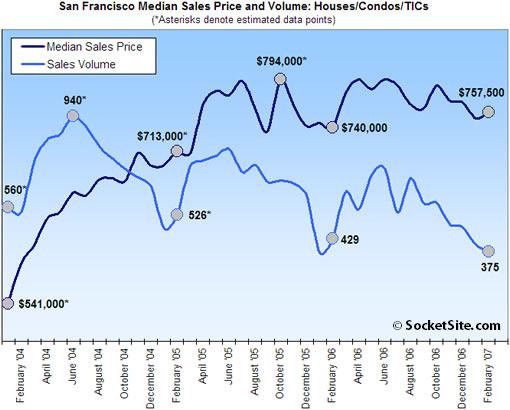

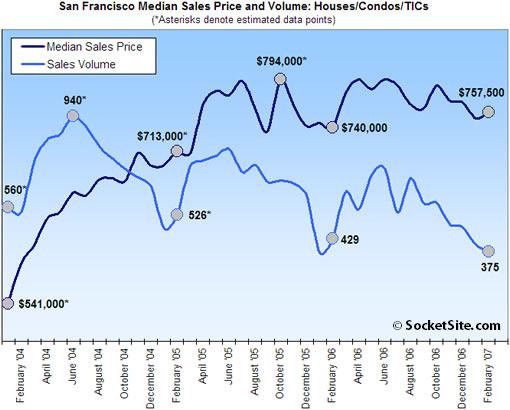

According to DataQuick, the median sales price for existing homes in San Francisco was $757,500 last month, up 2.4% compared to a revised February ’06 ($740,000), and up slightly (0.7%) compared to the month prior. Sales volume, however, fell 12.6% year-over-year (375 sales in February ’07 versus a revised 429 sales in February ’06) and was down 6.7% compared to the month prior (402 recorded sales in January ’07). Sales volume typically builds through the first six months of the year.

For the greater Bay Area, the recorded median sales price in February was $620,000 (a revised year-over-year increase of 0.3%) and sales volume was 6,305 (down 7.9% from a revised 6,844 sales in February ’06). At the extremes, Contra Costa county recorded a 5.5% reduction in median sales price year-over-year, while Marin county recorded a 3.8% year-over-year gain.

UPDATE (3/19): We’ve adjusted our graph to reflect DataQuick’s change in methodology. Data points marked with an asterisk (*) reflect our estimate of what DataQuick will/would report for revised sales volumes/prices.

∙ Bay Area home sales lowest since 1996, prices still flat [DQNews]

∙ San Francisco Homes Sales Up, Median Sales Price Waffles [SocketSite]

Have prices ever gone down in the City of San Francisco in particular? (Not the bay area or california or the US)

SF shows an increase of 2.7% ,almost paralleling escalation, between 2006 and 2007-looks pretty resilient to me- given this is a housing collapse?

I wonder if they will ever come down….

From 1990-1995, there was a small decline in home prices in SF proper. However, this decline was more significant if you adjust for overall inflation during this period.

https://socketsite.com/archives/real_estate_economics/

What kind of effect do you think the subprime catastrophe will have on the overall market? It shouldn’t effect the high end — which is a very large chunk of the City. And my understanding is that the percentage of subprime borrowing in SF is low — only 5% — compared to other counties in the Bay Area.

But if lenders drastically cut back on 100% financing that’s gotta have an impact on the entry level, $600k and under, buyer. Won’t it mean less people will be able to get financing at those prices, and thereby bring down the prices on lower end properties?

I can almost foresee a market where the low end gets lower and the high end gets higher, leaving very little in-between. What do others think??

“I can almost foresee a market where the low end gets lower and the high end gets higher, leaving very little in-between. What do others think??”

I can see the high, HIGH end properties remaining oblivious. People who spend eight figures on a home purchase probably have enough cash to do what they want.

But the “starter home” market will stall first if buyers can’t qualify for these asking prices nay more, then the people who wish to sell their “starter homes” won’t be able to sell, so they won’t be able to bump up into their bigger house, so it will impact the “home after starter home” market. And so forth.

It will be Nasdaq 2000 all over again with one little difference: in 2000 people didn’t owe 90-100% on their stock.

please remember, there is a difference between the Median Price and the Mean/Average price.

