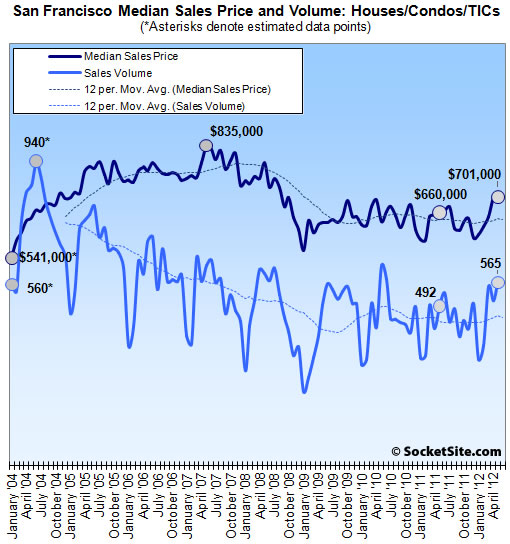

Recorded home sales volume in San Francisco rose 14.8% on a year-over-year basis last month (565 recorded sales in May 2012 versus 492 sales in May 2011), up 11.0% as compared to the month prior but versus an average April to May increase of 14.1% over the past seven years. An average of 643 San Francisco homes have sold in May since 2004 when recorded sales volume hit at 863.

San Francisco’s median sales price in May was $701,000, up 6.2% on a year-over-year basis, up 0.1% as compared to April in which the median was up 6.9% year-over-year.

For the greater Bay Area, recorded sales volume in May was up 26.1% on a year-over-year basis, up 14.8% from the month prior (8,810 recorded sales in May ’12 versus 6,988 in May ’11 and 7,675 in April ’12) on a recorded median sales price which was up 7.5% year-over-year, up 2.6% month-over-month.

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 21.9 percent of the resale market. That was the same as in April and down from 26.5 percent a year ago. The April and May level was the lowest since foreclosure resales were 18.8 percent of all resales in January 2008. Foreclosure resales peaked at 52.0 percent of the Bay Area’s resale market in February 2009. The monthly average since 1995 is about 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 21.9 percent of Bay Area resales last month. That was up a tad from an estimated 21.7 percent the prior month and [up] from 18.1 percent a year earlier.

At the extremes, Marin recorded a 41.9% increase in sales volume (a gain of 95 transactions) with a 2.0% drop in median sales price while Contra Costa recorded a 11.3% increase in sales (a gain of 168 transactions) with a 15.7% gain in median price. The median sales price fell 4.2% in Solano as sales increased 43.0%.

As always, keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) many months or even years prior and are just now closing escrow (or being recorded).

∙ Bay Area Home Sales Up Sharply, Median Price Rises to $400,000 [DQNews]

∙ Recorded San Francisco Sales Up 20.6% In April (Year-Over-Year) [SocketSite]

“Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 21.9 percent of Bay Area resales last month. That was up a tad from an estimated 21.7 percent the prior month and down from 18.1 percent a year earlier.”

How is 21.9% down from 18.1% last year?

[Editor’s Note: Good catch, typo on DataQuick’s side, and since corrected above. The percentage was 18.2 two years ago and 12.5 percent the year before that.]

Awesome!

SF is not seeing as much progress as the bay area generally in terms of sales volume or median prices. But watch the arguments that SF is “really” way better than the bay area case-shiller numbers because, well, you know, because . . .

It’s hard to tell from the chart. What is the general consensus on when exactly we hit bottom?

The 30 year mortgage rate was 4.5% one year ago, now it’s 3.7%. 1-(3.7/4.5)=18%. With a 20% downpayment, the monthly interest payment on a home is 18%*.8=14.4% less than it was a year ago.

Yet the median home price is up only about 6%. Property taxes haven’t changed so that makes the total payment about 11% lower for the same home, but the trend is still down.

What’s “saving” housing is interest rates, and a bit of a dot com 2.0 bubble that appears to be tailing off, though the zynga employees are up 8 cents per RSU in exchange for a lower salary.

“What is the general consensus on when exactly we hit bottom”

well, according to some on here, it’s a rolling 6 months from now!!

But I think in SF it was a fairly sudden, sharp yet shallow and short bottoming around late 08, early 09.

