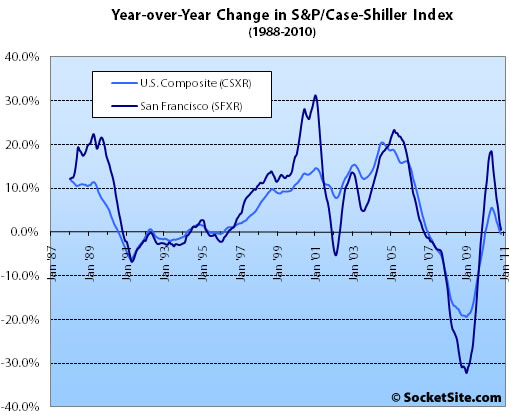

According to the November 2010 S&P/Case-Shiller Home Price Index, single-family home prices in the San Francisco MSA fell 1.2% from October ’10 to November ’10, down 37.2% from a peak in May 2006 and down to a negligible 0.4% year-over-year (YOY) gain, a steady slide from the 18.3% gain reported this past May and down from 2.2% in October.

For the broader 10-City composite (CSXR), home values fell 0.8% from October to November, down 30.3% from a June 2006 peak as values fell 0.4% year-over-year.

“With these numbers more analysts will be calling for a double-dip in home prices. Let’s take a moment to define a double-dip as seeing the 10- and 20-City Composites set new post-peak lows. The series are now only 4.8% and 3.3% above their April 2009 lows, suggesting that a double-dip could be confirmed before Spring. Certainly eight cities setting new lows, and with the only positive news concentrated in southern California and Washington DC, the data point to weakness in home prices,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s.

“With an annual growth rate of +3.5% in November, Washington DC was the strongest market, but still well below the +7.7% annual rate of growth seen in May 2010. The only city with a gain in November was San Diego, up a scant 0.1%. While San Diego, Los Angeles and San Francisco are still ahead from November 2009, their annual rates are shrinking in recent months.”

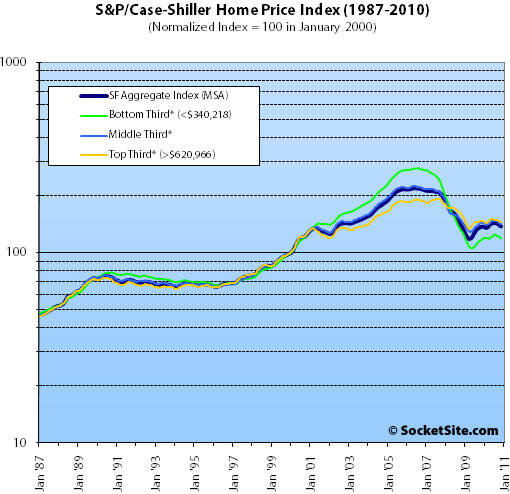

For the fourth time in four months prices fell on a month-over-month basis across all three price tiers for San Francisco MSA single-family homes. And for the first time in a year, home values fell on a year-over-year basis for San Francisco’s top two price tiers.

The bottom third (under $340,128 at the time of acquisition) fell 1.6% from October to November (up 1.6% YOY); the middle third fell 1.1% from October to November (down 1.9% YOY); and the top third (over $620,966 at the time of acquisition) fell 0.6% from October to November, down 0.6% on a year-over-year basis.

According to the Index, single-family home values for the bottom third of the market in the San Francisco MSA have fallen back below September 2000 levels having fallen 57% from a peak in August 2006, the middle third is back below June 2002 levels having fallen 37% from a peak in May 2006, and the top third has retreated back below March 2004 levels having fallen 24% from a peak in August 2007.

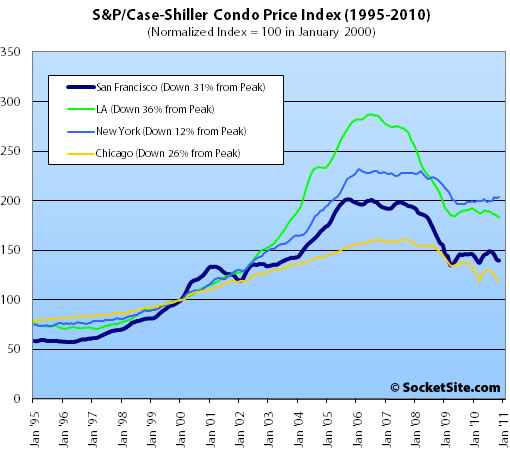

Condo values in the San Francisco MSA fell 0.8% from October ’10 to November ’10 for a 4.5% drop in value year-over-year (down 30.6% from December 2005).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

∙ U.S. Home Prices Keep Weakening as Eight Cities Reach New Lows [Standard & Poor’s]

∙ San Francisco (MSA) Home Value Slide Accelerates In October [SocketSite]

∙ May Case-Shiller: San Francisco Tiers Up But Gains Moderating Atop [SocketSite]

Well, so much for that dead cat bounce.

