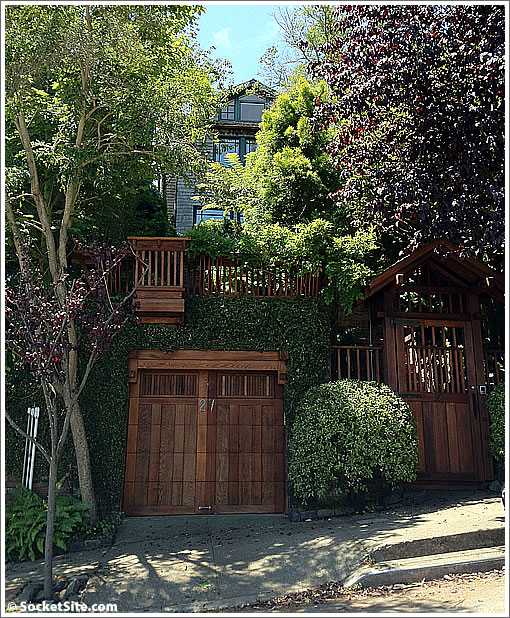

Last month we first reported Armistead Maupin’s 1,606 square foot home was about to hit the market at 27 Belmont Avenue

As we noted at the time, the property had been priced by Bernie “Fifty Offer” Katzmann at $1,198,000, under $750 per square foot for the Parnassus Heights property with views.

As a plugged-in reader noted soon thereafter:

Around this neighborhood the lore is that nice houses go for $1000/square foot. This one counts as nice — not only views, but green outlooks in multiple directions. Plus, the house has gotten a lot of love from somebody with taste. So yeah, there are comps for a 1.6M price.

The sale of 27 Belmont closed escrow last week with a reported contract price of $1,640,000 ($1,021 per square foot). Yes, that’s 37 percent “over asking” yet more or less right at market having simply been priced well below.

Keep an eye out for the press release and postcards, perhaps even an article in the paper!

∙ Armistead Maupin’s Storied San Francisco Home Hitting The Market [SocketSite]

∙ Have You Heard The One About The House With Over 50 Offers? [SocketSite]

∙ It’s Not This Mid-Century Modern Noe Valley Home That Was Flawed [SocketSite]

We’ve been through this before and I always wonder if a property was listed 10% below the expected sales price rather than 30-40%, whether the outcome would be any different. There would be a lot less people wasting their time. Of course, than the realtor couldn’t brag that he had 50 offers and it sold for 37% over asking. I’m tired of this game.

Has socketsite always been so [Removed by Editor]? With so little inventory anything like this should be good news.

[Editor’s Note: If by “[sexist vulgarity]” you mean willing to tell it like it is and not get caught up in press release reporting, then yes, it always has. Heck, we’ll take it as a compliment, but such language from a Realtor!]

94114 – Where do you see the realtor bragging that he had 50 offers over asking and a sales price of 37% over asking?

Fischum, that will be in the postcard that is sent to the neighbors in a little while and then in the puff piece in the Chronicle. Look, he’s a top top producer and his clients obviously have a lot of trust in him as they agree to list their properties well below market so as to generate a bidding war. I’m not a real estate agent basher. It’s just frustrating that so many people waste their time when the list price is not even in the ballpark. A list price 10% below asking would generate fewer offers but probably yield the same result.

The fact that this closed at such an unround number like $1.64 tells me that these were the buyers that tacked on that little extra / squeeze amount to try to make the difference on the offer. And they won. And the sellers got the best price as a result. Someone please explain to me the problem here? $1000+/psf comps in Parnassus Heights.

his job is to sell houses. seems like he’s doing it.

94114 – So you’re just making assumptions, then? OK, got it.

It may be frustrating for some buyers but it’s actually an example of the market working in its purest form. The listing agent is basically asking anyone interested to write an offer for what they think its worth/willing to pay. If you think an offer written at list for this place has a chance in hell of getting accepted, then you (or your agent) don’t know what you’re doing.

Plus I have to think there’s a little bit of fandom in the price as well.

Who wouldn’t want to live in the former home of the creator of MaryAnn, Michael Mouse and Mrs. Madrigal?

Now please pass the bong.

This strategy of listing at a low price only works when the house is appealing to a lot of people who also have the financial resources to pay its actual market price. There has to be an emotional pull to the place to get folks to bid it up to what they all know it should go for. Once there, it might get a boost from ego or competitiveness or the thrill of the chase but it’s rare for the boost to be really big.

I’d be very surprised to see this strategy work for dumpier places. I remember another listing from this agent that was blah and it sold at ask.

[Editor’s Note: The SocketSite Reality Check For CBS’s Infamous “42 Offer” Home.]

In April 2007, my realtor priced my 100% modernist remodeled Palo Alto Eichler for what I thought was 10% under that admittedly overheated market’s price. Four bids warring resulted in a sale at 26% over asking. I can’t help but see the similarity to this example and the others sited here. And the market now is reminding me of 5+ years ago, which I greet with mixed emotions.

crazy, crazy, crazy.

$1,000-1,020 per square foot is market-rate there? Wow, didn’t realize it had gotten that high there.

@Fischum: This is not the market working in its purest form. If the agent wanted that, then he wouldn’t provide a listing price and people could bid whatever they wanted. The low-ball listing is just a sleazy tactic to draw lots of offers. It doesn’t help the sellers (the agent’s client) and, not surprisingly, it pisses off buyers. But as others have mentioned, it allows the agent to claim that he got lots of offers for a house he was selling. Sorry, but if you can’t figure out that pricing things 35% below market is stupid and unhelpful, then you are just lost.

I agree with Fischum. This, in fact, is the market working in its’ purest, cleanest form.

Any seller can make any offer on a property, whether it’s higher or lower than the stated asking price. What if this property were listed at $1.64m and all potential buyers thought it was too high, but there were 50 offers submitted, all UNDER the asking, but perhaps very close to it?

How is that different? In that case the market is clearly working and saying the property is priced too high.

NoeNeighbor – There’s very little difference between listing a property at 35% below market value and asking buyers to “bid” on a property. He’s essentially asking buyers to bid what they think the house is worth and willing to pay.

The only people wasting their time are the people who thought this property might have closed anywhere near the list price. They’re the ones who are “lost”.

So, in other words, screw the buyers. Poor lost buyers who don’t realize that when something is listed in SF, they should expect to pay 35% over the list price. Why not list it at 100,000? You’ll get even more lost buyers. More people to bug their loan brokers for pre-qual letters and more offers for everyone to sift through. The only thing this exercise is about is the agent’s ego.

94114 – No one’s saying that at all. It’s about being able to study the market and ascertain what a reasonable offer might be. That’s what a good agent does. No one’s saying you should pay 35% over list for any property being sold in SF.

@Futurist and Fishchum, why under price by *that* much, though, if not to crow over the large number of offers?

If auction pricing becomes the norm, then please let me never see another “sold x% over asking” stat. *I* know that the sold price is the only thing that matters, but it wastes my time to go to an open house and then realize that the listing price that lured me there has nothing to do with its value. (And no, you can’t always tell this from an online listing.) Multiply that wasted time by buyers and agents who aren’t aware of the micro-markets and put in unrealistic bids––perhaps over asking, but not over asking by this much.

I don’t have a problem with pricing at the lowest end of what you will *accept* for a house––I have done this. But I think it’s wrong to price below what you would accept.

RenterAgain – I think that’s a very valid argument, although I don’t think this place falls into the category of a listing where the list price *may* reflect the actual value (but I can easily see how that could happen).

I also roll my eyes whenever I see or hear any agent touting stats like “X% of my listings have sold over asking!”.