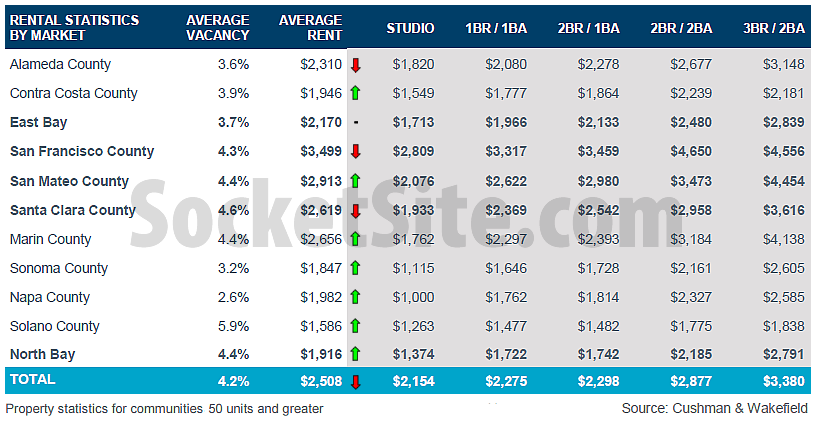

Having slipped by $25 a month in the second quarter of 2016, the average asking rent for an apartment in a building with over 50 units in San Francisco dropped by $96 (2.7 percent) to $3,499 a month in the third quarter of the year while the asking rent for an apartment in an East Bay building was $2,170, up by one dollar.

At the same time, while the apartment vacancy rate in San Francisco dropped from 4.9 to 4.3 percent, the average vacancy rate in Alameda County, which includes Oakland, ticked up from 3.1 to 3.6 percent and the average asking Alameda rent slipped by $11 (0.5 percent) to $2,310 a month, according to data from Cushman & Wakefield.

Across the greater Bay Area, the average asking rent slipped $14 (0.6 percent) to $2,508 per month while the vacancy rate held at 4.2 percent. But the asking rents did increase 3.6 percent to $1,847 in Sonoma County, 3.5 percent to $1,586 in Solano, 1.1 percent to $1,946 in Contra Costa and under a percent to $2,913 San Mateo and $2,656 in Marin.

And in terms of new supply, there are roughly 21,000 units of housing under construction across the Bay Area, including 7,000 units in San Francisco.

I can assume the drop in SF is the result of the high rental property price and more competition to get tenants. The more they build, the lower the rental will go but it won’t pen out for the developers so nothing will get built.

…and since nothing gets built, rents will go up, and more will get built… ?

Just trying to follow along here.

It is a balance where supply never adequately meets demand.

Supply and demand don’t “meet”.

Each one exists and relationship between them determines prices. As we increase supply, prices will drop if demand remains relatively consistent.

Exactly, it is a fierce cycle that no one has learned from.

Interesting that in SF and CC 3 bed/2 ba is cheaper than 2 bed/2ba. Why is that?

Newer buildings tend to eschew three-bedroom units, which means the three-bedroom stock tends to be older and in buildings with less modern amenities.

I am doubtful that this limited data supports the broad conclusion stated in the headline. This is only for buildings with 50+ units. These are a small minority of units across the city and are subject to different pricing strategies and concerns than other units. Maybe the headline conclusion is right, but I don’t think this report shows that.

SF’s housing inventory is cataloged by the city–only about a quarter of housing units are contained in buildings with 20 or more units, so likely significantly fewer in buildings with 50 or more units.

While imperfect and obviously a subset of the larger market, the institutional market tends to react faster and less emotionally when it comes to rents, which are priced relative to the market as a whole. In addition, institutional trends are less likely to be driven by changes in the mix.

Plus it’s really easy to monitor asking rents at many of the big buildings and do apples-to-apples comparisons.

I assume these numbers don’t include concessions? Most big rental buildings are offering 4-6 weeks free, something that was not true 18 months ago.

That’s correct, effective rents have likely dropped by significantly more.

That explains all of the articles about how it’s cheap to live in San Francisco now.

That’s right, because unless local rents drop below those in less expensive areas, they really haven’t dropped at all! And if they do, it’s obviously evidence that everybody was simply overpaying before, not that the market has lost any steam.

No it doesn’t. It just demonstrates your excessive enthusiasm for a piece of data that validates your bias.

While the trend above might not match what you were told in a seminar, it’s based on solid data. And yes, we are admittedly biased when it comes to drawing conclusions based on data versus industry spin.

“..it’s obviously evidence that everybody was simply overpaying before..”

That’s what the pros always say, isn’t it, when the market turns down? On the way up, it’s going up forever, because tech, views, and they’re not making any more land. On the way down, it’s “everybody was overpaying before.”

Seminar?

Does anyone have any apples-to-apples comparisons in SF over the last year or two? Like an apartment or flat rented out in 2014 and re-rented recently? That kind of data is always more indicative….

I have a 3bd/2ba in the inner sunset. Rented Aug 2015 and after tenant moved out, re-rented it this August for about 10% less. It sat on the market for 2 weeks with no showings at the old rate. But you need to aggregate thousands of those data points to draw any conclusions.