Over all the MSA this is basically a lost decade. Back to 2002 on average. Locally it’s a different story. 2004 is not such a bad year in terms of prices for the upper tier, but 2000 is the edge of the cliff for the lower tier.

This all follows a trend that we have seen many times in the 2000s: the social polarization that translates into gentrification in the star cities which has its counter-effect in suburban blight. The educated and affluent don’t look for their American Dream in the boonies, but in Noe Valley.

Why is this report at odds with this one?

“LOS ANGELES (AP) — Home prices are falling across most of America’s largest cities, and average prices in eight major markets have hit their lowest point since the housing bust.

The Standard & Poor’s/Case-Shiller 20-city home price index released Tuesday fell 1 percent in November from October. All but one city, San Diego, recorded monthly price declines.

Over the past year, prices have risen in four major metro areas. Prices rose 3.5 percent in Washington, the largest gain. Los Angeles, San Diego and San Francisco also posted gains.”

[Editor’s Note: It’s not. The AP piece is simply a lot less precise. San Francisco posted a negligible 0.4 percent gain on a year-over-year basis (as we noted above) but fell 1.2 percent from October to November, down across all three price tiers for the fourth time in four months.]

Look at the data Sunny Jim and you’ll see there is no inconsistency between the two. SF’s lower tier (under 340k at purchase) saw a 1.6% YOY increase while the middle tier and upper tiers saw YOY declines. The aggregate data show a .4% YOY increase but that’s all at the very lowest tier.

Also, these are Sept-Oct-Nov data. Prices softened during that period and into December, so it’s a near-guarantee that CSI will show YOY declines across all tiers in the next report.

Trulia is now reporting a quarterly RvB analysis on their site. While I’ve not gone into detail with regards to their calculations they are showing SF and 5 other cities being more expensive to own versus rent. I’m not entirely sure they are impartial but at least they are consistent. Should be interesting to see how this plays out. Interestingly, SF is only one ‘point’ from being B/E on RvB. Not sure I buy it for now.

For Sept/Oct/Nov you were getting the cheapest mortgage money we’ve seen. 30yr’s in the 4.25% range at their lowest. They seem to have settled at 4.75% to 5%, but that’s not gonna help. The dead cat bounce is indeed over.

Yeah lowest rates in a lifetime and all we got was this tepid bounce?

If this proves one thing: at the “All you can eat debt buffet”, there’s a point where people have to stop. The Gov’t keeps pushing, the industry keeps pushing, but consumers can’t take anymore debt.

There’s always room for Jell-O.

Just last week many were talking about how good December was. Now you’re going back to November, courtesy the never apt CSI, and summing up with fatalistic talk? Not particularly having htat.

Consumers can take more debt. There are lots and lots of people earning half what they would need to buy a place today. They are renting and are debt free. They’ll take on all the debt they can afford when prices fall further.

The tax credits and then, low interest rates helped keep people who absolutely could not afford to buy today, in the market at the current reduced prices, but those things are now over. There is nothing now but even lower prices to bring the market into equilibrium.

The problem, of course, is demographics. Lots and lots of baby boomers retiring, many of whom had to retire earlier than they thought they would, who NEED the money in their homes. Gen X and Y, however, don’t seem to be in any hurry to buy.

Sit back and enjoy the ride!

@tipster

I thought the problem was the stock market & real estate crashes meant many boomers had to keep working instead of retiring???

“summing up with fatalistic talk? Not particularly having htat.”

The beauty of it is that I made a concrete prediction that will be proven either right or wrong in one month! No subjective anti-Popperian waffling there.

BZZZZZT! Wrong! Interest rates are still low by historical standards (30-year remains under 5%) and holding steady … sales volumes are stable and prices are nominally flat.

The ride down is over …

Interest rates are still extremely low, true. That is why it is remarkable that sales have remained so slow and inventory so high, and prices have continued declining (see CSI post). Rates will climb – maybe not in the next six months but they will.

As for the downturn being over, I doubt it:

http://www.redfin.com/CA/San-Francisco/49-Missouri-St-94107/unit-1/home/1654032

(18% below 2004 price on Potrero Hill, -26% since mid-07)

I do think that the extreme low end will not fall much farther. But the nicer places/neighborhoods have been following the same path as the lesser nabes but trailing by about a year or maybe 18 months. Makes sense given the financing differences between the groups. No end yet in sight to the ride down in the higher tiers.

You predicted YoY. The MLS stats are in for that already.

