From a plugged-in reader:

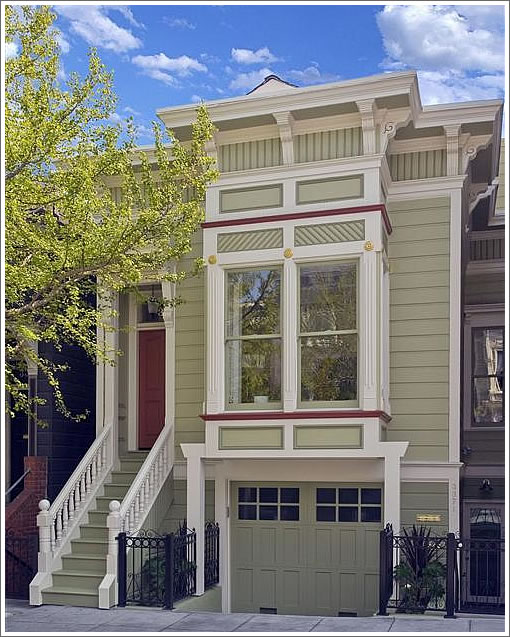

From time to time, people have debated about the value of properties that are in total disrepair. 3373 22nd St. provides some insight. It was sold in November of 2005 for $920,000. At that time it was a disaster — absolutely uninhabitable. We were told it was purchased by an architect and it appears that the buyer has been diligently pursuing the permitting and building process. Now 2 ½ years later, the façade has been preserved and restored and a modern 3,000 square foot interior has been created. It is on the market for $2,095,000.

Perhaps a plugged-in reader or two might consider taking a crack at the numbers. And while it’s definitely not an “apple,” it is another example of how median (or at least mean) sales price can be increasing without any actual “appreciation” (or for that matter, despite any market decline).

∙ Listing: 3373 22nd Street (4/3.5) – $2,095,000 [MLS]

Nice place. Not so sure about the bedroom on the main floor? Or the neighborhood. I wonder what he’s got in the place to fix it up?

Is it just me or does the interior look a little low end for $2M? Love the exterior restoration.

“Thank you for not overdoing it in the bathrooms”

I have *NO CLUE* about prices in the mission (seems high to me, but I’m feeling cheap this morning), and mapjack has a nice work-in-progress shot of this place.

http://www.mapjack.com/?GPymW9i4bFuC

The listing never says “this is in the mission” — lot’s of other codewords like “valencia corridor”, “Noe valley shopping” and such. I guess these are the gentrified terms? Sometimes listings (usually condos) will brag about being in the mission. A target demographic issue?

Anyhoo, nice pitch! 🙂

For $2M you are paying for the excellent restoration that opens up the interior space. The finishes are nice, but anyone who prefers some kind of idealized perfection is probably going to install their own vision anyway. With this remodel, apart from the facade, what you don’t see is probably at least as important as what you can see.

I suppose the implication here (by using “appreciation” in quotes) is that one restored property is going to skew the median/mean and mask what would otherwise be a decline in the neighborhood? I guess we should also ignore any probate property that hasn’t been touched in 30 years because, by that logic, deferred maintenance would be just another way to manipulate statistics, right?

I remember this one! Oh yeah, what a wreck. It looks like they did a lovely job and Travis Pacoe is a highly skilled realtor, so they did well on that front too.

A couple problems: 1. 920K on the buy = ouch. 2. I don’t care what the map says. When your property is located across the street from the Lone Palm you are not in Noe Valley. 3.Only two SFRs have ever sold for $2M or more east of Guerrero, and they were predictably on Hill and Liberty streets.

So this one is treading new ground. On the other hand, how else could they price it? Two blocks west and it’s $2.5M. I think somebody will come along.

As for the price breakdown, they put 200K down. It seems as if they financed the entire thing privately so they paid no interest on their own money. (The first person to come along and factor in a negative cost opportunity gets a frownie face from me — right here — and I promise to say nothing else neg cost opp.) It looks like a 500-600K job or so, ballpark, including holding costs. So that would be 800K in with a 1.62M break even, ballpark, including realtors and transfer tax.

Yeah, the main problem here was the buy. This property should have been 800K, max. I recall that many were surprised by it at the time. Nine hundred plus, east of Guerrerro? They’ll do fine but it will work out to 28% annually or something.

I think $2m is too aggressive. $1.6-1.8 seems more realistic.

re: dub dub’s comment about neighborhood names. Yes, I think condo or tic is more saleable in the “hot” mission than an SFR. It reminds me that SFR’s in the Castro ALWAYS used to be identified as Noe Valley in the sunday inserts. I could never understand who the agents thought they would fool by calling 19th and Eureka “Noe Valley”. That ended a while ago when agents finally realized there’s a market for larger homes in the Castro.

“think $2m is too aggressive. $1.6-1.8 seems more realistic.”

Why do you feel as if that’s the proper range?

Honestly, saying for the “neighborhood” here is tricky. On the realtor map this is Noe Valley. A $2M sale for a property of this quality build won’t do any other 3000 foot Noe properties any favors. On the other hand, the REAL neighborhood here is the rectangle between say 20th and 24th and Valencia and Guerrero. This could be a nice comp for that area.

I’d also remind everybody that those Lorax condos sold for HUGE bucks right at 22nd and Valencia, and they were half the size of this. That was in mid September, during a real panic. Some young guy or girl with money is going to want this property.

Seems too expensive for that neighborhood, especially when you consider that it’s really more of a 3/2.5 and a 1/1, if I have my math right. I wonder how much of the square footage is in the in-law unit?

The neighborhood is technically Noe but I think people living here will spend more time in the Valencia Corridor (or Mission) than along 24th St. That said, being within easy walking distance of Range, Dosas, Spork, Ritual Roasters plus a lot of other neighborhood places is not a bad life (and I like the Lone Palm!). And the 24th St. BART is just a few blocks away.

The finishes seem a bit modest but they won’t offend anyone (which might have been the point).

I agree with Fluj that this would go for around $2.5MM if it was on Fair Oaks or off of 24th St. So I wouldn’t be surprised if someone decides that saving $400K to live in a neighborhood that is in good shape and getting better is a reasonable trade-off.

@fluj:

I agree this is more Valencia/Mission than Noe. Not sure what the deets were on the Lorax condos, but I submit that there may have been a different type of buyer for those properties.

As I think the marketing for this property suggests, an SFH in this area may have a limited pool from which to draw buyers. Young guys or girls with $2M (in my experience) are few and far between, especially these days.

