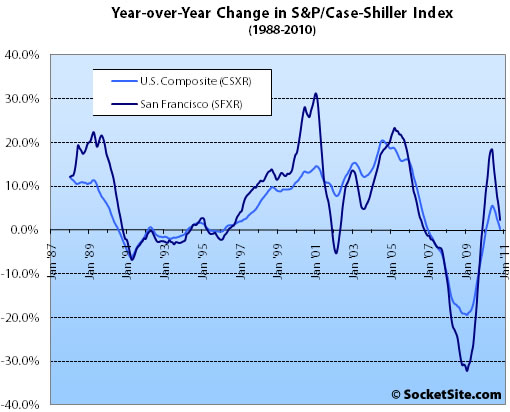

According to the October 2010 S&P/Case-Shiller Home Price Index, single-family home prices in the San Francisco MSA fell 1.9% from September ’10 to October ’10, down 36.4% from a peak in May 2006 and down to a 2.2% year-over-year (YOY) gain, a steady slide from the 18.3% gain reported this past May and down from 5.5% in September.

For the broader 10-City composite (CSXR), home values fell 1.4% from September to October, down 29.7% from a June 2006 peak as the year-over-year gain slipped to 0.2%.

The double-dip is almost here, as six cities set new lows for the period since the 2006 peaks. There is no good news in October’s report. Home prices across the country continue to fall.” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s.

“The trends we have seen over the past few months have not changed. The tax incentives are over and the national economy remained lackluster in October, the month covered by these data. Existing homes sales and housing starts have been reported for both October and November, and neither is giving any sense of optimism.

On a year-over-year basis, sales are down more than 25% and the months’ supply of unsold homes is about 50% above where it was during the same months of last year. Housing starts are still hovering near 30-year lows. While delinquency rates might have seen some recent improvement, it is only on a relative basis. They are still well above their historic averages, in both the prime and sub-prime markets.

For the second time in three months prices fell on a month-over-month basis across all three price tiers for San Francisco MSA single-family homes.

The bottom third (under $342,388 at the time of acquisition) fell 1.4% from September to October (up 4.6% YOY); the middle third fell 2.2% from September to October (up 0.4% YOY); and the top third (over $624,623 at the time of acquisition) fell 1.3% from September to October for a negligible 0.1% YOY gain.

According to the Index, single-family home values for the bottom third of the market in the San Francisco MSA have fallen back to September 2000 levels having fallen 57% from a peak in August 2006, the middle third is back to June 2002 levels having fallen 36% from a peak in May 2006, and the top third has retreated to March 2004 levels having fallen 24% from a peak in August 2007.

Condo values in the San Francisco MSA fell 3.4% from September ’10 to October ’10 for 3.4% drop in value year-over-year (down 30.0% from December 2005).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

∙ U.S. Home Prices Weaken Further as Six Cities Make New Lows [Standard & Poor’s]

∙ September Case-Shiller: San Francisco MSA Slide Continues [SocketSite]

∙ May Case-Shiller: San Francisco Tiers Up But Gains Moderating Atop [SocketSite]

∙ Homebuyer Tax Credit Extension For Closing (Not Contract) Date [SocketSite]

∙ Existing U.S. Home Sales Pace Up 5.6%, Down 27.9% Year-Over-Year [SocketSite]

Look for this to continue. This report measures August-October and does not fully reflect the recent big sales declines. November volume continued to fall off the cliff, and December is shaping up with further big YOY declines, particularly for condos/TICs.

I know this measures the MSA (and is suspect as has been often hashed out here). But let’s not pretend that SF proper is any different. Here in SF, inventory is way up and sales are way down. You know what that means for prices.

So, up from last year?

[Editor’s Note: As noted above, the Index suggests values are up 0.1% for top tier single-family homes on a year-over-year basis (down 3.4% for condos). The same index, however, also says top tier single-family values remain down 24% from peak (down 57% for the bottom tier, down 30% for condos) and have been falling over the past three months.]

Hmmm…. So that’s how high a dead cat can bounce when you whistle up 9T dollars out of nowhere and deploy them to prop up the market.

