While the estimated number of single-family homes and condos that traded hands across the Bay Area last month (4,849) dropped 31.4 percent from the month before with typical seasonality in play, the overall sales volume was 0.2 percent higher than the same time last year (January 2016).

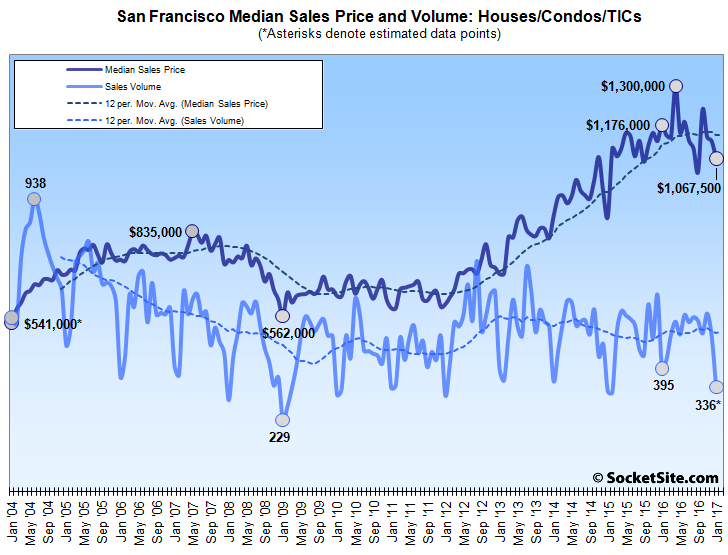

But in addition to dropping 32.9 percent from a downwardly revised total of 501 sales in December, the estimated number of homes that traded hands in San Francisco last month (336) was down 14.9 percent versus the same time last year.

And the estimated median price paid for a home in San Francisco last month was $1,067,500, down 9.2 percent on a year-over-year basis and 17.9 percent below the record $1.3 million median sale price recorded in April of 2016.

That being said, CoreLogic’s data for San Francisco County in January was estimated as the final tally was once again unavailable at the time of its report.

As we noted four months ago, the recorded sales volume in San Francisco was being goosed by contracts for condos in new developments that were signed (“sold”) many months prior but were closing escrow in bulk as the buildings came online in the middle of 2016. At the same time, signatures on new contracts were down 25 percent in 2016 despite an average of nearly 50 percent more inventory throughout the year and new condo sales dropped to a multi-year low in January.

In Alameda County, recorded homes sales in January (969) were 1.0 percent lower on a year-over-year basis with a recorded median sale price of $650,000, down 3.7 percent from December but 4.1 percent higher versus the same time last year. Sales in Contra Costa County (969) were up 2.8 percent on a year-over-year basis with a median price of $492,000, which was 8.7 percent higher versus January 2016.

Home sales in Santa Clara County (1,023) were down 2.9 percent with a median price of $786,500 (up 4.9 percent) while sales in San Mateo County (375) were 5.3 percent lower on a year-over-year basis in January with a median price of $930,000, up 3.4 percent versus the same time last year.

And up north, recorded sales in Marin (185) were 4.5 percent higher versus the same time last year with a median price of $812,500, which was 12.1 percent higher, Sonoma County sales (362) were 5.7 lower versus the same time last year with a median price of $360,750 (up 5.2 percent), and sales in Napa (96) were 7.9 percent higher with a median price of $589,750, 16.8 percent higher than in January 2016.

The median price paid for a Bay Area home overall was an estimated $620,000 last month, down 5.3 percent from December but 4.6 percent higher versus January 2016.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

any way you slice it, that is an ugly chart right there

I wouldn’t interpret too much into it. The mix of units sold could be driving this dip. Developers catering to the top-tier of the market ($+2.5M) are aware that they can make 2-6% more by listing the property in Spring compared to Dec/Jan. At the same time, mid/bottom-tier properties are more consistently listed throughout the year, as they are driven by job relocations or estate sales. Bottom line, I wouldn’t be surprised to see an uptick in median prices (for SFH at least) in April/May.

We’ll note the three-month moving average for the median price is down 3.5 percent versus the same time last year (i.e., accounting for seasonality).

That’s the first dip in the three-month moving average, beyond a 0.2 percent slip in the fourth quarter of last year, since January 2012.

Sales prices below the moving average for 2 straight months. Not a good sign.

If the two months were April/May, I would be very worried.

If the two months are December/January, I wouldn’t bother.

With a post-presidents day inventory hitting a 5 year high, the market should be less competitive than in previous years.

Not everywhere. not all properties.

Show me a millenial who can afford to buy a house, and I will show you a booming housing market.

In related news: Demand Really Dropped in San Francisco but Not Around the Bay