And, while the median sales price for ALL home sold has stayed the same, or risen, that does not mean the price for individual properties isn’t falling.

for example I am a buyer who has qualified for a 500k mortgage. Maybe six months ago that got me into one bedroom one bath in a paticular neighborhood. Prices fall on individual homes for 6 months. Because prices fell I can now get a two bedroom one bath in the same neighborhood for that same 500k price (heck I might even stretch to 550k to afford a 2 bed 1.5 bath).

Once recorded the median does not appear to fall because I still spent the same amount of money I would have 6 months ago, but in reality prices have fallen.

The median is a very bad figure to use to determine if prices are rising or falling. It is used mostly because it is available relatively quickly. But a more detailed analysis is needed to determine if prices are actually rising or falling.

Have prices ever gone down in the City of San Francisco in particular? (Not the bay area or california or the US)

Real estate, like politics, all local. In my condo building, prices were down 15% from what I paid for my place at one point. The guy above me paid something like 750K in 2000, sold for 620K a couple of years later. So, yes, prices CAN go down.

Price per sq ft is a more interesting measure, although again it doesn’t tell us anything about the ‘quality’ of properties that are actually being sold.

I know that SF prices seem resilient but several have mentioned problems with this assumption. Median prices don’t tell the whole story. You need to look at same unit sales over time (like Case/Shiller). Prices are actually falling. Also, when you adjust for inflation, prices are failing to keep pace.

The media is all in a fuss about subprime but do not let that fool you. There is a bigger credit crunch coming that’s going to hit beyond subprime. 75-80% of homes purchased in the Bay Area in the last 2-3 years have been “Alt-A” loans, also known as non-prime. You all know what these are: 100% nothing down loans, interest-only loans, negative amortization loans, 5/1 ARMs, etc.

This is the next wave. It doesn’t matter how good your credit is if you borrow an amount that you can’t afford once the reset hits. The secondary mortgage market is souring on these loans, which means you’ll quite possibly need great credit, 20% down and a fully amortizing loan going forward. Credit Suisse, Merrill Lynch and Goldman Sachs put out reports this week saying that this is coming next…

[Editor’s Note: You beat us to it (there’s only so much time in the day), and with this we agree. In San Francisco, the real story is Alt-A (more soon).]

You can read the Credit Suisse report for yourself, if you like:

http://usmarket.seekingalpha.com/article/29738

“On a year-over-year basis, Bay Area sales have fallen for 25 consecutive months. The declines have generally eased each month since sales fell 32.4 percent last July.”

Despite all the tech wealth, booming economy, new immigrants and fact that they’re not building any more land, it appears that actual “demand” is falling. At the same time I can’t help but see a fair amount of new “supply” under construction. So if it really is as simple as basic “supply and demand”, what does that mean for prices?

“It will be Nasdaq 2000 all over again with one little difference: in 2000 people didn’t owe 90-100% on their stock.”

Real estate prices don’t fluctuate– up or down– the way speculative stocks do. After the NASDAQ index peaked (in 1998), it lost 2/3 its value. Nothing like that has ever happened to home prices.

Most people in SF owe much less than 90-100% of the value of their homes. Most people bought their homes when prices were lower, and will be able to continue making their home payments, even if they have to refinance.

What evidence is there of this “booming economy” as posted above in San Francisco? When will people in the city get their heads around the fact that if any “booming” is going on, it is in the South Bay and Peninsula. I think San Franciscan’s religious obsession that “everyone loves the city” and “wants to live there” has been driving their reckless debt driven real estate speculation. My job is in the city, but if I were buying real estate as an investment, it would be down in Palo Alto and Saratoga. Just research how many city homes and condos are financed with sub-prime loans vs. the Peninsula and South Bay. I think “the city” is about to wake up from its dream status of thinking it is envy of everywhere else.

“Real estate prices don’t fluctuate– up or down– the way speculative stocks do. After the NASDAQ index peaked (in 1998), it lost 2/3 its value. Nothing like that has ever happened to home prices.”

I am not saying home prices with fluctuate, I am saying they will go down, steadily for years to come. Nasdaq index peaked in March of 2000 (not 1998). Nasdaq was not leveraged like real estate is i.e. people owned stock rather than owed on their stock.

I couldn’t agree more with Anonymous about “city envy” and pensinsula real estate being a wise investment.

As a homeowner in San Carlos, I’m loving it 95% of the time. (The 5% being Fri/Sat nights 9pm to 1am.)

Granted I got suckered into a bidding war an bid myself out of a year of appreciation…but that was 3 years ago. You do the math. I’m up.

And I don’t have to rebuy, resize, or relocate as i was able to afford a decent house/lot/location given variety and choice down here.

