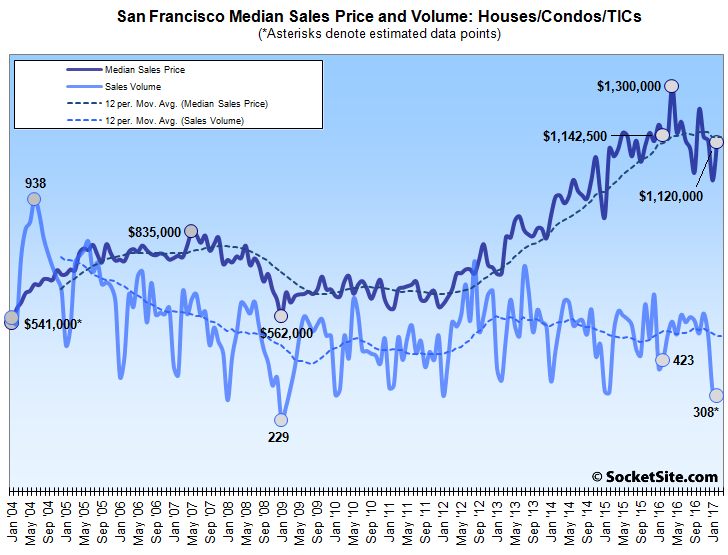

The number of single-family homes and condos that traded hands in San Francisco dropped to a five-year low of 308 in February. That’s down 4 percent from a downwardly revised 322 sales in January (versus a typical 12 percent seasonal bump). And on a year-over-year basis, home sales in San Francisco were down over 27 percent last month.

The median price paid for those 308 homes ($1,120,000) was 2.0 percent lower than at the same time last year and 13.8 percent below the record $1.3 million median sale price recorded in April of 2016.

As we noted five months ago, the recorded sales volume in San Francisco was being goosed by contracts for condos in new developments that were signed (“sold”) many months prior but were closing escrow in bulk as the buildings came online in the middle of 2016. At the same time, signatures on new contracts were down 25 percent in 2016 despite an average of nearly 50 percent more inventory throughout the year and new condo sales dropped to a multi-year low in January.

And while many continue to finger a “lack of inventory” for the anemic sales trend, listed inventory in San Francisco is running at a five-year high.

In Alameda County, recorded homes sales in February (966) were 4.4 percent higher on a year-over-year basis with a recorded median sale price of $682,000, up 6.6 percent versus February 2016. But sales in Contra Costa County (984) were down 2.7 percent with a median price of $508,000, which was 6.9 percent higher versus the same time last year.

Home sales in Santa Clara County (1,067) were 7.1 percent higher versus the same time last year with a median price of $845,000 (up 9.0 percent) while sales in San Mateo County (384) were down 7.7 percent with a median price of $1,032,500, up 14.3 percent versus the same time last year.

And up north, recorded sales in Marin (164) were 9.9 percent lower versus the same time last year with a median price of $815,000 (down 4.7 percent), Sonoma County sales (355) were 6.1 lower versus the same time last year with a median price of $525,000 (up 10.5 percent) and sales in Napa (94) were 3.3 percent higher on a year-over-year basis with a median price of $555,250 (up 1.0 percent).

Overall, Bay Area home sales dropped 3.3 percent on a year-over-year basis to 4,767 – the lowest February tally in nine years – with a median price of $649,000, which is 4.6 percent higher versus the same time last year.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

Five year low home sales on weakening prices.

The reversal of momentum buying?

Where are the hoards of buyers waiting on the sideline for a dip?

Perhaps many (both owner buyers and investor buyers) are realizing that this is quite possibly a systemic change in Bay Area real estate. The days of the region significantly outperforming other areas in appreciation are over. Maybe for a decade to come? The Forbes list of best metros for homebuyers and investors purchasing rental properties did not include any Bay Area city.

The factors making for the best home markets are future job and population growth as well as current affordability.

Home investors who got out in late 2014 or 2015 probably will be seen going forward as having correctly “timed the market”.

Current potential homebuyers are likely given pause because of falling rents – it makes more sense to rent for many and especially if one plans on not being in the area for more than a few years and certainly it does not make sense to stretch one’s budget to the limits to buy a home given future appreciation will likely be modest at best. No more taking a risk with the family budget on the expectation of yearly double digit price appreciation.

Maybe this explains why the hoards of buyers seem to have disappeared.

Let’s not get too dramatic. MLS numbers I see indicate 2,634 houses sold in 2016 compared to 2,286 in 2015. And 2,898 condos-TICs in 2016 compared to 2,866 in 2015. Numbers have been pretty steady since 2012 when they bounced up from the 4 year lull.