2010 4621 sales, 2302 SFR 750K median, 2319 condo/tic 650K median

2009 4329 sales, 2185 SFR 745K median, 2144 condo/tic 640K median

But by all means take your non-SF older to newer comparisons that may or may not have renters now and/or other changes instead.

[Editor’s Note: Recorded sales were flat from 2009 to 2010. Or more precisely, down 1 (sale, not percent). Medians, well…]

Jimmy,

Historical standards mean zilch. Where were prices last time rates were +7%? What matters is what people can pay to get into a home, and more importantly, how much they can pay on a monthly basis thereafter. Rising rates do not help this dynamic. I don’t think rates will rise much from here (supply/demand effect on capital), but there will be some impact from that .5% increase.

I believe the nominal ride down is almost over too. Most losses from here will be in real terms. But they will still be losses.

“You predicted YoY. The MLS stats are in for that already.”

No, he predicted YOY for Dec, not the entire year. You realtors are DESPERATE to keep running back to the start of last year when the tax credits goosed sales, but those days are over for GOOD. The first 6 months of the year are ancient history.

As for December, those YOY stats ARE in. DOWN. Hard. Sales down nearly 20%. Inventory up over 17%.

http://www.redfin.com/city/17151/CA/San-Francisco

[Editor’s Note: Recorded sales were down 1.4 percent on a year-over-year basis this past December while listed inventory is currently running 31.1 percent higher.]

Medians fluj? Seriously?

Anyway, here are the YOY MLS median numbers for December: http://www.rereport.com/sf/index.html

SFRs down 4%

Condos/TICs down 6.4%

I misunderstood then. You know that 2009 contained just as much if not more stimuluses than 2010, right? And I do understand your need to use all caps and yell and scream and sing and carry on on here, though. And it remains as off-putting as ever.

Medians? then, medians. Got it. Whatever is convenient. You don’t like median but you set some sort of stock by CSI with its litany of flaws? And I’m pretty sure you and “fluj” never exchanged a single word, “AT the newbie.”

Yes, we know the market is weak and likely to get weaker. Just cause someone questions that doesn’t mean they need to get drowned out and shouted down in an ocean of comments. One positive comment always generates at least 5x in responses of how wrong that person is. I’m all for healthy debate and I know full well first hand the biases of real estate agents. Let’s just leave room for dissenting views. Isn’t it more fun that way?

The rereport AT links shows:

Total sales for SFHs in Dec ’09 at 192 and Dec.’10 at 213.

a few thoughts

1) anybody with any ability to analyze the RE market knew these results would come in this way starting way back last summer. In fact, you can look at my posts back then (summer 2010 when we were hearing “SF is up 18% yoy!!!”) when I predicted exactly what we’d see now (prices softening in October 2010 with first negative YOY print around January 2011.) I hesitate to call them “predictions” because one can simply follow real time data and then construct probable future Case Shiller outcomes from that. (which is what many analysts are doing, most visibly Calculated Risk and Tim Lawler)

2) I disagree with some on this thread that the consumers won’t or can’t borrow more.

The issue is that our Federal Govt and the Fed Reserve have decided that the most important thing is to shovel as much money into the banks as possible.

Thus, almost all interventions are aimed at recapitalizing the banks. (of course, it’s hidden as a pseudo-program to save the homeowners, but that’s just plain lies and Kabuki theater).

in theory, a recapitalized banking system can then increase lending to the community helping the general economy. However, this is not the case when we have a zombified banking system (as we have). Instead, the money simply fills old holes and goes to record banker bonuses.

but our leaders are either unable or unwilling to see this. (or a combo of both).

our leaders do NOT care about unemployment or about housing per se, they only care if it impacts the banks and their biggest political donors. if the govt chose, it could change employment and housing… although it would come with a (possibly huge) cost.

as I’ve said for some time now, housing is a nearly 100% govt-influenced industry. to forecast housing one must be able to forecast the wills of our political leaders (Obama, Senate/House leaders, and our foreign creditors).

this has been the biggest theft in the history of Earth, and most people still don’t see it years later… when the banks are even bigger and more bloated and on continued direct federal govt life support sucking our country dry and shoveling more and more liabilites onto the taxpayer… while awarding themselves bigger and bigger bonuses.

the govt is trying to reblow a bubble as we speak… but can’t get it into housing (because the transmission system of Govt to Banks to Consumer is broken). Therefore instead it goes Govt to Banks to Commodities and Stocks.

which of course raises food and energy prices on the little people. and gives even more profits to our financial oligarchs. which of course is the plan.

but as long as Apple stock is up nobody cares. or as long as people in protected industries (like me, in medicine… or many people in tech, like many SFers) can pretend that they are not going to be relegated to the same forces that attacked Manufacturing in days gone by.

