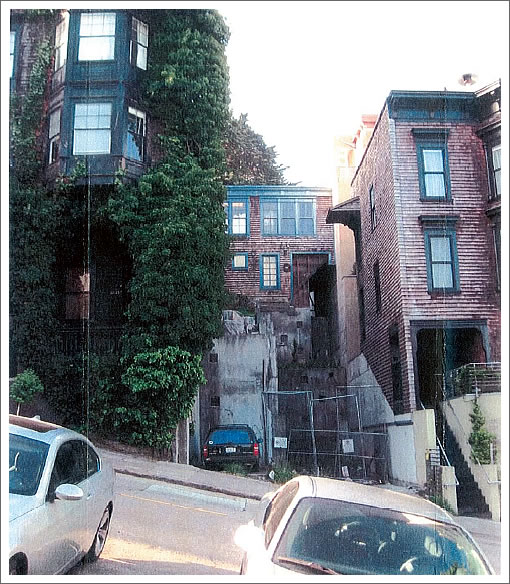

If you’ve ever driven up Lombard from Polk, chances are you – and all of your out of town guests – have been struck by the deteriorating lot at 1269 Lombard that’s long been stuck in a state of suspended construction.

First approved for development and excavated in 1998, the twelve year saga of 1269 Lombard involves a failed development attempt, a two year foreclosure battle (the property went back to the lenders in 2004), a four year approval process with Planning (that’s not yet over), and steadfast opposition from a neighboring tenant (yes, tenant).

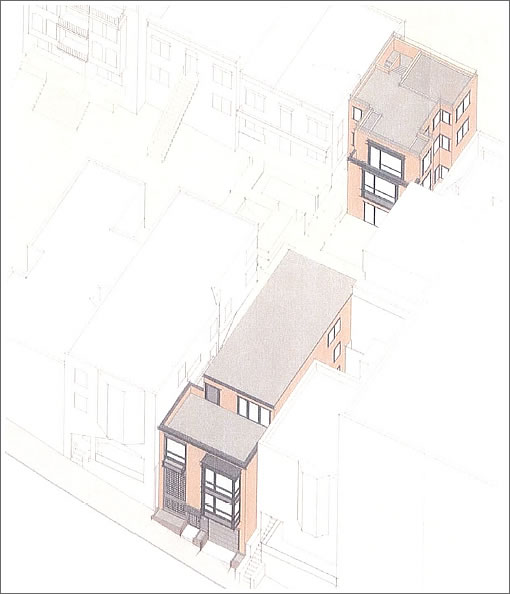

As proposed, the project will “demolish the existing single-family, two-story building located towards the rear of the lot and construct two new single-family buildings, located at the front and rear of the lot separated by an open yard.”

With a design that’s backed by the Russian Hill Neighbors Association and all adjacent property owners, it’s on to our Planning Commission this Thursday to rule on the neighboring tenant’s requested Discretionary Review opposing the project as well as front setback and rear yard variances for the design as proposed.

∙ 1269 Lombard: Planning Commission Review Packet [sf-planning.org]

∙ 1269 Lombard: History and Historic Preservation Commission Review [sf-planning.org]

Those of you who wonder why anybody would stretch themselves to buy a home in The City when the premium for buying over renting is so high should consider this.

If you’re not a member of the landed gentry, you’ll get mocked when you try to participate in the public aspects of the planning process. The implication being that your opinions about what should be built and how in the neighborhood you live in is on its face less important that the opinions of your neighbors who own, even if such owners don’t actually live in the subject neighborhood.

I wonder how much $$$ the tenant tried to extort from developer to play ball?

My experienced guess is that tenant is early to mid 50s single white guy. life passed him by and he is angry. someone has to pay.

would have been less snarky if post just read neighbor. Does not matter if neighbor is renter or owner. Owner transfer rights to renter in exchange for $$. The neighbors are the ones are most effected by the design tehy live next door it Since almost 70% of the city is renters, 70% of the neighbors are renters, so might as well be nice to them.

I have no sympathy for this tenant. The “I live in the neighborhood too” really doesn’t cut it. He/she simply does not own the adjacent property and should work directly with their landlord on compensation for any negative effects this proposed development may pose. There are plenty of other places to move to in the city. What a waste of time and resources.

The issue about owning giving you power over renting is moot. Obviously they had to ask his opinion to the tenant.

I was renting for 2 weeks and the guy next door asked my opinion to expand his house up through the proper channels. I have no views to be blocked and will suffer only minimum disturbance, but I thought it was nice to have a say.

Even if weren’t asked my opinion, I’d understand it. But having that extra power is NOT a justification for paying 2X rent to live a place.

The opposite! As a tenant you can move out for virtually nothing! As an owner, and if the new construction blocked some view or light, you are losing some value and you might be in “house arrest” unable to sell at the price you want because of the neighbor’s addition.

Renting is freedom.

Kathleen is exactly right. The tenant pays money to the owner to have the right of occupancy and has every bit as much right (or more) to weigh in on neighborhood development issues as his landlord. For all we know, the guy has a 20-year lease, but it doesn’t matter. We’re way, way past the days when one had to own land to vote. A leasehold interest is a valid property right.

Can this one person really prevent this from being built? It sounds like just about everybody else in the neighborhood is ok with it.

brandno: i see windows on the side of the downslope neighbor…

actually, it’s probably one of the people who live on the lightwell thingy in the downslope front building, which is due to be blocked on its remaining side. their downstairs is about to get dark, and frankly i don’t see how a non-renting neighbor wouldn’t have a problem with this either. or, at least, i wouldn’t be surprised.

funny how the yard gap matches with the upslope neighbor. gotta rub those elbows.

yeah, I don’t even think it is really those non-protected Property Line windows to the unit to the east as it is they are building right up to the side of that light well on the east. Since the lots run north-south, it is kind of a wash on the light issue (which side it impacts worse), so it seems like they sided with the building with more tenants (to the west) as to who got screwed less with the design.

