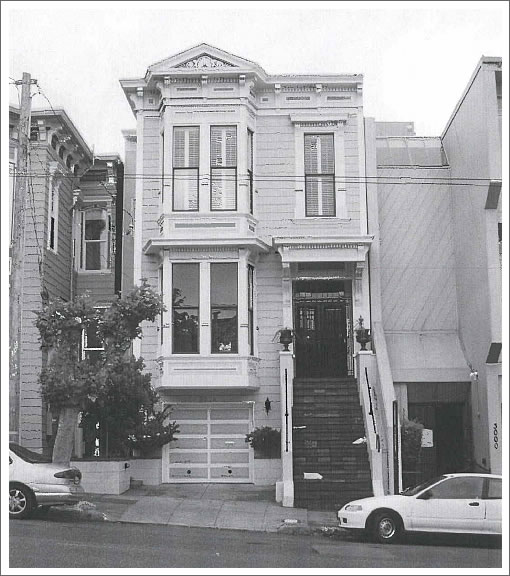

Built as a single-family home, the property at 3014-3016 California Street was converted into a two-unit building prior to 1913. At some point in the recent past, the two units were merged and the building once again became a single-family home, but illegally without the benefit of permits or permission for a dwelling unit merger (DUM).

Purchased for $740,000 in 1990 and refinanced in 2007 with a $1,925,000 loan, by 2009 the Pacific Heights property was in foreclosure and sold on the courthouse steps to a third party for $1,275,100 in June of 2010, configured as a single-family home.

From the current owner of the house who purchased the property from the third party for $1,350,000 this past April and is now seeking to legalize the dwelling unit merger and 3014 California’s status as a single-family home:

The previous owner…had purchased the house in foreclosure in 2010 and had kept it vacant until it was sold to us. He tried to get a bank to help him legalize the building as is, but the banks would not loan due to the fact that the permits showed the building as two units but when inspected, only one unit appears. [The previous owner] was furthermore unable to sell the property – again because banks were unwilling to loan on it. Ultimately [the previous owner] provided financing himself so that I was able to purchase it.

We are interested in making legal what has been done without permits, so that we may live knowing that there is no violation of the law, and so that we are assured that the work done in the past to merge the units was done in a safe manner.

This week, San Francisco’s Planning Commission is scheduled to hear the request to legalize the merger, a request the Planning Department recommends be denied as it doesn’t meet the majority of Planning’s five criteria to be considered when evaluating dwelling unit merger requests:

1. Removal of the unit(s) would only eliminate owner occupied housing. (Project Meets Criterion – The subject property is entirely occupied by the property owner. The building was purchased with the configuration of a single-family house.)

2. Removal of the unit(s) and the merger with another is intended for owner occupancy. (Project Meets Criterion – According to the DR Application, the current owners bought the property with the intention of legalizing the merger and staying there.)

3. Removal of the unit(s) will bring the building closer into conformance with the prevailing density in its immediate area and the same zoning. (Project Does Not Meet Criterion – According to the Department’s records, of the 28 lots within the 150 foot 311 Noticing area that are also within the same RH-2 Zoning District, seven (25%) have one dwelling unit, 12 (43%) have two dwelling units, four (14%) have three dwelling units, and five (18%) have four or more dwelling units. The prevailing density is two or more units; therefore the proposed project does not bring the building closer into conformance with the prevailing density.)

4. Removal of the unit(s) will bring the building closer into conformance with prescribed zoning. (Project Does Not Meet Criteria – The subject property is zoned RH-2, which allows for two units. The merger will bring the legal use of the property from two units to one unit; it will not bring the building closer into conformance with prescribed zoning.)

5. Removal of the unit(s) is necessary to correct design or functional deficiencies that cannot be corrected through interior alterations. (Project Does Not Meet Criteria – There is no record or evidence of what the second unit looked like or where it was located; however, based on how other buildings of this type were divided up, the building most likely contained two flat, one on each floor. Given the lack of information, the Department cannot conclude that the removal of the unit was necessary to correct design or functional deficiencies.)