This would definitely feel like Mission more than Noe, so has to appeal to the buyer who prefers the former. Is that a 2+mill buyer?

Still, agreed: the remake is kind of a miracle. If I remember right there were cautions about even going inside the original version.

This is a well executed remodel and restoration but…the location is just OK, and at a price point of over 2 million, prospective buyers want more than “OK”. I will be really surprised if this property sells at asking. (BTW, The Sketchers Factory outlet is just two blocks away! I love that store…)

didn’t socketsite have pics of the original? No link?

The highest price ever for an SFR in the Mission is $1.74M, 1362 Van Ness.

It isn’t a stretch to think of this in the same light as parts of Mission Dolores area, tho. I think the cutoff for that area technically is a block away or so. 3566 19th is has pretty much the same longitude, was a corner lot on an alley, and it sold for $1.9 last July. THat one appears to be 500 feet smaller.

What a beautiful restoration on the outside. However, I was disappointed with the inside – I assumed that some of the same victorian charm would have been preserved. While the inside is nice, it looks like many of the condos that are listed on this site.

Thanks Socketsite for reprting on positive developments for SFRs in The Mission!

We’re further in, on Treat Ave, and our block as well as the corresponding blocks have been experiencing a lot more property renovations. It’s great to see, as although the area has it’s issues it also has a lot to offer.

We’re currently in the middle of our own renovation and it’s exhausting and stressful and expensive. At the other end though we’ll be a good step towards a much better house.

I hope this house (above) sells for what it’s asking, as I’m sure they put a LOT of hard work, stress, money and love into it and whoever buys it will be very lucky they can enjoy it. It’s a fantastic location, BTW.

The problem I have with these full interior demo remodels is the lack of respect for any of the original plan layout, trim and Victorian details. This place looks just like an average condo or tic. No formal dining room, no trim, no character. You see the kitchen, which is small. You see and hear all the appliances. What kind of design sense is that? The remodel can be contemporary and fresh without losing character or style.

The projects I restore, just like this one, maintain the classic floor plan with center hall, formal dining room and kitchen with some walls. Many looking for a “real sfr” want just those things.This looks like a condo with a cute victorian facade..and overpriced for the ‘hood.

Having lived in both the Mission and Noe in the last two years I would characterize this as more Noe than Mission. The nasty part of the Mission tends to tail off west of Valencia. I am confident some buyer will see it that way. At under $700/sq ft for a new renovation this is a deal by Noe standards.

Isn’t $500-600K a little low for the reno though? I thought rule of thumb for SF was $300/Sq ft which would be closer to 900k. I’d love it to be lower but that’s what an SF architect estimated to me last summer.

I agree with noearch, interior strip jobs look ridiculous in old Vics. I do not like it at all and predict that the price will be lowered to 1.9M before long.

I like the exterior and neighborhood though.

Nice job.

These neighborhoods are slowly getting back to their original beauty.

Whatever the financial outcome, many thanks to this architect to bring this place back to life.

There was no “restoring” of Victorian detail possible here. This property’s interior was devoid of any details worth salvaging. And for every person who wants a formal dining room, another does not. That’s a matter of taste. But don’t wonder why the plaster medallions or wainscoting were not retained in this instance. They were long gone.

As for price, hey, maybe it did cost more than 600K. I tried to ballpark it. Assume that some areas needed more work than others, and that some areas were out and out new construction. There is no “rule of thumb” @ 300. Someone else will say 250. Another 400. Quotes vary greatly.

thanks craig for your comments. you get what I mean.

as for costs/SF for renovations, it’s realistic to budget $300/sf for a quality full interior exterior renovation and additions, including structural/seismic upgrade, all new systems, finishes, lighting, baths, high end kitchen, etc.

Just completing a similar full renovation in noe. I’m the architect. the final costs are at $290/SF for construction. that’s plus fees and permits.

fluj, foolio, et al – are you sure this is a SFH?? Why would anyone add an in-law if they didn’t have to vs. other uses for the same sq footage? Maybe the only way the owner could get the expansion past the planning dept was to add another unit (the in-law). Check the permit records – looks like that’s what happened.

I don’t want to jump to conclusions yet but if this is true I’d think the “highly skilled realtor” should be honest and list it as a 2 unit. And yes I understand that most buyers will want to live in it as a SFH anyway.

….continued. ok guys, time to stop arguing about the value of a SFH. It’s not:

Report Date: 5/8/2008 12:22:13 PM

Application Number: 200603156701

Form Number: 3

Address(es):

3633 / 023 / 0 3373 22ND ST

Description: VERTICAL AND HORIZONTAL ATLERATION/ADDITION CREATING A TOTAL OF 2 HOUSING UNITS, WHILE MAINTAINING THE LOOK AND FEEL OF EXISTING STRUCTURE. (FULLY SPRINKLED)

Cost: $378,000.00

Occupancy Code: R-3

Building Use: 28 – 2 FAMILY DWELLING

Resp:

This has been permitted as a 2 unit but it has been designed (and staged) as a SFR. I bet that whoever buys this will use the lower unit either as nanny quarters or as a family room. (I also wouldn’t be surprised if the bedroom on the first floor was used as a formal dining room).

It is possible that someone will buy it and live in the top unit and rent the bottom unit (which is a nice large studio), but most people don’t really want to be landlords in SF if they can avoid it.

Houses with in-laws are commonly listed as SFRs. Why wouldn’t they be? Especially if the in law is vacant. Further, the listing language very plainly describes the property. And I gotta say, casting aspersions on my unsolicited compliment, and further, the realtor’s honesty, is the type of bullshit that bothers me about this site. The value of an SFR with an in-law might be different than an SFR, and it might not. If the main house is large enough it won’t matter. So in this case I think it matters not.

Somebody better get on the horn to Travis and have this error fixed ASAP. Fluj, you seem to know this fella.

No mistake was made. This is how it is done. Like it or lump it, fence sitting all stars.

“fence sitting all stars”

Best line of the day.

There is, in fact, a methodology to construction pricing. and “ballparking” a projects cost is, perhaps a casual and initial way to talk about costs, but it’s not very realistic. Project costs/SF do vary widely..depending on complexity of the remodel, the quality of finishes and material desired by the client.

But, with a detailed set of construction documents and specifications, I can, in fact, define a projects cost of $300/sf, as an example..and it will be built for that. Yes, prices and quotes can vary from contractor to contractor, but with good drawings and specs the bids will vary by only 8-10%.

First I already said I’m aware that most buyers will view this as a single family. However just because agents “commonly” do things doesn’t make it right.