When in doubt, always follow the links (they’re there for you not us).

The (tenant’s) non-complying lot line windows in question are actually adjacent to the existing structure at the back of the lot which would be razed and rebuilt, at which time the developer would add two new windows to the tenant’s unit in an attempt to compensate for the loss of an existing one and partial loss of two.

The tenant also objects to a loss of access to the deck above the existing structure on the site, access to which is by means of an “illegal bridge” to the neighboring unit.

I totally disagree with Kathleen. Like Jimmy says, I imagine to renter to be rather bitter and angry cause he’s not a property owner as a mature adult. He has to get back at someone.

I have no sympathy with renters. 12 years ago I rented out my Noe V house to 2 well off people. We had a very clear lease agreement. When it came time for me to move back into my house they refused to move. It cost me 6 months of time, a lawyer and much stress to get my own f**king house back from these psychos. Never again.

But to the important issue. The proposed design of this project is outstanding, fitting in very well, and at considerable cost to the owner. I hope this is approved quickly and built. Let’s get rid of this unsightly hole in the ground..finally.

OK, I get it now. The janky shack on site does not, despite appearances, butt up against the back of the lot. The back unit of the next-door neighbors does, with windows that apparently look into the “back yard” of the site in question.

Wow, talk about a walk down memory lane. I did development studies for the then owner back in 1978 between undergrad and grad school, and the solution looks pretty much the same over 30 years later.

In addition to the $10 an hour I got paid, Chuck and Kathy introduced me to raclette and the imperitive that gin and tonics MUST have the glass rim rubbed with fresh lime. Life lessons well learned. Cheers!

W-w-w-w-waaaaaiiiit.

So, said tenant is upset they won’t be able to trespass freely on the property of the person they are currently causing great inconvenience and no small financial pain to? Say what?!?! And then has the cojones to claim it as their right? Wow. Just wow.

Somebody needs an introduction to the police, a misdemeanor charge and a restraining order. You want to pi$$ me off and play on my lawn? I don’t think so.

Mind you, I say that as a renter, too. That’s just ridiculous.

A selfish NIMBY is simply a NIMBY regardless of whether (s)he rents or owns.

It’s embarassing that in a city of almost 900k one person who doesnt even pay property tax gets to decide what does and what doesnt get built.

We’re not even provincial, we’re passed that. We just fetishize stasis.

The tenant does pay property taxes – the landlord just acts as a middleman.

it is deeply unfair and absurd to claim that that tenants should have equal rights as land owners. They have not made *any* commitment, they have not risked anything. It is the landowner who has taken a large risk with a large chunk of money and likely taken out a mortgage they are liable for. Paying rent, for which you are not taking any risk or liability, should not give you similar rights as the land owner. Those concerned with justice and equality should stand up against the theft of property rights by tenants.

As a renter I have to say I am surprised that the tenant’s complaint carries any weight at all. If the tenant loses some light and is upset about it they have the freedom to move.

If I was the owner of the building next door and I lost the light/windows due to the development I would also, potentially, be losing equity. So I can see thier complaint carring more weight.

While quality of life issues are important, the idea that a neighohing renter’s desires would trump someone’s property rights is kind of ridiculous to me.

My rent pays for the right to occupy a unit, that is all. It doesn’t pay for the right to a specific view in perpetuity.

“If the tenant loses some light and is upset about it they have the freedom to move.”, “owner […], be losing equity.”

The reality in SF is that renters build equity. You have to pay people to move out of an apt. That is the DEFINITION of equity! (Or go through a painful/expensive process that scars your rights to your own property.)

The renter probably has a nice place and a great, controlled, below-market rent. Moving to him is throwing away equity.

SF is f*ed up w/r/t rent-control. Upside-down land.

We really do not need to reinstate a landed gentry system. If one remains angry and bitter about long past events, theraphy is in order.

The urge to impose unsightly and mean spirited characteristics upon anonymous others, may manifest in a physical illness if left to fester.

“The tenant does pay property taxes – the landlord just acts as a middleman.”

Um…no! The tenant pays rent to occupy the unit. No more, no less. The owner of the property pays taxes.

^ Oh yeah…there is NO connection between the two… The money is even laundered by the owner to be sure…

@kathleen: you really need to get a grip on reality, and start talking like a normal human. Cuz ya don’t make sense, girl.

to others: renters don’t ever build “equity”. It’s called extortion when they demand money to move out.

noearch, that is just silly talk. Renters who pay less than it would cost to own build equity (at the landlord’s expense) every month. Look up the definition of extortion — you’re using it wrong. Renters who protect their legal and financial interests are doing nothing wrong any more than are owners who take advantage of the mortgage tax deduction, which can honestly be called a grossly inequitable government handout. Your tenants were, presumably, simply breaching their lease. If you had the legal right to evict someone from your house you should have hired a lawyer and gotten it done quickly and properly and recovered any damages. People break contracts all the time — renters have no monopoly on that. Get a better lawyer next time.

It sounds like Kathleen has a grip on reality, and history. Once upon a time, only land owners of a particular race and gender were allowed to vote. And that’s not the type of society that SF is looking to emulate.

Sounds like a lot of people are “projecting” here.

“^ Oh yeah…there is NO connection between the two… The money is even laundered by the owner to be sure…”

Rental income can be used to cover a lot of items including mortgage, property management fees, repairs, insurance etc. To assume that the renter is paying property taxes is simply wrong.

BTW, I’d love to meet the renter that is writing property tax checks to San Francisco County.

“They have not made *any* commitment, they have not risked anything. It is the landowner who has taken a large risk with a large chunk of money and likely taken out a mortgage they are liable for. Paying rent, for which you are not taking any risk or liability, should not give you similar rights as the land owner.”

