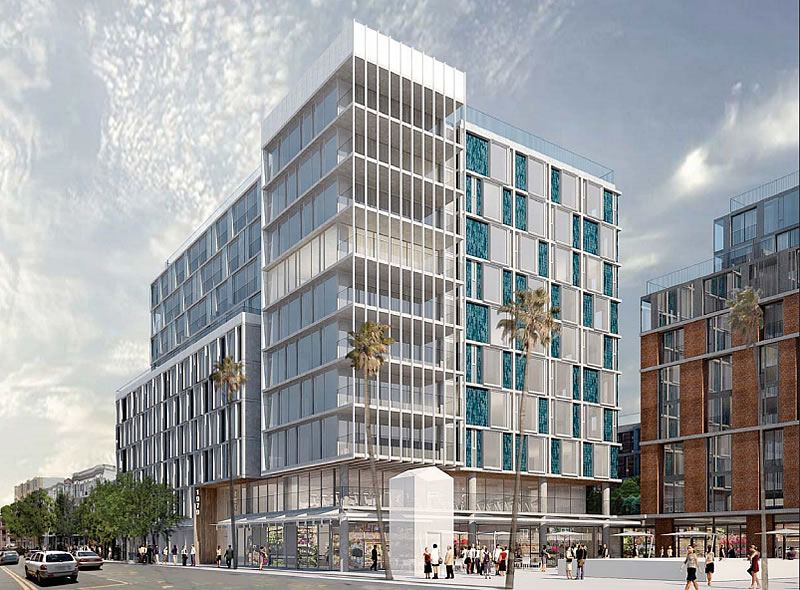

A settlement has been reached in the the legal battle between the family that still holds title to the 1979 Mission Street site and the development team behind the proposed 331-unit project to rise up to ten stories on the northeast corner of Mission and 16th Streets, the so-called “Monster in the Mission” development.

As we first reported last month, while the two parties had been engaged in “serious settlement discussions,” said discussions had recently broken down and the trial date loomed.

But a conditional Notice of Settlement has been filed with the court. And while the exact terms of the settlement haven’t been disclosed, based on our review of a draft agreement, the sale of the property should close by the end of the month and at the original contract price.

Maximus Real Estate Partners had agreed to buy the site for $41.88 million in 2013, but accused the Jang family, which owns the property, of working behind the scenes, “through a series of bad faith, fraudulent and oppressive business maneuvers,” to actively delay the approval process for the proposed development in order to sell the site to an unnamed “national development company based on the East Coast” for $55 million instead.

And in terms of the controversial project’s approval, Planning’s public hearing to review the Draft Environmental Impact Report for the project is scheduled for this Thursday (June 9), which ought to be a lively affair.

I live near this location – I own a building less than 2 blocks from this site. Yes, I support the development with reasonable onsite BMR units. Having said that, the histrionics that are sure to precede any development will be depressing, annoying and a distraction from the goal of development of housing and cleaning up that disgusting corner.

Let the show begin.

Oh, btw – Make it 20 stories tall and watch the fireworks…..

This is going to be a great project and great asset to the neighborhood!

And yes, will go a long ways to cleaning up that disgusting corner. Bring on the gentrification!

But why is it that you, and other continue to complain and want everything higher and higher?? This is not a small project! Let’s applaud the owners and developers for moving this forward.

I see you must have checked your sense of humor at the door….

If I am not mistaken, Gov Jerry Brown once said, “either gentrify or slumify!”

It boggles my mind that someone will be paying $1,000,000 to live at 16th & Mission. I haven’t been to that location in over 5 years, but if it’s anything like it was back then, I’d rather just move to the ‘burbs. Funny how all the sheltered twits want so badly to live among the crack heads and junkies, but at least they’re not moving into my neighborhood.

Homes are even going for $1 million even in the Bayview/Hunters point, just blocks from the projects. And no, 16th and Mission hasn’t changed much in the past 5 years. I guess there are fewer gang members shooting each other these days, and there are more tourists and yuppie types around, but there are still tons of drug dealers, addicts, crazy people, grime, regular fights and robberies, etc.

The funniest part is that some of these people paying insane amount of money to live in high crime SF neighborhoods literally have no idea that they’re high crime areas before they move in.