Listing this as a SFR may be OK for marketing purposes but every potential buyer better know that when they sell this place, or when the building department knocks on their door they better have 2 working kitchens, 2 separate entrances to each unit, a one-hour firewall between them, no staircase between them etc, etc, etc. And god forbid they rent out the inlaw for extra income without being fully aware of the consequences. This is not a SFR and that’s a legal fact.

without side by side independent parking for two cars, this looks and smells like an illegal inlaw to me.

“This is how it is done”

New motto for SFAR

Resp, the verbiage in the MLS clearly indicates same. The third sentence reads: “There are four bedrooms and 3.5 baths on 3 levels including a legal studio apartment.”

Since you were happy to provide the permit app, you’d probably concede that the property was likely duly inspected along the same lines prior to its going on the market. In order for it to be called “legal” that would be necessary.

It still didn’t stop you from questioning honesty, tho. Thanks on behalf of honest realtors everywhere. (sarcasm)

@ Noearch —

No one ballparks a bid, clearly. This is an internet blog. They asked for some numbers so I shot them out. It is not unrealistic to think that someone pulled this off for sub 250 a foot, either. Look at it closely. They didn’t go huge.

And I gotta say, casting aspersions on my unsolicited compliment, and further, the realtor’s honesty, is the type of bullshit that bothers me about this site.

No complaint about the Realtor or the work done. This area needs more redos like this one.

Kudos to the architect for the huge investment and the Realtor for taking the jump on this bet. If the price has to be lowered, he’ll take a small blow, but if it sells at close to asking, he’ll be a local hero. It has to be tried and the market will say if this is the right place/time.

OK, my bad for not noticing the realtor’s comments about the legal 2-family but everything I said still holds. It deceptive to uninformed buyers to call this a SFH. I can just see it:

buyers: oh honey look we can have a contractor put in a staircase to the family room and make it part of the main house. can’t we mr realtor?

realtor: i’m not sure but it seems easy enough. you should ask a few contractors.

buyers: oh wow, we can rent out the downstairs for $1500 and help pay for the mortgage. then when we’re ready to sell we’ll just ask them to leave. can’t we mr realtor?

realtor: i’m not sure on the legal aspects of this but you should be able to get at least $1500 for that unit.

buyers: it wouldn’t cost much to take out that kitchen downstairs that we don’t need and put in a wine cellar and a workshop instead. any maybe a room for our dogs.

realtor: that sounds perfect for your lifestyle.

all three wrong. look, I don’t want to comment of the value of this home since I don’t know the area half as well as you guys. let’s just hope the buyers know exactly what they’re getting and the agent is upfront about what a “2 family dwelling” legally means.

Honestly, it says quite plainly that there is an in law, so I don’t see how the listing is misleading anyone.

And they have the permit for the second unit, so it isn’t illegal.

The real estate business is theater. This is a great example: A) focus on it as an SFR because renting anything in SF can turn into a nightmare, B) focus on all of the adjacent hoods to avoid mentioning that its location, location, location is in a lesser one, than the hoods you mention and C) make what is clearly going to be a dining room into a bedroom because more bedrooms mean more $.

If the buyers are too stupid to notice these things, then they get what they deserve, and the agent is doing his or her job. That’s the game, and if you haven’t figured out how it’s played, you are going to be suckered quite quickly.

There is a line (the line being lies), and a lot of agents cross it, but here, I don’t see it being crossed. The agent has not flat out lied. That’s the theater. I thought the listing was very well done.

I’d be surprised to see someone take a kitchen that small at that price point, but all it takes is one, and it has got great curb appeal (except maybe for the dilapidated thing next door) and a lot of space.

Fluj,

I see your point that these properties are listed as SFR’s. But I don’t think realtors understand the legal consequences or difference b/w calling it a SFR & a SFR + separate studio.

As resp correctly points out, the buyer will be subject to certain building codes, and if they rent it out, the studio will be subject to rent control statutes. I’m sure you’re a very ethical realtor, but not all of your colleagues are so forthcoming. I’ve represented buyers in enough lawsuits against realtors to know that general industry practice does not always comport with the law.

“without side by side independent parking for two cars, this looks and smells like an illegal inlaw to me.”

That’s not necessarily true. For new construction, sure. But look at the permit above. For what was an SFR with an illegal in-law and an legallizing a nonconforming at a property with an existing garage? No. This falls into case by case and this thing was probably inspected already.

I’d like to get back to the discussion about the pool of buyers for this place. On 22nd @ Valencia, it seems inappropo for a family. Yet, 2000+ sf plus nanny quarters seem unnecessary for a cool young guy or girl.

What sort of person(s) exactly is going to buy this place?

I just went through the thread, and I am curious about the following statement:

“As for the price breakdown, they put 200K down. It seems as if they financed the entire thing privately so they paid no interest on their own money.”

Care to elaborate a bit? Do you mean a no interest loan from a third party paid at closing? A loan to be repaid in share of profits at closing? Use of the purchaser’s own cash that for some reason was called a loan?

Just trying to understand how the financing worked and the purchase structure (i.e., why it would be better/more profitable).

Thanks.

this is in the mission, but it’s between valencia/guererro, and 22nd/guerrero is very nice. it’s a lot more of a noe valley-ish feel than 22nd/folsom, where i lived for years. and for all the perceived stigma “mission” has over noe valley, i’m happy that this is still considered mission. noe valley seems to be descending to valencia these days in real estate parlance.

the place (at least the facade, which i walk by all the time) is stunning. nice neighborhood. quintissential sf.

I do know this realtor. He’s a bright guy and I can tell you that I’m 99 percent sure this particular realtor knows exactly each and every ramification. But I don’t want to put words in anyone’s mouth. Since you did put words in a phantom everyman-realtor’s mouth, resp, here’s how I would handle the same lines of inquiry:

buyers: oh honey look we can have a contractor put in a staircase to the family room and make it part of the main house. can’t we mr realtor?

realtor: legally no, you cannot.

buyers: oh wow, we can rent out the downstairs for $1500 and help pay for the mortgage. then when we’re ready to sell we’ll just ask them to leave. can’t we mr realtor?

realtor: Though you could probably get $1500 easily, especially if you include parking, there is no assurance that your lessee will leave when you want him/her to do so.

buyers: it wouldn’t cost much to take out that kitchen downstairs that we don’t need and put in a wine cellar and a workshop instead. any maybe a room for our dogs.

realtor: Legally, my understanding is that if this unit has never been in the rental market pool you may indeed be able to remove its kitchen. I would advise you to contact a builder, designer or architect familiar with SF building/planning code in order to make sure.