Historically, this is much more complicated than some people are making it. Historically, you also have things like life estates, remainders, and executory interests, in addition to various types of leaseholds and freeholds. Anyone holding any of these interests is considered to hold a property interest, and anyone in possession of a property has the obligation not to commit waste because that would reduce the value of the other holders’ property interests.

As such, someone with a leasehold has the obligation not to commit waste. The tenant here is perfectly within his/her rights to object to this because it may lower the value of the property. In addition, it’s reasonable to expect a renter to step in for a landlord, given that the renter is the person who is currently in possession of the property and can assert property rights on behalf of the owner. If you were the absentee owner who lives in another city, wouldn’t you want your tenant to do this?

Anyone arguing otherwise doesn’t really understand the law. And anyone who thinks renters don’t pay property taxes doesn’t make much sense either.

And are we really going to hold onto archaic beliefs that mortgages mean that someone is taking on financial risk, given the recent mortgage meltdown? It’s pretty clear in a non-recourse state that a mortgage is very little risk to an “owner.” And it’s pretty clear that an “interest only” mortgage has nothing to do with ownership.

Now, I’m not addressing the issue of whether or not a neighbor should have a right to complain. But if we’re going to assume that neighbors have a right to complain, then it’s reasonable that there’s no distinction made between owners and renters.

Willow, how about we talk about how homeowners can never “pay their house off” because they are really only paying the *bank* off?

Thanks for that sage advice AT: I’ll remember not to use it next time.

As for my two greedy tenants, here’s the basic story. Solid 2 year lease with them, 8 page contract written by a very competent lawyer. I gave them a 6 months notice I’d be moving back into MY OWN HOUSE on a specific date. They understood and agreed to this. When my move in date got closer: like 3 weeks, they decided they did not WISH to move out, citing extreme costs to find a similar rental. Like I cared.

I hired a second lawyer, one of the best in SF for landlord/tenant law. Filed all the proper forms and paperwork to evict legally. Greedy tenants then demanded $7000 to help move out and find another place. Total joke. Got a judge to bring a sheriff with us on the day of my move in. Came to my house with my lawyer, sheriff, ready to physically move them out. They had, in fact, 2 days before vacated the house, moved all furniture out. The place was a wreck, damaged, dirty. I did my inspection with photos and witnesses, deducted the entire deposit for damages. They were pissed, but didn’t protest any longer. I owned them nothing. And paid my own lawyer fees to rid them from my life entirely.

I got my house back. Oh, one more little part of the story.

My greedy, but cash strapped tenants went on, within one month to purchase a house in Noe Valley.

Yes, I’d call what they tried, and failed to do with me one thing: EXTORTION.

noearch, sounds like you did it the right way and it went pretty quickly — they moved out before you even had to bring the sheriff. But this was obviously just a business transaction for your tenants. They made a demand, you called their bluff and said no, and they moved out. You could have sued for any damages but appear to have decided it wasn’t worth it. If you enter into business transactions, you have to expect some risk that that the counterparty won’t perform.

I’ve worked on a LOT of financial restructuring deals the last few years. Typically, the borrower tells the lender “screw you; I can’t or won’t pay. Cut me a better deal.” Sometimes the lender says “no” and the borrower either pays, or defaults and they go to court. Or the lender says OK and they cut a new deal. Just business. I’m not saying defaulting on an obligation is an honorable way to do business — it isn’t — but again, tenants have no monopoly on such practices. Certainly you’re aware of many instances in which landlords failed to abide by legal or contractual obligations, no?

J wrote:

That time, when only land owners were allowed to vote, was the time before 1850 (it was gradually phased out on a state-by-state basis), although lots of San Franciscans, and not just certain commenters on socketsite would like to bring it back.

I haven’t seen any evidence that paying renters to move out of a place after a lease has expired is universal, but of course I’m not a landlord. If someone has a valid lease and the landlord wants to break it before the lease term ends, or if (more likely and common, in my opinion) the landlord was leasing out an illegal addition or unwarranted in-law unit, then the lessee would be nuts not to demand a payment to move out. Not saying that either of these were the case in the situation that noearch was describing, however.

noearch, you should rent the 1990 movie “Pacific Heights”, that’s what a renter from hell would be like.

@sfrenegade – Thanks for the post. I never really thought of rent in those terms and I certainly wasn’t aware of the legal point of view.

However, I will say it appears that the new owners are trying to mitigate any loss to the renter. Also, what are the impacts of rent control? Assuming the renter is a long term tenant and paying below market rate rent is there a quantifiable ‘loss’ of value? I mean if the the assume the current rent controlled rent is 1k a month and the market rate rent before construction would be 2k a month and then after construction the best the landlord could get is 1.5k has a rent controlled tenant experienced a ‘loss’?

BTW – I am excluding the loss off access to the other roof through the illegal bridge because, well, come on … hehe

@ A.T.: you sound like a lawyer..and you sound rather cold and calculating. your point of view, I suppose. Not mine.

The legal contract I had with the tenants was also based on trust and honesty. They deceived me. They lied to me. They tried and failed to use me. They turned into scumbags.

@brahma: I’ll have to rent that movie for some fun. But the tenants I had were from hell. How’s this for class? They (2 women) repaired their motorcycle in the living room, leaving lots of grease on the wool carpeting.

I did have the last word however: As they were walking down the front steps to leave, after the inspection, I loudly and with great harassment said to them: “Now get the hell off my property!!”.

That felt so f**king good.

The line of reasoning goes something like this: someone renting out property is a businessperson making a business decision. And to the extent that they are rational economic actors, it’s safe to assume that the rent charged to a tennant is covering all expenses incurred by the landlord to keep the property, including everything you mentioned, plus property taxes, which are just another expense or cost of doing business for a landlord, plus profit.

Therefore, the tennant is paying property taxes by proxy via the landlord, unless the landlord is operating some kind of charity.

I think you’re really stretching that one, brahma:

The tenant (one n) pays rent. That’s it.