When home prices in SF go down, we will definitely know about it since Socketsite cites these statistics in boldface type. If prices go down enough, they might get excited and add italics or even all-caps to the statistics. Maybe larger different colored fonts?

Its called “DataQuick” not “DataAccurate”; what do you want… 😉

Alt-A’s are the second wave; more like the tsunami wave.

Even still; I’m not sure the Alt-As are going to hurt the SF market as much as it impact the more broad market.

Lots of good thoughts on this thread. Alt-As will indeed be a problem, as will ARM resets for even those with sterling credit. Media seems to have forgotten about those since subprime blew up.

But to answer Damion’s question on subprime in the city, First American Loan Performance tracks this data. Of all mortgages in our fair city, supposedly only 11% are subprime, so not a high proportion compared to places like SoCal, where it’s around 25% in some zip codes. We do, however, have the dubious distinction of having the highest subprime loan amount of any city, approaching nearly $400K. So what we lack in volume we make up for in size. I can try and find a link to the report if anyone wants to see it.

eddy said: “I’m not sure the Alt-As are going to hurt the SF market as much as it impact the more broad market.”

I don’t think you realize just how many homes have been purchased here using Alt-A products. The Bay Area is more heavily dependent on these products than just about anywhere else in the country.

According to this article, “In the San Francisco metro area – San Francisco, San Mateo and Marin counties – 5 percent of mortgages were subprime, and 8 percent of those borrowers were delinquent.”

http://www.insidebayarea.com/argus/ci_5435520

And The Chronicle also supports that: “Within the city of San Francisco, just 5 percent of the total outstanding mortgages are subprime, according to First American LoanPerformance, which collects data from lenders.”

http://sfgate.com/cgi-bin/article.cgi?f=/c/a/2007/03/14/BUG4COKJJ11.DTL

If up 2.7% in SF is a ‘crash’, then let’s crash all year every year! The alternative is to rent, and I don’t want to just rent a 1 or 2 bedroom forever, and I refuse to spend more than $2,000 on rent.

“If up 2.7% in SF is a ‘crash’, then let’s crash all year every year! The alternative is to rent, and I don’t want to just rent a 1 or 2 bedroom forever, and I refuse to spend more than $2,000 on rent.”

Whether you “rent” money from your lender or you “rent” the apartment from your landlord doesn’t really matter. Both is money down the drain. The difference in this market though is that if you rent the money, you carry all the downward risk. But no reason to argue. We’ll know soon enough.

Well if renting from a landlord is bad and renting from a bank is bad, what the f*** we supposed to do, move to Kansas and live in a cornfield till prices drop 70%?

People forget the one has to live somewhere. If you’re up 3% on your 10% downpayment, you’re really up 30%. The money you spend paying the mortgage is the money you saved renting. It’s really that simple folks. Imagine renting for the past 7 years. Sure, you get a place to stay but that’s it. The homeowner not only has a place to stay, but increasing equity.

If DQ says SF is up 2.4%, you know prices are actually really up much higher than that for places you actually want to live. After all the negativity, prices are still up from 2006, which was up from 2005 by 3-6%, which was up 15-18% from 2004. I don’t know, but I think things feel ok to me, and it’s just a normalization.

Here’s a little primer on Alt-A:

http://genesis3.blogspot.com/2007/03/wall-street-manipulation-and-what-you.html

Warren Buffett on the Current Housing Slowdown:

“The slowdown in residential real estate activity stems in part from the weakened lending practices of recent years. The “optional” contracts and “teaser” rates (**Read Alt-A – IO and ARMS) that have been popular have allowed borrowers to make payments in the early years of their mortgages that fall far short of covering normal interest costs. But payments not made add to principal, and borrowers who can’t afford normal monthly payments early on are hit later with above-normal monthly obligations.” BRK Annual report 2006

***I contend that the reason so many bay area home buyers opted for IO and ARMs is that they could not afforrd the true monthly payments on their loans. As payments on these exotic loans have risen to meet the real cost of servicing these mortges, selling pressure and inventory level increases have followed. At the same time, credit is now becoming more scarce (read – subprime melt down, and eventual knock on to ALT-A as previously noted). One reason prices are holding in SF for the moment is that owners being driven out of their places by rising monthly payments are sitting on loan priciples that have grown that they need to cover through the sale of the home. Hence, this stand off between buyers and sellers we hear about.

Eventually though, much tighter lending standards and ever incraing inventory should bring nominal prices down sharply in SF. The top 10% of the market may hold, but everything else will now be subject to economic reality.