I think 10 of these data points, if consistent with each other,, accurate tell the tale.

Another data point.

We just moved out of a 2BR/2.5BA Loft in SOMA with parking. Our rent was $4800 starting early/mid 2015. It has been on the market for a month at that price, and no takers. The owner just dropped the price to $4500.

ours is not 2014/16 but it is 2012/16.

3BDR/2B Noe Valley flat. remodeled. 2012->2016 $4500->$4750 (tech family moved to peninsula home). 2016 $6000 (tech roomies).

took 2 weeks to rent as opposed to the line we had in 2012.

all renters were in tech and in existing groups/housholds looking for better digs closer to commute or relocation experts with tech clients.

I think most of that bump was from 2012 to 2014. I rented a 3/1 in Hayes Valley in 2012 for $3800. Re-rented it with in same condition in late 2014 for $5,900

My apple in the mish is down 4%. No big

From the MLS:

10 Brooklyn Pl #9 3,300/mo 10/20/2015

10 Brooklyn Pl #9 3,100/mo 7/16/2016

1177 California St #814 5,800/mo 5/29/2014

1177 California St #814 5,500/mo 10/5/2015

167 Fair Oaks St #1 3,650/mo 3/19/2015

167 Fair Oaks St #1 3,500/mo 10/5/2016

283 Dolores St 19,000/mo 5/1/2015

283 Dolores St 18,000/mo 8/17/2016

301 Main St #24D 6,800/mo 6/26/2014

301 Main St #24D 6,450/mo 4/22/2016

301 Main St #36A 7,000/mo 9/26/2015

301 Main St #36A 6,500/mo 10/29/2016

301 Mission St #906 7,500/mo 11/1/2014

301 Mission St #906 6,499/mo 10/21/2016

317 29th St #204 3,950/mo 5/22/2014

317 29th St #204 3,750/mo 8/13/2016

3187 Mission St #C 5,000/mo 2/26/2015

3187 Mission St #C 4,800/mo 4/8/2016

3189 Mission St #B 5,000/mo 2/26/2015

3189 Mission St #B 4,600/mo 4/6/2016

555 4th St #910 4,850/mo 7/4/2015

555 4th St #910 4,250/mo 8/31/2016

8 Buchanan St #814 3,850/mo 5/20/2015

8 Buchanan St #814 3,650/mo 2/16/2016

88 King St #1006 4,995/mo 1/24/2015

88 King St #1006 4,700/mo 9/23/2016

1719 La Salle 3,995/mo 3/17/2015

1719 La Salle 3,700/mo 6/15/2016

To be fair I did notice quite a few that did not go down.

This seems broadly consistent with what I have observed when I look at rental listings

Down a bit, much less competition to get something, but things are not exactly cheap.

How does rent control impact this number? I assume most landlords that are under rent control would not lower their rents as it readjusts the base down. Are these 50 plus unit buildings mostly post 1978 in which case they are not subject to rent control – and lowering rents in that case does not permanently lock them into a lower base.

Anecdotal, but several homes in my area which have rented out rooms in the basement (to techies) had vacancies recently and the owners did not raise the rents – even though the vacating tenants had been there several years.

Dave, as you should know, any unit, rent controlled or not, goes to market rate when it is vacant and available. Since the survey is for asking rents for available units rent control has no impact.

Just another anecdotal data point: I work for a small start-up, and we have begun hiring our developers almost exclusively outside of SF (like, in Poland) because we can no longer afford to pay developers a salary that would enable them to live in SF. At the same time, many of my colleagues (myself included) have left or are leaving SF for places like Seattle because we can work fully remote, and have access to much better, more affordable housing. Many, many startups are now following the same pattern, so I would expect to see some slight decrease in the number of people moving to SF specifically for work over the coming months, since those companies have begun to realize that they can manage workers remotely without having to pay them the inflated salaries that make it possible to rent in SF.

One of the real estate blogs did an article on the coming growth of telecommuting and how it will impact real estate and the best cities for telecommuting.

Obviously the key factors were home prices, rents, ISP service. Reno/Sparks is putting in a huge fiber optic network connecting to LA, Silicon Valley and LV in anticipation of taking advantage of the mobility telecommuting will increasingly afford workers.

Despite all the talk of IPOs and stock options, most young tech workers can’t afford to buy a home here and are not keen on paying 3K/month or more for an apartment – hence many renting downstairs bedrooms in various SF SFH neighborhoods. But that gets old as one gets older.

How this plays will be fascinating to see – I am one who thinks the Bay Area will have a lesser percentage share of the overall tech job base in coming years. Telecommuting could facilitate that.

Its a healthy thing if this happens and housing becomes more affordable to the average Bay Area family.

Telecommuting jas been DECREASING for past 10 yrs

I better hurry to lock in these rents at this level. Thanks to rent control! Hmmm… maybe I should buy instead, or risk getting priced out for good. When is the next America’s Cup coming to SF? Snap going IPO? It’s OK it’s not in SF, something about trickle-down, or splash-around (sp?) economics.