The landlord can do whatever they want with the rental income, pay taxes, gamble, buy drugs, whatever, or not.

The tenant has nothing to do with paying taxes, proxy or not. You’re playing with words.

“Also, what are the impacts of rent control?”

Rent control does affect the residual value of the property, but it seems like the residual value of the property would be higher if the tenant objects than if the tenant didn’t object.

Yeah, I don’t know how you use the illegal bridge as an argument in normal jurisdictions, but this is SF.

noearch — you’re splitting hairs here. This can simply be stated as “rent internalizes the cost of property tax.”

If there is any risk inherent in holding a mortgage, as one of the commenters above suggests, that risk premium is also internalized in rent. You would have to be a incompetent landlord not to internalize this risk in rent. An analog in another industry would be how R&D costs for a widget are internalized in the retail price of a widget, as are the risks of R&D.

@sfrenegade:

HUH?????????????????????????????????????

try speaking in simple english…and in black and white thoughts..

clarity always works.

Okay. I didn’t think internalization of costs was that foreign a concept, given that people commonly talk about externalities. Maybe they just fake it.

How about this: “Rent includes all of the costs of ownership plus a reasonable profit.” If a landlord is not getting that, either the landlord is probably not a good rental property investor or the landlord is gambling on assumed appreciation.

OK, how bout we just agree we each live on different planets?

You like expensive words and concepts.

I like clarity and simplicity. In the simplest 3rd grade voice, it’s like this:

Property owners pay taxes. Renters dont. leave it at that.

Brahma: Granted in the perfect world (for a landlord that is) rental income would cover all expenses with monies left over for profit. However, that is often not the case. As noearch states, the renter is simply paying “rent” at the agreed upon amount. How that rent is used by the landlord is impossible to tell and of no import or consequence to the renter. So to conclude that the renter in this case is paying property taxes is a not accurate.

@noearch

that is ridiculously simplistic logic. a simple analogy would be that all government expenditures are paid for by the government, and have no relation to the taxes that you pay.

Thank you Thank you Willow!!!!!!! That’s exactly what I was saying.

I love simplicity and clarity in language..and concept as well. Getting to the essence of an idea is often very hard, but important.

I’ll leave it to others to complicate ideas and thoughts, and add expensive words and legalese to every idea here.

Not for me.

And even though I pay sales tax for a purchase in a store, I am not really paying any sales tax — the store is — because the store actually cuts the check to the government and it may use different money to cut that check. Therefore I as the consumer pay no sales tax. Q.E.D.

noearch, please, you’re just being needlessly obtuse. Your “clarity and simplicity” is just a rhetorical tactic prodding readers of your comments to accept your political conclusion that renters are second class citizens because they aren’t paying any property taxes.

It’s not a matter of legalese or “expensive words”, either.

Even if one were a completely clueless landlord and had never cracked the spine of an economics book, ever, or set foot in a beginning financial accounting course, ever, it should be obvious that the rent you charge tenants has to cover your costs, including property taxes, after one has filled out Schedule E (and that’s just the example that comes to mind most quickly):

Now, Willow is correct that every year, the landlord won’t make a profit, but if you carry that on for too long, you’re putting yourself in the category of a hobbyist or charity operator, allowances I made in my earlier comment.

noearch, this is sad because I usually agree with your comments, but here you’re being a bit disingenuous. I honestly don’t see how “Rent includes all of the costs of ownership plus a reasonable profit” is too complicated for an adult to understand, unless you are intentionally trying to avoid logic and common sense here, as Brahma suggested.

Sorry, instead of “disingenuous,” I should have said “pretending to be unaware.” 3rd graders do know how to pretend, right?

given that there are tennants out there like this one (with his unusual sense of entitlement) and that this city’s rules so empower of them, isn’t it staggering that buying commands a premium over renting in this area? wouldn’t a rational market demand that i pay a premium to get the benefits of residence while simultaneously offloading my risks?

LOL at brahma and sfrenegade:

Where in hell did I say that renters were second class citizens?….well, ok. I admit that the two people who tried to rip me off when renting my house were, in fact, probably third f**king class citizens.

Anyway. thanks for your opinions. mine is just as valid.

Opinions are fine, but arguments that can be backed up are better.

In any case, neither noearch, nor anyone else, has had a good response to “If you were the absentee owner who lives in another city, wouldn’t you want your tenant to do this?”

In all the renter-bashing, many of you are forgetting that the underlying landlord has an interest too. And you’re forgetting that a good tenant is helping a landlord out by asserting rights on the landlord’s behalf in the City and County of SF (again, without considering whether someone holding a property interest should have those rights or not).

OMG @ sfrenegade: ok,you can hang on to your ancient, antique, feudal concepts of ownership and tenants all you want. It’s your right.

But I, and many others here opine that renters do not pay property taxes, and that they have little interest in the property other than occupying it. Tenants do not have any right, nor obligation, to assert their rights on behalf of the property owner. I have been an absentee landlord and made it a point to be proactive in ALL the matters relating to my property. All the tenant did was perhaps call me on an issue and I immediately took care of it. I would not ask, nor expect, my tenant to speak on my behalf.

noearch, if you knew anything about feudal concepts of ownership, you would know that it’s as kathleen and J said: the landed gentry were the ones who got to vote and assert rights. That’s what *you’re* advocating, not me.

In getting overly emotional about your concept of renting vs. owning, your arguments tend to elevate form above substance. As one example that I mentioned earlier, you utterly fail to recognize that rent effectively pays all the cost of ownership plus a reasonable profit, when properly calculated. (which, as I’ve mentioned on SS before, is why renting should be more expensive than owning)

It’s an elementary concept that rent internalizes the cost of property tax. A good analogy is the corporate tax. The price of goods and services internalizes corporate tax, so that we all effectively pay corporate taxes when we buy goods and services. When we pay for goods and services, we pay for all the costs of production or provision plus a reasonable profit, and those costs of production or provision include paying taxes.