These are not “sheltered twits” (nice name calling!), but rather people who see the value and growth and change in a GOOD WAY that is beginning to happen in this neighborhood.

The way to get rid of the crime, the drugs and dealers is to bring in new businesses and housing that will attract good people who want to make SF better. pretty simple.

Yup, I am sure lots of folks remember the Hayes Valley of say 20 years ago…wouldn’t get caught dead there after dark ….or there was a good chance you would be dead.

I lived in Hayes Valley 20 years ago (and earlier when the freeway was closed but still there). It was an absolute gem in the center of the city. It was seedy, but not dangerous. Lower Haight was worse.

Hayes Valley was one of the most vibrant urban enclaves I’ve ever seen. The sense of danger kept it that way. What it’s become now is still trading on that.

It’s really sad what has happened to it, and the perfect example of gentrification destroying what it seeks to co opt. Now it’s just another sterile, blandly upscale, overplanned mess of commodity real estate and monoculture of interchangeable corporate restaurants and retail. It’s Santa Monica or Newport Beach only more expensive and with a lower quality of life.

The best thing that could happen to this city is for more people to be afraid of it.

Perhaps because over the next 5 years their property will be worth 200% more? Perhaps because there aren’t many options for people to buy / live in this sadly underdeveloped city?

And maybe, with a little bit of that same optimism and foresight, the long-term residents of the city could avoid being locked into their decrepit and failing rent-controlled apartment—or worse yet, priced out as many others.

And this is precisely why a real estate “soft landing” is so elusive. People stretching/leveraging to buy in at $1M expecting their purchase to be $2-3M in the next five years may be ill equipped to deal with a valuation that merely flat-lines. It’s up or out for these buyers.

But “up” gets harder and harder to maintain. Even if $1M mission condos become $3M mission condos in the next five years, what then? Another 200% increase in the five following years? Now you have $9M mission condos at 16th and mission, now what? Still up?

Oh please, you’re wildly speculating in the most negative way. No one is saying those units will be 2-3 m in 5 years except you. What’s your point?

Why not show some positive attitude and address how the area is changing in a good way? Would you prefer this corner stay the crack den that it is now?

“Perhaps because over the next 5 years their property will be worth 200% more”

$1M * (1+200%) is $3M

And the point is that price expectations greatly influence demand. The number of people who can afford a $1M condo that will go to $3M in 5 years is much much greater then the number of people who can afford a $1M condo that will still be $1M in 5 years.

I know math. I’m an architect.

You’re just quoting hypothetical data, not facts. and so what? What again is your point?

I quoted one person’s stated price expectation. Another person stated an expectation of a price doubling every 10 years. If you google, you can find surveys of potential homebuyer’s price expectations.

The point is that people make decisions based on their price expectations and when these expectations get very high it can make almost any buy decision seem logical. And in a market with very low supply such as SF, it takes very few people with high expectations to set prices.

When someone such as JR Bob Dobs coming in planning on no appreciation for the next 10 years coming into a bidding situation against someone who expects a tripling in 5 years, guess who will be most motivated to be the high bidder?

But if prices flatten and this causes price expectations to flatten, this can drastically reduce demand at a given price level. And this is what can cause dramatic boom bust cycles.

Who exactly is expecting their property to triple in value in 5 years?! I would love to see those “surveys” as you call them. Even if you bought at the bottom 5 years ago your property is not remotely close to that kind of gain now.

anon, this is an interesting line of thought but the numbers you’re using to support this reductio ad absurdum argument are way too shaky. Can we agree that virtually nobody expects prices to go up 200% in 5 years (has that ever happened here?), regardless of what someone said off-the-cuff on this board? A more common expectation is 10% per year, or 60% in 5 years. (Perhaps ironically, if you put 20% down on a house which appreciates 60% in 5 years .. the leverage on your investment means about a 300% gain – maybe that’s what you think people expect? 😉

So now .. how would your argument sound with a less egregiously silly account of human expectations?

“Even if $1M mission condos become $1.6M mission condos in the next five years, what then? Another 60% increase in the five following years? Now you have $2.6M mission condos at 16th and mission, now what? Still up?”

Does this still sound crazy? I think not, but I also think it’s very improbable and our growth won’t hold for that long before the cycle ends.

