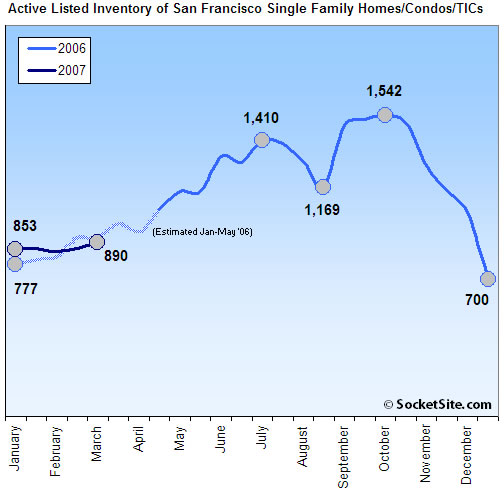

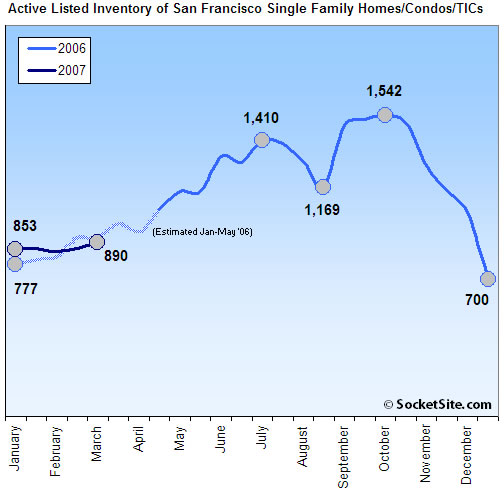

After a nominal dip at the end of January, Active listed housing inventory in San Francisco (SFH/Condo/TIC) is on the rise as new listings have slightly outpaced new sales over the past four weeks. Once again, however, we’d caution against relying on listed inventory to infer too much about the local housing market for at least another month.

∙ San Francisco Housing Inventory Update: 1/22/07 [SocketSite]

Low inventory…demand climbing again. (We know it is not that simple, but you need to be in it, to know it.)

I can’t tell you how many emails/calls we get looking for that one property that just doesn’t exist.

Nothing to worry about. Wednesday is the official first day of Spring, when the big boom starts.

“Low inventory…demand climbing again”

Huh? According to dataquick sales are off 12% from last year. Sales might be picking up steam in absolute terms since the beginning of the year – which shouldn’t come as a surprise to anybody – but relative to last year “demand” is in fact down. At the same time it looks like MLS inventory remains at about the same level as last year but we get the Socketsite scoop on a new sales office opening its doors almost every week. It’s funny how those “in it” always seem to gloss over all that new construction/supply.

Can we look at some numbers for properties over $1 million or $3 million? It seems like the inventory of these prices is climbing. A broad market slowdown is not too bad, but a slowdown in the luxury market would be scary.

There is no denying supply of new development condos is shooting through the roof, but that new development market is entirely different and should almost be in a class by itself. You can’t compare a condo in One Rincon, with a condo in the Richmond. There is no “glossing over”. Just telling it how it is.

Why would a slowdown in the “luxury” market be “scary”? It seems like we should be much more concerned with a broad market slowdown than with just a luxury slowdown.

I don’t really know, but I think the broad market will always cycle between slowdown and boom. But when people with money stop buying, it seems that we should be concerned.

As I mentioned in a previous post, high-end homes, particularly in Pacific Heights, have been moving surprisingly quickly. Even homes that were lingering on the market at the end of last year have sold. There aren’t that many houses left for sale here, though I expect more in the next few weeks. There’s a new house for sale on the north side of Vallejo for 6.5 mil. I think it’s a fixer… I give it two weeks on the market.

District 7 is indeed hot. There’s nothing under $2 million for a SFH. Very frustrating.

220 Richardson Ave – $1,198,000

10 Imperial Ave – $1,395,000

but point taken.

Single family homes on the other side of town are selling, too.

Socketsite saw value in 26 Samoset at $699k. Indeed. The winning bidder paid $850k.

220 Richardson Ave is next to Valero, and on Lombard, AND is a fixer. 10 Imperial Ave is ok, but only around 1,500sqft or less with leased parking in a quaint alley.

What’s shockingn is the new Octavia St. house between Chestnut and Bay that is asking $3.5 MIL! That would be a new record for that part of the Marina if it sells for over $3 mil, let alone $3.5 mil. The most was a house on Gough St. between Chestnut and Francisco for $2.5 mil 1 year ago. It’ll be interesting!

I called a realtor about a condo for sale in the MLS and they told me it was sold the other day. They then offered me anothr condo in the building which wasn’t even in the MLS.

Sounds like they are intentionally withdrawing inventory to tighten market