In SF the story isn’t going to be about the sub prime bust, it is going to be about ‘Alt-A’ bust.

Since the median sales price is 7-8 times the median income in SF many buyers use an Alt A mortgage to get into the market.

The sub prime meltdown is just the beginning, the Alt-A meltdown is picking up steam and will be arriving shortly.

http://www.marketwatch.com/news/story/alt-mortgage-losses-accelerate-threatening-mbs/story.aspx?guid=%7B7AE4DCF2-44BF-457B-8595-4440243EEA1D%7D&dist=TNMostMailed

“Well if renting from a landlord is bad and renting from a bank is bad, what the f*** we supposed to do, move to Kansas and live in a cornfield till prices drop 70%?”

Very simple answer: rent as long as prices are high and buy when prices are low. High vs low being defined as rental yield: if the rental yield is just 2% (like in the current market) that means P/E is 50. Would you buy a stock with a P/E of 50?

” The money you spend paying the mortgage is the money you saved renting. It’s really that simple folks.”

For folks contemplating buying _now_ it isn’t that simple, as the after-tax carrying costs of owning in SF (interest, tax, insurance, maintenance or hoa, loss of interest on equity) are typically so much higher than the cost of renting an equivalent property. The fact that people who chose to buy seven years ago have made out really isn’t very interesting to current buyers.

“If up 2.7% in SF is a ‘crash’, then let’s crash all year every year! The alternative is to rent, and I don’t want to just rent a 1 or 2 bedroom forever, and I refuse to spend more than $2,000 on rent.”

Have you thought this through? Let’s say you can rent a place for $2K/month or buy it for $600K. Even with 20% down, your monthly nut is around $4K/month with taxes, insurance, and HOA. Even net of the income tax shield you’re paying more. And renters don’t pay property taxes.

So you borrow 6% money to put into a 2.7% “investment” while a renter pays half of what you pay and puts the differential into a 6% money market account. Who’s better off in 5 years?

If you love the place and can afford it, buy it by all means, regardless of the market. But let’s not confuse a roof over our heads with a good investment. The WSJ article in another thread is a great read on this.

Hey Annon @ 7:55 AM ,you wrote:

“High vs low being defined as rental yield: if the rental yield is just 2% (like in the current market) that means P/E is 50. Would you buy a stock with a P/E of 50?”

Would you (or any one else) explain to novices like me how you arrived at the 2% for the current rental market with a P/E of 50. (I currently rent a somewhat large studio- 450 sq ft in Nob hill for 950$, and have rent control).

Thanks!

😉

re: the Alt-A impact in SF; you have to remember that a lot of people in SF can actually afford and need Alt-A loans. There are people that have better use for their cash flow than housing. As a result, the stats here are likely skewed by the likely fact that AltA’s have always been higher in SF than in other places. That’s not to say that there are a host of owners out there that simply cannot afford the fully loaded loan payments of these products once the teaser rate/period ends. I think we all believe that there will be some larger impact for these investors down the road.

And… just because dataquick states that median home appreciation is 2.6%; you shouldn’t assume your property has increased at all. Only recent/relevant comps and an actual sale will tell you what your property is worth.

“Would you (or any one else) explain to novices like me how you arrived at the 2% for the current rental market with a P/E of 50. (I currently rent a somewhat large studio- 450 sq ft in Nob hill for 950$, and have rent control).”

Example: the 450 sq ft on Nob Hill would sell for 600K. Your current rent is $950 per month which is $11,400 per year. So the rental yield is 11,400/600,000 = 0.019 = 1.9%. This does not take into consideration property tax and insurance/maintenance which the landlord has to pay. So if I were to buy your place for 600K and rented it to you for $950 per month, my return would be below 2% (Price / Earning of 50). So the investment only makes sense if the property appreciates – and after the current market run up, I doubt it will appreciate much.

If one is happy living in one’s $950/month rent-controlled apt, of course it is much cheaper to live there than to move into a $600k home. But that is not the choice most buyers face. For $600k, one could have bought a new 2 bedroom condo in the 1587 15th St building. What can one find to rent today in SF for $950?

“For $600k, one could have bought a new 2 bedroom condo in the 1587 15th St building. What can one find to rent today in SF for $950?”

What are the after-tax carrying costs (interest, taxes, insurance, hoa or maintenance, loss of interest on any equity) of a $600k property and how much can you rent a similar property for? That’s really the – economic – question to answer.