And again, your “opinion” has no basis in law or, in this case, reality, since obviously a tenant is allowed to assert these rights in SF, which is all I’ve said.

You could have easily sued your tenants for committing waste on your property. You didn’t. It’s been 12 years, so get over it or go seek therapy, because life’s too short to hold a grudge about this.

@noeach, perhaps another way to look at it is that if property taxes suddenly increased dramatically, you can bet your ass rents would increase. Landlords that didn’t pass on at least part of the costs to renters would suffer losses and eventually be bankrupted, leaving only landlords who did communicate those tax increases to the rental price.

Renter’s indirectly pay property taxes. Do you assert that property taxes and rents have no correlation whatsoever? If not, then to the extent they do, renters help pay property taxes.

This is not some nebulous, murky, difficult to understand link. There is only one level of indirection in the link. It may not be a convenient way to look at things for a given political stance, but landlords who in practice ignore the link would get bitchslapped by the invisible hand.

oh, ok.

marina girl wrote:

Without getting into whether or not the last part is in fact true in The City, not necessarily. The marginal utility of being a member of the landed gentry might be so high as to outweigh all the net other benefits of residence; something like that. Membership has its privileges.

Btw, I should say that I do like the design depicted above and given the circumstances, I’ll bet that Redwood Mortgage Investors VIII (sounds like a synthetic CDO doesn’t it?) and The Russian Hill Neighbors Association will prevail at the Planning Commission meeting.

Who the hell is the “landed gentry”? Who talks that way today?

How bout just calling them “people who work hard, save their money and become property owners”?

nothing magic, or rad about that, huh? god , you renters are a bunch of whiners.

“you utterly fail to recognize that rent effectively pays all the cost of ownership plus a reasonable profit, when properly calculated.”

sfrenegade: Rent does not always equal or exceed cost of ownership. It is determined by what the market will bear. I.e. my cost of ownership for a 2 bedroom downtown condo maybe $5000 but the rental market may dictate that I can only get $4000 for that very same unit. Two different concepts that are not always related…

I’m a renter, and I vote, but do not believe I pay property taxes.

Every citizen with a non felony over 18 votes whether they rent or buy so that “gentry” argument is stupid. I don’t understand in what world people are in where they don’t think the property owners who have more invested (and write the property tax check) should not have considerably more power than the renter on surrounding property issues.

Your rent check is not the same as paying taxes that is an asinine argument. And for those that argue it is, please tell me the last time you recieved a tax bill or argued against the appraisal value. Everytime your pay for something you do not get temporary ownership rights and therefore are not subjected to the risk/reward costs that the true owners are.

“Rent does not always equal or exceed cost of ownership. It is determined by what the market will bear. I.e. my cost of ownership for a 2 bedroom downtown condo maybe $5000 but the rental market may dictate that I can only get $4000 for that very same unit. Two different concepts that are not always related…”

And when that’s the case, you’re either not being a prudent rental property investor, as I said above, or you’re gambling on future appreciation to offset the loss. Plenty of amateur rental property investors make this mistake.

“therefore are not subjected to the risk/reward costs that the true owners are”

People get really stuck on this “risk/reward” concept because they think of a mortgage as some sort of risk. But a mortgage is just a contract — you have contractual rights under a mortgage as does the bank.

Furthermore, do people not realize that being a rental property investor is simply buying a leveraged asset (assuming you have a mortgage) in order to get a cash stream? As an investor, you need to determine your expected rate of return in order to determine whether something is a good investment. Most of this goes into what Brahma was discussing yesterday at 1:03PM about rational economic actors. If you’re making less than your cost of ownership, you’re not being a good investor, and you’re either being charitable (as Brahma said) or you’re gambling on future appreciation (which is not comparable to investment).

Plenty of small landlords leverage the asset to achieve small losses by intention. That could be whether to arrive at a cost of living smaller than otherwise rent, or any number of tax benefits. If appreciation ever comes then that’s good too.

“Plenty of small landlords leverage the asset to achieve small losses by intention. That could be whether to arrive at a cost of living smaller than otherwise rent, or any number of tax benefits.”

Will you please explain this anonymous? The tax benefits should be included in the investment calculation if the calculation is properly done. If you’re talking about using a rental property to offset ordinary income, the passive activity loss changes in 1986 killed that for casual property investors. What do you mean by “cost of living smaller than otherwise rent”?

There are plenty of landlords who don’t calculate things correctly — irrational economic actors. That doesn’t mean that the general economic principles I’ve stated regarding rental property investment are wrong.

@sfrenegade: What kind of real estate planet are you on?

Seriously, many, many real estate investors/owners do not cover their full monthly expenses from the rent. That’s pretty common knowledge. Mine didn’t from my previous condo. But so what? I was able to write a lot of it off, and in the meantime, it kept appreciating quite nicely when it came time to sell.

And that makes one an amateur rental investor making a mistake???

I made out very well when I sold my condo, and used the proceeds to buy a Noe Valley house. Thank you very much.

How much did you actually save in taxes from write-offs? What was your total cost of ownership and your total return? Calculate the numbers and then get back to us.

In any case, it sounds like you got lucky because your condo appreciated, but that doesn’t make you a good investor. A good investor would have charted out the likely years of ownership and determined an annual rate of return that was appropriate.

FWIW, the three people on SS who seem to know how to calculate return are probably FormerAptBroker, missionite, and probably 45yohipster since he appears to know what he’s doing.

WOW!…I’m not sure I have ever felt such disdain, hate and vitriol from anyone here before. You don’t seem to be a very trusting person. Too bad.

It’s obvious now that you don’t care to engage in meaningful dialogue, but rather delight in simply trying to make everyone else but yourself look stupid and ignorant. There are plenty of commenters before me who basically say the same thing I am saying.

