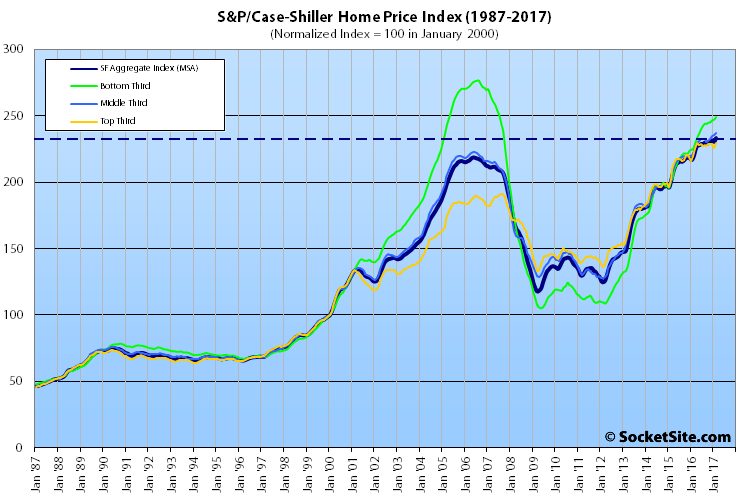

Having slipped at the beginning of the year, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked up 1.2 percent in February to an all-time high.

The overall index for single-family home values is running 6.4 percent higher on a year-over-year basis, versus 9.3 percent higher on a year-over-year basis at the same time last year, led by gains in the bottom third of the market.

Having ticked up 0.8 percent in February, the index for the bottom third of the Bay Area market is now running 10.3 higher versus the same time last year, while the middle third is running 7.0 percent higher having ticked up 0.7 percent in February.

And having rebounded 1.5 percent in February, the index for the top third of the market is running 4.6 percent higher on a year-over-year basis and 19.9 percent above its 2007-era peak, while the index for the bottom third of the market remains 10.0 percent below its peak a year before.

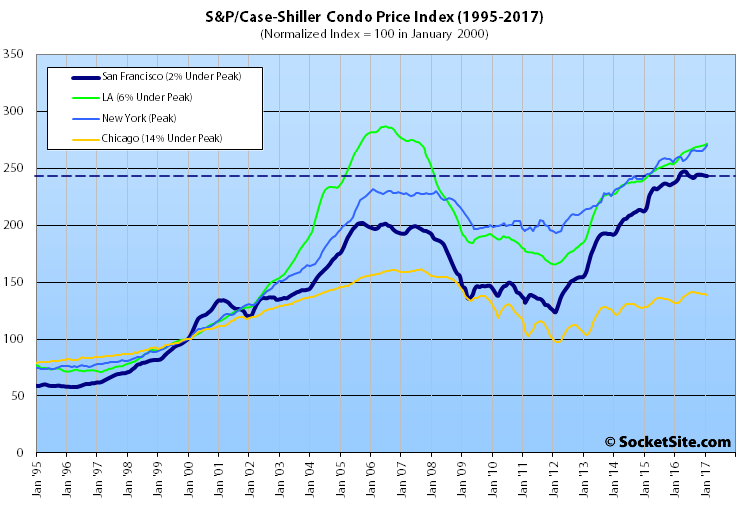

The index for Bay Area condo values inched up 0.2 percent in February and is running 20.7 percent above its previous cycle peak in October 2005, but the year-over-year gain, which has been trending down since the third quarter of 2015, dropped to 1.5 percent, which is the smallest year-over-year gain since the second quarter of 2012.

And for the twelfth month in a row, Seattle and Portland reported the highest year-over-year gains for single-family homes, up 12.2 percent and 9.7 percent respectively. But Dallas, which is now running 8.8 percent higher on a year-over-year basis, has displaced Denver (8.5 percent) for the third place spot.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

The bottom third outperforming the top two tiers seems like an ominous portent (if the past is any guide). Should I be concerned about “easy money” or “irrational exuberance”?

The bottom tier is still 10% below the late 2006 peak. And those figures are not inflation adjusted. In real terms, it is about 32% below the 2006 peak. Even the top tier remains below the previous peak of almost 10 years ago in real terms. Prices are high, to be sure, but nothing like the 2006-08 bubble.