@ Tom,

I saw an initial 200 down on the purchase. After that, no evidence of a construction loan. Do you understand? From what I saw they used their own cash to develop the property. I did not call that a loan. I said it was not a loan, and therefore it did not cost them money to use their own money.

Fluj,

Why would you put anything “down” if you are paying cash? I think that threw a lot of us. If you pay cash it’s all down.

Because they took out a purchase loan, right? They got a mortgage. Then, after that, they paid for the construction with cash. That’s what the chain of title shows at any rate. Who knows? Maybe a rich uncle paid for the construction with an unrecorded note.

Very true.

Say you have 900K available for a 900K place. I’ll make things simple and not include all the fees added to the price.

You buy the place cash and THEN go to the bank to ask for 600K to redo the place. The bank then tells you: “Hey, this is not gonna work”.

What do you do now. You will not do a HEL because the current value of the place cannot justify it.

It’s safer (and cheaper) to put 200 down to get a great rate, keep 700 (that would have made 5% on a CD) and do your own financing.

Just my 2 cents.

Foolio:

I am not sure why you think 22nd between valencia and Guerrero is innapropriate for a family; there are a fair number of SFRs with families in the area and even more just 2 blocks away on Fair Oaks. The place has a nice flat, sunny yard and Dolores Park is close by. I could easily see a family living here. I could also see well to do empty nesters moving in here.

To various others: I don’t quite get the debate about the appropriateness of listing this as an SFR with an in-law unit. It seems to me that is its most likely use (not as a two unit/duplex) because while you could rent the 2nd unit, I doubt you could sell it for much. As for someone wanting to modify it; it seems to me that anyone planning on doing any remodeling in SF should be aware of the various restrictions that can make even seemingly innocuous rennovations impossible. There are limitations on what you can do to any building — I don’t see anything that makes this place easier or harder to change than many other buildings.

BTW, it does have 2 side by side parking spaces.

SFS,

that makes no sense. If you bought the place with cash, you have 900K of equity. You could take out a first mortgage to get the 700K out. But obviously you would only do that if you could make more than the mortgage rate, so you would almost never do that.

Switching topics, if this was a 250 psf remodel (two kitchens: I think that might be generous), and needed $50K in structural work/electrical/plumbing, that’s 800K. Paid 920, so we are up to 1.720. Commission is 100K, so that’s 1.820. Carrying costs after tax about 3.5K per month for 2.5 years, about 100K, totals 1.920 (assuming he upped the property tax as he added the value). Opportunity cost of the 200K down, and 400K for improvements (1/2 of the 800K, spread over the 2.5 years), about 60K. 20K for staging/landscaping/paint/external restoration/mortgage fees. So this cost the guy 2.0M. Throw in another 25K for permits. See where I’m headed?

Did I mess this up? If the guy gets an aggressive price, he gets $70K for 2.5 years of work and a fantastic job. Maybe I’m off by 50K? That’s still not much for 2.5 years.

The two realtors for a couple of months work make more than he does, for two and a half years.

I guess the debate about the SFH/2unit listing is more about how far “over the line” agents should go in marketing properties. we all have our own opinions. hopefully the buyers agent will inform them of their rights and options.

the other reason that the SFH thing should be discussed is valuation of the property on a sq ft basis. without commenting on the value of this specific property, a smart buyer in any neighborhood of SF will not place the same value per sq/ft on a an area of a home which is separated, both LEGALLY and PHYSICALLY from the main part of the home.

and I agree with sanfronzi about the financing. you should always maximize your mortgage when you buy. you can always pay it down voluntarily. but it’s not as easy pulling money back out later.

As far as cost, I think it’s a tad north of 600K, more like 700-800K, but not $300/sqft.

Interior trims could be very pricey, doing it right for such place is probably 60K-80K by the time you factor painting. The kitchen is smallish and not top notch quality.

As for selling price, I think someone will come under asking and the seller will relent. Overall a very risky project, not an experienced developer.

Tipster – you’re math may be off but your conclusion is smart (and that assumes it sells for axing price).

just one small change:

“The two realtors for a couple of days work make more than he does, for two and a half years.”

Tipster,

Come one man. You have no experience in these matters. Stop positing numbers as if you do.

One, your 50K for structural, electrical and whatnot would be included in any bid. Two, they put 200 down. Cost amounts would be figured from what they owe, 720, not the 920 amount. Why do you insert that 200K back in, as if they owe it? Three, nobody talks about opportunity cost as a real cost except you folks. They might have a very full portfolio elsewhere. Four, landscaping is often included. Five, permitting is included.

Six, your conclusion. Incorrect number followed by arbitrary sideways realtor diss.

That was not apt from start to finish.

If you bought the place with cash, you have 900K of equity.

Correct, but then you’d have to go to the bank and ask for a loan. At least 2 drawbacks with this: 1 – there are costs associated with loans and some of them are fixed. 2 – Anytime you go to the bank you’re subject to a reject risk. Maybe the bank will not accept a full equity HEL or maybe not at a good rate. Nowadays, they are impossible to get without leaving at least 5-10% in equity.

250 psf remodel

Your numbers add up to a very small profit margin. But this is true only if you use market rate contractors. Were I an architect, I would have a big list of very good friends who owe me for all the good business I have brought them and can make me a sweet deal.

This is why you’ll see ads saying “Contractor special”. For those places, a total remodel only makes sense if you can do it for cheaper than market rate. I am not saying that contractors lose money there, but construction work is full of small inefficiencies (leftover paint, material and many other small things that add up quickly) and economies of scale, especially since the insides were redone condo-style with false ceiling, spots and very simple dry walls.

There are prices for the regular clients, and then there are the prices you can negotiate with people you do most your business with. I do not see how they can save on labor costs, though and this is one labor intensive job.

I hope the owner who did this great redo had a sweet deal on the construction work, otherwise his margin will be slim.

If you put “oppotunity cost” into the calculation, then it means if you make any profit (since the “profit” is above “oppotunity cost”), it is a good deal.

Do not forget you have to pay tax on that “oppotunity cost” (treasury?), but is tax-free here.

And don’t forget the carrying cost (mortgage) has tax deduction. “Carrying cost after tax at 3.5K”? Where do you get that? The mortgage rate 2.5 years ago was way lower than right now. If the seller had the intention to remodel and sell, he would get ARM for 3% to 4%, around 2000/month before tax, or 1200/month after tax.

And like San FronziScheme said, it is most likely that the per sqft cost for him is way lower than the $250, since he is an architect.