You mean to tell me that no one else got “lucky” (your words) by buying a condo or real estate 27 years ago and holding it? In reality, anyone who buys real estate and makes money is also “lucky”, and not just stupid or lying. Guess what? There are no absolute guarantees in real estate.

And no, I don’t have to get back to you or anyone with my “numbers”. I talked about my experience. Take it or leave it.

Chill out. Have a wonderful day.

noearch: I think sfrenegade is separating investment results from rental property into two parts: 1) income (rent minus debt service, maintenance, property tax, insurance, opportunity cost, plus tax benefits) and 2) appreciation or depreciation. If I understand his point correctly he is saying that the former is often – maybe “usually” if we’re talking SF – a loss, and accordingly people purchasing rental real estate in SF must be banking on significant appreciation to justify their investment (if they are thinking analytically about it).

It seems to me that you view such appreciation as likely (indeed, you’ve experienced it yourself when you sold your condo) and he views it as unlikely. None of us know for sure which way it will be, but even if you assume the market is as likely to go up as to go down, an income-only loss will look like a bad investment.

No one said there are absolute guarantees. But you can easily calculate an expected rate of return based on estimates. Sometimes those estimates are right and sometimes they’re wrong. But, you chose not to calculate an expected rate of return and you were apparently still able to make a profit on faith, which sounds lucky to me.

Po Hill Jeff, You understand me correctly for the most part. However, in cities other than SF, #1 is usually the majority of the profit, whereas #2 is usually a tiny annual rate when adjusted for inflation.

However, it’s not that I view appreciation as unlikely. I think people need to be realistic on their expectations for appreciation when making estimates of return. Given the state of the housing market, appreciation could easily be flat or negative for the next several years when adjusted for inflation. If you base your appreciation calculation on 4% above inflation for the next 5 years starting in 2010, you’re probably doing it wrong.

As far as people who bought 27 years ago, they were much more likely to be able to use it as a cash-flow positive rental, before the 2 bubbles came and distorted things. 1st bubble started at end of 80’s, 2nd (much larger) bubble started around 2000 and is still deflating.

ok, I guess I don’t get you people. well, some of you anyway. It’s this simple:

Some of us bought a long time ago. We held it for a while. We sold. We made money. We took that money and bought something else, specifically a SFH in Noe, a fixer in a great neighborhood, where we saw the tremendous potential in the long term.

It worked. The SFH has increased in value by 13 times. Was I lucky? maybe, maybe not. I researched (with my excellent realtor) the neighborhoods with the most potential. We did our homework, and found the right house, for me.

I’m not a real estate expert by any means. I’m an architect. I used that skill to find a great potential. That’s not just luck.

I’m sure others have done the same, and probably better.

The level of ignorance in this thread is mind-boggling. There are seriously some people who would argue that renters don’t pay property tax? Ha. I guess that I don’t pay income tax either – my employer does…

Well, you can play the semantics game all you want, but as many of the commenters above have said:

Renters don’t pay property tax.

The property owner does.

Pretty simple concept, huh?

As I noted above, consumers don’t pay sales tax. The storeowner does. Simple, but equally illogical reasoning.

No, renters do not pay property taxes (duh) ,but landlords use renter’s income to pay their expenses, including property taxes. Any sensible landlord will factor in this parameter before deciding to be in the rental business

In a way, the rent collected and then used to pay property taxes can make up for an essential hole in the system: renters do not pay as much as owners to the city but do get the same services. 911 dispatch does not filter their EMTs on your renter/owner status. Your public school will not ask you for more dues or treat your kid any differently based on that status neither.

At the same time, why would a landlord with 10 units pay 10 times his cost of living in the city? Simple: he doesn’t. This is factored into the rent as well as the multiple tax breaks you get when you’re landlording.

Also, let’s not forget. Buyers do not pay any real estate transaction fees. It’s all paid by the seller!

“The level of ignorance in this thread is mind-boggling. There are seriously some people who would argue that renters don’t pay property tax? Ha. I guess that I don’t pay income tax either – my employer does…”

Your are lacking a clear understanding of the arguement.

Your rent is part of of an owners overall revenue to which he at some point must pay property tax with. But a renter never recieves a tax bill nor do you have an legal standing to argue a property tax bill as a renter.

To people that are claiming a renter pays property tax, i’d be curious to know if they think the renters in condos should be allowed to serve on HOA boards since in their estimation their rent transfers to them temporary ownership.

@ fonzie: yes, you are totally right. And I have been saying exactly the same thing, but there are some stubborn one minded types here who keep insisting that renters do pay property taxes.

I suspect they really don’t believe that, but are merely playing word games with us. On the other hand, some here really do believe that.

Then they should prove it or shut up. Prove that the renter gets a property tax bill from the SF Tax Collector. Prove that the renter can deduct property taxes from their income tax forms. Nope. Not gonna happen. Ever.

I’ve said it before and I’ll say it one more time: Renters do not EVER pay property taxes. The only person paying property taxes is the legal owner of the property.

There……does that clear it up for everyone?

Have a wonderful evening.

You guys are far too kind. Don’t give a person who is so quick to call someone ignorant so much of your time. It would be nice if some of the frequent posters on here policed their lapdogs a little better.

Good lord, using noearch’s definition, most people pay no taxes, because they never actually write a check to the various tax authorities. Like I said before, I don’t pay income tax, my employer does! Looks like I’m getting off completely free! How much sense does that make, noearch?

Just looked at my lease. There’s a line that says:

All sewer, water, garbage, and [i]taxes[/i] on the property are included with rent paid.

So, I guess that this is renter [i]is[/i] paying property tax, by noearch’s definition, since something is in writing saying so.

That’s saying you aren’t paying those things.

