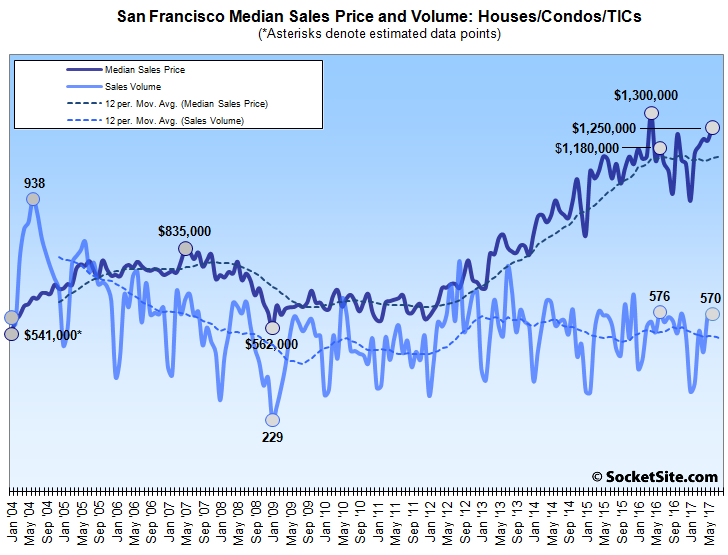

The number of single-family homes and condos that traded hands in San Francisco inched up 0.7 percent from 566 in May to 570 in June versus a typical seasonal gain of closer to 3 percent. And on a year-over-year basis, sales actually slipped a percent versus an 11.0 percent gain in May, according to recorded sales data from CoreLogic.

In Alameda County, recorded homes sales in June (1,902) were 11.7 percent higher versus the month before and 4.6 percent higher on a year-over-year basis while sales in Contra Costa County (1,907) jumped 18.4 percent from May to June and were 5.0 percent higher, year-over-year.

Home sales in Santa Clara County (2,071) ticked up 4.6 percent from May to June and were 2.4 percent higher versus the same time last year, while sales in Marin County (367) ticked up 3.7 percent in June but were 1.6 percent lower on a year-over basis. Sales in Napa (169) jumped 17.4 percent and but were only 2.4 percent higher on a year-over-year basis, home sales in Sonoma County (659) ticked up 7.0 percent from May to June but were 1.6 percent lower versus the same time last year and sales in Solano County (646) dropped 2.7 percent in from May to June and were 11.9 percent lower, year-over-year.

In total, excluding San Mateo County due to a temporary data issue, recorded home sales across the Bay Area increased 8.6 percent from 7,637 in May to 8,291 in June and were 2.1 percent higher versus the same time last year but 6.9 percent below average driven by a slowdown in new construction sales.

The median price paid for those 566 homes in San Francisco last month ($1,250,000) was 3.7 percent higher than the month before and 5.9 percent higher versus the same time last year, but still 3.8 percent lower than the record $1.3 million median price recorded in April 2016.

The median sale price of $770,000 in Alameda County was 10.0 percent higher versus the same time last year while the median price in Contra Costa County ($580,000) was 7.2 percent higher, year-over-year.

The median sale price of $965,000 in Santa Clara County was 12.2 percent higher versus the same time last year, the median in Marin ($1,080,050) was 13.7 percent higher, the median in Napa ($597,000) was 11.6 percent higher, the median in Sonoma ($588,500) was 11.0 percent higher, and the median sale price of $400,000 in Solano was 6.7 percent higher on a year-over-year basis last month.

And across the Bay Area, excluding San Mateo once again, the median sale price in June was a record $735,000, up 7.5 percent versus the same time last year.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

Rumors of the SF housing market’s demise have been greatly exaggerated . . .

Are you kidding? You must be joking right ? Either that or you are very young and don’t understand cycles?

No offense meant to you, but seriously how can you look at that chart posted and not intuitively know a huge bubble is embedded?

I don’t know when it will correct or how much but I do know RE is in for a rebalance here around the bay, and I’m thinking sooner vs later.,,, I mean if you believe socketsite it’s already here..,, and it’s going to deepen…

yes yes! I’m looking forward to re-entering the market when the time is right!