No major disagreement with c/s here. Lots of intervention in the numbers and still more intervention to come. Hard to know for certain if this is the dead cat bounce/double dip, or if we are just at a point of the long sideway slide. My best guess is that we’re on the sideway slide with slight decreases yoy for a few years. And for the record, I do think that SF prime is ‘different’ to some extent; not immune, but will fare better overall.

nicely “spun” article

“The sky is falling! The sky is falling!”

“Oh no! How bad is it?”

“A 2.2% YOY increase in prices!”

“Um, ok. Thanks for the update…”

Dave… just take a look at the top chart. Think it’ll be long before your 2.2% YOY gain is underwater? The slope of that decline looks about as steep as the cliff diving that we saw in late 2008.

Reminder:

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it!”

Dave, it does indeed show a 2.2% YOY gain for SFRs. But that’s all at the bottom tier (under $342k at purchase, up 4.6%) while the middle and top tiers are flat YOY. And condos are down 3.4% YOY.

Find me an “apple” in SF that shows a YOY gain. Try to sell your house at an October 2009 price and see how many offers you get!

But as as been noted, this is August-October data. Just wait another month or two. The trend is plain as day. The 2009 “bottom” has already been shown to be a false bottom in SF as many, many apples highlighted here have demonstrated. The CSI numbers will confirm that soon enough for those who prefer that measure.

The slope on that second chart was scary from ’07-’09, and then the government pulled out all of the stops.

But the government seems less interested in propping up home prices any longer and you can see the scary downward slope starting all over again.

Should be fun this winter when you see the effects of 5% interest rates as compared to the 4.4% average you see at the end of this graph. A 10+% drop in prices is required to equalize the monthly payment to what it was when interest rates were 4.4%, and that has pushed a bunch more sellers into negative equity.

I suspect this is what they’ll keep doing now. They’ll try to hold at 5% as long as the Chinese let them, and let the market shake out for six months to a year, then allow it to rise to 5.5% and repeat the process.

Each time they do this, recent buyers sacrifice half or all of their downpayments and then the process starts again.

If you just let prices fall, no one buys anything and the rich and powerful holding the mortgages take all of the loss until prices reach their natural equilibrium point, which you can see from the second graph, is around 1996 pricing. The way they are doing it is much smarter: it lets individuals (who have zero political power) take much more of the loss and so the rich and powerful won’t take nearly the hit.

And don’t forget that every time someone buys a house using a mortgage the potential loss from the old mortgage, which is on the books of private companies, gets transferred to the new mortgage where fannie and freddie (i.e. taxpayers) are on the hook for the loss.

1996? I’m as big a bear on housing/the economy/the world as anyone, but 1996 seems a bit pessimistic. A lot has happened in the Bay Area since that time, and 1995/1996 is generally regarded as the trough, in real terms, of the last housing bubble/bust in the late 1980’s.

Having made that point, there is no telling where an over-correction could take things. Lots of folks bought recently, including myself, thinking things had at least stabilized. 2011 could be a rude awakening.

“First Published: December 28, 2010 6:15 AM”

The perma-bear renter seems to have woken up early for this… like a kid on Christmas day.

^Man, the market must be bad if the best you can do is to complain about the time of the posting.

Things must be worse than I thought.

the perma-bear/christmas post was pretty funny.

Too bad you can’t change the domain name to http://www.schadenfreude.com

Since at the end of the other thread there was a bit of discussion of which metaphor is apt and I personally prefer the “slow motion train wreck” cliché, when I noticed that the Los Angeles Times had posted an update to their in-house Money & Company blog about the Case-Shiller numbers release, this quote jumped out at me:

Emphasis added. I don’t share the contrarian opinion, but hey…train metaphor FTW!

diemos —

I think you nailed it–the toxic MBS and CDOs on the banks’ books can’t be transferred to the taxpayer wholesale, so it has to be done retail, one mortgage at a time. Thus we have the “bailing out” of the banks (but with inadequate cash, because the toxic assets’ book value is just too damned high), and the simultaneous propping up of the housing market to enable at least some bleed-off of 2004+ vintage mortgages.

Now I know how long these perverse policies will continue.

It is interesting to see how sf has held up better than some other areas. I am currently looking at a place up in the gold country that is 40% under its last sale price in 2002, and 70% under an almost identical house that sold in 2005. Some areas of CA are back to late 90’s pricing even if sf isn’t there yet.