This debate is just silly. It is true that the renter’s rent check is not cut directly to pay for property taxes, sewer/water/garbage, HOA dues (if applicable), or maintenance. But the funds from that rent check cover all those things (unless the landlord is a business fool and is subsidizing his/her tenant, which many are in SF, incredible as that sounds). The argument is just which pocket the cash is pulled from — but it is the same cash.

In other words, a distinction without a difference.

My uncle Cletus picks up and cashes the rent checks from my rental property. Uncle Cletus is somewhat of a hayseed and spends that check on whiskey, hookers (lot lizards as he calls them in trucker lingo), and monster trucks.

Uncle Cletus may be a low class doofus, but he is wealthy (something about oil a-spurtin out of the ground he discovered while huntin on the back forty), so he sends me a check every month partly out of guilt for embezzling my rent check and partly because he’s really an upright kind of guy. I use the funds of that check to service the loan, maintenance, and pay taxes on the rental property.

So you see, my tenants don’t pay my property taxes, Uncle Cletus does. Instead my tenants are paying for booze, ridiculous vehicles, and prostitutes.

That’s a gem:

Seriously, many, many real estate investors/owners do not cover their full monthly expenses from the rent. That’s pretty common knowledge. Mine didn’t from my previous condo. But so what? I was able to write a lot of it off, and in the meantime, it kept appreciating quite nicely when it came time to sell.

I feel like I’m in 2005 again. Why make money on rent? You’ll sell for a profit!

Bad business call rescued by a unique real estate bubble. That’s speculation, not rental investment. I wonder how 2007 rental investors will fare in 5, 10, 15 years 😉

Well..anon needs to get a brain…and a life…and learn how to read.

but whatever, I know what I said and others know exactly what I mean. I don’t owe anyone more explanations.

Now how bout getting back to the basics of this article: Good architecture, great solution to a complex site,and let’s encourage this to get built very soon.

That’s saying you aren’t paying those things.

Classic. Just like when my cell phone provider raised the price of my plan by five dollars but gave me “free” text messaging! I’m not paying for the text messaging, it’s free!

Some people on this thread need an understanding of economic substance. If you’re arguing based on economic form, you would say that only corporations pay the corporate tax, but that doesn’t fly for economic substance since the corporate tax is internalized in the cost of goods and services. This isn’t a very difficult concept.

The principles of economic form vs. economic substance can easily be seen like VAT, which is collected at various levels for enforcement purposes (form because it’s collected at each level of production), but is ultimately paid by the consumer (substance because it’s a consumption tax).

In any case, I assume this all started when someone complained about someone not paying property tax and still protesting something at planning. I still haven’t found anyone who wouldn’t want their tenant to enforce rights on their behalf, have I? So far, there has been only one person who has said they wouldn’t *expect* the tenant to do that.

Good morning puffessor renegade!

I see you just had your big bowl of words for breakfast. Did you sprinkle some nuts on top also?

🙂

In an economics transaction involving 2 parties, taxes imposed on the transaction do NOT necessarily pass-through to one of the two parties (the consumer), as some here suggest.

This issue is usually addressed in economics textbooks with regards to cartels. Based on some reasonable assumptions (elastic demand and marginal price above marginal cost due to the cartel), a tax on oil might not be fully passed through to consumers. If the cartel raises the price by the amount of the tax, demand will be reduced even more, so that income goes down. So the cartel has to eat the tax. Because marginal price is above marginal cost, this is possible. Also, any tax collected can be rebated to the consumers by lowing other taxes they pay, which is another way of putting the tax on the producer rather than the consumer. This reasoning is why some economists to propose a stiff oil tax back in the 1970’s as a way to break the OPEC oil cartel. As it turns out, the cartel broke anyway without a tax.

Similarly, if marginal price of rental housing services is above marginal cost (and here we are mostly concerned with ongoing costs rather than the sunk costs of buying the building, and ongoing costs for all buy slumlords are always way below price or rent), and demand is elastic (as it surely is), then a property tax might ONLY affect landlords rather than tenants, and this is especially true if the property tax allows other taxes (which would be paid for by tenants) to be lower.

Suppose property taxes went up by a factor of 10 and sales and incomes taxes were reduced to compensate. More than likely, rents would NOT rise enough to make up for the additional property taxes, and the tenants and landlords would share equally in the reduced sales and income taxes, so the landlord would suffer a net loss.

Suppose property taxes were eliminated and sales and income taxes were increased to compensate. More than likely rents would NOT be reduced (and let’s disregard the issue of rent control for the time being) by the amount of tax reduction. So the landlord would capture most of the benefit and the tenants would be hurt by the increased sales and income taxes.

The above reasoning shows that property taxes are paid primarily by the landlord, not the tenant, other than in slumlord situations where the building is free, ongoing costs are all that matters and demand is not particularly elastic.

well, thanks for that econ lesson, Fred. I almost get it.

But we all know that property taxes are paid ONLY by the landlord (property owner).

Have a fabulous day!

Fred, a decent analysis, and this concept would apply to cartels who artificially elevate prices, but it has one big flaw:

“Suppose property taxes went up by a factor of 10 and sales and incomes taxes were reduced to compensate. More than likely, rents would NOT rise enough to make up for the additional property taxes, and the tenants and landlords would share equally in the reduced sales and income taxes, so the landlord would suffer a net loss.”

This result is not more than likely. If a big component of rational landlord’s expenses went up 10-fold, he/she certainly would try to capture that increase through rent. Of course, rents are dependent on what renters are willing and able to pay, not what a landlords costs are (hence the many unhappy, irrational, landlords who bought in the past 6-7 years). If the rational landlord could not recoup the added costs in rent and the result was a profit that was lower than was worth the risk, then the consequence would be many landlords leaving the business. The rational landlord is not going to simply lose money on this business and forgo other alternative opportunities to put his/her cash to use because some other tax was lowered — the landlord gets that separate benefit regardless of the source of income.

Bottom line is that landlords directly pay property taxes and tenants indirectly pay them.