Yeah, I realize that…it’s more just the trend that leaps out as potentially the very beginning of something bad….but from the last time this happened it was five years of boom before the crash. Just an interesting observation, because all prices have been moving in lockstep since about 2013 according to Case Schiller.

In terms of standard deviation I’d say this last run up was about 20% more extreme than the last one. But for the time being the mild sell signal we got last year has turned back to positive. In late 2006 we got a similar mild sell signal after which the market turned positive and made another run up of about 5% before tanking for real. History doesn’t repeat but it often rhymes. I am basing this on charting analysis of moving averages and Bollinger Bands.

The market may be hitting peaks again, but it will not crash (and way overcorrect) the way it did in the late 2000’s.

I mean back then I knew several entry level corporate rats taking on zero down, interest only type loans to buy the then new wave of condos in SF and OAK at obviously overinflated prices. And those were the people that actually had decent paying jobs that could afford the loans. Not to mention the much larger groups of people who were generally poor & undecated and sold houses in the central valley and less expensive areas purely on the fact that continued infinite appreciation would allow them to “afford” it.

Its just not like that right now. This next bust will be more of a mild downturn, a recession vs near depression (and aboslutley it was a depression in housing back then), and it will probably occur as the tech / social media frenzy eases up, employment continues to slip (as SS reminds us, thank you!), startup money dries up, and marginal companies fold or are devoured at increasing rates. But it wont be a widespread housing bust like it was last time.

Those who have been buying up stocks over the last 10 years should have small fortunes by now and if its not for retirement, but meant to finally be able to buy a home here in the bay, they should be cashing out now and sitting on cash until the dryup of money occurs, employement rises, more companies fold, prices and demand side pressures ease up on housing, and then these people can actually get a starter home. For those looking to move up sell now and sit and wait!!!!

Theres your unsolicited advise!!

First off, for the 2007 crash if you think that was an over-correction you need to look into just how massive a bailout and market intervention the government had to perform. And think about what the market would have done absent any massive government intervention.

And secondly:

“POPPYLOAN offers up to 100-percent home financing on the purchase price of a home up to $2 million, with no down payment or added requirement for private mortgage insurance.”

“The exorbitant rent here makes it almost impossible for people to save up for a down payment. It can take people 28 years to save up a 20-percent down payment in San Francisco. ” [ Rebecca Reynolds Lytle, senior vice president and chief lending officer for the San Francisco Federal Credit Union (SFFCU).]

If it takes you 10 (or 28) years just to save up a down payment to get into the housing market, how stable will you be to economic shocks or a downturn in housing prices?

And what drives bankers to do this?

“We used to get about 25 mortgage applications a month through our online system, but now we get about 10 applications a day,” Lytle said. “About 80 percent of those are POPPYLOAN applications.”

Lower your lending standards and boom! a 10x increase in loan volume! And why stop at 100% loans? Some people don’t have money for closing costs so let them borrow 105%,… Why pay down the principle, just go IO?

That’s why it’s hard to predict when this will end, because you can keep going further down this path until suddenly you can’t.

Some more reporting on “POPPYLOAN”:

“In an atmosphere of continued cautious lending, the product has raised some eyebrows, but it is nothing like the no down payment, no-doc, risky products that were behind the housing crash. Borrowers are fully vetted, income and assets verified, and while there is no minimum credit score, the vast majority of the credit union’s borrowers have above-average credit scores.

“We’ve always done very conservative lending. Our philosophy is you lend to the person, you have to understand their situation and verify what they’re telling you,” said Lytle.

The credit union, which has been in existence for 60 years, holds all the loans on its own books. Credit unions make the loans to their members, so they already have a relationship with their customers.”

The bubble years were driven by lenders shoveling off the risk onto other dupes by the millions; that is what enabled to game-playing. A credit union that keeps all its loans isn’t going to hand out cash to any nob with a pulse like in the bubble years. This is a non-story.

Reading the link I posted is hardly “more reporting”. Taking the trouble to verify the info of someone you’re about to hand upto $2M zero down over to is great, but it’s a pretty low bar.

“A credit union that keeps all its loans isn’t going to hand out cash to any nob with a pulse like in the bubble years.” However, “Lytle said the credit union has declined about 34 percent of applications so far, and she expects that percentage to increase.”