@NoeNeighbor:

I can only speak for myself–I wouldn’t move my family into an SFR @ 22nd/Valencia. It’s a fun neighborhood for 25-year olds, but it’s not somewhere IMO that’s great for kids. I don’t think the fact that there are some nice neighborhoods a few blocks away changes my opinion.

I don’t really see empty-nesters here, either. I can’t picture them waiting 1+ hours for a table at Dosa or staying out ’til midnight to catch a show at the Make-Out Room.

But maybe I’m wrong…

Quick note about Dosa, since it has been mentioned two or three times. Is it just me or does your clothing smell like the food when you walk out of there? I’ve been there twice and it happened both times. Hope you like what you order. It’s gonna stay with you till you get your sweater dry cleaned.

Fluj,

Yup, no experience, just what I read here. But I DO have some common sense. That tells me that a falling down “enter with hardhats only” redo probably has more issues than a standard “we’d like to remodel our house”, so I added in $18 psf for those unusual issues and used the low end of the scale for the rest: 250K psf.

NoeArch at 12:15 says “$290/SF for construction. that’s plus fees and permits.” So my 250psf was supposed to include fees and permits? How come yours come included, if he says no.

Landscaping is included? Huh? At 250 psf? Doesn’t matter, probably wasn’t much either way.

3 year interest only loan at 7.8% on 720K (with one point) is 5.4K per month, plus property tax on the average amount (started at 920, ended at 1820 – average 1.320M, about 1300 per month) is 6.6K, after tax will run about 3.5K per month depending on your tax bracket. Maybe I’m as much as $800 high, subtract 24K if I am. Big deal.

Just the one point on the mortgage is 7K. The new fence outside in front probably cost 1K installed. Paint had to be at least 3K easy. Prep work and minor restoration on the exterior of a falling down house (incl a garage door) another 5K if it didn’t need a new back fence. Staging 3K. Landscaping 1K. I eyeballed it and said 20K. I’d say I wasn’t that far off.

Opportunity costs are real: I used 4%, not an aggressive number.

Exactly where was I off?

The realtors WILL make more. That wasn’t a snide comment, it was a realistic assessment that this work didn’t pay off for this guy: others involved with the transaction did better for less work and no risk. Don’t take those comments so personally.

You said 28% initially. It’s MUCH less.

Sorry. If what I read on here is true, he didn’t make anywhere near 28%. If it sells under asking, he makes squat.

Overall, the architect probably risked 6-900K of his own money and expects 300-650 in profits

Cash:

200 down

400-700 in work

Loan:

700

Mortgage expenses:

75-100? 30 months at 2500-3500/month

Optimistic price: 2100

Net after Loan is paid off: 1400

Invested in total: 700 to 1000

That’s not accounting the taxes on profits (he owned it more than 2 years, did he live in it?) and tax savings.

And that’s IF, a big IF the house sells for that much.

Overall, that’s a story that can work in a bull market. But are we in one????

Whether he makes a nice profit or not, who cares? As long as he brought this nabe a small notch higher.

“Whether he makes a nice profit or not, who cares? As long as he brought this nabe a small notch higher.”

Yeah, I think that’s the way to look at it. Like a charitable deduction. Maybe he can carry the loss forward to the next housing boom. 😉

Tipster,

Re noearch “How come yours come included, if he says no.”

I can’t say. The people I work with include permitting fees, electrical, structural, etc.

But don’t you see where you’re off by the 200K from the very onset?

3 years at 7.8%? WHY?

Opportunity costs are not factored in by people who do this for a living. This IS the opportunity.

@tipster: not following you completely but I’ll try.

the project I mentioned (in noe) is a full renovation/re-build of an 1880 Victorian. The real construction costs at the completion of the project are $290/sf. PLUS the cost of arch/engineer/permit fees. I’m the architect(not the owner).The project is 2800 sf x $290 = $812k for const costs. hope that clarifies it a bit.

Yeah, I think that’s the way to look at it. Like a charitable deduction.

The greatest things were brought by the bulls:

– colonization of the Americas

– railroad expansion (full of boom/busts stories)

– automobile and highways

– Fiber optics all around the world (Global Crossing)

– Plenty of condos for our golden years in Florida!!!

– and many many more

The losses of the bulls during the downturns are our gains.

This is an outstanding location for people looking to be in a more happening area with Noe-type features. Just where the hustle of the Mission/Valencia turns into more sedate Noe.

22nd Street is the anchor. A block away, you have great higher-end restaurants (Garcon, Spork, Esperpento, Range, Dosa, Foreign Cinema, etc.) and hipster nightlife and amenities (Latin America Club, Lone Palm, Cafe Revolution, 12 Galaxies, Ritual Roasters, Video, etc.).

The Lorax Condos right on 22nd/Valencia sold for over-asking (mid-900’s and 1.4) during the peak of the sub-prime implosion. That should tell you that this location is very attractive to people (including younger families) who want a little more excitement but similar to Noe.

3 year interest only loan at 7.8%? In 2005?

Come on, Tipster, you knew he could get a 5/1 in 2005 at 3 to 4%. Even if he has to put into some principle, that is his equity, and the amount is very small.

Someone getting 7.8% mortgage rate (2005 or today, ARM or 30-year) should NEVER buy a property.

The Lorax Condos right on 22nd/Valencia sold for over-asking (mid-900’s and 1.4) during the peak of the sub-prime implosion

A reference to the sub-prime crises cannot be applied to the SF market. Only a few lower-segments like Bayview-Hunter’s Point really suffered from the subprime crisis.

It is starting to seep through into the almost-still-healthy SF market. A 20% YoY profit is history and having a profit at all is not a given anymore. Expectations are lowered and you can see it in more and more realistic re-pricings.

Whether we will stagnate back into affordability in a few painful years or go through a severe downturn is a matter of opinion (I hope for the latter for myself, but see proof of the former more often than not).

But the bull market as we know it is over.

Trust me, I was shopping for homes during that time as well, and the sub-prime implosion actually had A LOT of impact.

It was almost impossible finding money! Lenders were clamping down big time, and even people with outstanding credit like me had a ridiculous time finding money. Rates were all over the place (mostly high!). So the market of potential buyers decreased dramatically, which gives pause to the fact that those places were able to still sell competitively during that time.

Fluj: I am surprised that you say that opportunity costs are never factored in by people who do this for a living. It really should be. Let’s say this guy had $600K tied up for 2.5 years. If he makes just a $100K profit then he is making around 6% compounded — he probably could have gotten a CD for that rate in 2005 and not had to lift a finger. Also, doing this project meant he couldn’t bill somebody else for their project. So to truly come out ahead, he should include the value of his time. I don’t know what the figures actually are — this may have been a great deal for him — but ignoring the return one could make one’s capital or the value of one’s time is a sure way to overpay for real estate.