Gus, My point wasn’t to validate one particular person’s growth expectations, but just to point out how out-sized growth expectations can feed back into current prices. And how this makes a soft landing difficult since merely having expectations flatten can very greatly impact the buying decision.

Even the 10% per year expectation that you believe is common is far above the actual long run 4.2% growth rate. And you still have the issue that if you expect prices to flatten and medium term expectations go to 0%, the drop from 10% to 0% is huge.

As ‘cfb’ pointed out, homes near the projects in the Bayview are going for $1M. And this is completely rational if you truly expect 10% price growth. Who wouldn’t like to buy $1.6 for $1 using borrowed money. The details of the underlying property become almost irreverent compared to the expected financial gain.

mwsf, The TLDR version is just that ‘Stop Driving’ was mystified that people would pay $1M for condo’s here and ‘Bobby Mucho’ replied that they would pay because they expect large appreciation. That’s the key dynamic.

Personally, I find that you get a lot out of anecdotally talking to people and getting a feel for their expectations and buying criteria. I don’t find that rigorous academic study adds much more, but people have done surveys and studies of this.

Here’s an IMF paper looking at the role of expectations and other factors in the last boom/bust. And here’s a paper by Case and shiller that has some survey data from the last cycle.

In 2004 the average expected 10 year appreciation for Alameda county hit 14% and 17% for Orange county. There’s an interesting commentary section at the end and you could literally bury yourself in paper reading about different pros and cons of various studies and analysis. But as I said above, I don’t think you really gain much from that level of detail.

are people still leveraging? i seriously dont know the answer. Are the mortgage requirements still strict at 20% down?

SoFi at the very least has billboards around town touting 10% down on up to $3M.

Fanie lowered DP to 5% on Jumbo loans and rocket mortgage is going gangbusters for 3.5% FHA loans.

But even beyond high LTV, people can leverage themselves via family loans and simply by just forgoing other savings and maxing out on home payments.

After all, why have other savings if your condo will double or triple in value?

It’s called liquidity.

A good rule of thumb is that SFHs in SF tend to double in value every decade. This has been the case for a while in most, but not all, neighborhoods. Not sure if it applies to condos at 16th and Mish, but why not?

A doubling every decade would represent annual appreciation of a little over 7 percent, which is roughly 40 percent above the long-term average appreciation for housing in San Francisco (4.2 percent) as calculated prior to the last bust and would result in an anticipated value that’s 50 percent higher than the long-term average would suggest to expect after a decade.

Yeah – doubling every 18 years is quite different from doubling every 10. Anyone making a home-buying decision that is premised on prices doubling every 10 years is in for a rude awakening some day.

Frankly, I would advise that would-be homebuyers assume no appreciation for the next 10 years when undergoing the “should I buy” analysis. If it still inks out financially, go ahead and buy. If not, the decision requires a far more careful analysis.

I bet the average yearly appreciation in the last 20 years is higher than 4.2%, especially if you look at 1995-2015. Probably not reaching 7%, and neighborhood dependent for sure. But if any data junkie wants to run those numbers, please do 🙂

SFH in SF are up about 20% (not 100%) in last 10 yrs

No, Anon, YOU are supposing that a $1M condo will be worth $9M in ten years. No one else is saying that this is likely or even imaginable. If my math is correct, that’s an appreciation of about 25% each year for ten years.

I suggest you find a better argument.

He doesn’t have one. But the underlying tone by him and others is that they are trying to show us that they have great compassion and “care deeply” for the not so well off people who cannot afford these units, and those who will be displaced.

It’s a false compassion. Cities change and evolve and yes more well off people are moving here who CAN afford these, and thus will help create a better, cleaner and safer neighborhood.

Those who get displaced (not all) will be able to take advantage of the BMR units being offered by VIRTUE of the number of market rate units being owned and purchased by “us rich guys”.

Funny how that works.

Asked and answered. See above.

This area has regional significance…it’s one of the very few rapid transit stops in the SF and Peninsula.

Oh, but to have had $100,000 to invest on Houston Street in NYC in 1970.

FWIW, making it 2x as high would not generate either 2x the amount or depth of opposition, which is pretty well solid and likely maxed out at this point.

Great! Please build it yesterday.

