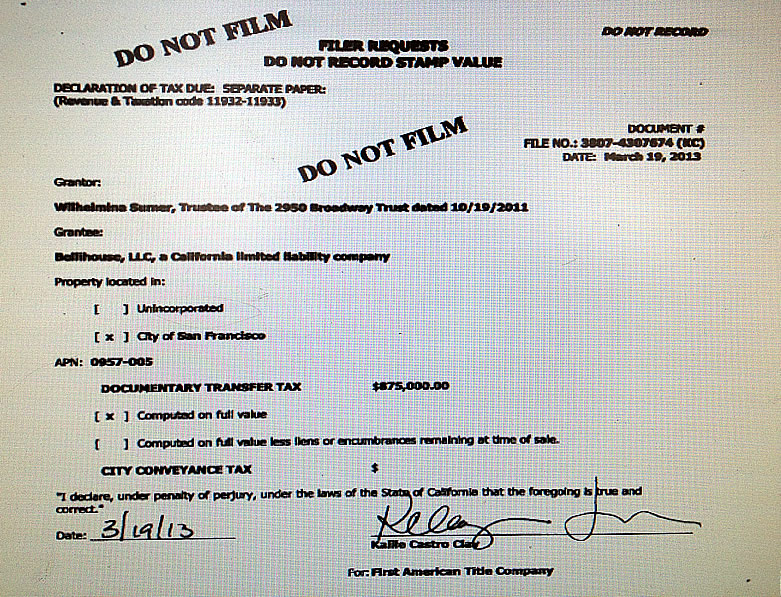

In an attempt to hide the sale price for a property in San Francisco, sellers or their agents have been able to request that the computed transfer tax to be paid for a property, from which the sale price could be calculated, be recorded separately from the deed and hidden away from the public, despite the fact that the tax is intended to be public record.

Earlier this week, San Francisco’s Board of Supervisors unanimously approved an ordinance which will require the transfer tax to be recorded on the face of any deed or similar document, making it easier for the public to find the amount of tax paid for a property and calculate the sale price.

Expect the ordinance to go into effect within the next 60 days.

Sounds great. Why don’t we do this with residential leases too?

Right. Rents should be available to the public too – especially rent controlled units.

I agree. Most of the functions of the Rent Board should be able to go online in a Database 201 Create-Retrieve-Update-Delete record format for landlords and tenants. The tenants get named, protecting the validity of the lease, the rents automatically get calculated at legal limit increases, capital expenditures automatically get depreciated and passed through at appropriate rates and un-permitted units get surfaced, and either legalized or taken off the market. You could have relocation payments pre-calculated for Owner Move In or other No-Fault Evictions. Take uncertainty out for everyone. Landlord and tenant petitions about various issues could be brought on-line.

If we ask for an in-person interview for AirBnB, isn’t it a small thing to bring the normal business on-line?

The hiding the transfer tax amount is a canard anyway. The assessed basis for the building is available on-line at the Recorder’s office for all to see. This ‘written on the deed’ concept will just make it simpler for Zillow and Redfin to machine read, as far as I can tell.

I agree. Now the anti-rent control fighter in me would see it as a way to cross reference high earners (from linkedin, for instance) with low rent and then build a wall of “rich people who pay way too little”

Sorry but totally disagree soccermom! I don’t want the rent board or any other SF agency meddling in my private affairs. Pure and simply- it’s non of their beeswax!

Good idea, and let’s put the income of everyone in SF on the data base also.

yes, the more transparency the better. Who could be against that? The free market and democracy rely on an informed public. All private contracts and purchases should be made public, not just for real estate: employment contracts, medical payments, and of course all government subsides, especially the mortgage interest tax deduction. Clearly most of the functions of the IRS should be online.

The information was already available to anyone who wants to look up the tax records, the prior law just meant that the transfer amount wasn’t on the actual deed itself.

Unless the transfer tax was recorded on the deed, it hasn’t been publicly available. Assessed values can take years to update.

Sounds like a government process problem rather than actual hiding.

The only reason to have requested the transfer tax not be included on the face of the deed has been to hide the sale price.

I agree with you @pity. Mortgage rates are listed on notes that are recorded with deeds, so this could be imputed anyway. In Japan I believe the government publishes a list of the top taxpayers. It would also be help to educate payers on better tax strategies and ultimately get us a system that was more fair.

I thought this was already required under a state law, effective this past Jan 1st.

The state law, which applies to general law cities and counties, did not automatically apply to San Francisco as it is charter city and county.

I disagree and think its generally a violation of privacy. So long as the government knows, records and collects its tax revenue I’m not really sure why the general public should be made aware of sale prices or tax liabilities. I suspect that this will just lead to more transactions being conducted at non-arms length.

What’s the problem with privacy?

“Public opinion is a sort of atmosphere, fresh, keen, and full of sunlight, like that of the American cities, and this sunlight kills many of those noxious germs which are hatched where politicians congregate. That which, varying a once famous phrase, we may call the genius of universal publicity, has some disagreeable results, but the wholesome ones are greater and more numerous. Selfishness, injustice, cruelty, tricks, and jobs of all sorts shun the light; to expose them is to defeat them.”

Personal privacy is great – but the real estate business affairs of millionaires should be a matter of public record – especially where whether they are paying their taxes is concerned. Because nowadays – they often do not pay and the Mayor protects them.

Mr. Mel Murphy…..

Or Mr. Randy Shaw

Credit card bills should be public too.

And confirming my wife spends too much? No I prefer to stay in the dark.