No, noearch, you don’t quite get it. I’m using “paid” in the economics sense, meaning who ultimately absorbs the tax (reduced net income). You are using “paid” in the literal and trivial sense. sfrenegade is also using “paid” in the economics sense, but I think he/she is wrong about who absorbs the tax, and that you and I are right about who absorbs the tax. The question of who “pays” (in the economics sense) property tax can’t be answered without some assumptions, as my two examples show.

Fred, that’s a good analysis, but you’re also talking about a generic economic transaction as opposed to a lease. Practically speaking, there are no cartels involved here. And property tax certainly does not move in anywhere near the range you’re describing in California with Prop 13. What you’re saying is generically applicable, but not necessarily applicable to this situation.

Even in other states, property taxes realistically don’t go up by more than a few percentage points at any given time, and again, excluding rent control as you suggested, rents are somewhat elastic and can typically be adjusted within the realm of property tax increases. In other jurisdictions where I’ve owned property, the county often would lower the tax rate concurrently with revising valuations so that overall property tax paid stayed stable for a few years.

And again, if we’re talking about substance, and not form, renters certainly get the benefits of paying property tax, e.g. services, schools, fire, police, etc. The municipality sees this as pass-through as well. And as residents of a municipality, they’re choosing to spend their dollars in that municipality too and contributing to the economy of the municipality.

Hmmm….

I guess I don’t actually pay for my rent, food, clothing, etc. My employer does, even though I write the checks for those things.

And of course, my employer doesn’t pay for those things because he passes those costs on to his customer, the federal government.

And the federal government doesn’t pay for those things because they pass those costs onto the taxpayer.

Wait! That’s me! So I guess I do pay for them after all.

I think I’m going to side with Noearch on this one just to avoid trying to consistently deal with the endless circularity of the economy.

I know I’m beating this horse to death, but I can’t resist. The subject fascinates me. 🙂

A.T. writes: “If the rational landlord could not recoup the added costs in rent and the result was a profit that was lower than was worth the risk, then the consequence would be many landlords leaving the business”

Profit lower than risk ONLY occurs in the slumlord situation, the rent is ongoing costs plus profit. For everyone else, much of the rent is return on capital, and this is a sunk cost. If the property tax is raised, and the landlord can’t pass the tax through to renter, then he has no choice but to eat the entire tax hike. After all, he has to pay the tax whether or not he rents, so at least he might as well get the rental income. If the tax is raised to such a level as to make the property worthless, then the slumlord situation is reached. In places like Detroit, for example, property is essentially free for the taking. But if you take it, you have to pay property tax and this is NOT zero. Slumlords take the free property only if they can extract enough rent to meet the ongoing costs (property tax plus repairs, utilities, etc). If the property tax is set too high, it may not be possible to meet this test, in which case no one will take the property off the city’s hands. San Francisco property is NOT free for the taking, that I am aware of. Furthermore, the idea that raising property taxes hurts everyone implicitly assumes that other taxes are not reduced, which is not proper analysis. To understand who is paying the tax, we have to assume that the total tax burden is constant, and if we raise property taxes, we lower other taxes. In most jurisdictions, property owners lose disproportionately from property taxes. If the property tax rate is lower on owner-occupants than landlords, then owner-occupants will likely be net gainers from higher taxes on landlords, landlords will net losers and tenants will be somewhere in between, though it still matters what the taxes are used for. Taxes could be used for things that disproportionately benefit property owners, such as fire departments.

sfrenegade: I used extreme examples because that makes the point clearer. If you use very small changes, then you have to bring in all this apparatus of elasticity of supply and demand curves and marginal this that and the other thing. As for your comment about renters getting the benefit of taxes, this is precisely my point. Renters and landlords benefit alike from taxes, but landlords pay tax disproportionately–thus landlords are net losers.

diemos: You have taken a much more extreme position than A.T. or sfrenegade, both of whom mostly confused the issue, whereas you are pushing the point of parady. “Raising taxes on the rich justs gets passed through to the poor, so really a tax hike on the rich and tax cut on the poor hurts the poor more than the rich”–this is at the level of a right-wing blog rather than a right-wing think-tank.

Taxes and spending both have a distributional effects, as should be obvious. Some gain from spending more than others, some lose from taxes more than others, there are net winners and net losers from government intervention in the economy. Eliminating the government entirely is not an option, and thus there will be a never-ending war by interest groups to direct the spending in their direction and the taxes in someone else’s direction. One way to accomplish this is the obscure the issue, as diemos, A.T. and sfrenegade are trying to do, with various degrees of subtlety. As should be obvious, taxes on the rich disproportionately affect the rich, and taxes on property disproportionately affect property owners. There is pass-through, but it is seldom 100%. The idea that it doesn’t matter who gets taxed because all taxes ultimately gets paid by everyone is profoundly misleading.

Fred, nice analysis. But you state: “If the property tax is raised, and the landlord can’t pass the tax through to renter, then he has no choice but to eat the entire tax hike.” There is another option — sell the building(s) and exit the landlord business. One could not impose a “targeted” tax on landlords by raising property taxes because they could just quit if the tax could not be passed on to the tenants (with all the caveats that supply/demand sets rents, not landlord costs, and landlords would not quit the business if they still earned sufficient profit).

I don’t think I’m trying to obscure any particular issue. I’m talking about payment of taxes. If there were no tenants, landlords wouldn’t be paying property taxes, as A.T. said. That suggests that tenants pay at least some percentage of property taxes.

If we exclude rent control (which has its own distortion affects), rents in SF would be easily adjustable to account for property tax — I see little evidence that there isn’t sufficient elasticity in supply and demand curves here. In addition, property tax under Prop 13 is a joke for all long-time landlords, so very little adjustment would be needed for long-time landlords. Fred is speaking incredibly generally and trying to overgeneralize with extreme examples, but I’m talking about SF where property tax is highly invariable from year to year.