Then a fairly long period of stabilization, although it’s clear the recovery is continuing apace right now.

Would love, love, love to see some inventory numbers as well though..Any chance of this Ed???

@tipster, Why is there always some “exception” as to why things are positive? It is what it is man. I don’t remember you saying, “Sales are plummeting, but it’s only because Zynga hasn’t IPO’d and interest rates haven’t fallen yet.”

When you say “saving” what exactly do you mean? So what would happen if interest rates went to 6%, or 8%? Seems there isn’t a perfect correlation here. Obviously, it would hurt people with ARMs to a degree but the whole second wave of implosion never really materialized in large part due to the rates being low. And who knows if the second wave implosion would have ever come really? Maybe the “bit of a dot com 2.0 bubble” would have been enough to save it?

It’s 2012 now. We’re long past the insanity of 2006,7,8 and the rear view mirror is certainly pretty clear. The rolling six month meme is not accurate. I’m asking a serious question. When was the bottom? The point at which, if we cross it, we will have a new low and can agree that we’re factually at a “new” low point again.

I know it seems a bit crazy to ask a legitimate question on here anymore.

@tipster, Why is there always some “exception” as to why things are positive? It is what it is man

It just lends itself easily to a cartoonish Scooby Doo type conclusion.

“I’d have gotten away with the housing collapse in SF I predicted if it wasn’t for those pesky interest rates…”

It’s 2012 now. We’re long past the insanity of 2006,7,8 and the rear view mirror is certainly pretty clear. The rolling six month meme is not accurate. I’m asking a serious question

Sorry, eddy. That was my facetious answer. But I did follow it with a serious one. I genuinely believe bottom was as farback as late 08/early 09 – thats whan sales, medians, inventories, apples were all looking bad.

It seemed like then that the bottom could fall out of the SF housing market like it did elsewhere, confidence was so shot and vultures were gathering.

But spring came, and it never quite materialized. Thats why I think the prior winter was bottom.

Things *aren’t* positive. Europe, our biggest trading partner, is blowing up on us with no real solutions, cans are now being kicked about one day down the road at a time, China is slowing and the US appears to be heading into, or already is in, a recession.

Rushing into the market now is like rushing into the ocean before a Tsunami when the tide goes out and screaming “free fish!!” Do you get free fish if you do that? Yes you do.

The tide is going out. Interest rates don’t go down 18% YOY in a recovery. Sorry, they just don’t.

Okay. Tsunami. Meanwhile Microsoft is set to announce acquisition of Yammer for $1B. Another local pop for you to mope around about incessantly.

@ tipster: You are probably right that interest rates don’t go down during a recovery, but the fed rate hasn’t dropped in well over a year…so I don’t think they have. Mortgage rates HAVE come down, but that speaks more to a drop in spreads — which is correlated to a recovery in housing. Banks are feeling better about lowering they spread, as they think the worst is behind them.

As for the bottom in SF, I still think it was March/April ’09. I said that last year, and I’m sticking with my prediction.

Eddy – I don’t think you can assume that we have passed the real bottom until the following occur:

1. Europe climbs out of its economic crisis

2. Fed interest rates rise to a sustainable level

… and this implies that our banks clear their books of bad mortgages.

We may have passed the bottom already but until the economic crisis unwinds more it is too early to declare Mission Accomplished. There’s still too much uncertainty on the horizon and political meddling is unpredictable. The looming big election is a major reality distortion field here in our country.

I hope this works itself out without too much drama.

@ eddy – good question

If you look at 12-month sales price moving average, it hasn’t budged much since 2009. We’ve either hit the floor 4 years ago and have been crawling along horizontally since, or, we’ve plateaued and have further to fall…

Curiously, volume has also remained flat over this period. If volume increased, expect prices to fall, and vice versa. Simple supply and demand.

Only time will tell.

Why is the SFGate “home price report” (link in name) total of home sales in 2012 a fraction of that in 2011? Take the Mission for example – 22 YTD homes sold compared to 159 in 2011.

That contradicts the numbers in the graph here.

I’m not making any assumptions about where the market is headed and what theoretical bottom may or may not come our way. Ignore the future for a moment. Let’s look at the past. We have lots of charts. All of these charts show some low point. We are not at those low points in the present. Do we have a general consensus on where the bottom was in the past 10 years. This is not an unreasonable question.

