant space, which is up from 4.7 million square feet in the fourth quarter of last year, the amount of rented office space available for sublease remains at 1.5 million square feet with tech firms still accounting for roughly half the excess space being offered.

On the demand side, new leasing activity totaled 1.5 million square feet in the first quarter, up from 1.3 million square feet in the fourth quarter of 2016, but net absorption totaled a negative 553,000 square feet versus a positive 362,000 square feet in the first quarter of last year.

And with 3 million square feet of new office space slated to be ready for occupancy in San Francisco by the end of the year, 42 percent of which is currently pre-leased, Cushman’s list of companies out looking for space currently totals 5.4 million square feet, which is down from 6.2 million square feet the quarter before.

The first negative absorption since the first quarter of 2011. Following the second weakest year of total net absorption since 2011.

It’d be nice to know what accounted for the jump of 500K in truly empty space. Was this some of the Twitter space they will not be expanding into? Part of Schwab’s move out of SF and the space that put onto the market? Blue Shield’s Oakland move won’t happen for a few years so, even though they will free up close to a million feet, that space won’t be on the market for a few years.

Bottom line, the first quarter ends with 8.7 million feet available or set to come online office space during the remainder of the year – with 5.4 million of space being sought. Not a strong position for the SF office market as the second quarter kicks off.