I really hope this project goes through. I find SocketSite’s use of its opponents’ nickname (‘Monster in the Mission’) disappointing. How about a more journalistic ‘1979 Mission’? Short of that you could have come up with. I like ‘A New Hope’, or maybe ‘The Great White Hope’?

“Beauty in the Mission”

[Editor’s Note: That’s too close to the Beauty on Bryant, which was actually coined by that project’s opposition.]

Miraculous on Mission?

Not really calling it that, just noting that it is called that by some. 1979 Mission doesn’t ring a bell with most people, but a lot of people know about the “Monster In The Mission.”

The Great White Hope? For this project in this contested neighborhood? There would be blood in the streets, and it would quickly achieve legendary status in the annals of Marketing Fails. I’m getting fond of Monster in the Mission, myself, and look forward to its normalization. “I’ll meet you at the Monster, we can decide where to go from there.”

So, is the suspected sale to Maximus at the original figure the current owners’ tacit admission of their “bad-faith, fraudulent and oppressive” conduct?

And, just who was that East Coast developer allegedly angling to take on this project at an inflated price and what were their plans?

I wonder if the new agreement will include a time-specific contingency on the developer’s obtaining approval to proceed. I still can’t believe Maximus was foolish enough to agree to a 1-year limit in the first place.

As we reported above, “the sale of the property should close by the end of the month.” At which point, a contingency clause would be moot.

Correctorama, you are! It hadn’t sunk in that they are now proceeding with a full transfer.

Let the entitlement games begin. I wonder if the lull in the action took any of the steam out of the opposition.

Hmmm…upscale vs. shabby…more info please 🙂

Given this is likely a long way from approval (the EIR process is starting and there is huge community opposition) would Peskin’s talk of a 50% BMR requirement for SF residential projects apply to this project? Assuming such a change came before this project were to get formal Planning Commission approval?

It does look like a monster. It is too tall even if it is next to BART – which is oversubscribed, remember. All for re-developing the site but this will replace the current fly-blown corner with a new one. Build say to 5-6 storeys so it does not stick out like an ugly sore thumb.

i would prefer 20 here. Its at the core of transportation in the most dense city west of NYC

BART is not oversubscribed here…it is the Bay Tube that is the choke point, and Montgomery and Embarcadero stations that have crowding issues. And one building doesn’t make a difference anyway.

About the “price” expectations, friends thought I was crazy to buy my place for 85K in 1981 when it was worth 25K just 10 years before. BUT NOW IT IS WORTH 1.5 MILLION !

congratulations!!! Had you invested $85k in the US stock markets during the early 1980s bear market, you could well have even more wealth now. The Nasdaq was under 200 in 1981 and is nearly 5000 now. Crazy how a growing economy creates so much wealth so broadly. Oh well, better luck in the next 35 years.

Yeah, but like the old saying goes “you can’t live in your stocks”.

Sure, but in SF you can live in your rent controlled apt. And in recent years even turn a profit on it renting out on Airbnb.

But you can sell them without paying a 5% commission and transfer taxes (you pay about $10, if that). And you don’t have to pay property taxes each year on your stocks. And you don’t have to buy insurance in case they get damaged. And you don’t have to routinely spend money on a new roof, new water heater, new appliances etc. for them. And you don’t collect cash dividends each quarter on your home.

Many advantages to a home as an investment vis-a-vis stocks/bonds. And many disadvantages.

I am convinced that whoever coined the phrase “The Joys Of Home Ownership” didn’t own one…. S/He was just selling stuff to the poor fools (like Me) who do….

I think that phrase is meant to be sarcastic.

The major difference between stocks and real estate is of course leverage. With stocks, 2:1 might be possible but watch out for margin calls; with houses, it’s 4:1 or higher.

Another big advantage with homes is you can deduct the interest payments from regular income. And the the first $500k in gains is tax-free. But another disadvantage is you cannot deduct losses from the sale of a home, as you can with other investment losses. Two different animals – neither is inherently superior. I’ve owned my homes for more than 20 years – works out for me financially and otherwise (I like the control and certainty). But I don’t pretend it is the only, best investment. Real estate people tend to relate only the positives and stay mum about the negatives. I don’t really blame them as that is their business. Stock hawkers do the same.

The returns should take into account both dividends and rents as well as tax. I’ll bet stocks returned superior still on that basis. That is true for over-all market at least. Ask Shiller.