As to what the future holds, Corelogic is out with a new report saying shadow inventory is falling. I’ve linked to a BI story here (note: I consider BI largely useless except for when they simply present facts). I’m not convinced that ‘crisis’ in europe is going to have a material impact on our average joes home buying / power. And interest rates moving to a sustainable level is a red herring. The goverment can obviously hold the rate wherever they like and for as long as is needed.

@ blaise5000

Something is obviously wrong with The Comical’s home price report. If you add up all the 2012 year-to-date numbers, you get approximately 500 sales, which is about 10% less than the 565 sales the above SS chart says sold in the the single month of May.

Maybe they intended to show May only numbers?

DataDude – yes, comical!

They have been reporting these bogus #’s for the last couple months, so it is not a one-time glitch.

“The goverment can obviously hold the rate wherever they like and for as long as is needed.”

Perhaps, but won’t this eventually fuel inflation and affect the real dollar value of property?

Another way of looking at this is if the Fed can keep interest rates low indefinitely, then why have they not done so in the past?

“Why is there always some “exception” as to why things are positive?”

That’s just SocketSite. When things are bad it’s due to fundamentals. When things are improving it’s mix or some other anomaly.

Shadow inventory nationally is now down to Dec-08 levels which is also when I would call the bottom.

^Or you could call it the result of a misallocation of resources, which usually has negative consequences that may not be immediate.

The Socketsite has become way more neutral over the past six months. Maybe someone bought a home? In any event, still no agreement on the bottom.

[Editor’s Note: Or maybe it’s the market.]

As others have said, it has most likely bottomed sometime between very late 2008, and late 2011, but there are credible arguments for either side. Prices have been more or less flat in that timeframe.

It’s impossible to provide an exact bottom, as the numbers are not accurate enough and there are several ways to look at them Is it median price? Average price? price per square foot? something else? And how do you take distressed vs. non in to account? Different people think different numbers are more important, and they don’t all align. Then there’s nominal prices vs inflation adjusted. Lastly, different parts of SF have fared differently, so some of it depends on where you live.

Much of the determination depends on if you are a bear or a bull, with bears generally thinking the date was closer to today, and bulls the opposite. Personally I think the bottom was in late spring/ early summer 2010 due to the massive government intervention (tax credits & down-payment assistance) at that time.

http://dqnews.com/Articles/2012/News/California/Bay-Area/RRBay120614.aspx

“The typical monthly mortgage payment that Bay Area buyers committed themselves to paying last month was $1,491, … down from $1,533 a year ago”

prices didn’t drop, but payments did.

good enough reason for me to wait more.

you are probably right that interest rates don’t go down during a recovery, but the fed rate hasn’t dropped in well over a year…so I don’t think they have. Mortgage rates HAVE come down, but that speaks more to a drop in spreads — which is correlated to a recovery in housing.

You are comparing mortgage rates to the overnight interest rate. The appropriate rate to compare against is the risk-free 10 year. Spreads have certainly come down from their panic-high at the time of Lehman, but they bottomed out in early 2010 and are now increasing.

http://research.stlouisfed.org/fred2/graph/?g=810

What you are seeing with falling rates is falling long dated risk-free rates, not a reduction in perceptions of mortgage risk. The traditional interpretation is that the long dated rates are falling because the market things that zero short rates are here to stay. At least for a long time.

So good news if you want to buy a house and live in it, particularly if you believe your income is secure.

Not so good news about the economy as a whole, though.

Risk free rates may even keep dropping, and I wouldn’t be surprised if mortgage rates kept dropping with them. But the spread isn’t dropping.

I thought a lot of the mortgage rate decrease was due to the decrease in the 10-yr treasury. A lot of that decrease has to do with money fleeing the Euro.

As for the bottom of the housing market, I’d say we are still in it and its been happening since 2009. Basically nominal prices have been bouncing around at about the same level as our 1-2% inflation slowly eats away at real prices.