Have sales just totally cratered in 2017 with the “hoards” disappeared (or even the hordes)? Doubt it, but maybe. But you certainly can’t draw any such conclusion from these numbers. I agree we are unlikely to see double digit price appreciation, or much at all, for a while.

I have never been one to say there would be a dramatic drop in prices – just a modest drop or flattening for an extended period. With other markets (some) significantly out-appreciating the Bay Area. A shift is occurring which ultimately will be good for the Bay Area in terms of affordability and retention of jobs here.

If there is a “flattening” after this run-up. it will be the first time that has happened. I’m not saying that it can’t happen, just that there’s no precedence for it, and that it runs counter to Minsky’s redoubtable theory of how asset bubbles form and resolve (the financial instability hypothesis). Until he’s proven wrong, I’ll stick with Minsky.

Again the old argument about how much constitutes a correction vs a crash… again it must be pointed out that the median has already come down a lot from the peak while the economy is supposedly still booming, so what happens when it actually slows? You’d think it would come down at least that much again. I’d call that a crash if I bought at the peak.

After the dot com bust I’d say we got a relatively mild correction, but this run up has been much more intense than both the dot com and the housing bubbles. Just look at the chart.

If it was just this one data point, that would be one thing. But combine this with the 25% drop in condo volume on a 10% price drop, plus the recent weakness in rents…

And all this with the stock market at an all time high (at a stretched P/E).

What happens when a recession hits?

MLS-based data is an incomplete subset of the overall market represented above.

Recorded sales in San Francisco are down 3 percent over the past year. Over the past six months, sales are down 7 percent. And over the past three months, sales are down 22 percent.

But sure, keep moving along and don’t look behind the MLS curtain and industry spin, there’s nothing to see here.

So it looks like the sales decline is entirely new condos. And?

Lowering volume = inaccurate price values

You missed the point. Sales prices are not the same as home values.

The explanation is quite simple actually. Fewer top end homes sales = change in mix = change in median sales price.

As the editor says, the median sales price isn’t a good indicator of change in value. But while prices may not be home values, they are prices.

If you have a 20% off sale at your store and no one shows up, that’s telling you something about buyers response to price.

Mix might be an issue, but there have been a few apples shown here showing weakening values, plus price reductions are on the rise and the percent of listing under $1M is relatively constant.

And of course, inventory of homes for sale at a five year high and sales at a five year low….

Volume is still higher than 2009, are you saying we weren’t able to accurately figure out what home prices were then?

Someone posted a SJM article in the jobs thread below. Apparently there is now a population shift out of Santa Clara, San Mateo and Marin counties. SF has not seen this yet it because of foreign immigration to the city per the article.

As it is, the region has not grown as fast as some other metros in recent ears but, if a net out-migration is sustained for a number of years, there could be a further relative slowing of population growth. All this adds to the macro phenomena of the Bay Area relative to other areas seeing significantly slower home price growth. It becomes not just people not being able to afford to buy but potentially the pool of buyers beginning to shrink.

While inventory here is at a 5 year high, Seattle is seeing historically low inventory despite all the new units coming on the market.

Above and beyond whether there is a recession (or, more accurately, when there is another recession) there are fundamental dynamics at play in the Bay area which portend possible big changes in the coming decade.

If you look back at the SocketSite archives, I bet people were saying the same things in Detroit in 1950. Population was at its peak of 1.8 million with plenty of good paying jobs. Down to 677K in 2015 and kicked off the top 20 US cities by population for the first time since 1850. Of course, everyone wants to live here and for many, many reasons nothing that extreme could ever happen. Ever. Seriously.

I don’t know. Yesterday, we went to check out a nicely staged/remodeled Sunset home at its first showing. Hoards of people were there. Remember, the double parked cars lining the street? They were back. Either the really nice looking homes are bringing out the masses or everyone’s NCAA brackets were too far busted to care anymore…

Good god hoards again for the second time in one thread. Good people, HORDE is the word. It derives from the Mongolian (think Ghengis Khan) Golden Horde, a huge nomadic army sweeping over the steppes of Eurasia. Hoard is what what those sad scary people do who collect too much string and old newspapers. They are also occasionally featured in Socketsite threads. Learn the difference! Language is fun! 😉

Thanks for the clarification. I’ve never used either word on Socketsite, but good to know they’re is a difference.

PS. The “they’re” was used in jest!

know kidding?

🙂 It is a pain that one can’t edit a socketsite comment. Because we all make mistakes from time to time……

Horde of nervous people thinking about selling.