Folio: I actually know a couple of empty nester types who are interested in moving into the City and would prefer houses to condos and like the Valencia Corridor area, so I think there might be interest from those types.

@ noeneighbor

No way, the guy didn’t have 600K tied up for 2.5 years. The expenses happen incrementally. A whole lot of them happen near the very end, too. Opportunity costs do not belong in small models such as this one. If it is a big REIT or something, sure.

@fronzi

“A 20% YoY profit is history and having a profit at all is not a given anymore.”

And you know this, how? By giving all the cost numbers bear steroids on the internet?

@ noeach,

When you say plus, do you mean including?

@Knower: I think the potential buyer pool for $900k/$1.4M Lorax condos is substantially different than the one for a $2M SFR. And, IIRC, September 07 was when many previously-locked-in loans expired, so I suspect the credit situation may be quite different now.

@NoeNeighbor: Perhaps. I still do not think so, especially from empty-nesters with $2M in this market, but who knows?

By the way, I don’t think I can over-emphasize how desirable that block is to a certain segment of people. 22nd Street there is quintessential “Hipster-Mission/Valencia”.

A block further away in either direction is almost like being in another neighborhood. Really. It’s that block-by-block specific.

Why should (phantom) opportunity costs ever be subtracted from (real) profit?. How is this not an opportunity too? They are not really subtracted by the bank when you deposit your profits into an account. Stop factoring them in. It is not credible.

And 7.8%. LOFL.

fluj,

The buyer pools there might be different, but there is still a good amount of overlap. If my friends and I are any indication, we are/were looking in that area, and would jump on either a 2/2 condo OR SFR.

Of course, it all depends on what you’re getting. Several new condo constructions near there with larger 3/3+ condo configurations that would be of similar pool with SFR.

Those Lorax condos were very beautiful.

@fluj:

are you serious? plus means PLUS. in my previous comments I have stated the cost/SF. Thats the construction cost. Fees and permits are above and beyond that number. thats what plus means..

far as I know.

I love this neighborhood, actually. It is my favorite neighborhood in the city. I spent my 20s there and would love to get back if possible.

fluj,

I know this more or less the same way you everybody does. Browsing through heaps of data available now to us mere mortals. SocketSite Apples-to-Apples is also a small source.

20% YoY will only happen when a significant improvement has been made or with a great strike of luck (for instance if you grab your granny neighbor’s place for very cheap). But buy a house, live in it without doing any work, sell it the next year and chances are you’re not gonna make much. Ask the ORH lucky first buyers how they’re doing.

You’ll still find 20-30% and more profits, but with 2+years since the last sale, and most of the profit can be accounted on 2003-2006 skyrocketing.

i think the in-law apartment is probably not covered by rent control. this project cost enough and was substantial enough to qualify the building as newly built and therefore not subject to rent control. anyone with experience know differently?

A small addendum:

The reason I like the Case-Shiller index is that it counts the $/sf.

Plenty of small houses in SF are getting a full redo, because the buyer segment for houses at 1.5M+ will not live in 1300 sf with a 7ft ceiling basement. 2500 to 3500 is what you can do with a typical 25ft front lot.

Now, many 1900-1920 small houses are 900-1500sf. If they sold at 1M, after doubling the surface they’ll be worth 1.8M+ easy.

Statistically, selling these places will skew the median sale price.

$/sf stats are way more reliable and the numbers for SF were not going up…

“20% YoY will only happen when a significant improvement has been made or with a great strike of luck … but buy a house, live in it without doing any work, sell it the next year and chances are you’re not gonna make much”

Right. So why would you make that comment in this thread, then? We are not discussing static appreciation here. We are discussing a particular wholescale rehabilitation and build.

fluj, You’re going out on a limb there. “Static” appreciation? Come on! Of course, if I buy a house 1M and put 10M in gold tiles all around, I can sure claim that it appreciated by 1000%! Apples to Apples is what matters.

This place has been bought 2 1/2 years ago and significant improvements have been made.

If you look at my previous posts, I do not question the place will sell for way more than it brought 30 months ago.

Accounting for a 500K profit for a 900K investment + 700K loan, that would be a 30% in 2 years 1/2. But buy this very same house 2M in May 2007 and try and sell it for 2.5M today…

Did 20% YOY appreciation ever happened in SF, without remodeling?

Yes it did. Look at the peaks in 2K and 2K5 for the $/sf:

https://socketsite.com/archives/2008/01/november_spcaseshiller_san_francisco_msa_continues_decl.html

That’s SF MSA. I am talking about the city of SF.

But why would you buy this house and try to improve it? You wouldn’t. It’s apples and oranges.

There is buying a house and living in it and doing nothing and then putting it on the market in two or three years. Any profit will be due to static appreciation.

AND

There is buying a house and actively adding value to it via any number of rehabilitations and improvements.

What you said is that the days of 20 % profit YoY are gone. Well, no, they’re not. They’re probably gone for the static properties. But for the active properties? I don’t think you’re someone in a position to make that statement.

————-

Also, as to opportunity costs. They are something one weighs before one invests, to determine whether to invest or not. They are not something to be subtracted from real profit.

So you hand the bank clerk a $250,000 check, right? She goes, “Sorry. I’m going to have to deduct 6% due to the monies you might have made elsewhere.” No. That is ridiculous.

Opportunity cost = figuring out whether to go for it or not. Once the investment begins, the investment itself is an opportunity. And again, that is not to say there is not another opportunity underway in another area of finance. Hopefully (usually?) there is.

was this a complete teardown where only the facade was saved? or a near complete gut job?

the only identifiable interior details of an italianite victorian are the pocket doors and the way the fireplace protrudes from the wall. even the fireplace has been modernized.

does that affect property value? it does look like a modern condo with a vintage facade. that’s a real shame, considering the attention to detail the facade has been given. I can’t imagine it would have been much more expensive to find restoration materials (moulding, wainscotting, cast plaster) at an architectural salvage yard. you can even get cast iron clawfoot tubs that have new porcelain.

seems like a shame. facade-ism.

True, It’s MSA only. Zillow has zip-code by zip-code but I don’t have the link.

As SF is the jewel in the area, I think the appreciation was either the same or higher than the average.

I don’t think you’re someone in a position to make that statement.

Here comes the fluj we all love to hate. You made my day.

Very nice house, nice remodeling,

very bad pricing, worst location.