You got me there! They just hand out cash to 2/3’s of the nobs with a pulse.

And the real key point is that Ms. Lyttle just laid out the boom/bust dynamic from the point of view of bankers. Drop your lending standards and you get a 10x increase in loan volume. Look back a few years and see that your loans have done well and call it a day. Nevermind that few people default in a rising market. And no thought given to how someone who struggled for 28 years to save a down payment would fare were housing prices to drop. The same dynamic apples to banks, mortgage brokers and fintech lenders. You just won’t catch the CEO’s of wells fargo or Sofi making these types of quotes on the record.

Quite a leap there — she says they’ve rejected 34% of the applicants so far with more rejections expected. No word at all on the numbers or percentage of acceptances; in fact, the article you quote states only 1 such loan to date has closed. Yet you stretch that to claim that 2/3s have been accepted. And you further assume that those 2/3s were nobs with a pulse — i.e. the uncreditworthy NINJA loans of old. Yet your article says: “Borrowers have to have funds in reserves as well as income to qualify,” she said. “Most of the people we’re declining have credit issues, don’t make enough money or don’t have enough savings to cover closing costs.” And “This is not a program for first-time homebuyers. It’s for middle-market professionals, well-paid people. Not everyone qualifies.”

This boom is driven by high-income/asset people buying up the scarce supply of SF homes. It very well may end, but it won’t be for the same reasons as the last bust. There is zero evidence that no-down crap loans are fueling anything. Credit Unions are regulated, and they aren’t allowed to make the crap loans of 2006.

It’s ambiguous from the article, but my assumption was that 34% was the current rejection rate and as they advertise more widely and expand their net they expect to pull in more “nobs”. As you’d expect whenever you expand a program from initially targeted customers to the wider public. And thus the rejection rate going forward would drop.

But either way, you’re nitpicking the tip of the spear. The conservative mainstream banks have already lowered the bar from 20% to 10% for jumbo’s, Conventional down to 3%.

I agree completely agree that this is all about high-income people. Lower/middle income people haven’t been part of the SF housing story for some time now. US median income is $51k, buying at a pre-bubble 3-4x income puts you in a $150-200k house. Even in a post-apocalyptic SF, that’s just not happening. And that’s why you are only seeing froth in certain markets.

The last bubble was arguably the first national housing bubble. But there have been plenty of regional boom/busts before.

How much water do you need to overflow an olympic size swimming pool vs how much water do you need to overflow a kitchen sink? The historically massive scale of the last bubble isn’t necessary to cause irrational exuberance in a few regional markets.

“High LTV jumbo mortgages represent about 80% of mortgage lending at San Francisco-based online lender SoFi since it expanded its student-loan business to add mortgages last fall, says Michael Tannenbaum, vice president of SoFi’s mortgage business.”

If everybody has so many assets why is there such a rush of borrowers to low down payment products when they become available? Especially when interest rates are so low?

It’s really not surprising that an on-line lender (that nobody has ever heard of) that has set up its mortgage business model as catering to those who don’t want to put 20% down would end up with a substantial portion of that one lender’s borrowers not putting 20% down. That is not representative of SF buyers generally. During the last bubble, plenty of NINJA nobs bought in SF because banks threw them loans. No more. I agree with you that prices are very high here and could easily fall. I just don’t see any indication that is imminent or the necessary, or even likely, outcome.

How can people save money for a down payment while paying these exorbitant rents and healthcare costs? Only 50% of Americans own stocks (that includes 401k) but the wealthiest 10% own 80% of them. Meanwhile total unfunded pension liabilities have quadrupled since 2007, so don’t expect boomers to be as loose with the money.

First time buyers will not help much because the $1.31 trillion in student loans is larger than the total value of subprime mortgage loans in 2007 and default rate is already 11%, so what happens when debt strapped millenials face a recessionary hiring slowdown?

There is also a huge sub prime auto lending bubble and that could crush FICO scores even worse.