This is a great real-estate market, if you know how to play it well.

And music is all about rhythm.

You need to read my post. There is a big difference between “A huge bubble is embedded … RE is in for a rebalance” and “the demise is already under way.”

No way one could look at that chart and conclude prices have done anything worse than plateau. We can all predict anything for the months and years to come. I’ve been reading predictions of various crashes for about 5 years now.

Agreed, anon. There are two type of people: a) The bubble is coming, it’s going to pop! and the b) Prices aren’t going to plunge, they’ll dip or plateau for a bit.. but not pop and plunge.

It’s turning out to be the B scenario. The “pop” happened back in 2008/9 because of terrible lending practices – not a local problem to SF. (and honestly, when I bought at the bottom in 2011, the property was only down 20%) We don’t have a national housing crisis, and lending rules have changed. When I talk to an escrow agent now, they all have seen deals post 2011 with “20-40%” down payment. Home owners aren’t as desperate wear in the Bay area.

Tech companies kept making money, employing people and keeping the BAY area afloat. And even better: Some of the FANG stocks have went up 50% in just 4-5 months. (Facebook, Apple specifically) Money will only influx into the Bay area further. (Netflix and Google also benefited a LOT)

It’s pretty clear that tech is definitely the future and will eat up everything, and who better will prosper than the SF Bay area? Time to buy property in a year or so.. and ride it up the next wave.

So there are only 2 scenarios, A and B? “Some people” have so little imagination – real and nominal prices can nteract over a period of time in complex ways, and the period of time can range over years. A bubble can deflate very slowly, or bumpily….it can take a while. For those expecting a big buy oppty after a crash – probably a dream.

Sure this time it’s different young one! I’m not saying we are due for another 2009 style housing depression no way….

But a correction and wipeout of the marginal ( and I mean marginal “rich” as well as true marginal, yes it’s coming soon now)…

Buy fang! Load em up! To the moon!!!

The economy never contracts, I know this is different. But that stock or property on hope you can turn it over in 1-2 years to a greater fool..,,

Yes the peak is for sure near….

I am not young and I do understand cycles.

I will assume you understand supply and demand, especially demand. Since our housing prices are subject to high demand from the companies based around here.

We have had a plateau for a year or so now. I don’t know how long it will last.

Question: What about overseas investors?

I commonly hear about local tech downturn causing depressed real estate prices.

Would/ does overseas investing keep prices from dropping?

I’m wondering who else buys houses in Bayview/ Hunters Point for $1.5m+.

The one on Venus street? I couldn’t believe when I saw what it went for (1.23M). While International buyers have a bad rep, I still have to see how they destabilize a real estate market in the US. NYC and Miami have been destinations for foreign money for a very long time and the two cities have some of the highest and most stable real estate markets. I know Vancouver is somewhat notorious for foreign money driving up prices, but it is a) a much smaller market than Bay Area and b) it had different regulations compared to the US.

Pero, I live in Bayview and also couldn’t believe the sales price of $1.23M on Venus street.

We bought a house in Bayview not for $1.5m+ but close to $1m which we thought was a lot for the area. The weather is very good and it’s so quite with a convenient access to downtown SF or Silicon Valley. There are not many choices for shopping, dining, or activity in Bayview yet so we currently shop and dine in Dogpatch and Potrero hill. We see more and more people walking around with yoga mats or running on the street with iphones.

My husband is a director at a company and I own a small business. We ran into a couple at a party who just moved into a block away from our house. The husband is a medical doctor and his wife is a professor. We heard from our friend her business client(Mkt. manager) working in Silicon Valley is building/remodeling a house in Bayview.

If you don’t need public schools, and will not sell within 10-15 years, Bayview and Eastern shoreline SF are a great deal today. Those are two very important ‘If’s, IMO.

The comment about public schools in Bayview is irrelevant here due to SFUSD’s lottery system. Most kids don’t go to their neighborhood school.

Isn’t Venus street Silver Terrace and not BV? Or has BV taken over Silver Terrace

Sparky-b, you are correct. The Venus street is in Silver Terrace and the house on Venus street is very close to the border line with Bayview. The price per sqft($680) in Silver Terrace is usually higher than the one($625) in Bayview.