2 mil. price tag, I can have tons of choice.

The investors are newby or what.

Another example that architect can build but cannot invest. $920k + $600k(remodeling cost) = $1.5mil, You can get 1.2 mil. if you are lucky enough.

300k net lost.

Fluj:

There is nothing “phantom” about opportunity costs. If someone puts capital into a project and could have earned $100K from a CD on that capital during the time it was tied up, then the person had better make more than $100K on project or they are losing money. Why spend time and effort on an investment as risky as real estate if one is not going to make more than one could make by just parking the money in a relative safe CD?

In this particular case, I have no idea how much capital was tied up for how long. So it may be that the opportunity cost was much less than $100K. But it is still absolutely appropriate to include it in a model — even for a small deal like this.

In some ways it is easier to think about this in terms of rate of return. If CDs pay 5%, then the rate of return you get on the capital you invest should be significantly better than 5% to justify the time, effort and risk of a real estate investment. Subtracting opportunity cost is an equivalent way of analyzing a project to see whether the returns justified taking the risk.

Fluj : “I don’t think you’re someone in a position to make that statement.”

Fronzi: “Here comes the fluj we all love to hate. You made my day.”

Fluj: Arthur Fronzarelli, first off, I knew you hated me. Thanks.

Second, you flatly said the days of 20 % YoY are over. You did so in this thread, a thread discussing a complete rebuild.

I bet this very property makes 20% YoY.

hj,

I love italianates but one thing that often bothers me with their original design is the tiny rooms. They made sense when heating was coming from a wood-burning fireplace and people had 4 kids and money for only 1200sf. But that does not fit to today’s standards.

My point is if you wan to live in a real worker’s Victorian place (these houses catered to the middle working class) you’ll have to gut it out or push the walls somehow.

I agree that the false ceiling and spot lighting are not a very nice touch, but the place is much much better than what people on this board said it was like.

Noeneighbor,

I understand.

Why should that amount should be subtracted from real profit though?

Why are they continually brought up in threads such as this, threads discussing profit much higher than a typical 5% CD yield or whatever?

They shouldn’t be.

No, SF (city) benefited least from the subprime. I cannot think of any area which appreciated 20% YOY. Actually, I can give many examples of 40% appreciation over 7 years.

Stockton etc has the most apprecation, and crashed the most.

Whatever fluj.

I’m repeating myself and so are you. But let me nail it down for you again.

If I buy a house 1M and put 10M in gold tiles all around, I can sure claim that it appreciated by 1000%. Apples to Apples is what matters.

This place will make maybe 30% over the 2 1/2 years it took to get it done when all is accounted for.

But apples-to-apples YoY 20%. Nope.

SF city benefited from option ARMs with owners paying interest only (neg-am). These are going to have a much bigger effect than subprime when they reset to principal + interest.

Mortgage Reset Chart

yea, fluj irritates a lot of people here. dude, you’re just too rigid and ya dont listen. lighten up.

and no, youre wrong. it’s not JUST about taste and what one may like or dislike, with regard to a remodel of a Victorian. re-read my comments way back. The owner-architect of that little house ruined the basic structure of the plan. as I said and others agreed, it DOES look like a standard condo. fact is: formal dining rooms, semi-closed kitchens, good floor plans, period lighting and trim do add value to a property..and more often than not bring MORE per sf when it comes time to sell.remodeling a Victorian does not have to mean just saving the facade. A more appropriate, yes better solution is to respect what’s there and work with it to create a fresh workable floor plan with character, style and substance. That’s exactly what this particular house on 22nd lacks.

thanks noeneighbor – you explained opportunity cost correctly. when you put cash into a project you need to earn a return greater than the “risk-free rate of return” which is what you’d get on a CD or treasuries or something RISK FREE. buying a house is not RISK FREE. you need to earn a premium above and beyond the risk free rate in order for the project to make sense.

opportunity cost means you are foregoing an opportunity to invest risk-free. if you buy a $2M house for cash you are foregoing $100K a year opportunity if the current risk-free rate is 5% (pre tax). if instead you put zero down, then your opportunity cost is zero but you’re paying 5.5 or 6% or whatever in pretax mortgage. If you’re gonna count the cost of financing in you rate-of-return calculation then you gotta count opportunity cost. It’s basically the same thing.

The reason you take opportunity cost out is not that you don’t earn that money, but that you are earning it because of your cash invested. If I can earn 5% from a project or the same amount with a CD, I should keep the money in the cd and do something else because the profit is all due to the money, not the project. So you subtract it to find out what the profit was on the project.

If interest rates on CDs are 10% but I can make 50K on a 1mil real estate investment, you’d say woo hoo, I made 50K. Everyone else would say you lost 50K bc of the opportunity cost. You take it out.

As for the interest rates, I doubt you could get a jumbo for 3%. But yoiu are right, it was less than today. So he gets another 30K @ 5%. So he makes 105K if it sells at asking.

Noearch,

I am chilled out, man. I didn’t even say how I felt about it. I sort of agree, truth be told and am merely telling you what people say. However, I did see it in the first place and no details were salvageable. I just said some would disagree. In fact, I know a few architects who hate Victorian interiors because they are usually so dark. You can say it isn’t about taste if you like. That’s your prerogative and I don’t want to challenge you on that.

Tipster, you don’t subtract what you might have made elsewhere afterward. That is something one does beforehand to evaluate an investment. Sorry. Everyone understands the concept perfectly. Continue subtracting them afterward to your heart’s content. I don’t really care to argue with you about complete nonsense any more. It is dinner time.

Fronzi,

You initially said “profit” yet you continue to argue “appreciation.” Why you’re doing so is unknown.

We walked through the open house last weekend and thought it was fantastic, and the price on the lower side (I would bet it goes over). Every surface was tasteful (hooray for restrained bathrooms people!) and it has great bones and light. The kitchen remodel could have been more stylish, a bit fuddy duddy with the classic finishes and it lacks a proper soaking tub. The lot is extra deep and the yard strangely/rarely private. The restoration details were well thought out. Someone spent a great deal of effort restoring this place. Kudos on the flip!

What’s key is what this remodel does to the value of the entire block, neighboring 2-3 blocks, and perhaps the entire neighborhood? It does a lot. That is the key as remodels not only boost the existing home, but everything around it. Congrats to all homeowners around here.

Fluj:

I think discussions here are confusing because people are looking at things in different ways. If you just want to know how much profit was made, then you are right, it doesn’t make any sense to subtract the opportunity cost. And, you can use that profit figure to calculate a rate of return (which you can compare to whatever benchmark you want).