Unlikely. I receive 8.8% cash on cash return net of taxes from my current rental portfolio (acquired between 2013 and 2015). That of course doesn’t include capital appreciation. I don’t think you can find any class of stocks that perform similar.

Is there a study that takes all these factors into account?

Dividends are taxed at a lower rate than rental (ordinary) income but rental income is offset largely (in the early years) by depreciation. Lowering the effective tax rate on the rental income well below the cap gains rate..

Jimmy, is your RE portfolio representative of an entire class of RE investment, or is it just your portfolio of a small number of properties in a local market? I’m sure many individual stocks and the stock portfolios of many individuals have had better returns than your personal RE portfolio. And some have done worse. Same for RE portfolios. FWIW, Tesla stock acquired at 2013 ave price has had a better return than your RE portfolio, but Tesla stock acquired at 2015 ave price hasn’t.

The really big differences are that stocks usually have much greater liquidity and much lower transaction costs, together those enable much greater volatility. Oh, and the volume in the financial markets (stock, bond, and currency) are larger than the RE market by many orders of magnitude.

I’m only talking about my cash on cash return, month over month. That doesn’t include capital appreciation … which in my case is well over 500% based on the net dollar amounts invested.

Is it representative of the market as a whole? I doubt it. But I guess I don’t really care… because I don’t own the market as a whole, just a few houses in good locations.

well, good for you, but you can’t generalize or compare your few houses to an entire “class of stocks” as you did. With power of leverage 500% is not an uncommon move for a few holdings in a market (RE or stock) bounce. FWIW, I’ve made 100% on an IPO in a few hours, and with no more paperwork than a line item on a statement. May your market and house bounces always be up.

My point is not to look at capital appreciation at all, but the day-in day-out cash flow of an asset stocks, bonds or real estate. Find me a stock or bond that consistently pays an 8.8% dividend, with or without leverage. I don’t think they exist, except possibly certain REITs (which are just proxies for real estate anyway). That was my point. If you know of any solid high dividend stocks then I would like to add them to my stock portfolio.

Average junk bond yields as of yesterday were 7.23% so if the average is 7.23% I’m sure you can dig up a bunch of individual bonds that yield over 8.8%. In Feb the average hit 10%.

I’m sure you can look in hindsight and find plenty of junk bonds that paid high yields without default or other loss of principle. And with credit derivatives on those bonds you can see huge hindesight profits. But as Jake points out it’s very easy to find high returns in hindsight.

@Jimmy, for yield right now, I like EAD, a Wells Fargo closed end fund trading at a 8.5% discount to NAV, yielding about 10.5%. Built in leverage, but not too much, lots of junk bonds. CHY another, more convertible focused. Both are less liquid in market hiccups, the best time to buy.

Robert Shiller did a study going back like a million years and concluded that stocks out performed most of the time. Googling probably will squeal a link or two. Here is one: Robert Shiller: Don’t Invest in Housing.

Junk bonds… interesting. I’ll look into it. It’s not a totally compelling place to put money as there’s no prospect of capital appreciation (interest rates aren’t likely to decrease significantly in the future) but it isn’t terrible.

Here’s where I think Schiller’s analysis breaks down. When I buy a house, I (a) use leverage and (b) collect rent. So while the underlying asset, in general, may only appreciate at the rate of inflation (clearly not at all true in selected markets like this one), you gain income from it along the way. Over time, amortization of the underlying note amounts to retained earnings; after subtracting depreciation, it’s practically tax free. He doesn’t seem to factor any of that in to his analysis but it makes a huge difference. If you play the game long enough, you are getting houses in prime locations … for free!

The S&P by comparison, is a piece of junk. It has done essentially nothing (inflation adjusted) in 20 years and dividend yields are pitiful around 1%.

And he could have put down just $8.5k or $17k of his own capital.

PLEASE quit using the negative / clickbait title “Monster in the Mission”. It’s only reinforcing the negative views of the project. “1979 Mission” or “16th and Mission Project” (really anything) would be more journalistic. It’s pathetic that a project that’s zoning compliant with the Eastern Neighborhoods Plan could be referred to as a “Monster”.

How about Elysium?

UPDATE: Monster Planning Commission Meeting in the Mission Next Month