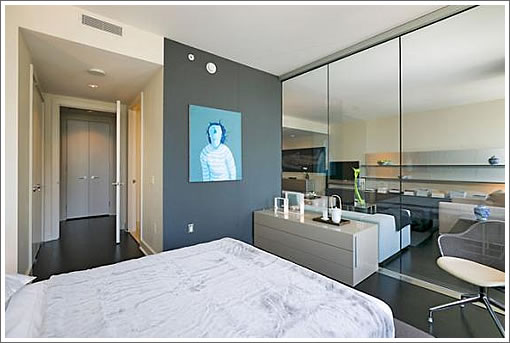

Purchased for $2,250,000 in 2007, remodeled with a wall of glass between a bedroom and living room to provide more light, and then listed for sale asking $2,595,000 in 2008, the rather voyeurlicious™ two-bedroom St. Regis condo #23F sold in a short sale for $1,588,000 in 2012.

While never listed for sale, according to a plugged-in tipster, 188 Minna #23F just sold off-market for $3,500,000, 120 percent more than the seller paid in 2012 and $2,292 per square foot.

Things are officially off the hook.

Oh NO! This makes me begin to wonder if Einhorn is right and we are back in bubble territory?

“Off the hook” indeed!

Of course he is right. But he is also right that this bubble is limited to a small number of stocks, not market-wide (or even NASDAQ-wide) like in 2000 and 2007.

There has already been a lot of deflating – TWTR is almost back to its day 1 price, down about 45%. And I’m just glad that once again the Bay Area found a way to suck billions from Wall Street and Main Street based on little other than hot air.

I was just about to respond to moto mayhem’s post on another thread regarding tech CAPE’s.

Basically as you point out it’s a small number of stocks that are exhibiting bubbly behavior. Big tech, which probably heavily weights tech sector indices, seems at a more normal valuation. I found it very ironic to be comforted by a more normal 22 PE for the tech sector on a thread about Linkedin which is trading at a PE of 710!! (And this is after todays 7.8% drop in price!)

But it’s the 87% of this years IPO’s that show no profit and ones yet to IPO that don’t seem to be making any money that have bubble potential.

Also as you point out, market reaction post IPO has been mixed. With some quicker deflations going on then last time. Castlight health which posters brought up here on SS a few weeks ago regarding its first day pop to $40 has already fallen to $14, which is below its offer price.

As they say, history might not repeat, but it does rhyme!!

Price per square foot sure does seem crazy. Then again SF price per square foot is much less than NYC and decidedly mid range globally. And I would think that the economy here is doing better than comparable cities around the world. So based on that at least, SF does not seem to be horribly over valued.

$3,500,000 ($2292 psf) is mid range for a 2 bedroom high rise condo globally? At this bubbly price you don’t need to think mid range, but can shop in London, Paris, NYC, or even Tokyo. In New York the 2013 average price per square foot for a condo was $1,387, and Tokyo is slightly more, Hong Kong is about $2000 psf, with only the better part of central London (Hyde Park, Mayfair, etc)approaching $3100 a square foot.

Yeah. This rate will practically get you a townhouse in South Kensington. Huge dollars per foot for SF.

Average psf for SF is still well under $1k which is cheaper than comparable cities. So of average SF still has some ways to go. The price of this place is decidedly not average of course.