Hmmm….RE Report shows a price drop….DataQuick shows a median drop….CSI shows prices falling….so what about average prices? Or $/square foot? Zestimates?

There must be SOME metric that can be redacted to show prices are rising, right? How about a MACD oscillator or something like that. Maybe going back 10 years just to be safe.

Some banal obfuscation would be helpful as well. Maybe something along the lines of, “Nice homes in good areas continue to sell at attractive prices” or something similarly accurate yet meaningless.

REreport includes areas with large sales volumes outside SF. DQ includes foreclosures and non arms length. CSI is CSI. But you rotely dismiss the MLS figures. OK. Great point.

Recorded sales are flat YoY, but recorded sales of SFR and Condos that are brokered deals (MLS) are up according to my data 10% and 17% respectively YoY. ReReport has it at 7.5% and 14.9% respectively and I don’t know how they pull their data, but the difference is not that important IMO, the trend is what is interesting. What is really down as I pointed on another thread is sales of TICs and 2-4 unit buildings. I would suspect non-brokered condo sales are likely also down significantly. IMO each of these different markets (SFR, Condos, TICs, Multi) needs to be analyzed separately.

Median pricing did soften in December YoY and IMO market has been softening a bit for 6 months, but as has been pointed out here often one must be careful about looking at just one month’s of data for trends. Better to look at trailing indicators IMO. I like 3 month and 12 month to get different views, which show median prices have basically been flat (+/- 5%) for last 9 quarters now.

No statistical measure of a diverse data set is perfect and this includes Case Schiller (CS) as well as median and mean $/SF. As we know CS has the additional “challenge” that it reports on suburban areas that really don’t have anything to do with SF RE.

Finally, I found this annual CS report worth a read. Note: only includes data through Oct report.

Meanwhile [3501] Clay sells in 60 days (long escrow) for $5.575M for 6000 sqft with no view and a MAJOR amount of work required to be brought up to standard. $929/psf. Rent now and be priced out forever! 🙂

This is fun but it’s getting old. Maybe it would be easier if we just got together once a month over drinks. Maybe at one of the new places on Union that have opened up recently and are packed nightly. Wait a sec… I thought Union Street was going out of business? Lot’s of new, packed places over in the Mission too. And Soma/Financial District.

The economic tea leaves are greener than they have been for a long while. But pay no attention to that at all. The Dow didn’t cross 12k today either.

And it’s not entirely unclear that we’re not going to see another homebuyer credit. At some point the gov had to end the previous credit just to flush out the bench warmers. But another credit would bring about a whole new crop of supporters.

I wish there was a way for me to easily link back to my specific comment from last week where I laid out my overall point of view. But, in short, I believed that SFRE market was going to correct, it corrected, and I’ve now shifted to a more neutral position. I tend to post more bullish comments just to highlight the contrarian from what is the predominate voice @ SS.

Not to over simplify, but employment and interest rates are the primary drivers. Government intervention is the third leg of the stool. Given the 2012 elections I don’t see any of these factors trending in a direction that would substantially kill RE.

[Editor’s Note: From the listing for 3501 Clay which closed escrow on 1/21/11: “Elegant home located on a great corner in Presdio Heights. Built in 1904, this home has approximately 6,012 square feet of living space,(per appraiser) plus a partially developed basement of 1,959 square feet. (per appraiser).”]

Like AP, Dow Jones News Wires is reporting “Year-to-year, four metropolitan areas saw improvement: Los Angeles, up 2.1%; San Diego, up 2.6%, San Francisco, up 0.4% and Washington, D.C., up 3.5%.”

Socketsite buries it like this: “down to a negligible 0.4% year-over-year (YOY) gain”. I had to read that three times to understand that what was “down” was actually “gain”. I guess when YOY prices are _down_ 0.4% it will be reported as “negligible” as well?

[Editor’s Note: That’s right, we buried it right in the first sentence employing the exact same structure we’ve used for years (be the number up or down).

The context the AP and Dow Jones News Wires seem to be missing is that the year-over-year “improvement” has been dropping over the past six months, from 18.3% in May to 0.4% in November.

And yes, we’d consider a 0.4% decline to be negligible in the context of much larger declines just six months prior.]

“this has been the biggest theft in the history of Earth, and most people still don’t see it years later… when the banks are even bigger and more bloated and on continued direct federal govt life support sucking our country dry and shoveling more and more liabilites onto the taxpayer… while awarding themselves bigger and bigger bonuses.”

Bravo SF’er. Couldnt agree more. But HOW do we, the little people, change this? A somewhat rhetorical question as I believe this internet themed, hopefully mass movement might be the answer as to how us little people can do something as voting changes NOTHING: “Crash JP Morgan, Buy physical silver”

See here:

http://www.guardian.co.uk/commentisfree/2010/dec/02/jp-morgan-silver-short-selling-crash

Come on, Happy in SF. 0.4% is noise, at best.

