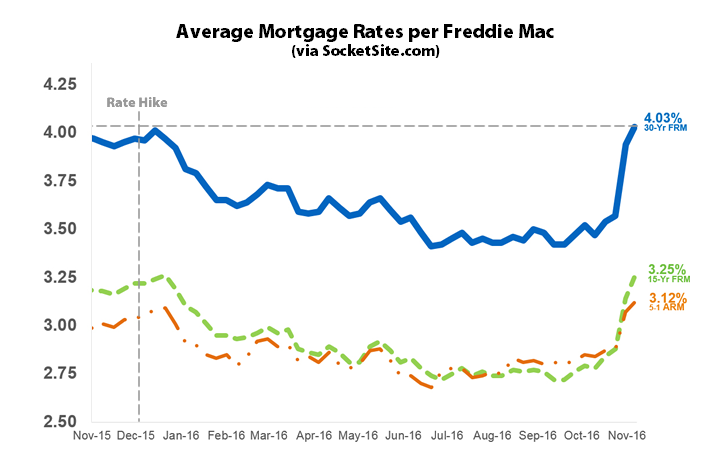

For the first time this year, the average rate for a benchmark 30-year mortgage is over 4 percent.

And having jumped 46 basis points over the past two weeks, a move which shouldn’t have caught any plugged-in readers by surprise, the prevailing 4.03 percent average rate is the highest in sixteen months and 8 basis points above the 3.95 percent rate in place at the same time last year, according to Freddie Mac’s Primary Mortgage Market Survey.

At the same time, the probability of the Fed enacting a rate hike by the end of the year, a probability which had dropped to below 35 percent at the beginning of August, before ramping up to 74 percent four weeks ago, is now running at 93.5 percent according to movements in the futures market.

If interest rates continue to rise, the effect on RE will vary. As long as the increase is modest. Population, job and salary growth may have as strong an effect. Depending on the market.

There are markets where real estate prices are at historic highs and the average person can’t afford to buy. Per Trulia, a mortgage payment in San Francisco takes 52% of a person’s income as opposed to 27% in much of Florida. Those markets will likely be the most impacted by mortgage rate increases.

Depending on the market then, this remains a good time to invest in RE IMO.

There are wild cards out there. If a huge stimulus package is passed and is targeted, then places like Detroit could boom.

If a one time repatriation of overseas corporate cash occurs and is targeted, then too those areas targeted might boom.

If Dodd Frank is modified in a way that gets small banks back into the mortgage business, then that could temper negative effects of increased mortgage rates.

Interesting times for RE investors and RE homeowners alike.

Yeah, provided he doesn’t go off the rails on social and moral issues, trumps economic policies stand to benefit RE investors in the Bay Area.

Yup. The market hit a new high and it’s being called the Trump rally, but I think RE remains the best place for the little investor to get ahead. Get some of the benefits tax-wise that the wealthy get de riguer.

On taxes, the possibilities for RE investors seem to be:

Lower taxes would put more money into the middle class and stimulate the economy. More people might be able to save for a down payment or pay off debt and qualify for a loan.

Lower taxes on the wealthy, which I’m not a fan of, would encourage more second/vacation home purchases and boost high-end real estate which has been in a slump lately.

Lowering the corporate tax rate from 35% down to 15% would be a game changer for real estate investors. Partly, as the proposal has a “pass-through” for entities such as LLC’s, S Corps and LP’s. Many real estate investors hold their properties in an LLC. Personally I invest in LLC RE entitlement projects in the Bay Area and this would help me.

There are trade offs, possible elimination of the 1031. This might be time to do a 1031 if that was on your radar.

Trump’s tax plan would cap itemized deductions so another factor to consider.

In any event, for RE investors especially, this is a time to keep eyes wide open and try to anticipate what may come. I don’t agree with it all, but as one who believes RE investing is the best way for Joe and Jane six-pack to reach critical mass earlier rather than later in life, new opportunities may be opening up.

In the past, these supply side inflationary antics were done in a dropping interest rate environment but nowadays the bond market will not go for it. Trumpflation is going counter the business cycle so at best it will delay the downturn.

Rising rates instantly increase the monthly housing payments, but salaries are slower to keep up, so housing prices will drop. The recent construction boom won’t help. I’d wait to buy the dip even if you are paying higher rates, you can refi later or sell at profit as rates drop again.

I’m a bit worried on the mortgage rates rising. Previously, it seemed you could get a $1m home for $3k a month now it’s rising. I did not re-fi (don’t want to, our rate is 4.75) but am worried about housing cost with this rise, but it is a slow “boiling frog” rise.

How is the 93.5% probability calculated? “movements in the futures market.”