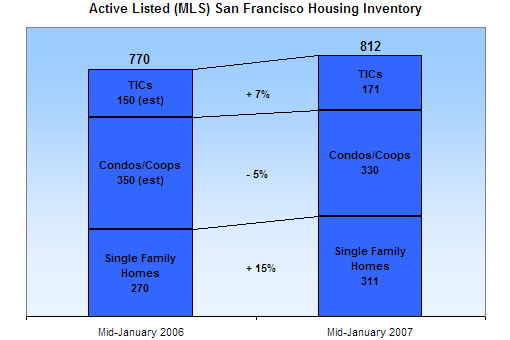

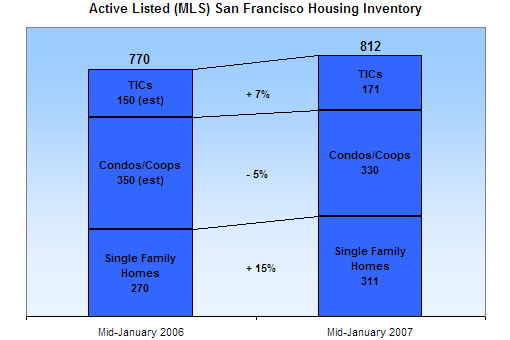

After a thorough New Year’s cleaning, Active listed housing inventory in San Francisco is once again on the rise as new (and perhaps not so new) listings have outpaced sales over the past couple of weeks.

And while overall Active listed inventory might be up ~5% year-over-year, we’d caution against relying on the data to infer too much about the local housing market for at least another month (or two). That being said, keep in mind that it wasn’t until the end of April that San Francisco crossed the 1,000 active listings mark in 2006.

Looking forward, we see a particularly strong pipeline of new TIC units and condominiums in new developments.

∙ A New Year’s House Cleaning (And Reader Predictions For 2007) [SocketSite]

∙ A New New Policy Change For The MLS [SocketSite]

A very good measure of a market is how many months of supply is available. There are different definitions of what is under-supplied, balanced, and over-supplied, but from what I’ve read, a four to six month supply is considered relatively balanced. SF typically has much less than this – on the MLS at least – at closer to one to three months of supply when the market is hot. With 812 properties currently available on the MLS, and an average of 218 sales per month during 2006 (from the previous thread – 2,614 sales over 2006 = 218 sales per month) = 3.7 months of supply. And yes, I know that these figures leave out the large amount of new condo construction. I guess the way to figure that out would be to get the total inventory (again from Socketsite) and then divide that by the monthly closed sales from Dataquick. So let’s see, as of the last the Socketsite Cii (Complete Inventory Index) on 9/26, it shows around 2,425 units that are available but not on MLS. So let’s add those 2,425 units to the 812 available on MLS to bring total supply to 3,237. Then, let’s go back over the Dataquick numbers for 2006 which I show having a total of 6,069 sales for all of 2006, or an average of 506 sales per month. So that gives us 6.4 months of supply now. Again, not as bad as some areas of the country with 12-18 months of supply, but the point is that the large amount of new condos on the market now and hitting the market in 2007 will be tipping the supply/demand equation towards the oversupply side more so than the city has seen in quite a while. Interesting times indeed.

Good points. My question is this, though: will the flood of condos in Mission Bay/Rincon Hill depress condo values elsewhere? My guess is that some buyers will only want to buy in established neighborhoods they prefer, and for them, the new developments would never be an option.

The standard answer by most real estate people is no – that the neighborhood and the product are so different that the markets don’t overlap much. Someone looking for a house in Pac Heights is generally not looking for a high rise condo in So. Beach. But I think the answer is “kind of.” If prices do adjust and the developers have to start getting aggressive with their prices to move units (this hasn’t happened yet BTW) it would shift some of the demand from established neighborhoods to these newer developments if the price differential was large enough and the newer developments were seen as a significantly better deal.

I bought a condo in an established neighborhood just a few months ago. For me, location was key, and I’m not a fan of SOMA/SoBe. However, the right price on the right unit might have swayed me. But, I found that prices in these areas were too high–and the price per square foot on most developments was higher that what I ended up spending for a nice address with a view that includes SF landmarks. My HOAs are higher than what most of the newer developments charge, but I know from experience that you’re safer starting out with higher dues in a building with a documented maintenance history and track record behind its financial management than betting on lower dues that can be part of a marketing tactic (and increase dramatically during the first few years after the association takes over from the developer). If SOMA/SoBe does see a glut of units and resulting competitive pricing, will buyers willing to pay a bit of a premium for more established areas be lured away? I doubt it.

I own a condo in potrero hill and thought that I’d go look at some of he big condo projects just to see what you get for your buck. I initially thought that I might even be interested in upgrading to a bigger space, but after looking at Rincon hill and Infinity I realised that those large condo projects are actually way more expensive than the condos here on the hill. I guess you are paying for a view. The are selling faster than they can complete the build and of what was available requires a very, very high end life style (one that I don’t have). Because of this I don’t think that they actually compete with other areas very well. They are pretty much separate areas of the market. The size of spaces on the hill are much larger on average, there are actual neighborhoods in other areas rather than High-rise living, and the prices on the new condos are so much more than the prices here on the hill that, if anything, it made me think that the hill was even better for those that are in the market to purchase. At the rate we are building houses here we can’t even keep up with the increase in demand. That, along with the fact that we are developing an larger economy here that is geared toward the high end of the wage scale means that though price growth may slow a bit, as the economy kicks in people in the new jobs will also want a place to live. When looking at the over all picture it would also be good to corrolate the increase in jobs created to housing supply. Once you see that trend increasing at a faster rate than housing supply it is likely that housing prices will begin rising sharply.