I understand why AP and Dow Jones News wanted to round out their reporting with all markets that weren’t negative, but do you really want to argue that less than half of one percent change is significant?

@Happy — I think the sentence is intended to indicate that the YOY gain from Nov 09-10 is down from the YOY gain for Oct 09-10.

Looking at the house price graph it would appear that 0.4% is about 1/150th of the range of the data. That would appear to be negligible.

@lol 7:42 – “This all follows a trend that we have seen many times in the 2000s: the social polarization that translates into gentrification in the star cities which has its counter-effect in suburban blight. The educated and affluent don’t look for their American Dream in the boonies, but in Noe Valley.”

From looking at the price tier data this is not what I would conclude. It would appear that the lower price tier actually did better during the boom. That tier seems to be overshooting on the downside, but it’s not clear if will settle at a lower relative value then the other tiers.

@Legacy Dude — Indeed!

Good points Ex-SFer.

It’s all rigged to favor the big guys and, as usual, the little guys get screwed.

One threat in the future is if/when the dollar is no longer the reserve currency. If that happens then real estate will be a good place to be in at that time. Along with other “real” investments.

I dunno how serious the threat is to the reserve currency status. I have friends rightfully skittish about investing in stocks or real estate and whose 401ks are pretty much all in cash. They think they are safe but IMO are taking a huge risk.

There are deals to be made in RE IMO. But in very selected markets. Certainly California is not one of the markets. The coastal areas are still too pricey and the Central Valley and Inland Empire, though “cheap” will take longer than average to recover. Especially with the jobs situation in California.

tc_sf,

Yes, the lower tier did shoot very high during the bubble, and crashed much faster and deeper than the upper tiers. Now it’s recovering mainly because the basic economics apply 100% to that segment: buy-vs-rent clear and simple.

The boom was strongest in the lower tier, but there was no real cash input. It was almost 100% debt. When the less affluent (who were the ones buying up the ‘burbs) had to come up with real money instead of HELOC money, they stopped paying. right. away. Had the population buying up the boonies be more middle class, they’d have been more likely to suck it up, with a longer term view (illusion?).

In the mean time, some of the affluent and their offspring cashed out from the ‘burbs and fled to the city.

This cycle proves my point. Also proving my point is the massive influx of people coming back from the Peninsula through shuttles. All educated and rather affluent.

[Editor’s Note: Tales From The Courthouse Steps And Contrasts Across Town.]

No doubt about the fact that SF attracted and still attracts educated and affluent people.

Also no doubt that there was an overall trend towards high CLTV loans.

But at this point I think it’s too early to say if the lower tier is just overshooting, since pricing can have momentum as people reduce pricing expectations as they see dropping prices (and vice versa during the bubble), or will settle at a permanently lower plateau.

But you do raise a good point. Taking the theme of “Price is what you pay, value is what you get”, the pricing issue has been quite thoroughly discussed. And while I think that macro pricing issues ( price/rent, employment, interest rates,…) will dominate the housing market for the foreseeable future, it is at least interesting to consider value issues. i.e. In the last decade has the desirability of SF improved vs the burbs? More micro, will the mission continue to gentrify? Will Bernal backslide? Will the long up-and-coming Bayview actually up-and-come?

Note again, I’m talking about value here, not price. Unlike some blue-sky dot-coms, Cisco was and is undoubtedly a real valuable company but yet people who paid peak pricing of $77/share still lost a considerable amount of money. Had they bought with the leverage typical of RE transactions they would undoubtedly be completely wiped out.

tc_sf – on your value question I think that SF as a whole has increased in value due to an increase in jobs (Mission Bay and SOMA) as well as the aggregate effect of gentrification.

On neighborhood gentrification I think that many ‘hoods : Noe, Bernal, Richmond, West Portal, etc. have ratcheted up a notch or two from their blue collar roots. However I think that they will slide back from their “prime” values though I doubt they will ever return to the original values.

As for “up and coming Bayview” I think a more likely candidate is the Excelsior. It has housing stock that is almost identical to South Noe/GP yet it is still somewhat of a family neighborhood and much lower crime compared to BV/HP.

Yup, that’s some prime basement space.

http://www.mapjack.com/?HbAnWWAubFsE

[Editor’s Note: Yeah, we can’t imagine home theaters, au pair quarters, or space for a decent wine cellar would be of much value in this neighborhood.]

It’s impossible to quantify what portion of price increases were attributable to fundamental changes (more jobs, higher salaries, gentrification, etc.) vs. bubble mania. That said, several of the city’s neighborhoods haven’t really changed much in the last decade. Seriously – how different is the outer Sunset today vs. 2001? Has the fog suddenly become luxury fog, thus justifying a permanent increase in home prices?