A lot of people in SF have very high incomes or a lot of assets. Those are the ones able to save for a down payment. Not just the tech bros, but lawyers, bankers, doctors, etc. A lot of high earners here (an anecdote. a relative just out of college just finished up her first year as a developer at Lyft and made $150,000 with her bonus. At age 23. Her rent is $2600 a month. She saved $40,000 i her very first year out of college, and she got a $25,000 raise for the coming year). It’s only about 6000 homes a year that are bought in SF. It doesn’t really matter, for local housing price purposes, that 50% of the population could never buy here for the reasons you state. Those issues do, of course, matter for other policy decisions.

SF housing prices are not being driven at all by no-down NINJA loans. That was, indeed, a big joke, but that is history.

Yes yes, we all know SF is the Magical Land of Unicorn Fairy Dust, but a downturn in the national real estate market will certainly drag down local prices, as evidenced by every other downturn ever.

And while it’s easy to call the bubbles on the way up due to the hot flows of loose speculative money, it’s harder to predict what will happen on the way down, because the government will always step in with various wacky taxpayer funded bailouts for their bankster cronies disguised as help for Main Street. Like someone else said, where would housing be if the Fed were still not holding over $1.7 TRILLION in MBS for example?

By the way, your numbers are way off. Only the top 10% of households can afford the median home in San Francisco, not 50%.

I was just answering your question, which was: “How can people save money for a down payment while paying these exorbitant rents and healthcare costs?”

High incomes, which a lot of SF residents have, allow them to save money for a down payment, or to pay all cash, for the relatively small number of homes that get sold in SF each year..

It’s not like 2005-07, when homebuyers were handed million dollar loans with no income or assets. That drove the mid-00s housing bubble.

What is the basis for saying only 10% of households can afford the median home?

Got it from CAR. I guess it’s gone up a few points to 13 now, woo hoo!

That source doesn’t explain its methodology, which it says “based on traditional assumptions”. What are those assumptions?

Sorry, I found them, and they’re ridiculous. For instance: “It is then assumed that the monthly PITI can be no more than 30 percent of a household’s income.”

But plenty of people pay more than 30% of their income to PITI. That’s just a rule of thumb, it’s not set in stone. It’s especially common in SF and other expensive cities. If I’m making $150K and choose to pay $5k a month, in theory I’m violating their rules but in practice I’m getting in on a new house.

I’ve tried to educate Saddie, to no avail, on just how many highly-paid tech and professional couples there are who are able to save a few hundred K and then pay for a $1 to $1.7m mortgage and want to live in SF. These are most of the buyers. I personally know such people.

Yes of course, I mean we’ve got this gal right out of college making over $150k and looking to buy a million dollar home, that’s just par for the course around here. Which begs the question… if the last bubble was inflated on easy home loans, could this bubble be inflated on bloated tech salaries?

My understanding is the auto subprime is pretty small / nothing like the housing subprime. As to these loans you note above, sure there is always nonsense like this out there for fools, but I belive the % of loans in this category is fractional vs back in the bust. I would need to confirm that though.

the other point to consider, in the core bay area, is outside all the new condo towers in central SF, SFH new construction has been very low. There hasnt been much supply coming online (SFH I mean), and its nothing like the overbuild in the exburbs like tracy, brentwood, etc that we saw in the last bust. In fact I believe many of those outlying areas never really recovered and are like the midwest of CA – still pretty stuck / stagnant and feeling the hangover from the last binge. The coastal core markets we live in are pretty solid.

So fundamentally I still think this will be more of a garden variety pullback vs a fallout. I am referring to housing specifically – I think the stock market will get pretty beat up when it finally corrects, but housing will outperform relative to stocks.

The example about the UBER employee is exactly the people I am talking about that, if they are smart with their money they will do very well here long term. You dont even need 150k per year either, you can do it with less IF you are smart with your spend.

All these crazy hi rents you here about, yes are true numbers, but if you are smart you make sacrafices to save on rent (roomates, less than ideal location, etc)..

Its all doable. I did it. If I can do it anyone can.

Edit on my reply on the UBER person….see the garbage in the press about people whining about not being able to make it here on 160k per year is the same fool who will probably take the POPPYLOAN. See these people have no sense. Your UBER person if they are smart is hoarding those savings to either invest in stocks when they fall OR to get a good (20% or more) downpayment for a home when it falls. They are not buying $9 toast.