It’s good to see the index heading back down. We should see new lows in the SF MSA by mid- to late-2011. I’m not sure we’ll get all the way back to 1996 pricing, but 1998-99 prices for places in the city should be pretty commonplace for those willing to wait a few more years.

Two new ill-conceived, albeit well-intentioned, new state laws should keep the supply of distressed homes humming. First, those facing foreclosure in Cal. now have a tough time getting lawyers to fight the big banks. A new anti-fraud law prohibits lawyers from accepting any payment unless and until they succeed in fighting to action. Thus, no decent lawyer will take on such cases, leaving most people unrepresented. Second, a new state law requires lenders in most cases to forgive all security on a short sale. Thus, there will almost certainly be fewer short sales approved as it will often be simpler to just foreclose.

CSI got all screwed up when foreclosures dominated the sales stats. Look for a return to that in 2011.

the san francisco msa is so large and diverse that this data does not reflect what’s going on in all neighborhoods.

what’s happening in far flung exurbs like fairfield antioch and brentwood where houses cost $250,000 is very different than urban core neighborhoods like sea cliff,st francis woods or other areas where families make $250,000+ a year.those areas have seen no or minimal price drops while brentwood has seen 50% price drops. the demographics are completely different when it comes to education,unemployment,and financial recources.

“far flung exurbs like fairfield antioch and brentwood where houses cost $250,000 is very different than urban core neighborhoods like sea cliff,st francis woods or other areas where families make $250,000+ a year.those areas have seen no or minimal price drops while brentwood has seen 50% price drops”

meep, take a look at:

http://www.redfin.com/CA/San-Francisco/66-Sea-Cliff-Ave-94121/home/604530

http://www.redfin.com/CA/San-Francisco/200-Santa-Clara-Ave-94127/home/1928169

Sea Cliff down 27% from 2004. St. Francis Wood down 28% from 2005. Yes, it is not 50%, but your “no or minimal price drops” theory is all bunk. The “SF is different” notion went to pot about two years ago. Tell me, how many buyers in Fairfield, Antioch or Brentwood lost $900,000 on their home purchase like the St. Francis Wood place? Guess those Sea Cliff and St. Francis Wood buyers aren’t so smart or immune after all.

“Sea Cliff” instead of 66 Sea Cliff and “St. Francis Wood” instead of 200 Santa Clara …. seriously, why do you always do that on here? What’s so fun about that particular trolling method?

according to zillow and trulia the people in seacliff are “smart or immune”

http://www.trulia.com/real_estate/Sea_Cliff-San_Francisco/1459/market-trends/

“Sales prices have appreciated 36.7% over the last 5 years in Sea Cliff, San Francisco”

full text below.

Sea Cliff SummaryThe median sales price for homes in Sea Cliff for Sep 10 to Nov 10 was $1,796,250. This represents a decline of 9.5%, or $188,750, compared to the prior quarter and an increase of 14.5% compared to the prior year. Sales prices have appreciated 36.7% over the last 5 years in Sea Cliff, San Francisco. The median sales price of $1,796,250 for Sea Cliff is 181.10% higher than the median sales price for San Francisco CA. Average listing price for homes on Trulia in Sea Cliff was $2,646,458 for the week ending Dec 22, which represents an increase of 12.1%, or $285,104 compared to the prior week and an increase of 15%, or $344,626, compared to the week ending Dec 01. Average price per square foot for homes in Sea Cliff was $761 in the most recent quarter, which is 37.36% higher than the average price per square foot for homes in San Francisco.

it is illogical to believe that the heart surgeons, financiers and corporate lawyers in seacliff are suffering in this economy as much as people in places like antioch and fairfield. the unemployment rate is almost 4x higher for people without college degree and there are not a lot of unemployed heart surgeons .they also don’t have access to the securities ,savings or even family money that the sea cliff folks do.

why does this offend you? i was pointing out the limitations of using the sf msa to determine what’s going on in specific neighborhoods

meep, seriously? You’re relying on trulia’s summary of median sales prices when there are single digit sales per year in Sea Cliff? You’re almost as bad as fluj with such a ridiculous argument.

I pointed to actual, apples-to-apples sales. Go ahead and find me real, recent sales that show 36% appreciation in the last five years!