That’s why I continue to think buy vs. rent, although not perfect, is still the best overall metric for determining fair value for any piece of real estate. This, of course, assumes rents are relatively stable and properties are comparable. More importantly, it only works when the mortgage market does. We currently have a nationalized zombie mortgage market in this country, which has done more to keep home SF prices stable than any tech stock option grants, IPOs, or overpriced scene restaurant openings.

“i.e. In the last decade has the desirability of SF improved vs the burbs?”

Not if you have school-age kids.

“This all follows a trend that we have seen many times in the 2000s: the social polarization that translates into gentrification in the star cities which has its counter-effect in suburban blight. The educated and affluent don’t look for their American Dream in the boonies, but in Noe Valley.”

I think this is oversold or at least an oversimplification, and what we’re seeing is two different types of suburbs. The historic suburbs like Oakland, Berkeley, Palo Alto, Fremont, and San Mateo, just for example, will be just fine. People with families will appreciate the better schools, the better commutes, and the better amenities in some of those places, in addition to more space. More importantly, those places have more jobs these days. San Francisco is no longer the job center that it used to be, and companies have spread out over more of the Bay Area starting in the 1980s or so. Even somewhere like San Ramon (http://www.ci.san-ramon.ca.us/gprc/draft-gp/gphousing.pdf — see page 11-25) has a large number of jobs, and many of those jobs are with good companies.

It’s the Antiochs, Morgan Hills, and Tracys that are not job centers that are more problematic. The exurbs (by definition commuter communities) and the far out suburbs are the ones where populations are moving out. These further out places were largely funded on funny money. Someone mentioned the cratering in parts of the Inland Empire earlier, and many of those parts are in this category, but somewhere like the San Fernando Valley, where there are plenty of jobs, will be just fine.

@TMOD — For particular hoods, I think that Noe is firmly entrenched as a desirable place to live. Parts of Bernal seem very nice now, but given the housing stock, the projects and being surrounded on a few sides by much less desirable areas I’m less certain as to what will happen. The Mission seems like a great destination, but has never seemed very family friendly to me so I consider it more likely then not to de-gentryfy to some extent. To me the Richmond has always seemed to be a bit of a pseudo-suburb. I didn’t see that change much during the boom. West Portal also seems a bit suburban, but a notch or two above Richmod. I don’t think either will change much.

I mentioned Bayview since people seem to be perpetually talking about it being up-and-coming, I haven’t looked much at Excelsior but I’ve heard others mention it. I’ll have to keep an eye on it.

@Legacy Dude — I was in no way attempting to justify the run up in pricing. In my mind the macro issues of bubble pricing, credit, etc absolutely swamp any value changes over the last few years. Some attempts to rationalize large price changes with small value issues such as “kitchen has been cooked in” border on the ludicrous. I also agree that price/rent is a very good metric to look at. The Belvedere house feature here recently illustrated that even at the very high end, rental equivalents can be found.

The pricing issue has been hashed out quite a bit though and while they are entitled to their opinion, I find little merit in the arguments of the minions of medians. But the value issue seems less debated and far more subjective then that of pricing.

Regarding the mortgage market, the best proposal I’ve seen so far involves slowly raising the “price” Fannie and Freddie charge by 5 basis points every quarter. Thus slowly making private market loans more competitive and also slowly reducing the risk to taxpayers.

@sfrenegade — The issue with family’s is quite a good one. As the remnants of the dot-com influx age it will be interesting to see what they do.

“kitchen has been cooked in” border on the ludicrous.

Between that and the “transit friendly now busy street in the future” take yesterday I see you’re slipping right into the Socketsite bears’ disingenuous paraphrase meme. too bad.

@anon —

“applestoapples,

Here is a question for you, What is the difference between a brand new house and a hause that someone lived in for 3 years cooked in 5 days a week, stained the carpet, scratched the floors, dinged up the walls, put stickers on the doors, etc.

A: Nothing, it’s a perfect apple.

Posted by: sparky-b at December 17, 2010 7:51 AM”

The attempt to bring what I consider normal wear and tear issues into the pricing discussion particularly stuck in my mind. I remember a long time ago arguing with landlords about these sorts of issues when attempting to get a return of a security deposit. And while at the time a ~$1000 security deposit seemed like all the money in the world, the scale of these issues hardly seems relevant give the price changes exhibited on this site.

Looking at the word “disingenuous”

disingenuous |ˌdisinˈjenyoōəs|

adjective

not candid or sincere, typically by pretending that one knows less about something than one really does.

If one assumes that the original poster knows the cost of removing stickers from doors, the characterization of disingenouity is perhaps more apt for him then I.