“What are the after-tax carrying costs (interest, taxes, insurance, hoa or maintenance, loss of interest on any equity) of a $600k property and how much can you rent a similar property for? That’s really the – economic – question to answer.”

This is an academic exercise – basic lease vs. buy analysis.

$600K at 6% on a 30 yr. fixed is $4,006/month with 20% down. Assumes $400 in monthly HOA and rolls in property tax, for an annual payment of $48K. You deduct $28,600 in interest in year 1 which, at a 35% tax rate, is about $10K in deductions. So year 1 of owning costs you $38K. Assume no improvements.

Say the same property rents for $2K/month, or $24K/year. Owning is $14K more expensive than renting in year 1. Add $5K in closing costs and it’s $19K more expensive.

Coincidentally you can project this analysis forward over the life of the asset (aka your holding period) to see what you’d have to sell it for to be better off than renting. In this case, if you flipped in a year, you’d need to sell for around $640K to make up the extra cost and 3% realtor commission. So you’d need at least 7% annual appreciation to make it work.

As someone who works both in Chicago and San Francisco, here is a question for the “plugged in” crowd in S.F. In Chicago, the rents in the building where I own a unit are about 1,800 to 3,000. The prices of the units are between 220,000 to 500,000 so it is really about the same in costs whether you own or rent. In San Francisco, ownership is far more expensive than renting, why would this be? (BTW, my home NorCal is in Mill Valley which is on a street where cottages rent for about $1,700 to 2,700 but sell for between 900,000 and 1.3 million.

The error in your calculations is the assumption that the 1587 15th St condo that sells for $600,000 rents for $2000/month. In fact, the asking rent on that condo is $2900/month:

http://sfbay.craigslist.org/sfc/apa/292152223.html

Using the $2900/month figure, the difference in cost between renting and owning is narrowed considerably– year one of owning costs $38,000, while year one of renting costs about $34,800. (I’m not counting the $5,000 closing costs, though if spread over 5 years of ownership, that would make the costs $39,000 for owning vs. 34,800 for renting.)

That’s OK, Dan, I was being generous with my down payment and loan assumptions, since it’s unlikely most buyers/flippers put 20% down and do 30 year fixed financing.

$600K with zero-down on a 5/1 ARM at 6.81% puts cost of owning in year 1 at around $54K, net of tax. Rent it for $2,900/month and year 1 cost of renting is $34,800, as you pointed out. Payment of owning is now nearly $5,200/month because of no down and mortgage insurance, which adds about $200/month.

So to flip in a year and cover 3% commission you need to sell for around $672K to BREAK EVEN, or appreciation of 12%. Good luck getting 12+% in this market.

But you proved my point: without a 6-figure down payment, it’s tough to rationalize buying over renting here.

Something to consider in the rent vs. own decision is the rate of appreciation of rent which has been significantly outpacing purchase prices recently. The rent for my 2 BR apartment in South Beach has been hiked about 10% per year for the last 3 years (it’s a newer, very large complex). Including 1st year incentives, rent increases were 2005: 10.5%, 2006: 9.5%, 2007: 8.7%. Makes you wonder what rental appreciation rate should be entered into those online rent vs. own calculators (i.e. how long is this level of appreciation sustainable).

Notices of default mailed to Bay Area homeowners since 10/2004.

http://www.flickr.com/photos/7409273@N03/427735192/

Anyone notice a trend?

ca dave – yeah, it’s all contra costa (and some alameda). sf looks relatively unchanged over the past three years.

Thanks for posting. In addition, representing the data as percent change for each market would be insightful — the SF band could be varying +/- 20% but you can’t see it because it’s dwarfed by the larger markets.

Also, a longer time frame would be nice. As I understand it the left side of the graph represents near all time lows, and the current default numbers aren’t (yet) abnormal.

Regarding the 2000 NASDAQ, it’s not at all true that people owned 100% of their stock. Margin purchases added a lot of fuel to that fire, not unlike low interest rates and alternative lending did to this one.

Here’s San Francisco.

http://www.flickr.com/photos/7409273@N03/428481914/

Next you can feel free to attack the absolute numbers, which are small, but San Francisco is a very small market. I’m only pointing out the trend. Don’t shoot the messenger…

Great info ca dave, much appreciated. Amazing the trend is already so noticable given the ARM resets haven’t hit en masse yet.

Wonder if there’s a way to cross-reference this to the number of mortgages and keep a running tally of the % of defaulted loans in the city…