Purchased for $3,100,000 in early 2005, Penthouse #6 atop the Russian Hill building at 2555 Larkin Street returned to the market last year listed for $3,600,000.

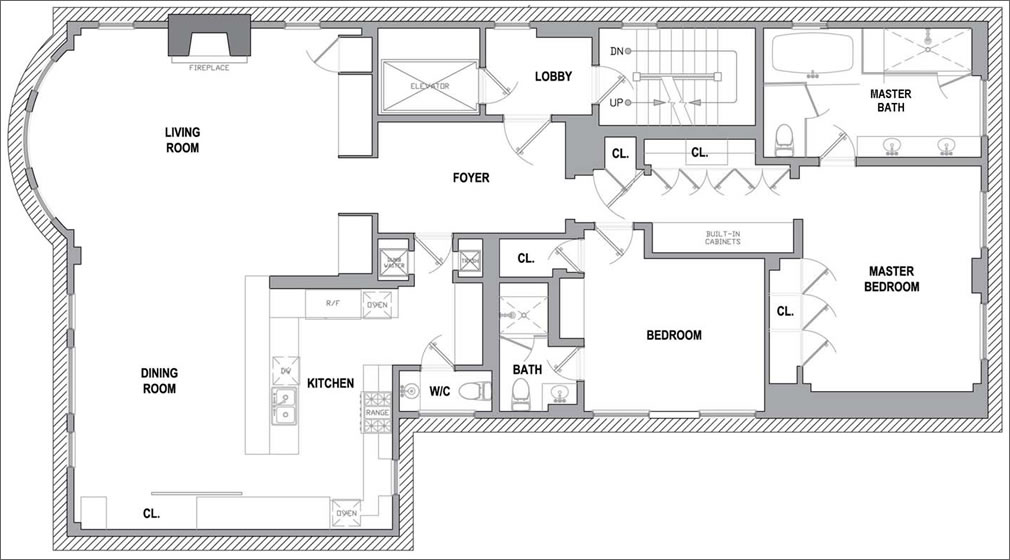

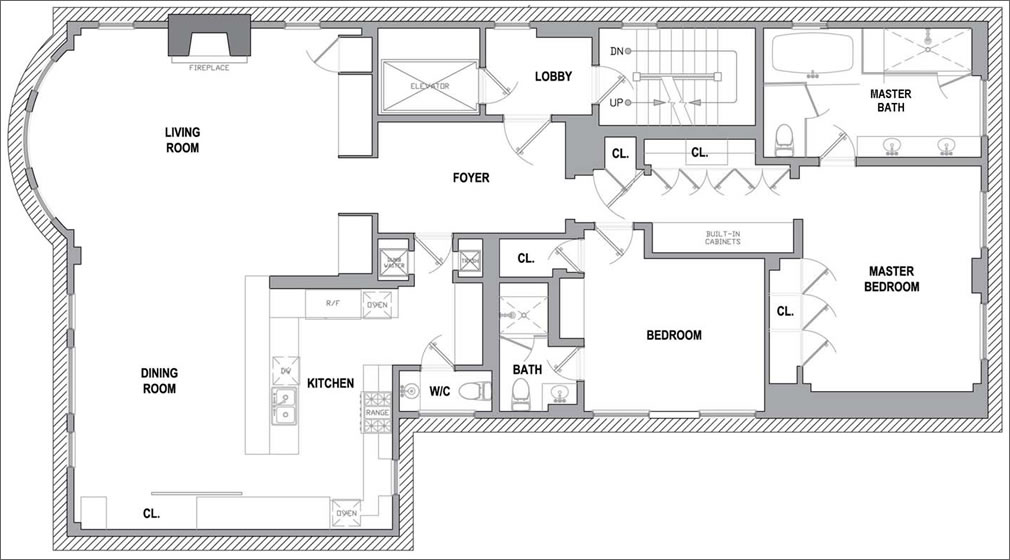

Withdrawn, relisted, and reduced to $3,450,000 in February, the sale of 2555 Larkin Street #6 closed escrow last week with a reported contract price of $3,275,000, a total of six (6) percent over its sale price in 2005 for the “ultimate luxury cooperative penthouse” with Golden Gate Bridge views from the living and dining room(s).

∙ Lurking Behind This Larkin Street Penthouse Wall: The Office [SocketSite]

meaning they lost money from inflation and deal costs. This is not surprising as most of SF is now back up to 2003 or 2004 prices, but not to 2005-2007 yet

Back to the price of 8 years ago less commissions. Lucky they did not buy in 2006-08! With inflation and transfer taxes, this is about a 23-25% real loss (and I’m ignoring 8 years of property taxes, maintenance, etc.). That is actually quite decent considering the shellacking housing has taken.

Housing, yes even in SF, is a lousy investment. By contrast, the S&P is up about 28% since early 2005, and that was with the greatest market crash since the Depression. But they had a very nice place to live, which is a great reason to buy a house. If you buy a home with any expectation of investment value, well, you know what they say about a fool and his money . . .

Yes, because penthouses are always a great jumping off point for making all encompassing “market” statements. LOL. Same as 2003, etc etc.

“This is not surprising as most of SF is now back up to 2003 or 2004 prices, but not to 2005-2007 yet”

Huh? Didn’t this sell in excess of its 2005 price???

Anon, by calculating the real loss for this property I would hope the return you quote for the S&P is also in real terms?

Somehow I suspect not though. You seem very good at adjusting housing prices for inflation, but very bad at adjusting S & P returns for inflation, and then including both the adjusted housing and unadjusted S & P return in the same post, parapraph or sentence…

Sorry, REpornaddict, but yes, I used real returns for the S&P 500, with dividends reinvested which is appropriate for this comparison. Nominal returns since early 2005 are over 50%. This home would have had to sell for over $4.5mm to equal that. Not even close.

“Somehow I suspect not though.” Do a little fact-checking before you go off spouting.

Thanks fot the correction anon!

Is there a good source for this index, with dividends reinvested.

thanks