Don’t forget — this is an election year, and one of the most reliable cyclic behaviors of the economy is that it does well in an election year. You can find a few counter-examples, but not many. But it is all about timing and expectation management. Too much market enthusiasm too early before the election and the whole thing peaks and drops before the vote. Thus, if properly managed, you would expect a period of uncertainly and market depression in late spring/early summer in order to set up the pressure for a solid rebound and enthusiastic market boom running up towards the election. Lots of historic precedence for this.

So, hang on to you hats, it going to be an interesting year, and I seriously doubt that we are actually heading into crisis.

As far as Europe is concerned — yah, it looks scary on the headlines, but look under the hood and what you see is a crisis being manufactured in order to create the right environment for deeper political union. You can only get folks to give up sovereignty when they are scared, so you need fear of the Euro falling apart in order to move to the next step of federalism there. Its hardball high-risk politics as usual, but I suspect that after the deal is signed the emotional content of the news will turn on a dime….. Don’t be suckered into the fear.

Bottom speculators:

The answer according to DQ:

“The median’s low point of the current real estate cycle was $290,000 in March 2009. The peak was $665,000 in June/July 2007. Around half of the median’s peak-to-trough drop was the result of a decline in home values, while the other half reflected a shift in the sales mix.”

(see link above)

Check your rearview mirror.

Hey Robert, nice to see you posting here again.

DQ charts show that the largest gains were in lower priced Contra Costa County, mostly due to the clearing out of distressed inventory. I suspect that there is still an overhang due to inventory that the banks have been holding off the market. Does anyone have any real data on that? This should not impact SF proper too much though.

Throughout the whole cycle, San Francisco county was less volatile than the surrounding counties. This is nice if you are a homeowner here.

The US does a lot of trade with Europe, but mostly with the stronger Northern European economies:

http://en.wikipedia.org/wiki/List_of_the_largest_trading_partners_of_the_United_States

A collapse of Greece or even a recession in all of the EU should not impact us too much. A total collapse of the EU and a continent-wide Depression would be a disaster world wide. Along with Big V, I think a greater fiscal and political integration is in the cards.

I don’t see a greater European union happening. The cultures are too different. Can you imagine Mexico and the U.S joining a fiscal union? Now multiply that by 20+. I think it’s more likely that the Euro will fail in some way, either being split into 2 currencies, or many of the weaker nations leaving it entirely.

I am fairly ignorant on these issues and could be convinced otherwise, but I just don’t see the PIIGS being willing to do what is necessary to be able to continue to exist in the Euro. Look at what has happened since the Spain bailout was announced, Greece and Irelend are already asking to renegotiate to the much looser terms that Spain was granted.

Even if a fiscal union does happen, it will probably take years to hammer out the details of something like that, so the Euro problem is going to be here for a while to come.

last time i saw this chart up the know-nothings were saying realtors were lying about prices being up. Silence now.

the bottom… it depends. South Beach’s was diff than Pac Heights which was diff from Bayview. Overall in SF the chart above shows a clear bottom in Q1 2009. will it go lower from here? retest the ’09 bottom? Or go up? Watch the stock market – that will tell you.

“last time i saw this chart up the know-nothings were saying realtors were lying about prices being up.”

Show me a Quote

https://socketsite.com/archives/2012/03/recorded_san_francisco_sales_up_91_in_february_median_u.html

https://socketsite.com/archives/2012/04/recorded_san_francisco_sales_up_113_in_march_yearoverye.html

https://socketsite.com/archives/2012/05/recorded_san_francisco_sales_up_206_in_april_yearoverye.html

Ha, hangemhi! One thing we know is that median prices are still 16% below 5 years ago, and add 10 1/2% inflation since then to boot and SF is still down by a quarter. Every realtor in town in 2007 would have blown a lung guffawing if anyone would have suggested we’d be seeing these prices in 2012.

As for the bottom, yes, watch the stock market, but also watch interest rates. Close to free lending is certainly providing a lot of support. SF is seeing the same thing that just about every other part of the U.S. is seeing. Nothing unique.

“Show me a Quote”

Oh? No Quote?

Silence now.

Youre Homework is to Think about why Realtor telling a Lie

Aint a great way to show Realtors arent Liars

Extra Credit

Compare and Contrast telling a Lie bout a Blog Post hoping to Get Lucky and be right

With always lieing that Prices are Up and hoping to Get Lucky when there are Up