I’m not offended. I own an SF home (and earn more than your typical heart surgeon or corporate lawyer, but not your typical financier). I’m just pointing out that your SF-immunity hypothesis has been conclusively disproven by the facts, and not just these two examples that took me 3 minutes to dig up but the dozens and dozens that have been featured on this site and elsewhere and are easy to dig up. You can ignore them or hide behind bogus conclusions based on medians and avg $/sf like fluj does, but that does not change their factual nature.

As for your hypothesis, you dramatically understate the extent to which “high” earners in SF stretched to afford bubble-era sky-high prices. They can’t afford them but bought anyway. And the buyers’ wealth does not drive prices anyway. Supply and demand does, and there is little to no demand right now and lots of supply. No different from Antioch except the real estate losses in SF are much greater in real dollars (although lower – so far – in percentage terms).

Nobody’s hiding behind anything other than you. You consistently, deliberately try to posit singular results as if they’re representative. Asking someone to present facts supporting the opposite, when nobody is positing the opposite in the first place is not valid. For a blog that’s so concerned with honing in on posters deemed to misrepresent median and the like, people like you who take a house and call it a neighborhood sure get a long leash.

I’m a little offended by referring to Fairfield, Antioch and Brentwood as “far flung exurbs.” From Merriam-Webster:

Emphasis added. I was dating someone during college whose mother lived in Fairfield and I also took one class at Los Medanos College during a semester off, and I can tell you that there are some, but not a whole lot of wealthy families living in those cities, certainly not in numbers anywhere near comparable to either Sea Cliff or St. Francis Wood (yes, I realize the demographics have changed a lot since then, but not by that much):

•Fairfield, CA: Estimated median household income in 2009: $66,753

•Antioch, CA: Estimated median household income in 2009: $57,747

•Brentwood, CA: Estimated median household income in 2009: $87,590

Perhaps Brentwood is a marginal example, but the best example of a “far flung exurb” would have to be Mountain House.

fluj, you’re “in the trenches.” Tell me, if a 2005 arms-length buyer in Sea Cliff listed his home for 36% over the 2005 price, do you think it would have a snowball’s chance in hell of selling at that price? No eff’ing way, and you know it. In a heterogenous market like SF real estate with small monthly sales numbers where the mix changes materially from month to month and the MLS data has all sorts of flaws and holes, MLS medians and $/sf provide little to no value at all. That’s why they are ignored by appraisers, as far as I can tell. Criticize “apples” all you want (and they are clearly not perfect indicators of the market), but how about pointing to something better? You can’t.

“You consistently, deliberately try to posit singular results as if they’re representative.”

How about you produce a singular data point that contradicts?

Sure that seller wouldn’t but that’s not the point. Nobdy is saying the market isn’t down, and I’m not criticizing apples either. My point was made, and easily made at that. I don’t need to point elsewhere.

“How about you produce a singular data point that contradicts?”

As opposed to a larger grouping that contradicts, the following, which was “Sea Cliff down 27% from 2004. St. Francis Wood down 28% from 2005” — based off two houses?

Why? It would just be one house also.

i would add that looking at the trulia data except for 2009 the number of homes sold in sea cliff is remarkably stable.

i have also not seen any data that would indicate that the wealthier single family neighborhoods in sf overextended themselves as much as folks in antioch fairfield.

if antioch median income is $58,000 and in 2007 the median house was over $500,000 thats a problem (sf may have similar income ratio but ~65% are renters,that’s not the case in antioch)

A.T. it is remarkable how in the houses you listed the owners appear to have sold for signifigant losses and did not undergo forecloser.

this tells me

1)the owners have the recources to handle the loss

2)this protects the rest of the neighborhood.it was the large number of foreclosures that brought down home prices in places like antioch.without those reo’s prices will correct but the 50-60% price drops aren’t going to happen.

just my opinion.

meep, we have some agreement! I also don’t think the better SF places will see 50-60% price drops from peak. But we’re already at 20-35% down, and I would not be surprised to see another 10-15% decline on top of that (30-50% total). Lesser nabes will do a little worse, some nabes will do a little better

What the sales I noted indicate to me is that it is something more than just foreclosures driving down prices so substantially as we are seeing huge declines even in market segments where there are not that many foreclosures and bubble buyers were relatively well-to-do. I’m putting my money on supply and demand.

i don’t think any neighborhood is immune there is a correction going on.