The City’s stated objective for strictly controlling unit mergers is driven by a desire to retain existing housing and is rationalized by “the fact that existing rental housing stock is virtually irreplaceable given the cost of new construction.” Pay no attention to all the construction cranes currently dotting San Francisco’s cityscape.

And of course, while the applicant’s stated interest in legalizing the merger is to “live knowing that there is no violation of the law, and so that we are assured that the work done in the past to merge the units was done in a safe manner,” it would also allow the applicant to obtain a bank loan and increase the property’s resale value.

What a DUM policy.

There is new rental stock being created. Just not new _rent_controlled_ rental stock.

Crazy.

What would happen if the National Guard bought a pornographic film sudio and proposed to turn it into an Armory?

I assume the new owner bought the house knowing that the merged units were illegal.

I also assume the new owner knew there were no guarantees they could get approvals to make the merger legal.

Regardless of what you think about the policy, the owner went in with their eyes open to the risks.

[Editor’s Note: That’s correct, at least with respect to knowledge of the illegality at the time of purchase.]

We had a similar project and reviewed the 5 criteria with the client and Planning. The particular project is also in an RH-2 zoned area which allows for single family AND multi family buildings, so the question of “does it bring it closer to the zoning” was a hard one to answer since both uses are allowed.

Seems odd that Planning sees it is NOT meeting the criteria for this particular response. I guess technically it doesn’t bring it any closer to conformance, but it seems unfair to give it a negative response out of the 5 categories for simply changing the use to within the overall zoned uses of the site…

Something here is a little weird. There are many, many homes in Pac Heights proper that “had” units in them that have more or less been illegally merged with the main house. I’ve never seen an issue getting loans on these properties. The whole DUM thing is a little ridiculous. I know the PC has an agenda, but the more they try to enforce it, the more owners are willing to break the law and the less new buyers care that an illegal DUM has occurred. I see many homes here with fake “units” in them that will likely never see another tenant.

How hard would it be to add restore them to two units in a way that could function as a single family home also? I’ve seen several large homes that have a “media room” with a kitchen and bathroom and a separate entrance. The property could then be financed as a two unit property which is not at all uncommon. Good luck.

Boo-hoo. I hope the PC throws the book at them. My back of the envelope calculation says these are worth $1+million per condo flat. Suck it up and find a partner for the conversion. YMMV.

Bwahaha, My house is/was in the same boat. Bought originally as a TIC. I bought out my partners downstairs and converted the whole shebang to single family.

Mirkarimi was supposed to help us, but he never followed thru on that promise (surprise)

I laugh at the bureaucrats who would ostensibly even give me a glance over this. If it never gets legally converted back who cares. It really won’t hurt my resale value. Screw em.

The owner should not have bothered going to the Planning Commission. It was a waste of money.

Just live in it as a SFR. Its best resale value is and always will be as a single family home, and there are well known banks in SF who will finance it.

My guess is this was an attempt to quick flip it using foreclosure-purchase-woe-was-me sympathy. Fortunately, the planning department is emotionless when it comes to DUM. Denis is correct, the city has countless “lower level units” that are so closely integrated into the home that its hardly worth the 2 unit designation. Strange things are afoot at the circle k.

I am the owner of this house. Thank you to those who expressed your support here.

For those asking about the financing, it is true that most banks will not loan on a property like this these days – a change since the real estate melt-down. The previous owner was in-contract 3 times, and all three times the deal fell through due to inability to finance. Loans are for a specific number of units (single family home vs 2-unit), and Freddie / Fannie won’t purchase loans where the loan-type doesn’t match the physical layout on the appraisal.

Some local SF banks (First Republic) don’t sell to Freddie / Fannie, and they aren’t concerned with this. But being local they do care about earth quakes and will not loan when buildings have brick foundations (guess what type of foundation this house has).

“3. Removal of the unit(s) will bring the building closer into conformance with the prevailing density in its immediate area and the same zoning. ”

The comparison to ALL properties in an area hardly tells the whole story. There should be some analysis of how this building compares to other buildings like it (whether by size or age), not to apartment buildings with five and more units.

Bravo!

Merger approved by the Planning Commission!

Moore (of course) and Wu opposed.

Could it be that reason is coming to San Francisco?