It was my belief that I, in fact, know much more about the pricing issues being discussed then the “dissenting views” that lead me to try and get a discussion going about value issues about which I know less (But do have opinions on).

Interestingly, CR just posted on the very question of changing tastes regarding urban vs suburban living. Albeit for Las Vegas.

http://www.calculatedriskblog.com/2011/01/housing-what-generation-y-wants.html

@ [Editor’s Note: Yeah, we can’t imagine home theaters, au pair quarters, or space for a decent wine cellar would be of much value in this neighborhood.]

I agree! I’m just sorry it wont be an Apple when it comes back in 2013. All snark aside, I think the basement sq/ft is likely very low and would require some major dig out to ever get it to qualify as habitable space. Cheers.

From the CR post to which tc_sf links:

“[T]hey may want the urban experience now, but eventually they’ll marry and have children and want to live near good suburban schools and have a bigger home with a yard.”

That sums up SF and the bay area to a tee. It’s why SF’s school-age population is among the lowest in the nation (if not the lowest) and far more people in the bay area choose to live outside of SF than in it. This is also relevant to a point I’ve often raised which is that SF home prices are certainly affected by those in the neighboring towns as many buyers will readily substitute one for the other, depending on price.

Providing one part of a definition now too? or even the whole definition thing in general? yeah. like I said. Too bad. “had been cooked in” — pretty flat and minimal. Not what you elaborated it into subsequently.

Were I to provide people the following link to Google’s definition of disingenuous and then add some comment about how I see your point that definitions #2&3 could be construed in a different light, then mock surprise that in fact there are no definitions #2&3 and that I indeed quoted the definition in its entirety (from my mac rather then google, but can’t link to Dictionary.app). That would be disingenuous.

Were you to be aware that I in fact quoted the definition in it’s entirety but pretended otherwise, that would also be disingenuous.

http://www.google.com/dictionary?q=disingenuous&langpair=en|en

“or even the whole definition thing in general? ” As in many other things, striving to be overly precise in language has limited value. I certainly swap my effects with affects with abandon. But in this case it seems your usage was completely backwards.

While excessive precision may not be useful, having an overt disdain for data, facts, definitions, statistics,… is perhaps a bridge too far.

For the “OK CSI is way down but SF is different” crowd, take a look at the Ritz:

http://www.redfin.com/CA/San-Francisco/690-Market-St-94104/unit-1502/home/21967222

Looks like it’s down ~45%. From around $1.5mm per tax records to $805k, $674/sf. Yeah, everything in SF is not down that much, but that’s the direction we’re still moving in.

[Editor’s Note: With respect to 690 Market #1502: Puttin’ On The Ritz (And Pressure) At Under Eight Hundred A Square and Ritz-Carlton (690 Market Street) At 39 Percent Off This Afternoon.]

From the LV Sun article referenced by the CR post,

“Another key feature of young housing consumers: They are carrying mountains of school debt and have entered the job market during the worst economy since the Depression. The upshot: They need cheap housing and will likely be renting long before they can afford to buy.”

http://www.lasvegassun.com/news/2011/jan/25/millennials-want-what-not-there/

While I think there may be some real trend of people valuing city living more highly then in the past, I do think that this is most acute in the young and maybe the retired. The young aren’t necessarily in a great financial position, so it will be interesting to see what the retired do.

Note that if the info for 690 Market #1502 posted by A.T. is accurate, this is a decline in value of ~$700k.

It is in this type of context that I would posit that nearly any wear and tear would be immaterial to the eventual price decline. Were someone to figure an ROI for this property (had it not been lost to the bank) including selling costs and cash flow vs equivalent rental during the holding period, I imagine that the cost to correct any wear and tear would be even smaller in proportion to the realized loss.

No, wear and tear is not the culprit at the Ritz-Carlton properties. Agreed.

But in this case it seems your usage was completely backwards.

I meant “insincere.” It’s front and center in everything you provided.

The CS report linked to by Skirunman above is quite interesting.

They seem, at the very least, skeptical that the tax credit caused any long lasting improvement in the national market.

“After some signs of recovery in the spring, home sales, housing starts, and home price appreciation moved back to, or close to, record lows during the latter half of 2010. After moderating in late 2009/early 2010, inventories of unsold homes, as measured in both units and months’ supply, are back up at levels witnessed in 2008 when the housing market was in the midst of its crisis. Mortgage delinquency rates and new foreclosures continued to increase in both the prime and sub-prime loan markets and the national unemployment rate remains high, fueling further speculation about the strength or duration of any recovery in the housing market”

Charts 4&5 comparing the performance of different regions are also interesting. Detroit for example, barely participated in the boom, but yet seemed to be getting hit hard on the downswing. I would posit that Detroit has seen quite a drop in actual value.