On the other hand, some people are trying to figure out whether or not the owner made a good investment. One approach to doing that is to see if the net sales price exceeds all the costs, including opportunity costs.

So both approaches work but you have to be clear what you are trying to determine. I think some posters have been a bit fuzzy on that.

Homeness Guy: Were you the person squatting in this place before it was sold? Are you still smoking whatever it was that created all the black marks on the wall? $1.2MM? There was a house on Hill St. (one block away) in horrible condition that went for $1.4MM just a couple of months ago. I think this is more likely to go for more rather than less than its asking price.

Despite some remarks to the contrary, it is on a nice street, on the safe side of Mission, and near all sorts of urban delights. Many people will happily overlook its somewhat bland design just so that they don’t have to make any renovation decisions themselves.

An opportunity cost can go the other way around. If you have the cash, and can have the leverage AND if you have a good knowledge of the market and see it as undervalued, there is an opportunity cost in NOT buying.

That would mean not buying a 400K house in 1997 even though the numbers made sense.

But 11 years after the trough, I think the opportunities in this market will be very punctual and not for the faint of heart, like this precise turn-around attempt.

fluj, if you cannot juggle between the concepts of a 2 1/2-year profit and YoY appreciation I guess that settles it.

Why are we fighting over opportunity cost?

According to tipster’s calculation, the seller would make 105K, in additional to opportunity cost of 60K. So, the return on this house is close to 3X of the opportunity cost.

That doesn’t sound bad, does it?

Great neighborhood (Liberty Hill? Most underrated neighborhood in SF). Great restoration.

“That doesn’t sound bad, does it?”

I did not mean to make it sound bad. It isn’t the kind of return that would make the risk worth it for the uninitiated or even the average person, but your point is apt: this architect will have done modestly well for 2.5 years over putting the money in a CD. And he bought near a peak and perhaps overpaid. I’d say he made out pretty well, all things considered.

Of course, it depends on whether it sells at/over/under asking, and the seller doesn’t have to rebate the 3% ($60K) that can be bottled up in the purchase price. I don’t know this area well enough to pass any judgment on that issue.

tipster,

In hindersight, if YOU (or I) want to start the project now, with your (or my) calculation, it is probably not a good idea, with your (or my) knowledge of the market.

And keep in mind, he is in the field. His knowledge of the market (and cost) is way better than ours. He can probably do the remodeling for much less than $250 (given the cheap interior look), and he probably knows exactly what kind of price range it will go for, so the risk is low for him.

You are only arguing that YOU wouldn’t do it, and I wouldn’t either. However, it is kind of meaningless to second-guess what others do. 2645 Lincoln Way sold for 1.9M (the story below this one). I see no way to remodel and make a profit on it, because I have to pay full price for contractors. Someone in the field might be able to pull it off. Who knows, and who cares.

“fluj, if you cannot juggle between the concepts of a 2 1/2-year profit and YoY appreciation I guess that settles it.”

But I can, tho.

YoY is not exclusive to apples to apples and apprecaiation. YoY to someone like me might be a project such as this one, this year, versus a similar project last year. And that is what I argued this entire time with you.

You plainly said 20% YoY profits are not possible. I disagreed. And off we went …

Perhaps I missed it, but no comments on the photoshopping on the image of the front of the house? Something about it just looks fake.

soapbox – Yeah, I was thinking the same thing. But this looks like simply a well produced photo of a house with a great facade restoration. I doubt that the sky was edited in because of the detail of the sky showing through the trees in the upper left. Plus you can see a reflection of a blue sky in the window.

If this is a fabrication then it fooled me 🙂

John,

The ONLY reason that guy made any money at all (assuming it sells at asking) is because money was cheap to borrow. HE couldn’t do it profitably now, at the purchase price he paid.

Therefore, initial purchase prices are going to keep falling for these types of projects. The risk of a sale price 2.5 years after you buy is higher and the money costs more.

What won’t stop is these places will keep getting sold. The owners will just have to take a commensurate lower purchase price to allow the person taking it on to make money. And amateurs will stop bidding on them, which was not the case when prices were rising and money was cheap.

And when an owner takes a lower price, they’ll still be making a zillion percent on their original purchase price in 1945 so they’ll be just fine.

Tipster,

So? Money was cheap two years ago, and that’s a factor in his decision.

Sure, money is more expensive, but keep in mind the opportunity cost (since you like to bring it up) is lower too, since you will be lucky to get 2.5% after tax on treasury today.

But, my point is, we shouldn’t second guess how people decided on remodeling/flipping as “armchair flippers”.

…wait, maybe some people like to discuss that….maybe I should start a armchairflippers blog…

“…you will be lucky to get 2.5% after tax on treasury today”

Why are you comparing to after tax investment returns ? Shouldn’t the fair comparable no-risk investment be a taxable investment ? After all profits from a spec home project are taxable too.

Of course you should compare after-tax.

That’s another reason why this dicussion doesn’t make sense. We don’t know if the owner lived there for two years (remodeling does not take 2.5 years). We don’t know about his mortgage rate. We don’t know his tax bracket.

Guys, let it go.

I walked by this place today, on my way to work. I remember this block: we almost bid on a place a little closer to Valencia when we were looking in 2002.

There are three bars within a block, so it isn’t really for me, but I bet some Dot Comer would love it.

This is a great remodel, and will lift the surrounding properties tremendously. That’s the great thing when someone in your neighborhood improves, EVERYBODY WINS!

3373 22nd street is in contract.

this place sold for $1.95MM. If $1.62MM is break even, then how do you think these guys did?

To me this $1.95MM still seems rich for this location in the Mission.

As the listing agent for this Property I really appreciate, as did the builders, all of your comments.

The marketing period for the property was lengthy at roughly 45 days. Clearly our initial price point of $2.095MM was aggressive and not accepted by the market. In retrospect primary issues were lack of a third bedroom on the top floor coupled with a slowing market, manifested by a more methodical, cautious approach by buyers, and secondarily location. Traffic during our open houses, however, was very heavy for the entire marketing period with 25-30+ parties touring every open house date up to the very end and many complements to finishes and layout.

Ultimately the property sold for $1,950,000; the Buyer represented himself, though, imputing an actual sales value of $1,999,000 – the second highest value ever achieved for a single family home in the Inner Mission.

What a fascinating discussion. As the buyer of this house (2016) after another remodel, I can say this house has great bones, great light, fantastic attention to details, a great neighborhood, and is perfect for a single mom with one child. I am very happy to live her and thank the folks who did the remodels!