“1)the owners have the re[s]ources to handle the loss”

You mean “*had* the resources”.

where are oceangoer’s ‘nice pills’ when you need them?

@meep “i have also not seen any data that would indicate that the wealthier single family neighborhoods in sf overextended themselves as much as folks in antioch fairfield.

if antioch median income is $58,000 and in 2007 the median house was over $500,000 thats a problem (sf may have similar income ratio but ~65% are renters,that’s not the case in antioch)

”

I posted some links on a previous thread that can help answer exactly these sorts of questions.

https://socketsite.com/archives/2010/12/summer_inventory_bears_winter_noe_fruit.html

The 66 Sea Cliff house appears to be in census tract 428.

Pulling up a summary table for that census tract:

http://factfinder.census.gov/servlet/ADPTable?_bm=y&-context=adp&-qr_name=ACS_2009_5YR_G00_DP5YR3&-ds_name=ACS_2009_5YR_G00_&-tree_id=5309&-redoLog=true&-_caller=geoselect&-geo_id=14000US06075042800&-format=&-_lang=en

I see a median HH income of $164k and a mean of $273k.

Not sure how good Zillow’s historical Zestimates are, but it shows a peak home value index of $2.8M in Sept 08 in Sea Cliff. Also not sure if Zillow’s “Sea Cliff” is the same as census tract 428.

Census data shows that tract 428 is 87% owner occupied

Peter Schiff is predicting 30% price declines from here.

http://online.wsj.com/article/SB10001424052702304173704575578190261574342.html?mod=WSJ_hp_mostpop_read#articleTabs%3Darticle

Hurry up and buy so that your downpayment can go to the bankers bonus fund. You’ll lose every penny.

How can I put this delicately? Peter Schiff, while being right on almost every macro-economic prediction he made in the past 5 years, is dead wrong when it comes to prime SF real estate. It’s already dropped 30% from peak and we are now in a prolonged period of detente where neither buyers nor sellers have the upper hand.

You need look no further for proof than the Zillow Zestimate on my own house which has gone up $60k already since I bought in June.

“we are now in a prolonged period of detente”

detente lasts until it doesn’t.

Past performance is not a guarantee of future results. For entertainment purposes only. Sorry, Tennessee.

For some reason I have had problems posting this, but here goes by third try. I originally posted this before the Schiff article came out, but we come to much the same conclusions:

—-

There is no such thing as a natural equilibrium point for prices, they are constantly moving.

If you really want to try and figure out what is likely next, you need to look at more than just one business cycle worth of data.

I found these googling around:

http://mysite.verizon.net/vzeqrguz/housingbubble/

The first one, with a graph of US home prices from 1970 to today shows you two important things: that prices tend to increase over the long run, and that they tend to wiggle up and down around the mean. You can see that we had the mother of all real estate cycles from 2000 to 2006 and we still have not returned prices below the long term trend, though they are close, at least nationally.

http://www.realestateabc.com/graphs/calmedian.htm

This one is more relevant to us since it shows California prices. Too bad the guy stopped updating it in 2004. But here you can clearly see the cycles. 1996 was not an equilibrium, it was the nadir of the last cycle.

http://www.census.gov/hhes/www/housing/census/historic/values.html

It would be pretty reasonable to assume that we will undershoot on the down side the way home prices did in 1996, so assuming that we end up at 1996 prices plus 40% inflation from there puts us at a Case Shiller value of 120. I think we still have a few more years before we hit the bottom, at say 4% inflation a year, so I would expect the bottom to be at about a CS of 130-140.

We got pretty close to that in Jan 09 but if the top to bottom of the cycle this time is really only two years, it will be the fastest down cycle yet. I personally believe that we still have 3-5 more years of stagnant home prices ahead of us and that The Fed will engineer the inflation they so desperately want.

peter schiff was all bullish on euro stocks and projecting how strong the euro region in general is/was. he got that very wrong and lost plenty of dough.

Well, the good news is that October of 2007 & 2008 had worse percentage drops; the bad news is that this October’s numbers are worse than any October during the nineties bubble (back then, when the market was going sideways as it seasonally oscillated along the bottom, Oct. declines were were usually less than half a percent). Double dipper, anyone?