In charts 8,9&10 they address the issue of the differing performance of the three price tiers. Comparing Denver, where they performed similarly, to SF, where the low tier boomed more and is busting more, to NYC where the low tier boomed more and has stayed higer then the other two tiers.

They also in chart 13 address the issues with Seasonal Adjustment and why they currently consider SA data to be less reliable then the NSA base data. Feb-Mar and Aug-Sep seasonality appears to have experienced a particularly pronounced change.

“this has been the biggest theft in the history of Earth, and most people still don’t see it years later… when the banks are even bigger and more bloated and on continued direct federal govt life support sucking our country dry and shoveling more and more liabilites onto the taxpayer… while awarding themselves bigger and bigger bonuses.”

ex-Sf’er, could you elaborate? I think I have a rough idea but want to know specifically what part you are talking about? or gil. . . .thanks.

“It is in this type of context that I would posit that nearly any wear and tear would be immaterial to the eventual price decline.”

tc_sf, I appreciate your defense of the comment, but don’t get yourself a hernia trying to ward off the trolls. sparky-b’s initial comment completely ignored the completely basic “sprucing up” smart sellers do when selling a house. Fresh paint, refinished floors, and new carpet still don’t disqualify a house from being an apple because this is baby stuff.

@sfrenegade — Point Taken!

@nanon, Gil, ex-SF — Here’s a link to the blog were I saw what I consider to be a pretty reasonable proposal to wind down the government interest in Frannie by slowly increasing their pricing:

http://www.nakedcapitalism.com/2011/01/john-hempton-what-to-do-with-fannie-and-freddie.html

Can’t hurt to write your congressman.

In my view, making loan guarantees is like writing a bunch of checks. The bankers may figure out ways to get and cash the checks, but stopping that is a game of whack a mole. Better to prevent the checks from being written in the first place.

If you want to get really mad, you can read how we, the taxpayers, have spent $160M defending Frannie execs from lawsuits!

http://www.nytimes.com/2011/01/24/business/24fees.html?_r=1

tc_sf,

You’re quote me above and are still going on about it like I claimed it made for the majority of the loss on the property. That’s not the case and I am not someone who says values aren’t down a sizable percentage from peak.

My post was in regard to a question from applestoapples about why I don’t think they are perfect matches. I don’t, you can, that’s fine. I never said it added up to a drop in value of $240K or $700K. By no means do I think that stickers cost that much, but they do cost a stripping and a paint job which isn’t free.

How about you look at it this way. You buy a new construction house and stay there for 5 years. The whole time you are there everything is under the builder’s warranty. You sell, the house looks the same, no stickers even, but the warranty is gone. Apple, yes. Did it lose value, yes.

@sparky-b — For better or for worse, the kitchen comment made quite an impression back when I read it. I had not remembered who wrote it until I just searched SS.

While I still think this makes a good example of being careful to compare the scale of value changes with any corresponding price changes you believe they cause, it was anon’s linguistic liberties that warranted further comment, not your original post.

Really, it’s different this time… or maybe not. Check out these CS Composite-10 numbers showing the relative minima of each seasonal cycle post peak in the 1990s.

April 1991: 76.86

March 1992: 77.31 (hurray, we’re rising) *

April 1993: 75.83 (uh-oh)

Feb. 1994: 75.63 (da bottom)

*Feb. 2010? (time will tell!)

According to Redfin, the sale of 3501 Clay was not an arm’s length transaction. Maybe this is why it sold so fast?

@happyrenter, Where does redfin say that re 3501 Clay. Redfin also lists the home at 4760 square feet. As far as I know redfin gets its data from the MLS which has the accurate information. Also, 60 days is not particularly fast. It also looks like they had a garage sale on 1/15 per an expired craigslist post found on google. Most likely an estate situation.

3501 Clay was arm’s length

So given all that, the question I have is – for say condos and sfd homes from say 600-850K, so middle range, in places such as Cole Valley, Ashbury, Inner Sunset and Inner Richmond, North Beach (if any), will they go UP or down or remain the same in 2011. I am living outside the US now (for 15 years) but would like to buy a place to retire in SF. Thus if the prices are going back up (and interest rates will also) then I need to buy and rent (and take the monthly loss)…

@Michael — just ask Mr. Tipster — he has all the answers when it comes to real estate.

Well, I will go on a limb there and say that Tipster will tell you that you shouldn’t buy…

But first off, if you KNOW you’ll take a monthly loss on a rental upfront, it’s not a very good sign. Rentals have a way of costing more than you expect while bringing in less. If you have a negative outcome right off the bat, you’ll be making a bet and all bets have a risk. As long as you’re comfortable with that, it’s fine. But if your family depends on a positive outcome, look for a real bargain and do your due dilligence. Not everything will appreciate the same way in the future.